Answered step by step

Verified Expert Solution

Question

1 Approved Answer

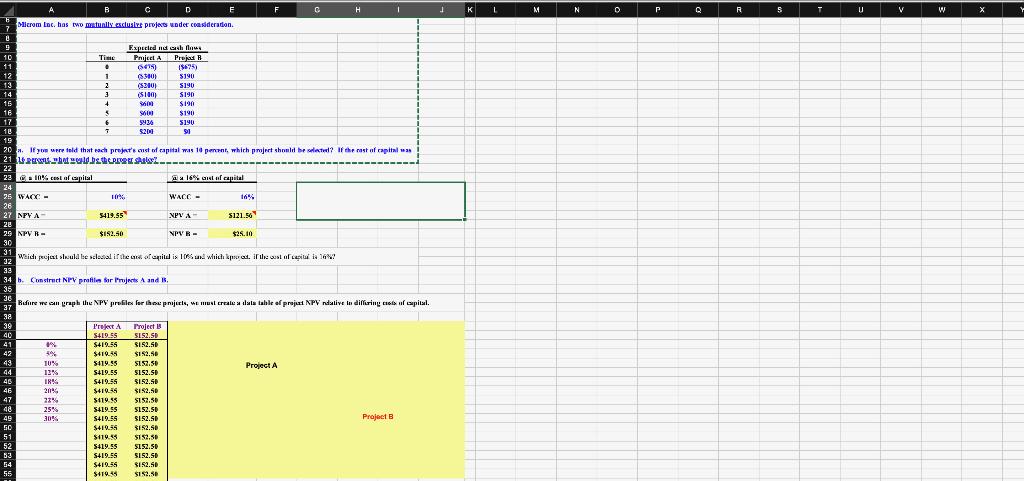

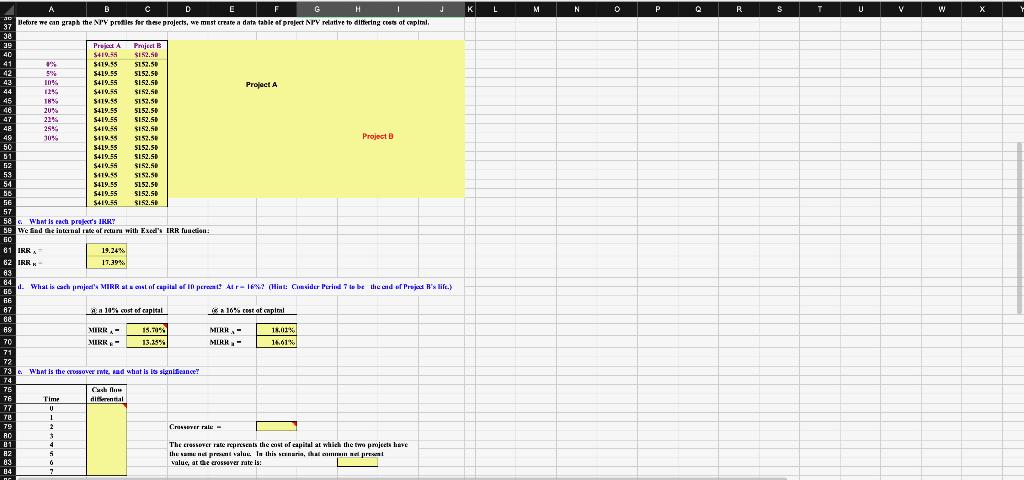

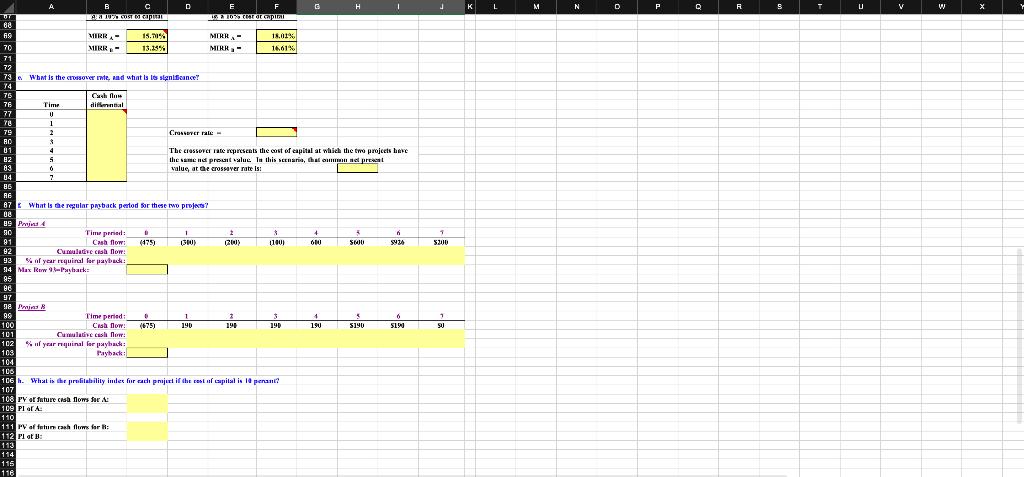

Help me in Excel with explanation please. 1 . K L M N N D P R 5 T U U V w X B

Help me in Excel with explanation please.

