Help me please!

Attached is a report from Goldman Sachs dated 10/23 with option recommendations. Exhibit 1 provides a list of call options, that Goldman is recommending to buy.

What is a good specific call option to write about. Can you point out to me what the maximum upside and downside is for both the writer/seller of the option and for the buyer, using graphs.

Since these are buy recommendations, help me figure out where Goldman Sachs might be wrong - just as they were wrong on their LMT call option recommendation.

I need about a page or two helping me talk about this, I'm so confused !

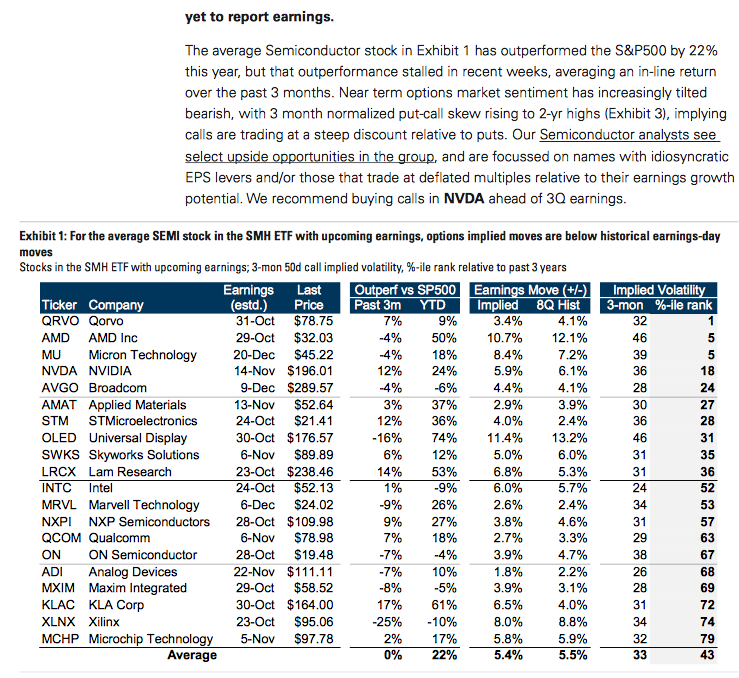

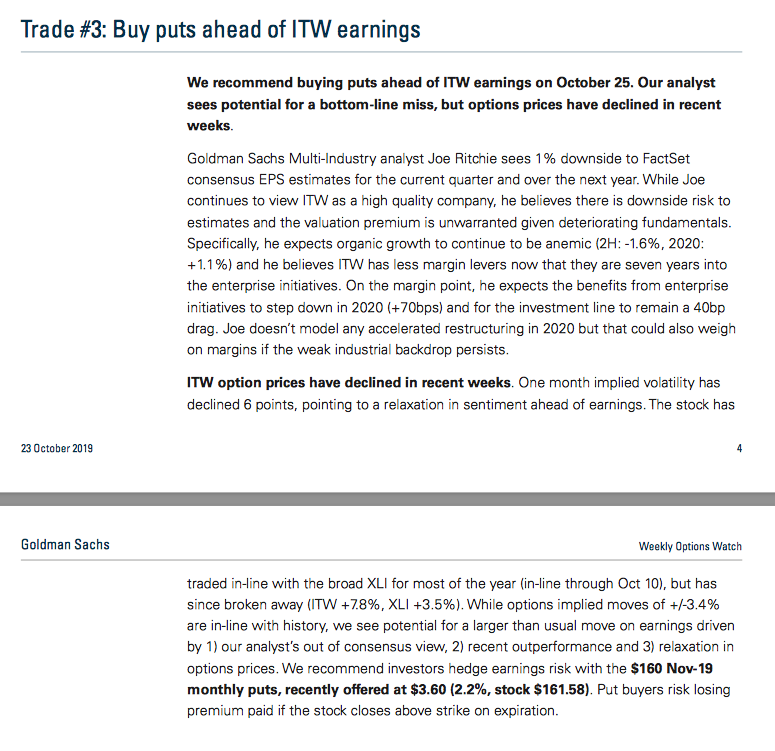

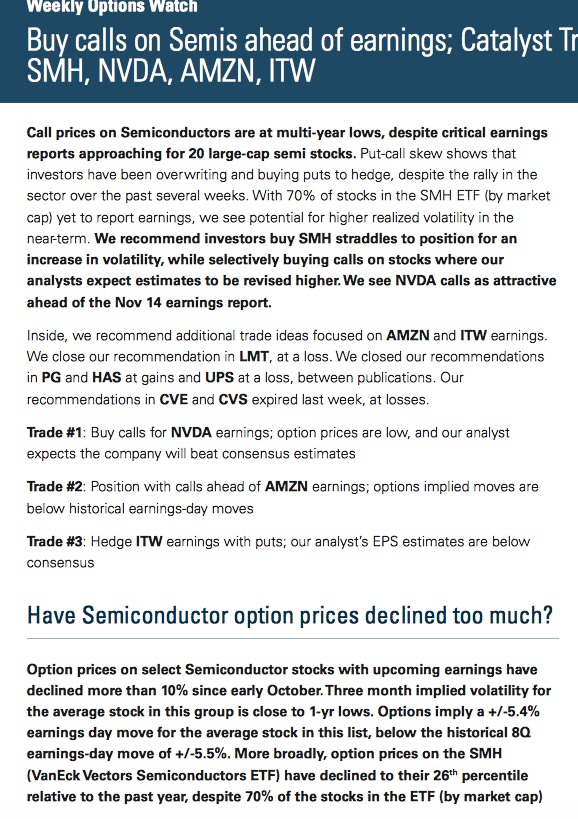

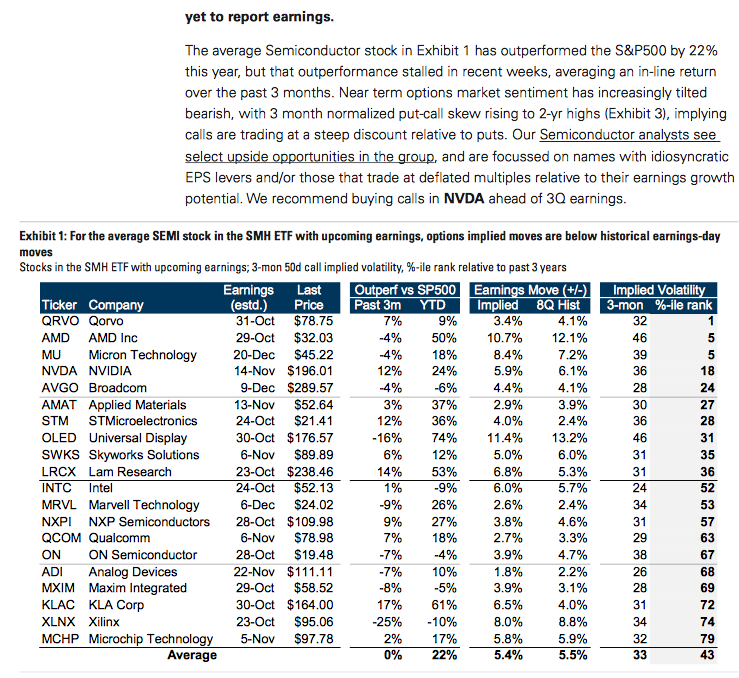

Weekly Uptions Watch Buy calls on Semis ahead of earnings; Catalyst Tr SMH, NVDA, AMZN, ITW Call prices on Semiconductors are at multi-year lows, despite critical earnings reports approaching for 20 large-cap semi stocks. Put-call skew shows that investors have been overwriting and buying puts to hedge, despite the rally in the sector over the past several weeks. With 70% of stocks in the SMH ETF (by market cap) yet to report earnings, we see potential for higher realized volatility in the near-term. We recommend investors buy SMH straddles to position for an increase in volatility, while selectively buying calls on stocks where our analysts expect estimates to be revised higher. We see NVDA calls as attractive ahead of the Nov 14 earnings report. Inside, we recommend additional trade ideas focused on AMZN and ITW earnings. We close our recommendation in LMT, at a loss. We closed our recommendations in PG and HAS at gains and UPS at a loss, between publications. Our recommendations in CVE and CVS expired last week, at losses. Trade #1: Buy calls for NVDA earnings, option prices are low, and our analyst expects the company will beat consensus estimates Trade #2: Position with calls ahead of AMZN earnings, options implied moves are below historical earnings-day moves Trade #3: Hedge ITW earnings with puts; our analyst's EPS estimates are below consensus Have Semiconductor option prices declined too much? Option prices on select Semiconductor stocks with upcoming earnings have declined more than 10% since early October. Three month implied volatility for the average stock in this group is close to 1-yr lows. Options imply a +/-5.4% earnings day move for the average stock in this list, below the historical 8Q earnings-day move of +/-5.5%. More broadly, option prices on the SMH (VanEck Vectors Semiconductors ETF) have declined to their 26th percentile relative to the past year, despite 70% of the stocks in the ETF (by market cap) yet to report earnings. The average Semiconductor stock in Exhibit 1 has outperformed the S&P500 by 22% this year, but that outperformance stalled in recent weeks, averaging an in-line return over the past 3 months. Near term options market sentiment has increasingly tilted bearish, with 3 month normalized put-call skew rising to 2-yr highs (Exhibit 3), implying calls are trading at a steep discount relative to puts. Our Semiconductor analysts see select upside opportunities in the group, and are focussed on names with idiosyncratic EPS levers and/or those that trade at deflated multiples relative to their earnings growth potential. We recommend buying calls in NVDA ahead of 3Q earnings. Exhibit 