Answered step by step

Verified Expert Solution

Question

1 Approved Answer

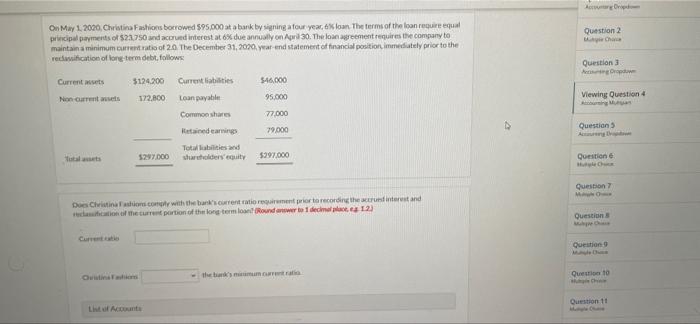

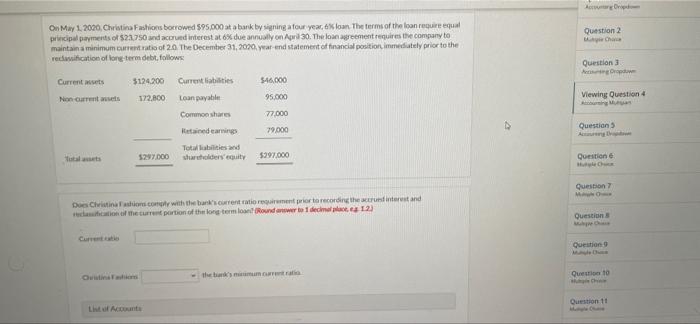

help me please help please Question 2 On May 1, 2020, Christina Fashions borrowed $95.000 at a bank ty signing a four year, loanThe terms