1 . K L M N N D P R 5 T U U V w X B C D F F . H 1 Microm Loc. has two matually exclusive projet de consideradon. U 9 Espected cash flows 10 Time Project A Pre 11 . (4) 1962) 12 1 (340) 5190 3801 13 2 (S21015190 14 3 SIO 5190 16 4 $190 16 9 will $190 17 6 $9365190 10 1 520 91 19 *. If were told that each projet'e cast of capital was 16 percent, which project should be selected? If the rest of rapital 21 Babser SAW 22 22 10% costofcial 16% del capital 24 25 WAC - HON WACC - 16% 26 27 MPYA 5419.95 NPVA 5121.56 28 29 NPVR- $152,50 NPVR $25.10 $ 30 31 32 Weidi pejat sula le local in the woferind is 1 which prout. The cost of all is 16V 33 34 b. Construct NPV profile for Irojects A and B. 35 36 Ruure we can graph the NP profiles for the pjes, me most create a dala table of prajut NPV ndalive in differing consul capital. 37 98 39 Project A Project 40 S41985 SISSP 41 09 $419.58 $152.50 42 y $410.45 $I$2.50 43 10% 541935 $152.50 Project A 44 13% S419.55 $152.SD 45 1R% S419.55 SI52.50 46 20% $41055 $152.50 47 22% $119.95 $152.50 48 25% 5419.95 5152.50 $ 49 3095 S419.55 $152.50 Project 50 $419.55 SIR2.50 51 $119.55 $12.50 52 5419.55 $152.50 53 S419.55 5152.SO 54 $410.58 $152.50 55 $41944 $1$2.50 K L M N O P R S V w X B C D G 1 J 20 97 Webore we can graph the N'Y profiles for de projects, we must create a data table of project NPY relative to differing cmts at capital 38 39 Projet A PmjB 40 $410.35 $152.50 41 % $119.55 $152.5 42 5% 5419.55 $152.51 43 10 S419.55 $152.5D Project A 44 11% $410.55 $152.SE 45 18% $119.95 $152.SE 46 20% 5419.55 $152.5D 47 22% S419.55 $152.5D 48 25% % $419.54 $ SIR2.SE 49 30% $ $114.45 SI52,50 Project 50 5419.95 $152.5D 61 S419.55 $152.5D 52 $410.55 $152.50 53 $119.45 $I 2.50 54 S419.55 5152.50 BB S419.55 $152.5D 56 $410.45 3152.58 57 58 6 What is each projects IRR? se we find cinnal tale of returi with Exod's ERR function: GO 81 IRRA 19.24% 62 IRRN 17.39% AS 84 What is Gach pinje MIRR of capital of Iperesni! Alr-1697 (Hint: Consider Perind to be the aid of Projas Rx life.) R'S GE BE 87 10% cost of capital a 16% cotofap 68 A9 MIRR - 15.00% MIRA- 18.01% 70 MIRR- 13,149 % MRK- 14,61% 71 72 73. What is the croSOLGT Wtz. And what is its significance? 74 75 Chlus 76 Timp dia 77 U Te 1 79 2 Crossover - RO $ 01 4 The crossover rate pesents the cost of capital at which the two project here 82 S the amend pron value. In this senario, la represal 03 6 value, at de cossover rate is: 84 7 ne L M N D P Q R S TU V w X MIRRA .15 A B B C C D E F G H TT A 107 COST Canal 18. 10% marcapai 88 69 MIRR- 18.01% 70 MIRR - 13.15% MIRR- 16,61% 71 72 73 What is the Crossover Inte, and what is its significance! 74 75 (ash flue 76 Time diflannal 77 U 7 1 79 2 Crossover rais- 80 $ 11 4 The crossover rate represents the cost of capital at which the two projects are B2 S nE preuit alul In this MEEharis, net prEasil 83 6 value, at de crossover rate is: 04 7 86 AE 87 What is a regular payback period for these two pros? 02 99 P4 90 Time period B 1 $ + 91 . .. Cashflow: (479 (30) 11001 000 SUU y24 92 Cum de cish Norr 93 of your requiral for payback: 94 Max Rww Phack: 95 97 99 Pias 99 Time period 1 2 3 1 5 100 Cash Dow: (675) 190 191 190 190 5190 519 101 Cumulative cash Now: 102 Sulyarnguinal for payback: 103 Payback 104 106 106. What is the profitability index furcade project if the capital is leperant? 