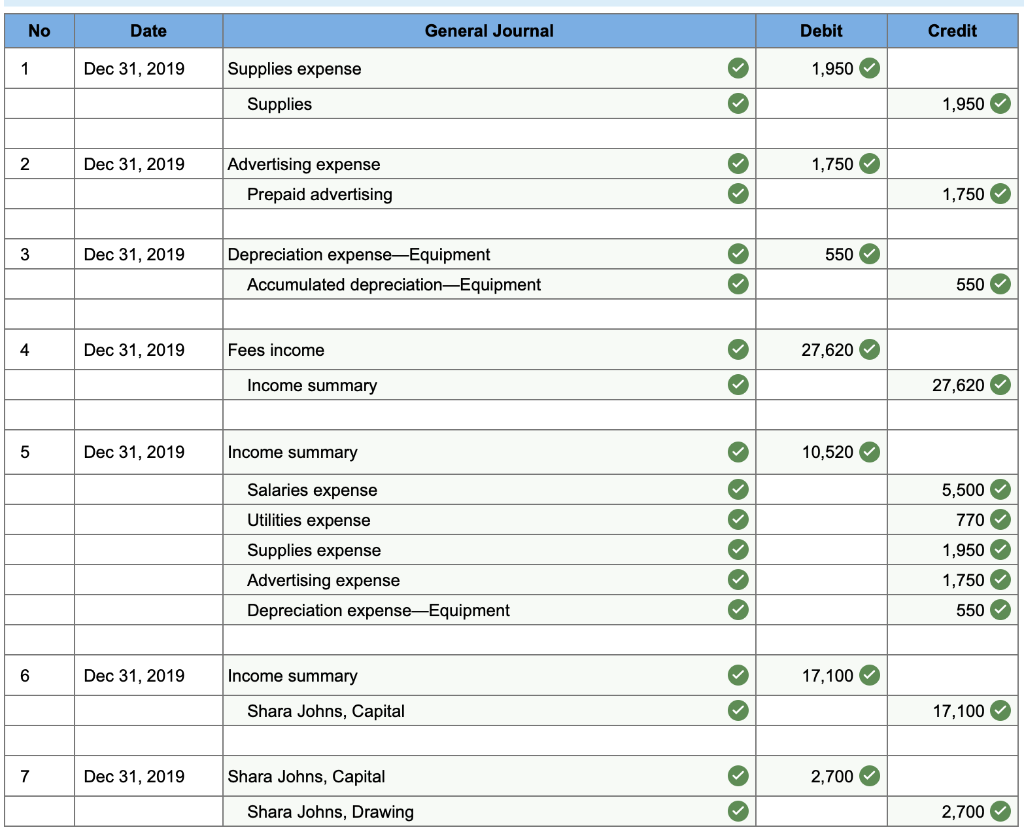

Help me fix with what I got wrong please.