help me please

help please

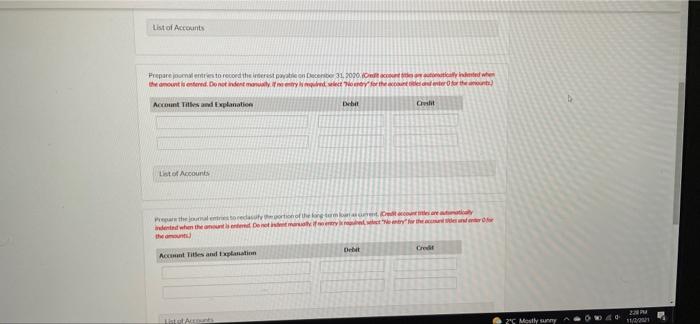

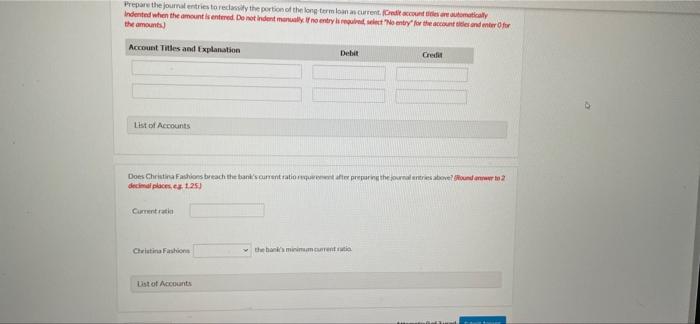

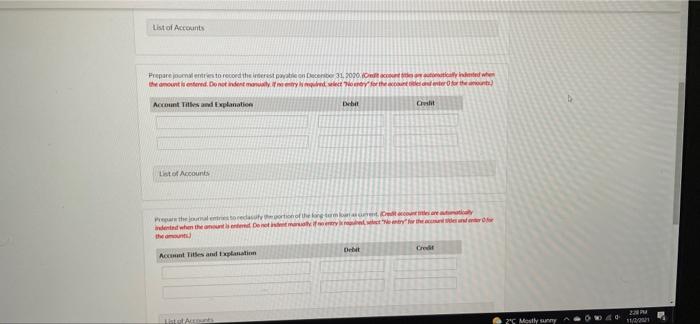

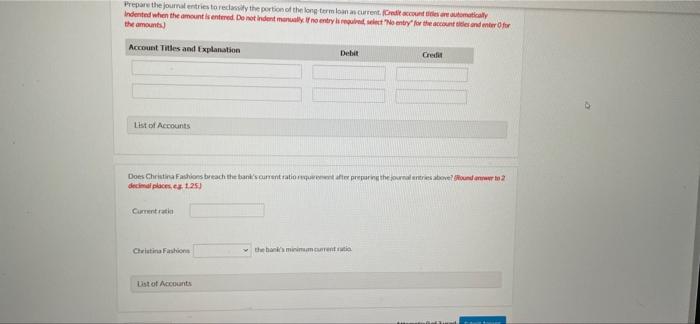

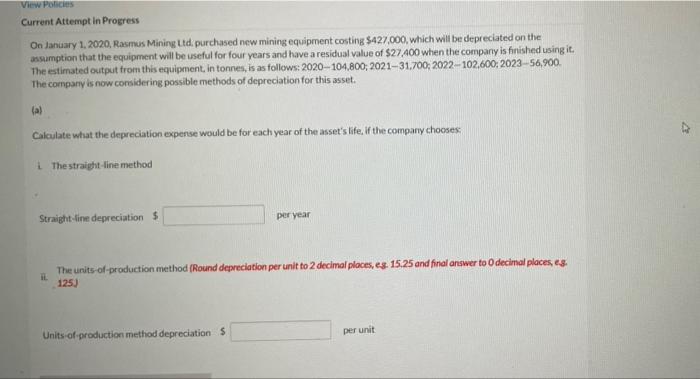

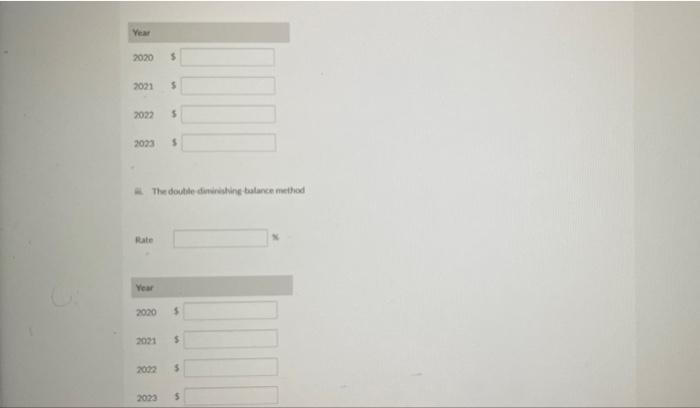

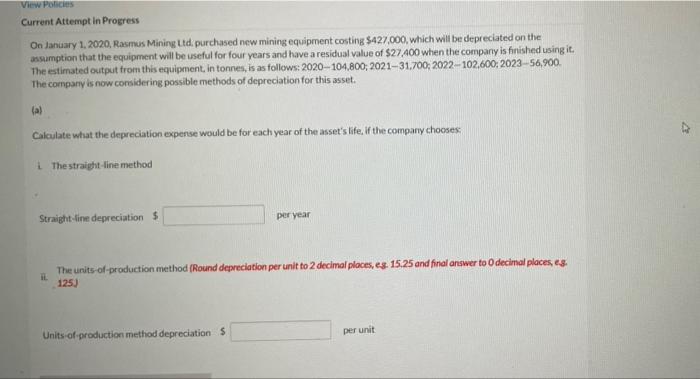

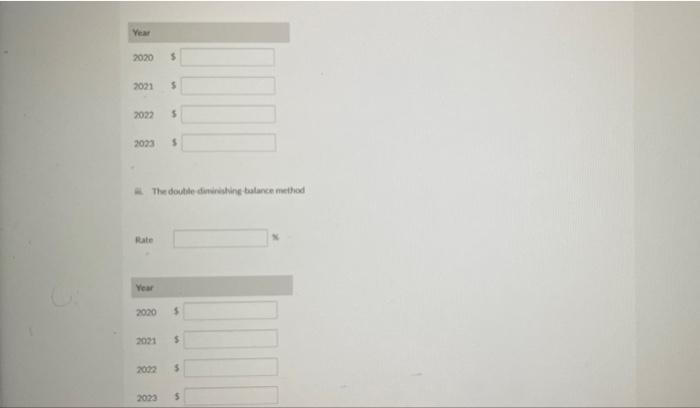

Question 2 On May 1, 2020, Christina Fashions borrowed $95.000 at a bank ty signing a four year, loanThe terms of the loan require equal principal payments of 522750 and accrued interest at x due annually on April 30. The longement requires the company to maintain a minimum current of 20 The December 31, 2020 year and statement of financial position, immediately prior to the redication of long term debit, follows Question 3 Dropdown Currentes Non Current 5124.200 172.000 Current liabilities Loan payable Common shares 546,000 95.000 Viewing Question 4 77.000 79.000 Questions Retained earning Total liabilities and urtaiders out totalt 5297.000 $297.000 Question Question Does Clvitnahon.com with the bank's current ratio requirement prior to recording the true interest and con meture portion of the long termo Round answer to decine 123 Questions Question them Quest 10 Question 11 Lito A List of Accounts Prepares to record the rest palon December 31, 2010. Odtially when the amounts entered. Donetindent monaty quod lectory for the Account Title Explanation Debit Gusht List of Account Prethored of the one tumat Indented when the Dreamweaver Delet Crede Accm Tites and Explanati 2 2C Mostly sunny A Prepare the journal entries to read the portion of the long termina continuo Indented when the amount is entered Dometindent monteret for the account and for the amounts) Account Titles and Explanation Cred List of Accounts Does Christina Fashion breach the bank's currentration after prepare the owner wound 2 decimal places 1.25 Current rati Christina Fashion the hos minimum currentie Ust of Accounts View Policies Current Attempt in Progress On January 1, 2020, Rasmus Mining Ltd, purchased new mining equipment costing $427,000, which will be depreciated on the assumption that the equipment will be useful for four years and have a residual value of $27.400 when the company is finished using it. The estimated output from this equipment in tonnes, is as follows: 2020-104,800, 2021-31.700, 2022-102,600: 2023-56,900 The company is now considering possible methods of depreciation for this asset. al Calculate what the depreciation expense would be for each year of the asset's life. If the company chooses: i The straight line method Straight-line depreciation $ per year . The units-of-production method (Round depreciation per unit to 2 decimal places, es. 15.25 and final answer to decimal places, es. 125) Units of production method depreciations per unit Year 2020 2021 $ 2022 $ 2093 $ The doute diminishing balance method Rate Year 2020 5 2021 $ 2002 5 2023 $ 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started