Help me calculate price to earning ratio and also market to book ratio. Thank you

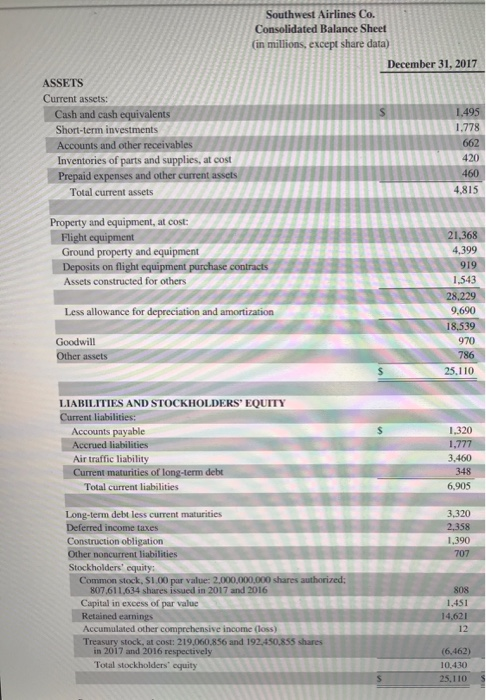

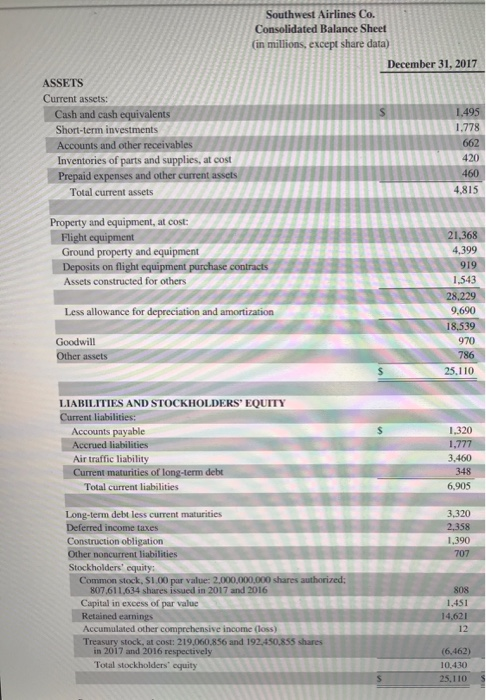

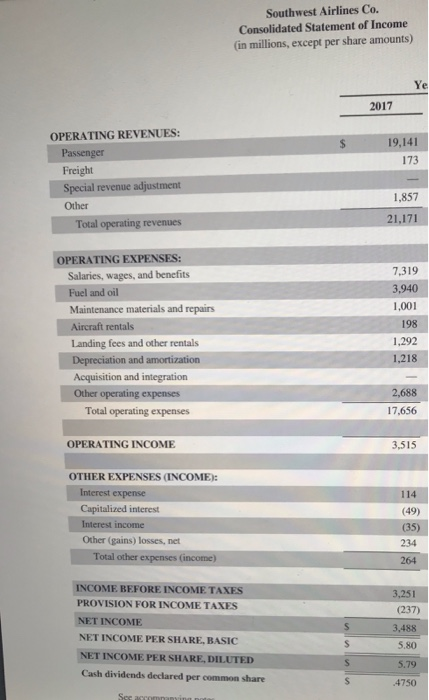

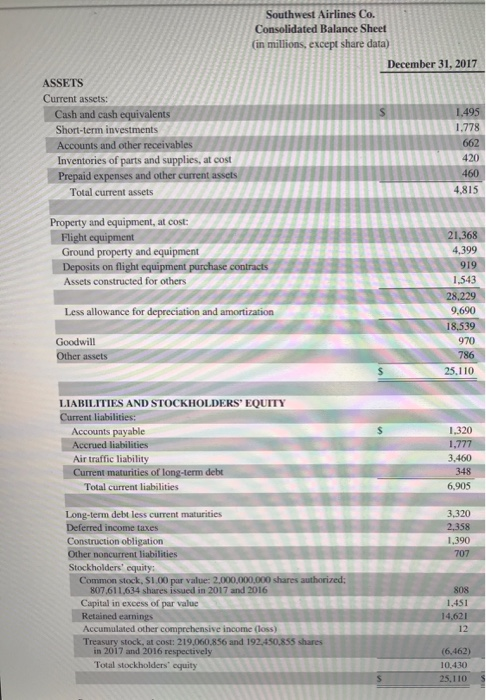

Southwest Airlines Co. Consolidated Balance Sheet (in millions, except share data) December 31, 2017 ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts and other receivables Inventories of parts and supplies, at cost Prepaid expenses and other current assets Total current assets 1.495 1.778 662 420 460 4,815 Property and equipment, at cost: Flight equipment Ground property and equipment Deposits on flight equipment purchase contracts Assets constructed for others 21,368 4.399 919 1543 28.229 Less allowance for depreciation and amortization 9.690 18.539 Goodwill 970 Other assets 786 25.110 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued liabilities Air traffic liability Current maturities of long-term debt Total current liabilities 1,320 1,777 3,460 348 6.905 3,320 2,358 1,390 707 Long-term debt less current maturities Deferred income taxes Construction obligation Other noncurrent liabilities Stockholders' equity: Common stock, S1.00 par value: 2,000,000,000 shares authorized; 807.611,634 shares issued in 2017 and 2016 Capital in excess of par value Retained earnings Accumulated other comprehensive income (loss) Treasury stock, at cost: 219.060,856 and 192,450.855 shares in 2017 and 2016 respectively Total stockholders' equity 808 1.451 14,621 (6,462) 10,430 25.110 $ Southwest Airlines Co. Consolidated Statement of Income (in millions, except per share amounts) 19,141 173 OPERATING REVENUES: Passenger Freight Special revenue adjustment Other Total operating revenues 1,857 21,171 OPERATING EXPENSES: Salaries, wages, and benefits Fuel and oil Maintenance materials and repairs Aircraft rentals Landing fees and other rentals Depreciation and amortization Acquisition and integration Other operating expenses Total operating expenses 7,319 3,940 1,001 198 1.292 1,218 2,688 17,656 OPERATING INCOME 3.515 OTHER EXPENSES (INCOME): Interest expense Capitalized interest Interest income Other (gains) losses, net Total other expenses (income) 114 (49) (35) 234 264 INCOME BEFORE INCOME TAXES PROVISION FOR INCOME TAXES NET INCOME NET INCOME