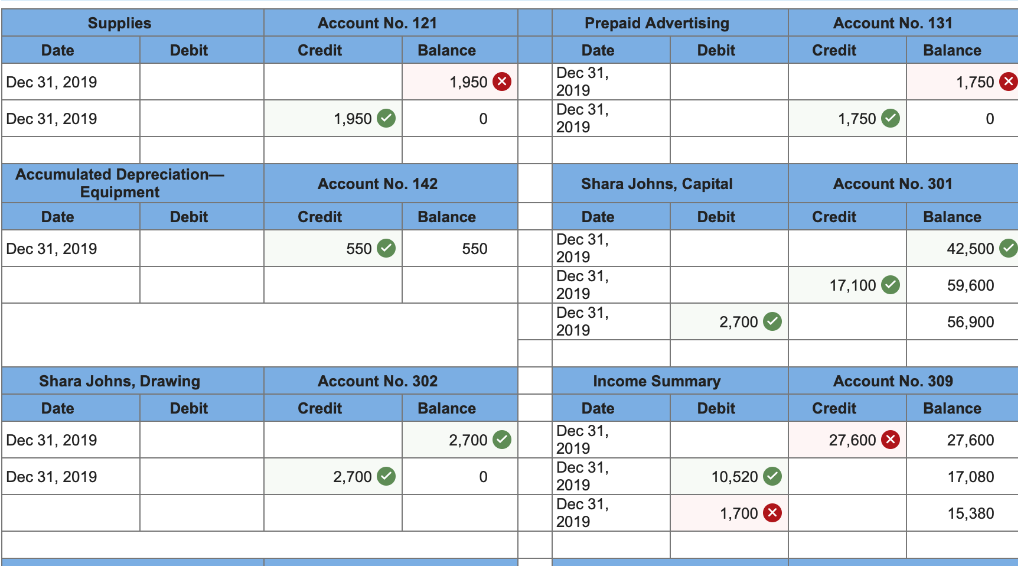

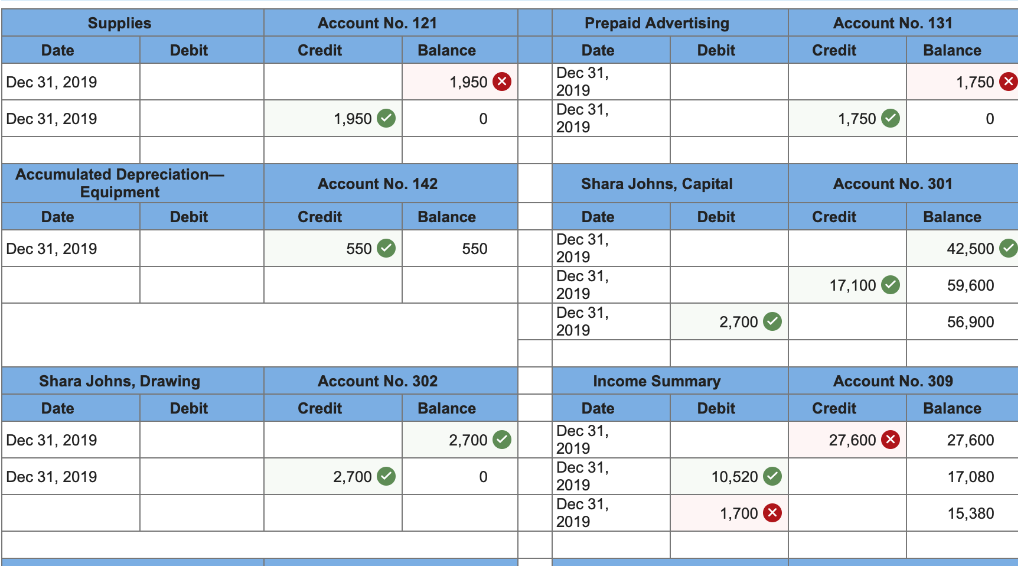

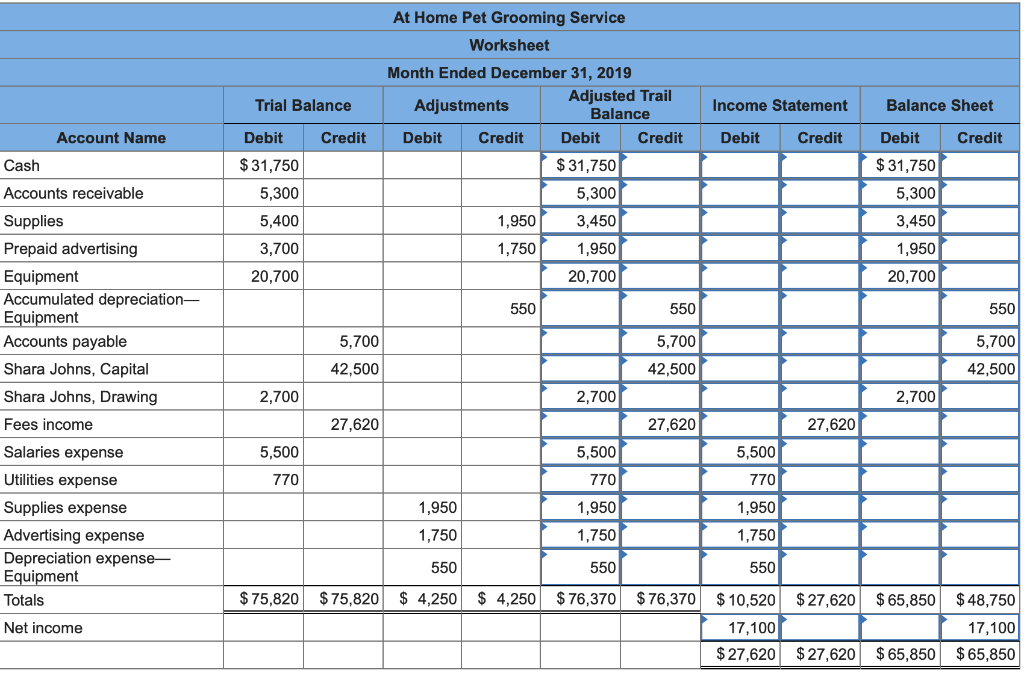

How should account NO. 121 look like ?