1: For the average SEMI stock in the SMH ETF with upcoming earnings, options implied moves are below historical earnings-day moves Implied Volatility 3-mon %-ile rank 32 46 Stocks in the SMH ETF with upcoming earnings; 3-mon 50d call implied volatility,%-ile rank relative to past 3 years Earnings Last Outperf vs SP500 Earnings Move (+/-) Ticker Company (estd.) Price Past 3m YTD Implied 8Q Hist QRVO Qorvo 31-Oct $78.75 7% 9% 3.4% 4.1% AMD AMD Inc 29-Oct $32.03 -4% 50% 10.7% 12.1% MU Micron Technology 20-Dec $45.22 -4% 18% 8.4% 7.2% NVDA NVIDIA 14-Nov $196.01 12% 24% 5.9% 6.1% AVGO Broadcom 9-Dec $289.57 -4% -6% 4.4% 4.1% AMAT Applied Materials 13-Nov $52.64 3% 37% 2.9% 3.9% STM STMicroelectronics 24-Oct $21.41 12% 36% 4.0% 2.4% OLED Universal Display 30-Oct $176.57 -16% 74% 11.4% 13.2% SWKS Skyworks Solutions 6-Nov $89.89 6% 12% 5.0% 6.0% LRCX Lam Research 23-Oct $238.46 14% 53% 6.8% 5.3% INTC Intel 24-Oct $52.13 1% -9% 6.0% 5.7% MRVL Marvell Technology 6-Dec $24.02 -9% 26% 2.6% 2.4% NXPI NXP Semiconductors 28-Oct $109.98 9% 3.8% 4.6% QCOM Qualcomm 6-Nov $78.98 18% 2.7% 3.3% ON ON Semiconductor 28-Oct $19.48 -4% 3.9% 4.7% ADI Analog Devices 22-Nov $111.11 -7% 10% 1.8% 2.2% MXIM Maxim Integrated 29-Oct $58.52 -8% -5% 3.9% 3.1% KLAC KLA Corp 30-Oct $164.00 17% 61% 6.5% 4.0% XLNX Xilinx 23-Oct $95.06 -25% -10% 8.0% 8.8% MCHP Microchip Technology 5-Nov $97.78 2% 17% 5.8% 5.9% Average 0% 22% 5.4% 5.5% 27% 7% -7% Trade #1: Buy NVDA calls for earnings Goldman Sachs Semiconductors analyst Toshiya Hari expects NVDA to beat consensus EPS estimates on earnings, but options implied volatility is only in-line with 3-yr average levels. Toshiya believes management is likely to deliver strong sequential growth in FY3Q (Oct) in the Gaming segment, supported by the normalization in channel inventory and the launch of its new products (i.e., RTX SUPER line). In Datacenter, he sees the combination of improving trends in hyperscale capex and increased adoption of GPU-based solutions for inference applications (e.g., note on 9/20, AWS announced the general availability of new EC2 G4 instances - powered by Nvidia's T4 GPUs - in North America, Europe and Asia) driving robust growth over the next several quarters. Toshiya sees yoy segment revenue growth reverting to positive territory in FY4Q (Jan) and accelerating further into 1 HFY21. His EPS estimate is 3% above FactSet consensus for the current quarter and 10% above over the next year. Option prices are only at median levels relative to history. NVDA's one month implied volatility of 42 is only at median levels relative to the past 3 years, despite earnings on Nov 14. Options are implying a +/-5.9% move on earnings, modestly below the historical 80 earnings-day move of +/-6.1%. One month normalized put-call skew is above its 80th percentile, implying options market positioning is skewed bearish ahead of earnings. We see calls as attractive, and recommend investors buy the $197.50 Nov 19 monthly call, recently offered at $8.20 (4.2%, stock at $195.61). Call buyers risk losing premium paid if the stock closes below strike price on expiration. Trade #2: Buy AMZN calls for earnings We recommend investors buy calls ahead of AMZN earnings on October 24. Options implied moves are below historical realized moves on earnings, while our analyst sees earnings beating consensus estimates. Goldman Sachs Internet analyst Heath Terry sees 