Answered step by step

Verified Expert Solution

Question

1 Approved Answer

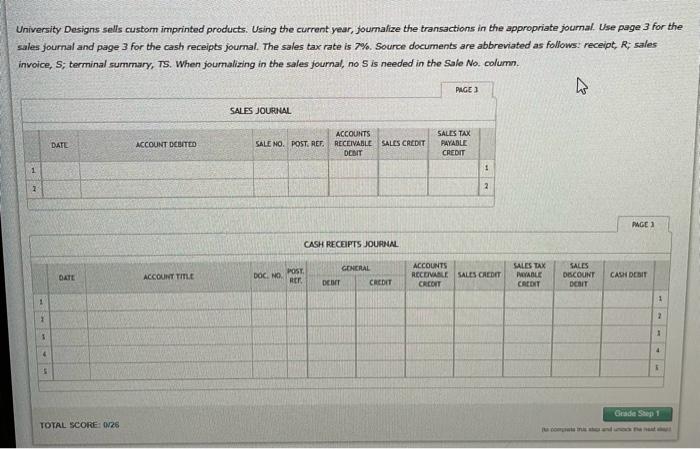

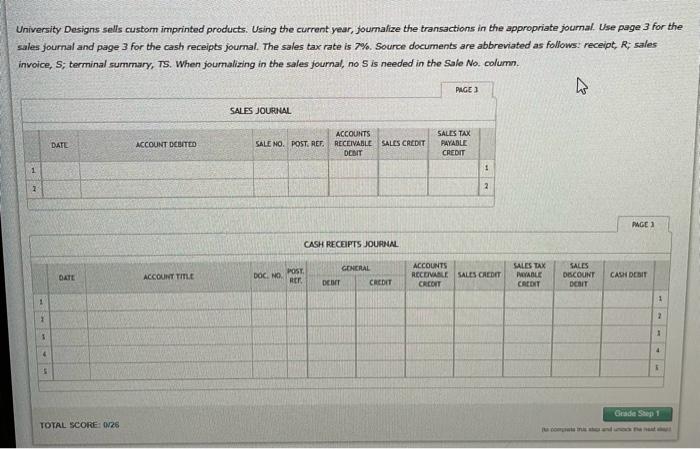

Help me fill out this table for accounting. University Designs sells custom imprinted products. Using the current year, journalize the transactions in the appropriate journal.

Help me fill out this table for accounting.

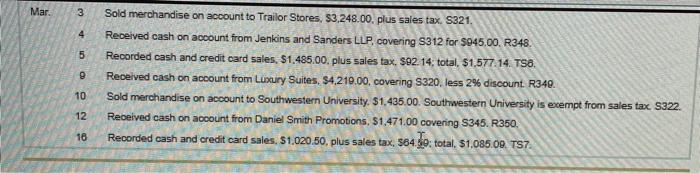

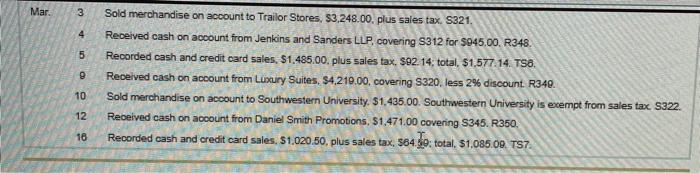

University Designs sells custom imprinted products. Using the current year, journalize the transactions in the appropriate journal. Use page 3 for the sales journal and page 3 for the cash receipts journal. The sales tax rate is 7%. Source documents are abbreviated as follows: receipt, R; sales invoice, S; terminal summary, TS. When joumalizing in the sales journal, no S is needed in the Sale No. column. Mar. 3 Sold merchandise on account to Trailor Stores, \$3,248.00, plus sales tax. $321. 4 Received cash on acoount from Jenkins and Sanders LLP, covering S3 12 for $945,00, R348. 5 Recorded cash and credit card 5ales, \$1,485.00, plus sales tax, \$92. 14, total, \$1,577.14. TS6. 8 Received cash on acoount from Luxury Suites, $4,219,00, covering S320, less 2% discount. R34e. 10 Sold merchandise on account to Southwestern University. $1,435.00. Southwestern University is exempt from sales tax $322. 12 Received cash on acoount from Daniel Smith Promotions, $1,471.00 covering S345. R350. 16 Recorded cash and credit card sales, $1,020.50, plus sales tax, 564. K9: total, \$1,085.09. TS7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started