Answered step by step

Verified Expert Solution

Question

1 Approved Answer

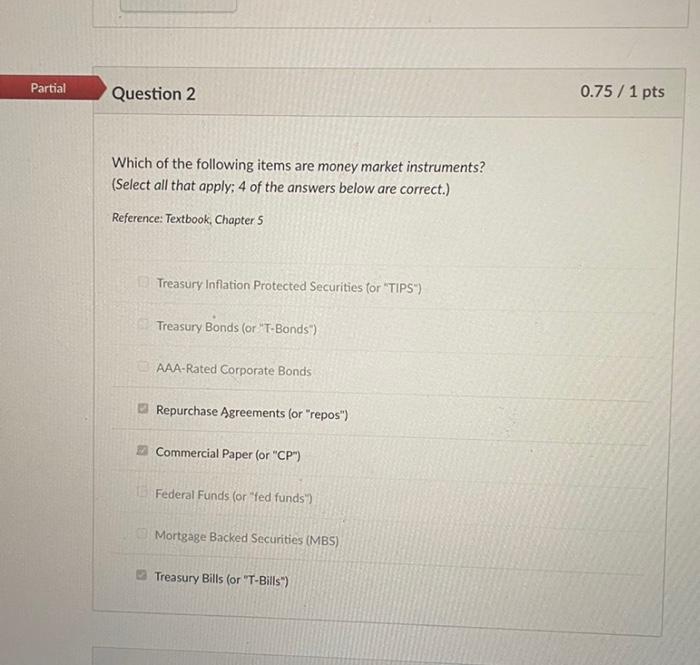

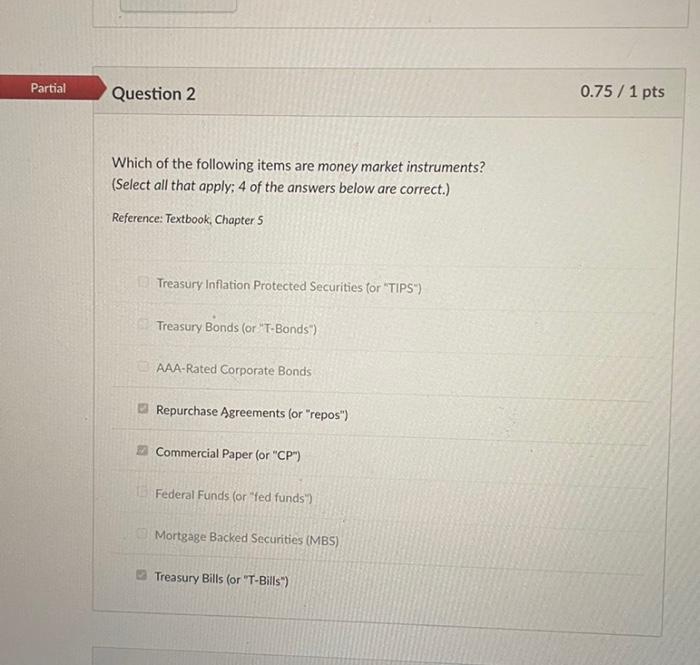

help me please. Partial Question 2 Which of the following items are money market instruments? (Select all that apply; 4 of the answers below are

help me please.

