Answered step by step

Verified Expert Solution

Question

1 Approved Answer

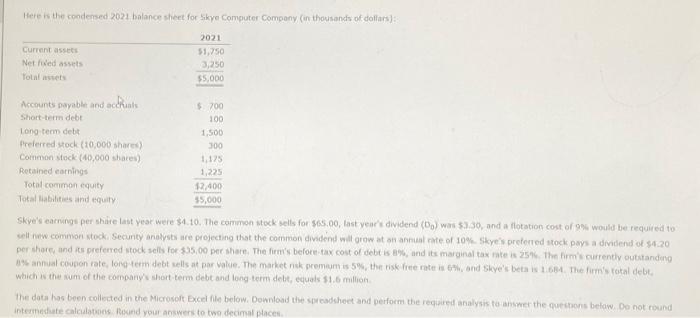

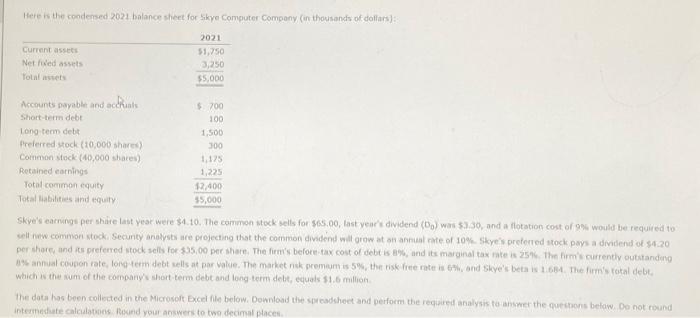

Help me fill in the blanks thanks Here is the condersed 2021 balance sheet for Skye Compoter Company (in thousands of doflars): Which is the

Help me fill in the blanks thanks

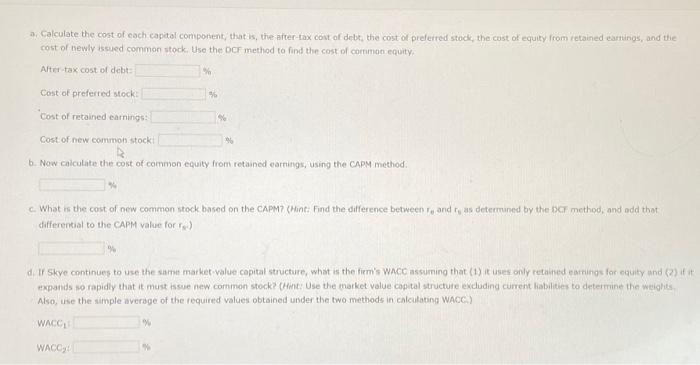

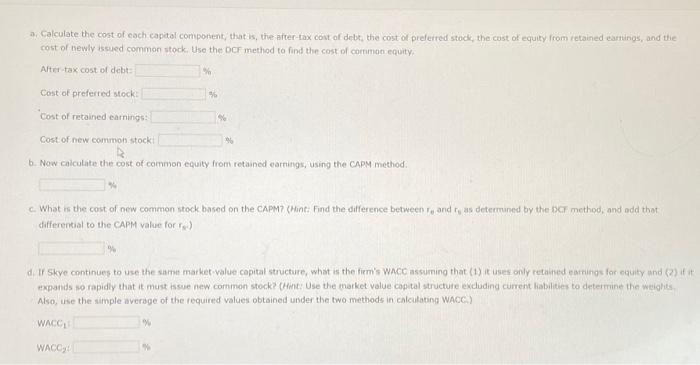

Here is the condersed 2021 balance sheet for Skye Compoter Company (in thousands of doflars): Which is the wum of the company short-term debe and long-term debt, equais $1.6 million intermedtate calcalatovens Round your answers to two decimaf places. a. Calculate the cost of each capitol component, that is, the after-tax coit of debt, the cost of preferred stock, the cost of equity from ictained earnings, and thie cost of newly issued common stock. Use the DCF method to find the cost of cornmon equity. After tax cost of debt: Cost of prefertied stock: % Cost of retained earnings: Cost of new common stock b. Now caiculate the cost of common equity from retained earnings, using the capM method: c. What is the cost of new common stock based on the CAPM? (Hint: Find the difference between rv and rb as determuned by the DCF method, and add that differential to the CAPM value for rs ) d. If Skye continues to use the same market-value cepital structure, what is the firm's WACc assuming that (1) it uses only retained earrings for equity and (2) if st expands no rapidly that it must issue new common stock? (Hmt: Use the market value copital structure excluding current liabilities to determine the weighits. Aiso, use the sumple average of the required values obtained under the two methods in calculating WACC.) WACC: 1 % WACC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started