33% upside to Buy-rated AMZN shares (on the Conviction List) over the next 12 months. Heath believes that we are still relatively early-stage in the shift of workloads to the cloud, the transition of traditional retail online, and the development of the advertising business. With revenue growth accelerating, he continues to view AMZN as one of the best risk/rewards in Internet. Heath expects the US eCommerce trend to reaccelerate in 2019 as store closures have reaccelerated. With apparel & accessories recording the largest share of store closures, he believes Amazon will be a primary beneficiary, considering this segment already sees >20% online penetration. His EPS estimate is 9% above FactSet consensus for the current quarter and 3% above over the next year. Options implied moves are below historical earnings-day moves. AMZN options are implying a +/-3.3% move on earnings, below the historical 8Q earnings-day move of +/-4.7%. One month implied volatility of 27 is only in-line with the 3-yr average, despite earnings on October 24. The stock has underperformed the broad S&P 500 by 2% this year, but one month normalized put-call skew is only at median levels relative to the past 3 years, implying options market sentiment is neutral heading into earnings. We believe calls are attractive, and recommend investors buy the AMZN $1767.50 Nov 19 monthly call for $51.08 (2.9%, stock $1765.73). Call buyers risk losing premium paid if the stock closes at strike price on expiration. Trade #3: Buy puts ahead of ITW earnings We recommend buying puts ahead of ITW earnings on October 25. Our analyst sees potential for a bottom-line miss, but options prices have declined in recent weeks. Goldman Sachs Multi-Industry analyst Joe Ritchie sees 1% downside to FactSet consensus EPS estimates for the current quarter and over the next year. While Joe continues to view ITW as a high quality company, he believes there is downside risk to estimates and the valuation premium is unwarranted given deteriorating fundamentals. Specifically, he expects organic growth to continue to be anemic (2H: -1.6%, 2020: +1.1%) and he believes ITW has less margin levers now that they are seven years into the enterprise initiatives. On the margin point, he expects the benefits from enterprise initiatives to step down in 2020 (+70bps) and for the investment line to remain a 40bp drag. Joe doesn't model any accelerated restructuring in 2020 but that could also weigh on margins if the weak industrial backdrop persists. ITW option prices have declined in recent weeks. One month implied volatility has declined 6 points, pointing to a relaxation in sentiment ahead of earnings. The stock has 23 October 2019 Goldman Sachs Weekly Options Watch traded in-line with the broad XLI for most of the year (in-line through Oct 10), but has since broken away (ITW +7.8%, XLI +3.5%). While options implied moves of +/-3.4% are in-line with history, we see potential for a larger than usual move on earnings driven by 1) our analyst's out of consensus view, 2) recent outperformance and 3) relaxation in options prices. We recommend investors hedge earnings risk with the $160 Nov-19 monthly puts, recently offered at $3.60 (2.2%, stock $161.58). Put buyers risk losing premium paid if the stock closes above strike on expiration. Goldman Saans beneficially owned 1% of more of SIVIH excluding positions managed by GSM and Derivatives as of September 