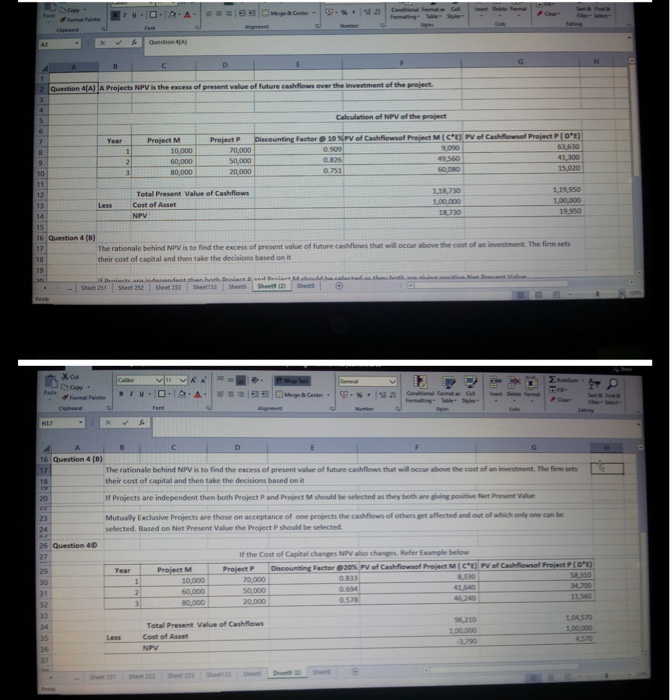

help me do question 4d i have done half and now can you help me turn the negative number to zero

