Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help me out The accounting concept that requires every business to be accounted for separatefy from ofher burinegs entitien, including its owner or owners is

help me out

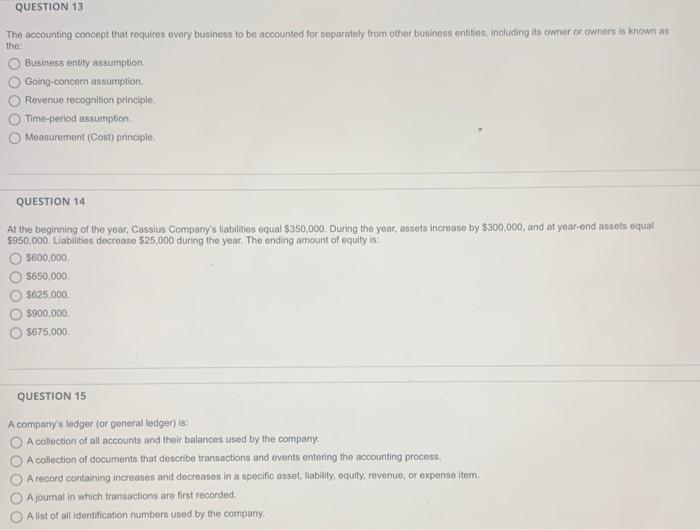

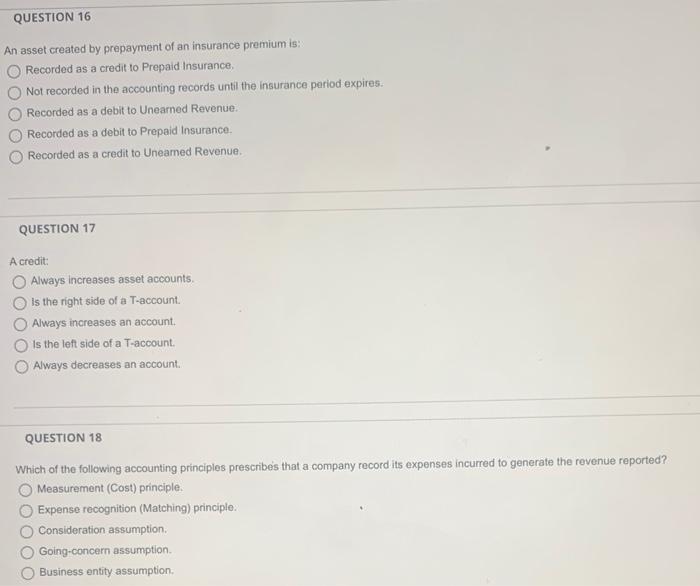

The accounting concept that requires every business to be accounted for separatefy from ofher burinegs entitien, including its owner or owners is kncwn as the: Business entity assumption. Going-concern assumption. Revenue recognition principle. Time-period assumption. Measurement (Cost) principle. QUESTION 14 At the beginning of the year, Cassius Company's liabilities equal $350,000. During the year, assets increase by $300,000, and at year-ond assets equal $950,000. Liabilities decroase $25,000 during the year. The ending amount of equity is: $600,000. \$650,000 5625,000. $900,000. 5575,000. QUESTION 15 A company's ledger (or general ledger) is: A collection of all accounts and their balances used by the company A collection of documents that describe transactions and events entering the accounting process. A record opntaining increases and decreases in a specific asset, liability, equity, revenue, or expense item. Ajoumal in which transactions are first recorded. A list of all identification numbers used by the company. An asset created by prepayment of an insurance premium is: Recorded as a credit to Prepaid Insurance. Not recorded in the accounting records until the insurance period expires. Recorded as a debit to Unearned Revenue: Recorded as a debit to Prepaid Insurance. Recorded as a credit to Uneamed Revenue. QUESTION 17 A credit: Always increases asset accounts. Is the right side of a T-account. Always increases an account. Is the left side of a T-account. Always decreases an account. QUESTION 18 Which of the following accounting principles prescribes that a company record its expenses incurred to generate the revenue reported? Measurement (Cost) principle. Expense recognition (Matching) principle. Consideration assumption. Going-concern assumption. Business entity assumption

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started