30, 2019. Option Specific Disclosures Price target methodology: Please refer to the analyst's previously published research for methodology and risks associated with equity price targets. Pricing Disclosure: Option prices and volatility levels in this note are indicative only, and are based on our estimates of recent mid- market levels unless otherwise noted). All prices and levels exclude transaction costs unless otherwise stated. General Options Risks - The risks below and any other options risks mentioned in this research report pertain both to specific derivative trade recommendations mentioned and to discussion of general opportunities and advantages of derivative strategies. Unless otherwise noted, options strategies mentioned in this report may be a combination of the strategies below and therefore carry with them the risks of those strategies. Buying Options - Investors who buy call (put options risk loss of the entire premium paid if the underlying security finishes below (above) the strike price at expiration. Investors who buy call or put spreads also risk a maximum loss of the premium paid. The maximum gain on a long call or put spread is the difference between the strike prices, less the premium paid. Selling Options - Investors who sell calls on securities they do not own risk unlimited loss of the security price less the strike price. Investors who sell covered calls (sell calls while owning the underlying security risk having to deliver the underlying security or pay the difference between the security price and the strike price, depending on whether the option is settled by physical delivery or cash-settled. Investors who sell puts risk loss of the strike price less the premium received for selling the put. Investors who sell put or call spreads risk a maximum loss of the difference between the strikes less the premium received, while their maximum gain is the premium received. For options settled by physical delivery, the above risks assume the options buyer or seller, buys or sells the resulting securities at the settlement price on expiry. Weekly Uptions Watch Buy calls on Semis ahead of earnings; Catalyst Tr SMH, NVDA, AMZN, ITW Call prices on Semiconductors are at multi-year lows, despite critical earnings reports approaching for 20 large-cap semi stocks. Put-call skew shows that investors have been overwriting and buying puts to hedge, despite the rally in the sector over the past several weeks. With 70% of stocks in the SMH ETF (by market cap) yet to report earnings, we see potential for higher realized volatility in the near-term. We recommend investors buy SMH straddles to position for an increase in volatility, while selectively buying calls on stocks where our analysts expect estimates to be revised higher. We see NVDA calls as attractive ahead of the Nov 14 earnings report. Inside, we recommend additional trade ideas focused on AMZN and ITW earnings. We close our recommendation in LMT, at a loss. We closed our recommendations in PG and HAS at gains and UPS at a loss, between publications. Our recommendations in CVE and CVS expired last week, at losses. Trade #1: Buy calls for NVDA earnings, option prices are low, and our analyst expects the company will beat consensus estimates Trade #2: Position with calls ahead of AMZN earnings, options implied moves are below historical earnings-day moves Trade #3: Hedge ITW earnings with puts; our