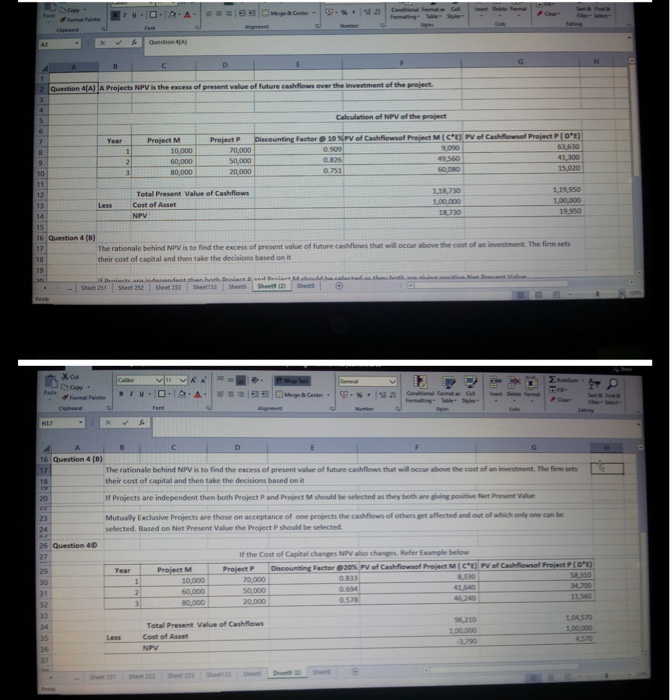

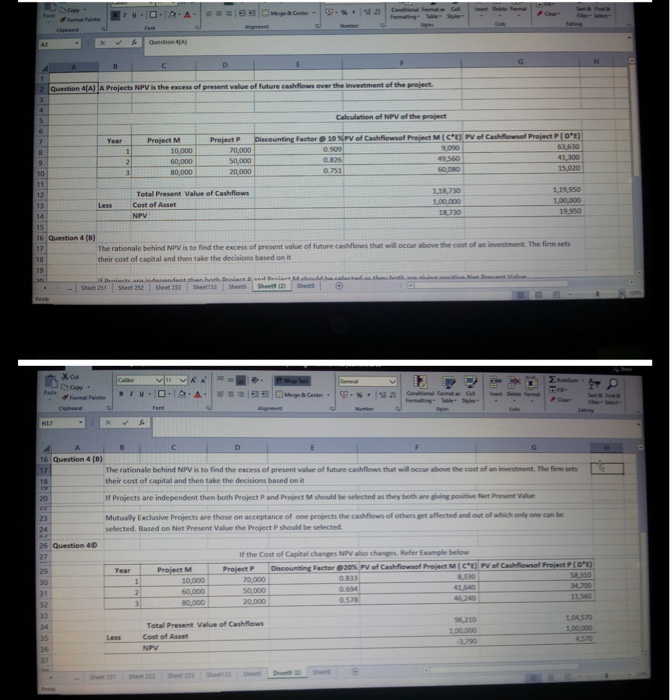

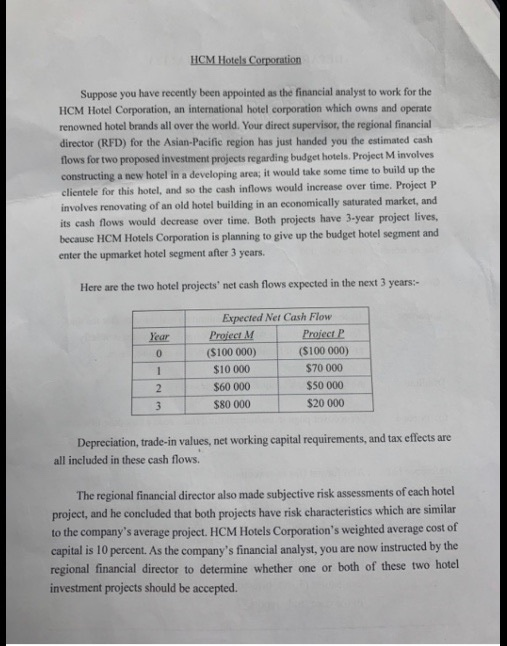

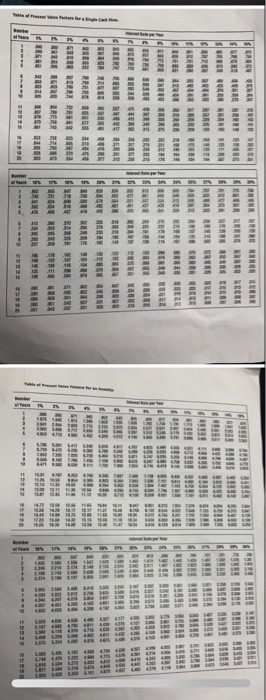

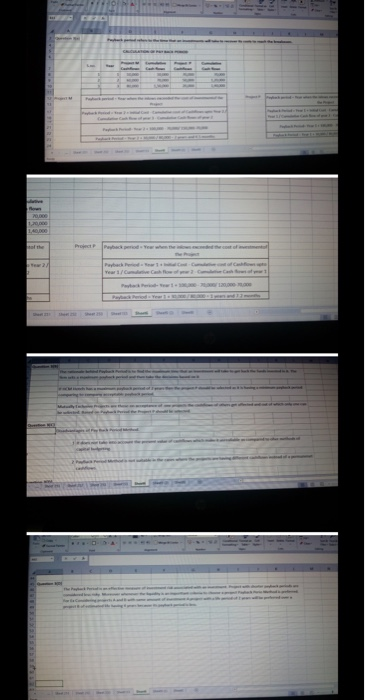

Cape farming Question 4A) H B 2 Question 4(A) A Projects NPV is the excess of present value of future cashflows over the investment of the project. 3 4 5 Calculation of NPV of the project 6 7 Year Project M Project P Discounting factor 10 PV of Cashflowsof Project M(CE) PV of Cashflows Project PDPE) 8 10,000 70,000 0.909 9.00 63,510 9 2 60,000 50,000 06 49.560 41,300 10 3 80,000 20,000 0.751 60.00 15,020 11 12 Total Present Value of Cashflows 1,18,10 13 Less Cost of Asset 1,00.000 1,00.000 NPV 18.730 19,950 15 16 Question 4 (8) 17 The rationale behind NPV is to find the excess of present value of future callows that will occur above the cost of an investment. The firm sets 18 their cost of capital and then take the decisions based on it 19 an Denicarlanandant than oth Benar Denim Sheet2 Sheet25 Sheet VA x cur 1 Copy Feel BIO-10A Mega Center Font HIZ X 16 Question 4 (6) 17 The rationale behind NPV is to find the excess of present value of future cashflows that will occur above the cost of an investment. The firm sets 18 their cost of capital and then take the decisions based on it 1 20 If Projects are independent then both Project P and Project M should be selected as they both are giving positive et Presente 23 Mutually Exclusive Projects are those on acceptance of one projects the cashflows of others get affected and out of which only one can be selected. Based on Net Present Valve the project should be selected 24 26 Question 4 Year 29 30 31 32 1 2 3 Project M 10.000 50,000 80,000 If the cost of Capital changes NPV also changes. Refer Example below Project Discounting Factor 20% PV of Cashflowsel Project MICP of Cashflowsof Project PIDE) 70,000 230 52.110 50,000 0.694 34,700 20.000 0.578 1.04570 100 DOO 100 DOO Total Present Value of Cashflows Cost of Asset NPV 36 37 HCM Hotels Corporation Suppose you have recently been appointed as the financial analyst to work for the HCM Hotel Corporation, an international hotel corporation which owns and operate renowned hotel brands all over the world. Your direct supervisor, the regional financial director (RFD) for the Asian-Pacific region has just handed you the estimated cash flows for two proposed investment projects regarding budget hotels. Project M involves constructing a new hotel in a developing area; it would take some time to build up the clientele for this hotel, and so the cash inflows would increase over time. Project P involves renovating of an old hotel building in an economically saturated market, and its cash flows would decrease over time. Both projects have 3-year project lives, because HCM Hotels Corporation is planning to give up the budget hotel segment and enter the upmarket hotel segment after 3 years. Here are the two hotel projects' net cash flows expected in the next 3 years:- Year 0 Expected Net Cash Flow Proiect M Project P ($100 000) ($100 000) $10 000 $70 000 $60 000 $50 000 $80 000 $20 000 1 2 3 Depreciation, trade-in values, net working capital requirements, and tax effects are all included in these cash flows. The regional financial director also made subjective risk assessments of each hotel project, and he concluded that both projects have risk characteristics which are similar to the company's average project. HCM Hotels Corporation's weighted average cost of capital is 10 percent. As the company's financial analyst, you are now instructed by the regional financial director to determine whether one or both of these two hotel investment projects should be accepted. ERES VEREX TRES REE RRRRRRRRR TEEN BRENE ER BERE BERE SERIER EN RESSER GREEN BEDRE EN TELER IS ERROR RULER RRE RUR EN ERE ERLER SEB BR BERRE E UR ER LE GB RARA 2 EEN KREEZE TERRE ARRA ARREDO KE 8 URL 88 ORE REARE GR RR RRET 38881 HERE IN CIER AREA LRREBE ZEGTE ERERE BERE BUY A BERE * 4511 BERE BUS DANS EGEU RR RRIS 620 BR WERK GR 5 8 MAR EBER X 1959 14 HH THI