How should account NO. 131 look like ?

How should account NO. 309 look like ?

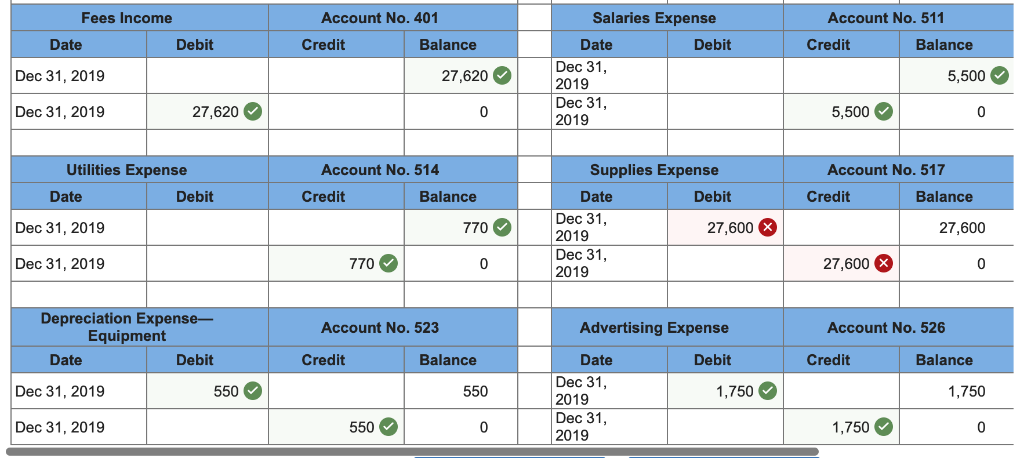

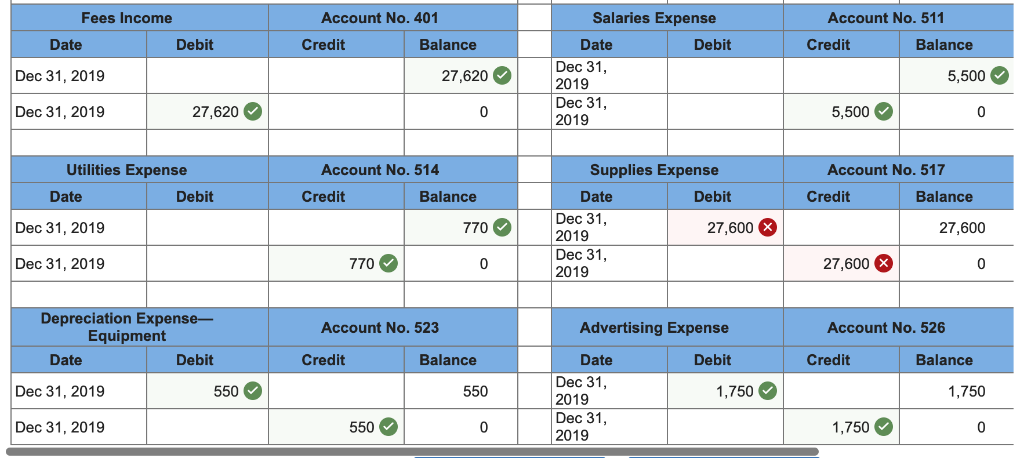

How should Account NO. 517 look like ?