PER SHARE, BASIC NET INCOME PER SHARE, DILUTED Cash dividends declared per common share 3,251 (237) 3,488 5.80 5.79 .4750 Ssen Southwest Airlines Co. Consolidated Balance Sheet (in millions, except share data) December 31, 2017 ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts and other receivables Inventories of parts and supplies, at cost Prepaid expenses and other current assets Total current assets 1.495 1.778 662 420 460 4,815 Property and equipment, at cost: Flight equipment Ground property and equipment Deposits on flight equipment purchase contracts Assets constructed for others 21,368 4.399 919 1543 28.229 Less allowance for depreciation and amortization 9.690 18.539 Goodwill 970 Other assets 786 25.110 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued liabilities Air traffic liability Current maturities of long-term debt Total current liabilities 1,320 1,777 3,460 348 6.905 3,320 2,358 1,390 707 Long-term debt less current maturities Deferred income taxes Construction obligation Other noncurrent liabilities Stockholders' equity: Common stock, S1.00 par value: 2,000,000,000 shares authorized; 807.611,634 shares issued in 2017 and 2016 Capital in excess of par value Retained earnings Accumulated other comprehensive income (loss) Treasury stock, at cost: 219.060,856 and 192,450.855 shares in 2017 and 2016 respectively Total stockholders' equity 808 1.451 14,621 (6,462) 10,430 25.110 $ Southwest Airlines Co. Consolidated Statement of Income (in millions, except per share amounts) 19,141 173 OPERATING REVENUES: Passenger Freight Special revenue adjustment Other Total operating revenues 1,857 21,171 OPERATING EXPENSES: Salaries, wages, and benefits Fuel and oil Maintenance materials and repairs Aircraft rentals Landing fees and other rentals Depreciation and amortization Acquisition and integration Other operating expenses Total operating expenses 7,319 3,940 1,001 198 1.292 1,218 2,688 17,656 OPERATING INCOME 3.515 OTHER EXPENSES (INCOME): Interest expense Capitalized interest Interest income Other (gains) losses, net Total other expenses (income) 114 (49) (35) 234 264 INCOME BEFORE INCOME TAXES PROVISION FOR INCOME TAXES NET INCOME NET INCOME PER SHARE, BASIC NET INCOME PER SHARE, DILUTED Cash dividends declared per common share 3,251 (237) 3,488 5.80 5.79 .4750 Ssen