2 (26 5.2.16 1 9 107 108 PY of future cash flow for 109 PIGA: 110 111 PV af totum rash flow for : 112 Pia 113 114 115 116 1 . K L M N N D P R 5 T U U V w X B C D F F . H 1 Microm Loc. has two matually exclusive projet de consideradon. U 9 Espected cash flows 10 Time Project A Pre 11 . (4) 1962) 12 1 (340) 5190 3801 13 2 (S21015190 14 3 SIO 5190 16 4 $190 16 9 will $190 17 6 $9365190 10 1 520 91 19 *. If were told that each projet'e cast of capital was 16 percent, which project should be selected? If the rest of rapital 21 Babser SAW 22 22 10% costofcial 16% del capital 24 25 WAC - HON WACC - 16% 26 27 MPYA 5419.95 NPVA 5121.56 28 29 NPVR- $152,50 NPVR $25.10 $ 30 31 32 Weidi pejat sula le local in the woferind is 1 which prout. The cost of all is 16V 33 34 b. Construct NPV profile for Irojects A and B. 35 36 Ruure we can graph the NP profiles for the pjes, me most create a dala table of prajut NPV ndalive in differing consul capital. 37 98 39 Project A Project 40 S41985 SISSP 41 09 $419.58 $152.50 42 y $410.45 $I$2.50 43 10% 541935 $152.50 Project A 44 13% S419.55 $152.SD 45 1R% S419.55 SI52.50 46 20% $41055 $152.50 47 22% $119.95 $152.50 48 25% 5419.95 5152.50 $ 49 3095 S419.55 $152.50 Project 50 $419.55 SIR2.50 51 $119.55 $12.50 52 5419.55 $152.50 53 S419.55 5152.SO 54 $410.58 $152.50 55 $41944 $1$2.50 K L M N O P R S V w X B C D G 1 J 20 97 Webore we can graph the N'Y profiles for de projects, we must create a data table of project NPY relative to differing cmts at capital 38 39 Projet A PmjB 40 $410.35 $152.50 41 % $119.55 $152.5 42 5% 5419.55 $152.51 43 10 S419.55 $152.5D Project A 44 11% $410.55 $152.SE 45 18% $119.95 $152.SE 46 20% 5419.55 $152.5D 47 22% S419.55 $152.5D 48 25% % $419.54 $ SIR2.SE 49 30% $ $114.45 SI52,50 Project 50 5419.95 $152.5D 61 S419.55 $152.5D 52 $410.55 $152.50 53 $119.45 $I 2.50 54 S419.55 5152.50 BB S419.55 $152.5D 56 $410.45 3152.58 57 58 6 What is each projects IRR? se we find cinnal tale of returi with Exod's ERR function: GO 81 IRRA 19.24% 62 IRRN 17.39% AS 84 What is Gach pinje MIRR of capital of Iperesni! Alr-1697 (Hint: Consider Perind to be the aid of Projas Rx life.) R'S GE BE 87 10% cost of capital a 16% cotofap 68 A9 MIRR - 15.00% MIRA- 18.01% 70 MIRR- 13,149 % MRK- 14,61% 71 72 73. What is the croSOLGT Wtz. And what is its significance? 74 75 Chlus 76 Timp dia 77 U Te 1 79 2 Crossover - RO $ 01 4 The crossover rate pesents the cost of capital at which the two project here 82 S the amend pron value. In this senario, la represal 03 6 value, at de cossover rate is: 84 7 ne L M N D P Q R S TU V w X MIRRA .15 A B B C C D E F G H TT A 107 COST Canal 18. 10% marcapai 88 69 MIRR- 18.01% 70 MIRR - 13.15% MIRR- 16,61% 71 72 73 What is the Crossover Inte, and what is its significance! 74 75 (ash flue 76 Time diflannal 77 U 7 1 79 2 Crossover rais- 80 $ 11 4 The crossover rate represents the cost of capital at which the two projects are B2 S nE preuit alul In this MEEharis, net prEasil 83 6 value, at de crossover rate is: 04 7 86 AE 87 What is a regular payback period for these two pros? 02 99 P4 90 Time period B 1 $ + 91 . .. Cashflow: (479 (30) 11001 000 SUU y24 92 Cum de cish Norr 93 of your requiral for payback: 94 Max Rww Phack: 95 97 99 Pias 99 Time period 1 2 3 1 5 100 Cash Dow: (675) 190 191 190 190 5190 519 101 Cumulative cash Now: 102 Sulyarnguinal for payback: 103 Payback 104 106 106. What is the profitability index furcade project if the capital is leperant? 2 (26 5.2.16 1 9 107 108 PY of future cash flow for 109 PIGA: 110 111 PV af totum rash flow for : 112 Pia 113 114 115 116Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started