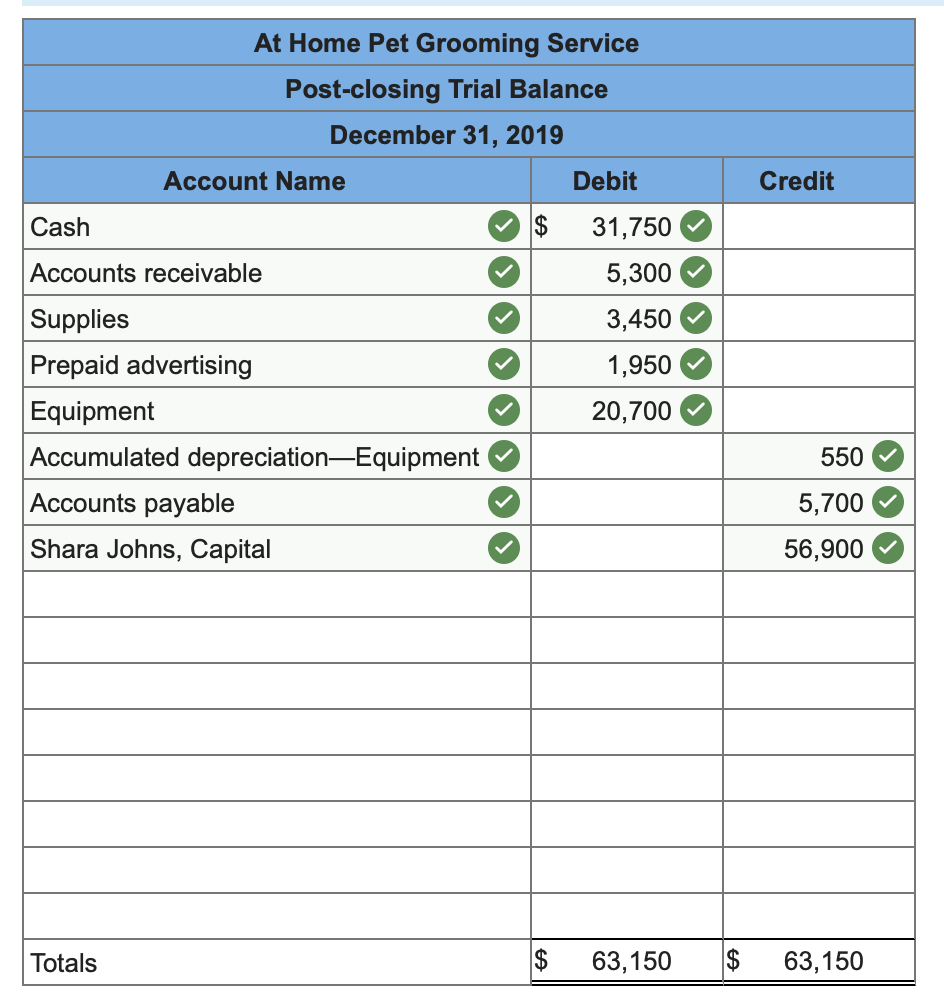

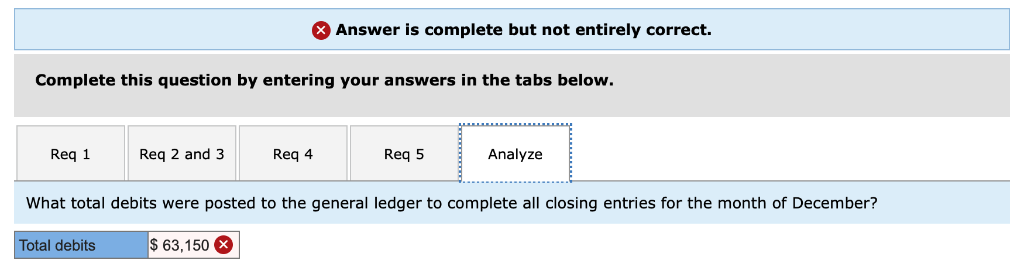

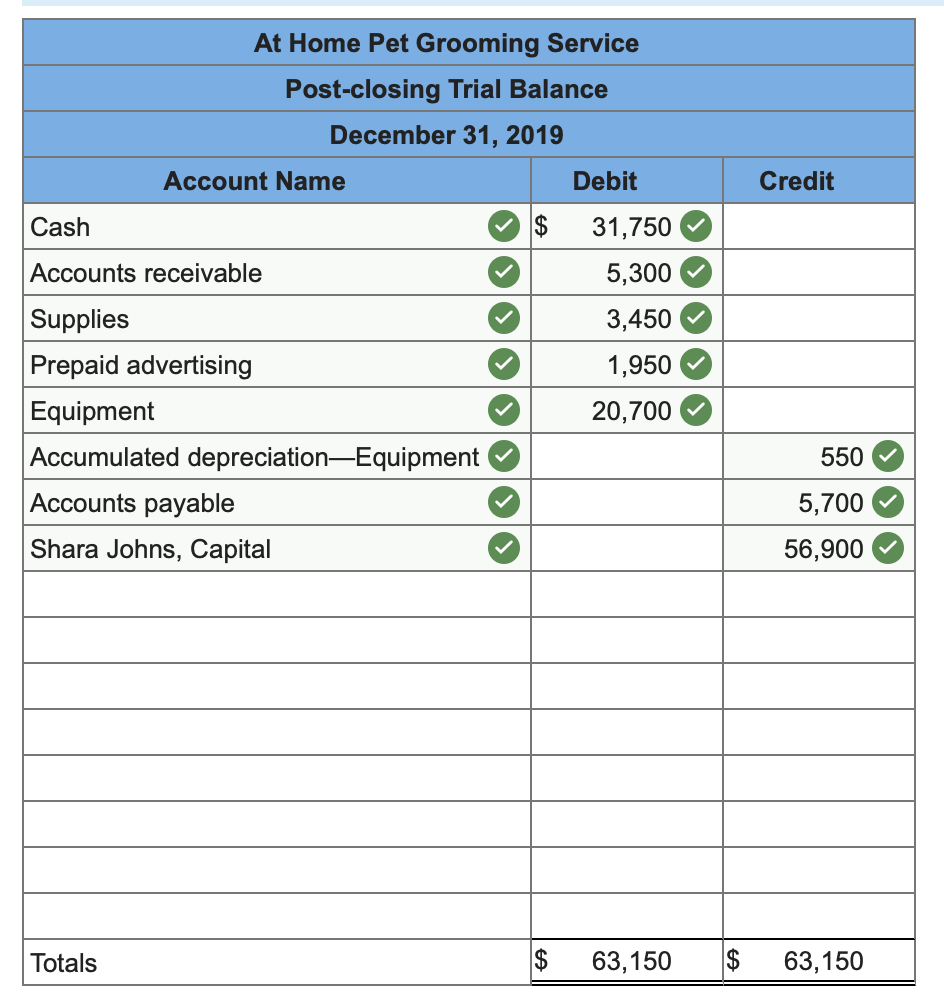

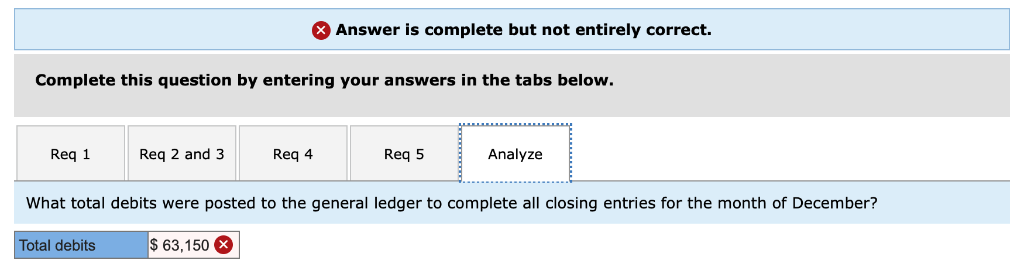

How do I get the correct answer please ? "What total debits were posted to the general ledger to complete all closing entries for the month of December?" Why is it not $ 63,150 ?

