Help me!

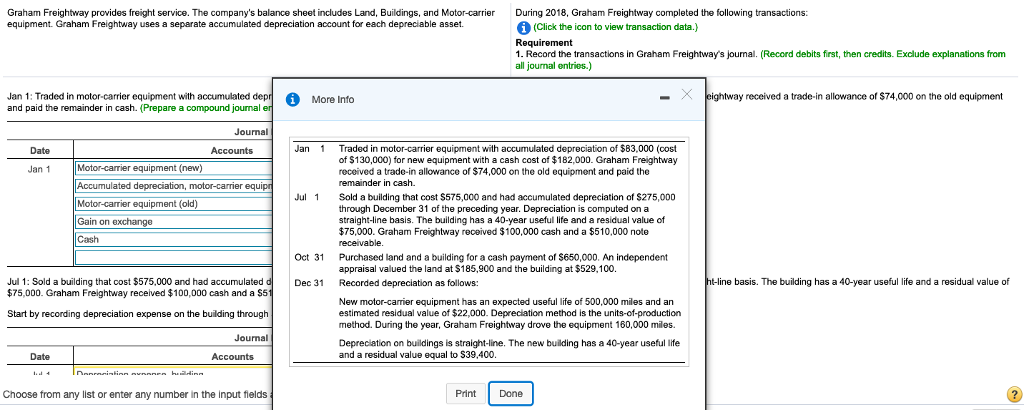

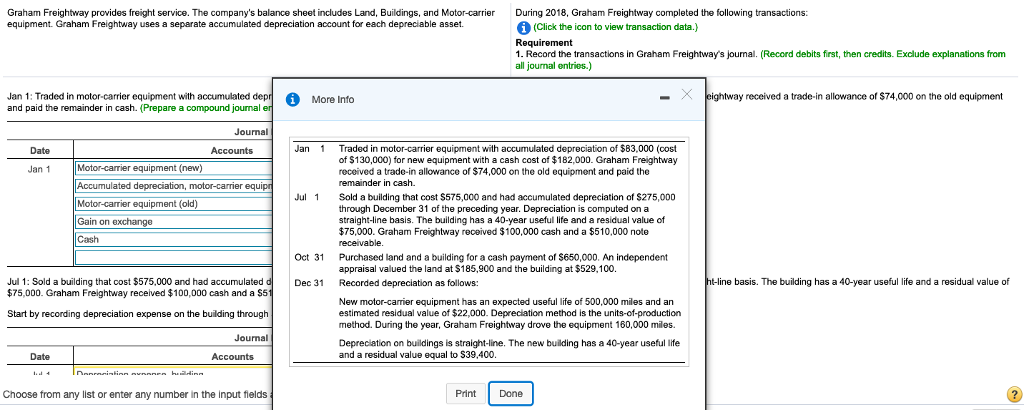

Graham Freightway provides freight service. The company's balance sheet includes Land, Buildings, and Motor-carrier equipment. Graham Freightway uses a separate accumulated depreciation account for each depreciable asset. During 2018, Graham Freightway completed the following transactions: (Click the icon to view transaction data.) Requirement 1. Record the transactlons in Graham Freightway's journal. (Record debits first, then credits. Exclude explanations from all journal entries.) y received a trade-in allowance of $74,000 on the old equipment Jan 1: Traded in motor-carrier equipment with accumulated dep and paid the remainder in cash. (Prepare a compound jounal More Info Journal Date Accounts Jan Traded in motor-carrier equipment with accumulated depreciation of $83,000 (cost of $130,000) for new equipment with a cash cost of $182,000. Graham Freightway received a trade-in allowance of $74,000 on the old equipment and paid the Motor-carrier equipment (new) Accumulated depreciation, motor-carrier equi Motor-carrier equipment (old) Gain on exchange Jan 1 Jul 1 Sold a building that cost $575,000 and had accumulated depreciation of $275,000 through December 31 of the preceding year. Depreciation is computed on a straight-line basis. The building has a 40-year useful life and a residual value of $75,000. Graham Freightway received $100,000 cash and a $510,000 note Oct 31 Purchased land and a building for a cash payment of $650,000. An independent appraisal valued the land at $185,900 and the building at $529,100. Recorded depreciation as follows: Jul 1: Sold a building that cost $575,000 and had accumulated 7,000. Graham Freightway received $100,000 cash and a $5 Start by recording depreciation expense on the building through Journal Dec 31 e basis. The building has a 40-year useful life and a residual value of New motor-carier equipment has an expected useful life of 500,000 miles and an estimated residual value of $22,000. Depreciation method is the units-of-production method. During the year, Graham Freightway drove the equipment 160,000 miles. Deprecation on buildings is straight-line. The new building has a 40-year useful life and a residual value equal to S39,400 Date Choose from any list or enter any number in the input fields Print Done