analyst's EPS estimates are below consensus Have Semiconductor option prices declined too much? Option prices on select Semiconductor stocks with upcoming earnings have declined more than 10% since early October. Three month implied volatility for the average stock in this group is close to 1-yr lows. Options imply a +/-5.4% earnings day move for the average stock in this list, below the historical 8Q earnings-day move of +/-5.5%. More broadly, option prices on the SMH (VanEck Vectors Semiconductors ETF) have declined to their 26th percentile relative to the past year, despite 70% of the stocks in the ETF (by market cap) yet to report earnings. The average Semiconductor stock in Exhibit 1 has outperformed the S&P500 by 22% this year, but that outperformance stalled in recent weeks, averaging an in-line return over the past 3 months. Near term options market sentiment has increasingly tilted bearish, with 3 month normalized put-call skew rising to 2-yr highs (Exhibit 3), implying calls are trading at a steep discount relative to puts. Our Semiconductor analysts see select upside opportunities in the group, and are focussed on names with idiosyncratic EPS levers and/or those that trade at deflated multiples relative to their earnings growth potential. We recommend buying calls in NVDA ahead of 3Q earnings. Exhibit 1: For the average SEMI stock in the SMH ETF with upcoming earnings, options implied moves are below historical earnings-day moves Implied Volatility 3-mon %-ile rank 32 46 Stocks in the SMH ETF with upcoming earnings; 3-mon 50d call implied volatility,%-ile rank relative to past 3 years Earnings Last Outperf vs SP500 Earnings Move (+/-) Ticker Company (estd.) Price Past 3m YTD Implied 8Q Hist QRVO Qorvo 31-Oct $78.75 7% 9% 3.4% 4.1% AMD AMD Inc 29-Oct $32.03 -4% 50% 10.7% 12.1% MU Micron Technology 20-Dec $45.22 -4% 18% 8.4% 7.2% NVDA NVIDIA 14-Nov $196.01 12% 24% 5.9% 6.1% AVGO Broadcom 9-Dec $289.57 -4% -6% 4.4% 4.1% AMAT Applied Materials 13-Nov $52.64 3% 37% 2.9% 3.9% STM STMicroelectronics 24-Oct $21.41 12% 36% 4.0% 2.4% OLED Universal Display 30-Oct $176.57 -16% 74% 11.4% 13.2% SWKS Skyworks Solutions 6-Nov $89.89 6% 12% 5.0% 6.0% LRCX Lam Research 23-Oct $238.46 14% 53% 6.8% 5.3% INTC Intel 24-Oct $52.13 1% -9% 6.0% 5.7% MRVL Marvell Technology 6-Dec $24.02 -9% 26% 2.6% 2.4% NXPI NXP Semiconductors 28-Oct $109.98 9% 3.8% 4.6% QCOM Qualcomm 6-Nov $78.98 18% 2.7% 3.3% ON ON Semiconductor 28-Oct $19.48 -4% 3.9% 4.7% ADI Analog Devices 22-Nov $111.11 -7% 10% 1.8% 2.2% MXIM Maxim Integrated 29-Oct $58.52 -8% -5% 3.9% 3.1% KLAC KLA Corp 30-Oct $164.00 17% 61% 6.5% 4.0% XLNX Xilinx 23-Oct $95.06 -25% -10% 8.0% 8.8% MCHP Microchip Technology 5-Nov $97.78 2% 17% 5.8% 5.9% Average 0% 22% 5.4% 5.5% 27% 7% -7% Trade #1: Buy NVDA calls for earnings Goldman Sachs Semiconductors analyst Toshiya Hari expects NVDA to beat consensus EPS estimates on earnings, but options implied volatility is only in-line with 3-yr average levels. Toshiya believes management is likely to deliver strong sequential growth in FY3Q (Oct) in the Gaming segment, supported by the normalization in channel inventory and the launch of its new products (i.e., RTX SUPER line). In Datacenter, he sees the combination of improving trends in hyperscale capex and increased adoption of GPU-based solutions for inference applications (e.g., note on 9/20, AWS announced the general availability of new