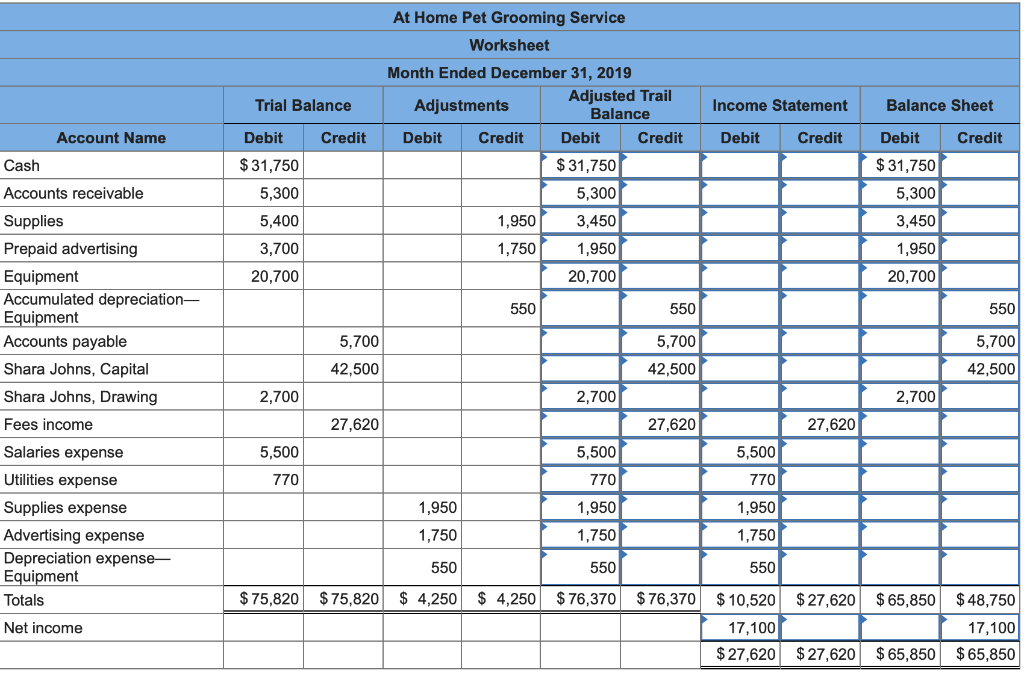

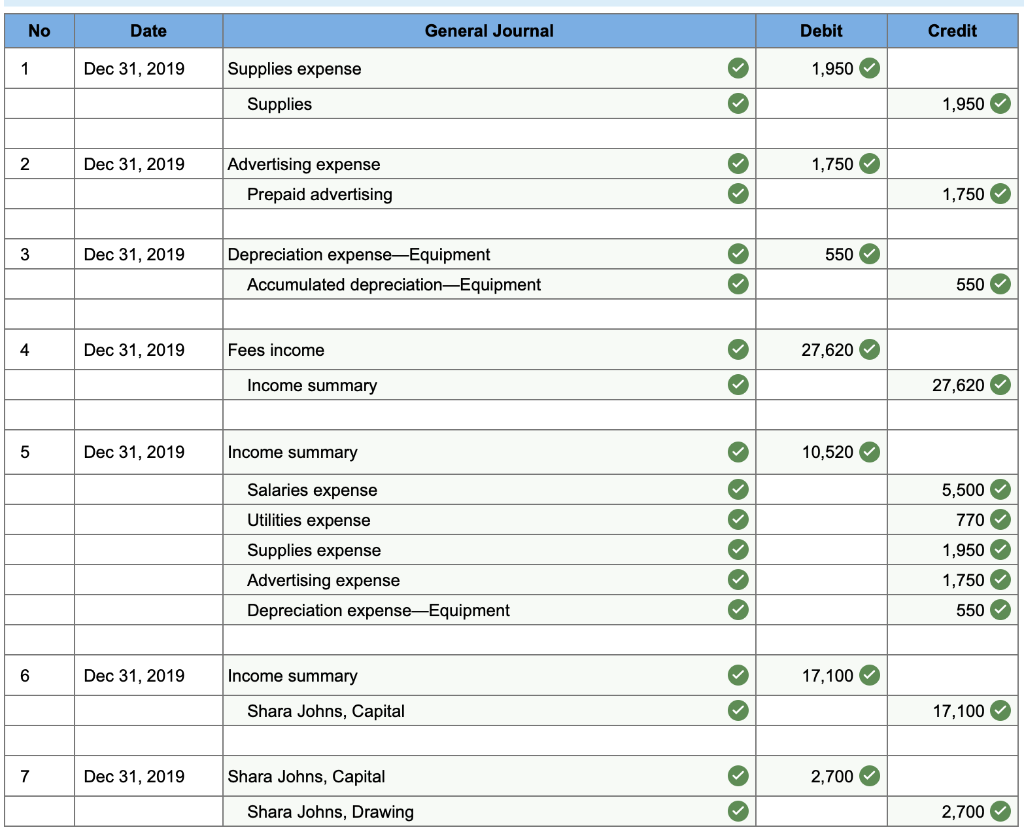

General Journal No Date Debit Credit Supplies expense 1 Dec 31, 2019 1,950 Supplies 1,950 Dec 31, 2019 Advertising expense 1,750 2 Prepaid advertising 1,750 3 Dec 31, 2019 Depreciation expense-Equipment 550 550 Accumulated depreciation-Equipment Dec 31, 2019 4 Fees income 27,620 Income summary 27,620 5 Dec 31, 2019 Income summary 10,520 Salaries expense 5,500 Utilities expense 770 Supplies expense 1,950 Advertising expense 1,750 550 Depreciation expense-Equipment 6 Dec 31, 2019 Income summary 17,100 Shara Johns, Capital 17,100 Shara Johns, Capital 2,700 7 Dec 31, 2019 Shara Johns, Drawing 2,700 Prepaid Advertising Supplies Account No. 121 Account No. 131 Debit Balance Date Debit Credit Balance Date Credit Dec 31, 2019 Dec 31, 2019 1,950 1,750 Dec 31, 2019 Dec 31, 2019 1,950 0 1,750 Accumulated Depreciation Equipment Shara Johns, Capital Account No. 142 Account No. 301 Date Debit Credit Balance Date Debit Credit Balance Dec 31 550 550 Dec 31, 2019 42,500 2019 Dec 31, 17,100 59,600 2019 Dec 31, 2019 2,700 56,900 Shara Johns, Drawing Income Summary Account No. 309 Account No. 302 Debit Date Debit Credit Balance Date Credit Balance Dec 31, 2019 2,700 Dec 31, 2019 27,600 27,600 Dec 31, 2019 Dec 31 2019 Dec 31, 2019 17,080 2,700 0 10,520 15,380 1,700 Account No. 401 Salaries Expense Fees Income Account No. 511 Credit Debit Balance Date Debit Balance Date Credit Dec 31, 2019 27,620 5,500 Dec 31, 2019 Dec 31, 2019 Dec 31, 2019 5,500 27,620 0 Utilities Expense Account No. 514 Supplies Expense Account No. 517 Date Debit Credit Balance Date Debit Credit Balance Dec 31, Dec 31, 2019 27,600 770 27,600 2019 Dec 