Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help me find the expected return and standard deviation of alpha co, beta co, portfolio 1, and portfolio 2. use excel please 19. You are

help me find the expected return and standard deviation of alpha co, beta co, portfolio 1, and portfolio 2. use excel please

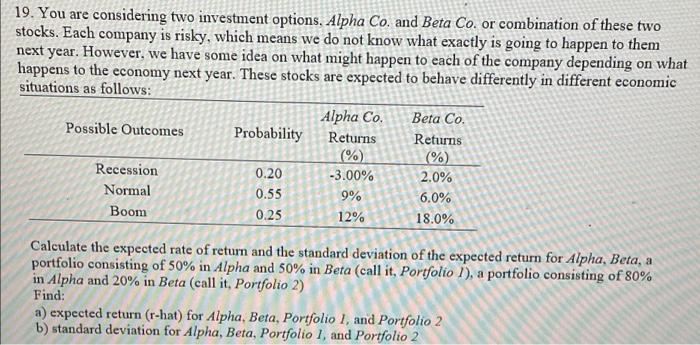

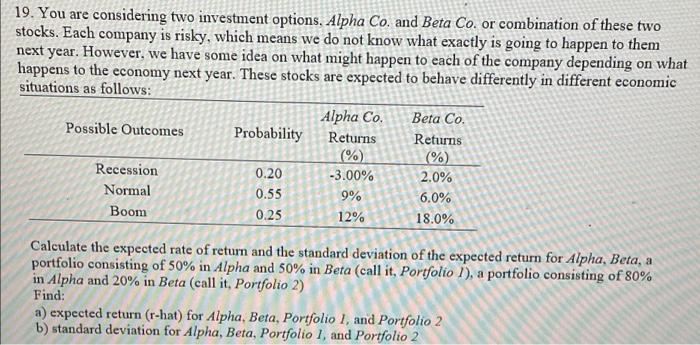

19. You are considering two investment options, Alpha Co. and Beta Co. or combination of these two stocks. Each company is risky, which means we do not know what exactly is going to happen to them next year. However, we have some idea on what might happen to each of the company depending on what happens to the economy next year. These stocks are expected to behave differently in different economic situations as follows: Alpha Co. Beta Co. Possible Outcomes Probability Returns Returns (%) (% Recession 0.20 -3.00% 2.0% Normal 0.55 9% 6.0% Boom 0.25 12% 18.0% Calculate the expected rate of return and the standard deviation of the expected return for Alpha, Beta, a portfolio consisting of 50% in Alpha and 50% in Beta (call it, Portfolio I), a portfolio consisting of 80% in Alpha and 20% in Beta (call it, Portfolio 2) Find: a) expected return (r-hat) for Alpha, Beta, Portfolio I, and Portfolio 2 b) standard deviation for Alpha, Beta, Portfolio I, and Portfolio 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started