Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help me please Inventory at the beginning of the year cost $12,500. During the year, the company purchased (on account) inventory costing $79,500. Inventory that

help me please

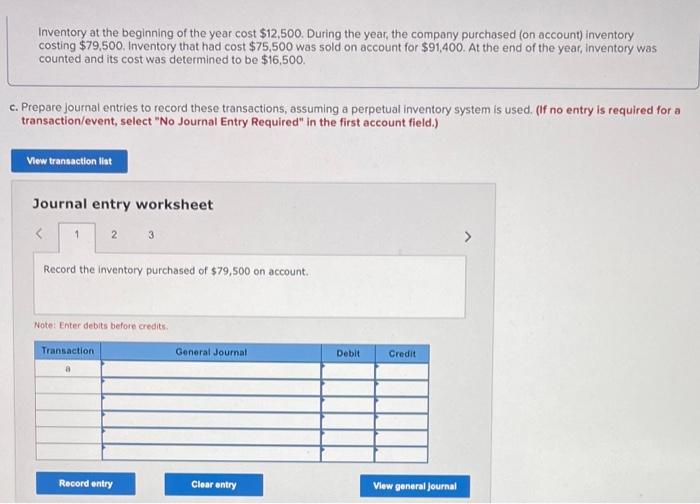

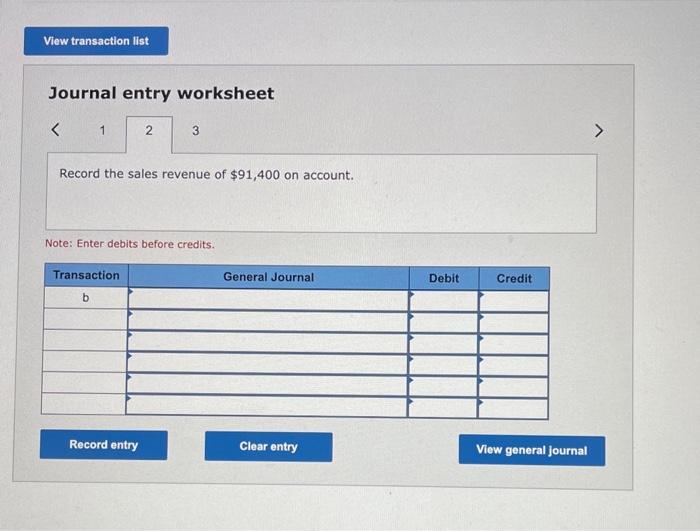

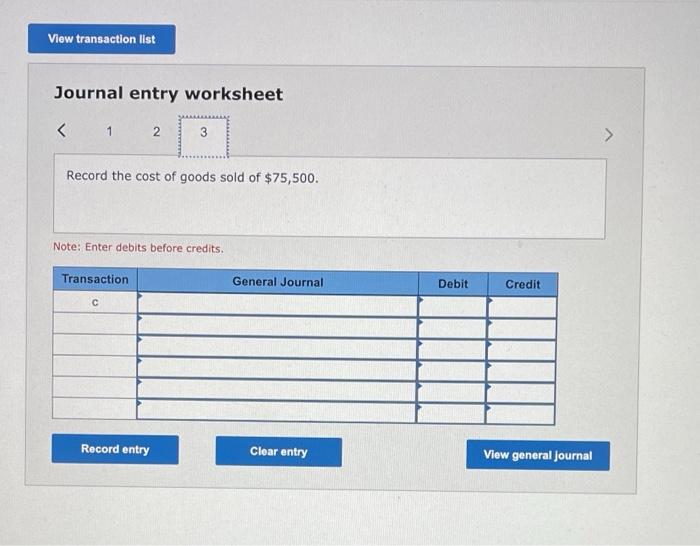

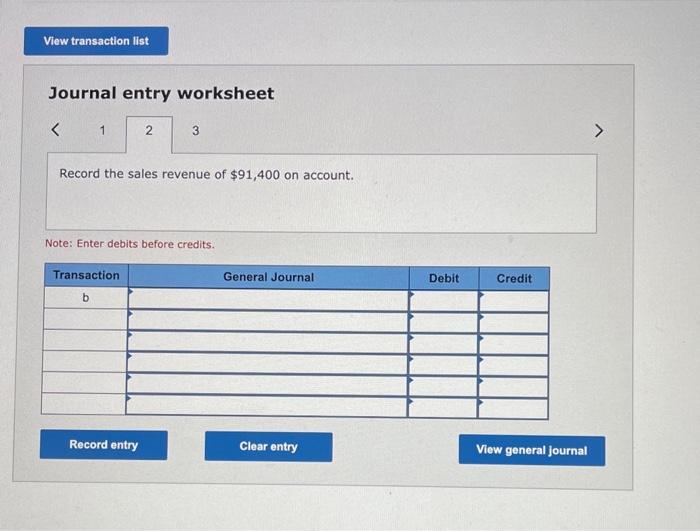

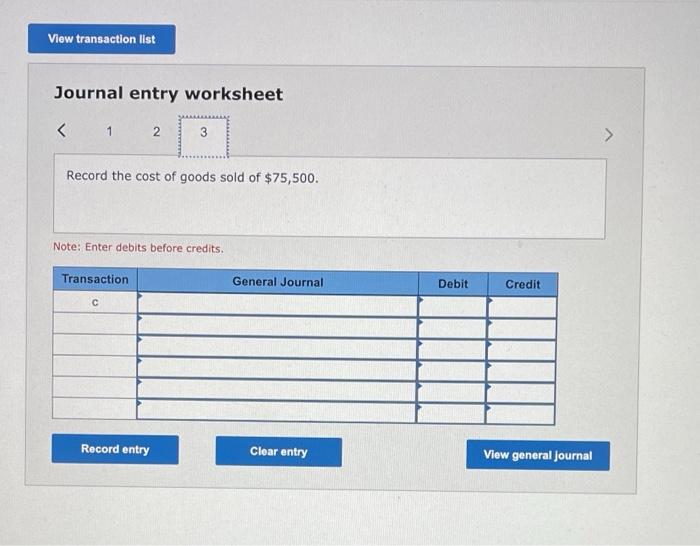

Inventory at the beginning of the year cost $12,500. During the year, the company purchased (on account) inventory costing $79,500. Inventory that had cost $75,500 was sold on account for $91,400. At the end of the year, Inventory was counted and its cost was determined to be $16,500. . Prepare journal entries to record these transactions, assuming a perpetual inventory system is used. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the inventory purchased of $79,500 on account. Note: Enter debits before credits. Journal entry worksheet Record the sales revenue of $91,400 on account. Note: Enter debits before credits. Journal entry worksheet Record the cost of goods sold of $75,500. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started