31, 2019 Dec 31, 2019 770 0 27,600 Depreciation Expense Equipment Account No, 526 Account No. 523 Advertising Expense Date Debit Credit Balance Date Debit Credit Balance Dec 31, 2019 Dec 31, 2019 Dec 31, 2019 550 550 1,750 1,750 Dec 31, 2019 550 1,750 0 At Home Pet Grooming Service Post-closing Trial Balance December 31, 2019 Account Name Debit Credit $ Cash 31,750 Accounts receivable 5,300 Supplies 3,450 Prepaid advertising 1,950 20,700 Equipment Accumulated depreciation-Equipment 550 Accounts payable 5,700 Shara Johns, Capital 56,900 $ $ 63,150 63,150 Totals Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Req 1 Req 5 Analyze Req 2 and 3 Req 4 What total debits were posted to the general ledger to complete all closing entries for the month of December? $ 63,150 Total debits At Home Pet Grooming Service Worksheet Month Ended December 31, 2019 Adjusted Trail Balance Income Statement Trial Balance Adjustments Balance Sheet Credit Account Name Debit Credit Debit Debit Credit Debit Credit Debit Credit $31,750 $31,750 $31,750 Cash 5,300 Accounts receivable 5,300 5,300 Supplies 5,400 1,950 3,450 3,450 Prepaid advertising 3,700 1,750 1,950 1,950 Equipment Accumulated depreciation- Equipment Accounts payable 20,700 20,700 20,700 550 550 550 5,700 5,700 5,700 Shara Johns, Capital 42,500 42,500 42,500 Shara Johns, Drawing 2,700 2,700 2,700 Fees income 27,620 27,620 27,620 Salaries expense 5,500 5,500 5,500 Utilities expense 770 770 770 Supplies expense 1,950 1,950 1,950 Advertising expense 1,750 1,750 1,750 Depreciation expense- Equipment 550 550 550 $76,370$76,370 $ 4,250 $75,820 $75,820 $27,620$65,850 $48,750 Totals 4,250 $10,520 Net income 17,100 17,100 $27,620 $27,620 $65,850 $65,850