EC2 G4 instances - powered by Nvidia's T4 GPUs - in North America, Europe and Asia) driving robust growth over the next several quarters. Toshiya sees yoy segment revenue growth reverting to positive territory in FY4Q (Jan) and accelerating further into 1 HFY21. His EPS estimate is 3% above FactSet consensus for the current quarter and 10% above over the next year. Option prices are only at median levels relative to history. NVDA's one month implied volatility of 42 is only at median levels relative to the past 3 years, despite earnings on Nov 14. Options are implying a +/-5.9% move on earnings, modestly below the historical 80 earnings-day move of +/-6.1%. One month normalized put-call skew is above its 80th percentile, implying options market positioning is skewed bearish ahead of earnings. We see calls as attractive, and recommend investors buy the $197.50 Nov 19 monthly call, recently offered at $8.20 (4.2%, stock at $195.61). Call buyers risk losing premium paid if the stock closes below strike price on expiration. Trade #2: Buy AMZN calls for earnings We recommend investors buy calls ahead of AMZN earnings on October 24. Options implied moves are below historical realized moves on earnings, while our analyst sees earnings beating consensus estimates. Goldman Sachs Internet analyst Heath Terry sees 33% upside to Buy-rated AMZN shares (on the Conviction List) over the next 12 months. Heath believes that we are still relatively early-stage in the shift of workloads to the cloud, the transition of traditional retail online, and the development of the advertising business. With revenue growth accelerating, he continues to view AMZN as one of the best risk/rewards in Internet. Heath expects the US eCommerce trend to reaccelerate in 2019 as store closures have reaccelerated. With apparel & accessories recording the largest share of store closures, he believes Amazon will be a primary beneficiary, considering this segment already sees >20% online penetration. His EPS estimate is 9% above FactSet consensus for the current quarter and 3% above over the next year. Options implied moves are below historical earnings-day moves. AMZN options are implying a +/-3.3% move on earnings, below the historical 8Q earnings-day move of +/-4.7%. One month implied volatility of 27 is only in-line with the 3-yr average, despite earnings on October 24. The stock has underperformed the broad S&P 500 by 2% this year, but one month normalized put-call skew is only at median levels relative to the past 3 years, implying options market sentiment is neutral heading into earnings. We believe calls are attractive, and recommend investors buy the AMZN $1767.50 Nov 19 monthly call for $51.08 (2.9%, stock $1765.73). Call buyers risk losing premium paid if the stock closes at strike price on expiration. Trade #3: Buy puts ahead of ITW earnings We recommend buying puts ahead of ITW earnings on October 25. Our analyst sees potential for a bottom-line miss, but options prices have declined in recent weeks. Goldman Sachs Multi-Industry analyst Joe Ritchie sees 1% downside to FactSet consensus EPS estimates for the current quarter and over the next year. While Joe continues to view ITW as a high quality company, he believes there is downside risk to estimates and the valuation premium is unwarranted given deteriorating fundamentals. Specifically, he expects organic growth to continue to be anemic (2H: -1.6%, 2020: +1.1%) and he believes ITW has less margin levers now that they are seven years into the enterprise initiatives. On the margin point, he expects the benefits from enterprise initiatives to step down in 2020 (+70bps) and for the investment line to remain a 40bp drag. Joe doesn't model any accelerated restructuring in 2020 but that could also weigh on margins if the weak industrial backdrop persists. ITW option prices have declined in recent weeks. One month implied volatility has declined 6 points, pointing to a relaxation in sentiment ahead of earnings. The stock has 23 October 2019 Goldman Sachs Weekly Options Watch traded in-line with the broad XLI for most of the year (in-line through Oct 10), but has since broken away (ITW +7.8%, XLI +3.5%). While options implied moves of +/-3.4% are in-line with history, we see potential for a larger than usual move on earnings driven by 1) our analyst's out of consensus view, 2) recent outperformance and 3) relaxation in options prices. We recommend investors hedge earnings risk with the $160 Nov-19 monthly puts, recently offered at $3.60 (2.2%, stock $161.58). Put buyers risk losing premium paid if the stock closes above strike on expiration. Goldman Saans beneficially owned 1% of more of SIVIH excluding positions managed by GSM and Derivatives as of September 30, 2019. Option Specific Disclosures Price target methodology: Please refer to the analyst's previously published research for methodology and risks associated with equity price targets. Pricing Disclosure: Option prices and volatility levels in this note are indicative only, and are based on our estimates of recent mid- market levels unless otherwise noted). All prices and levels exclude transaction costs unless otherwise stated. General Options Risks - The risks below and any other options risks mentioned in this research report pertain both to specific derivative trade recommendations mentioned and to discussion of general opportunities and advantages of derivative strategies. Unless otherwise noted, options strategies mentioned in this report may be a combination of the strategies below and therefore carry with them the risks of those strategies. Buying Options - Investors who buy call (put options risk loss of the entire premium paid if the underlying security finishes below (above) the strike price at expiration. Investors who buy call or put spreads also risk a maximum loss of the premium paid. The maximum gain on a long call or put spread is the difference between the strike prices, less the premium paid. Selling Options - Investors who sell calls on securities they do not own risk unlimited loss of the security price less the strike price. Investors who sell covered calls (sell calls while owning the underlying security risk having to deliver the underlying security or pay the difference between the security price and the strike price, depending on whether the option is settled by physical delivery or cash-settled. Investors who sell puts risk loss of the strike price less the premium received for selling the put. Investors who sell put or call spreads risk a maximum loss of the difference between the strikes less the premium received, while their maximum gain is the premium received. For options settled by physical delivery, the above risks assume the options buyer or seller, buys or sells the resulting securities at the settlement price on expiry