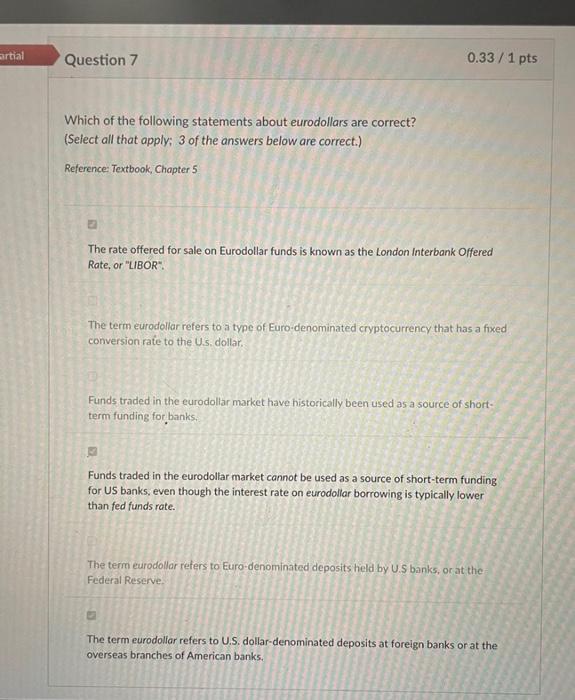

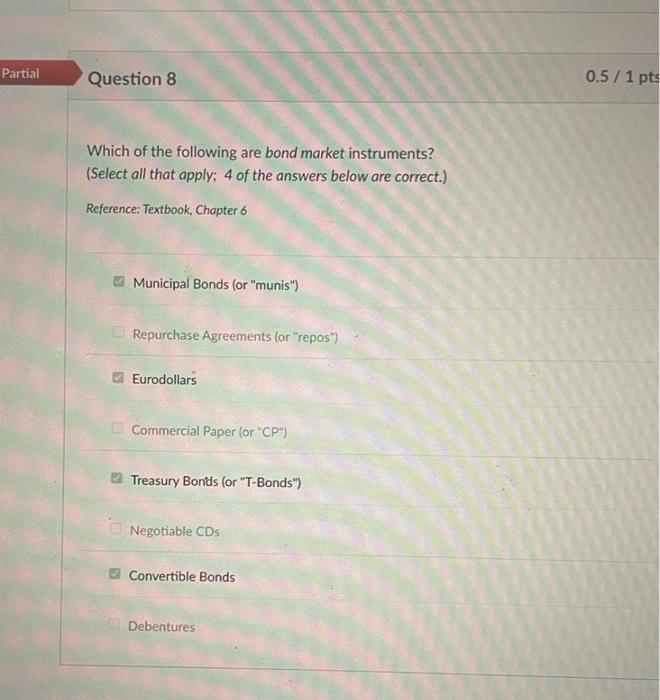

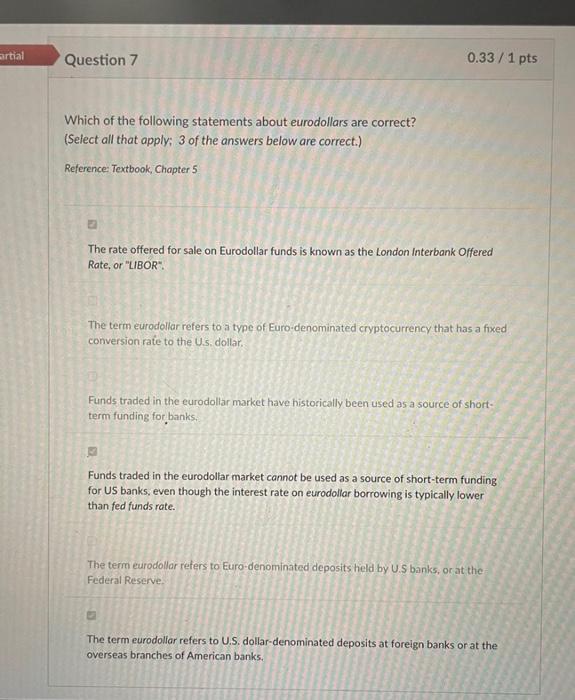

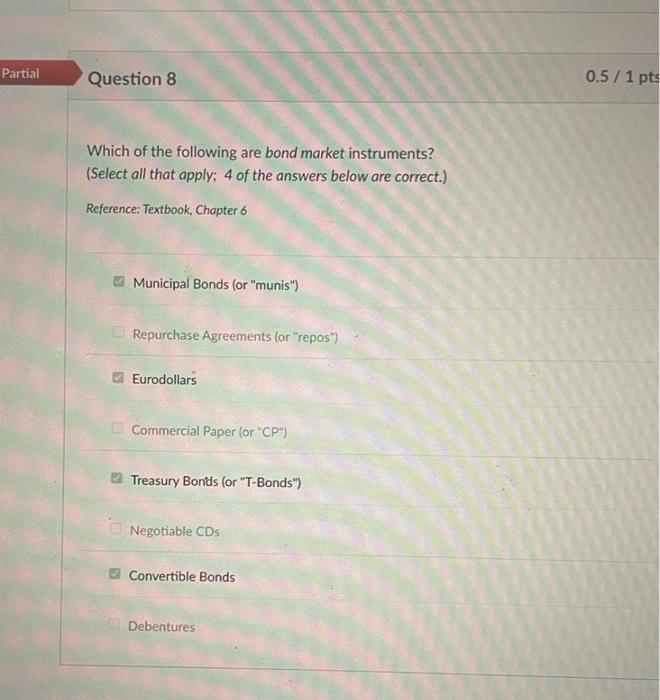

Partial Question 2 Which of the following items are money market instruments? (Select all that apply; 4 of the answers below are correct.) Reference: Textbook, Chapter 5 Treasury Inflation Protected Securities (or "TIPS") Treasury Bonds (or "T-Bonds") AAA-Rated Corporate Bonds Repurchase Agreements (or "repos") Commercial Paper (or "CP") 15 Federal Funds (or "fed funds") Mortgage Backed Securities (MBS) Treasury Bills (or "T-Bills") 0.75 / 1 pts artial 0.33/1 pts Question 7 Which of the following statements about eurodollars are correct? (Select all that apply: 3 of the answers below are correct.) Reference: Textbook, Chapter 5 The rate offered for sale on Eurodollar funds is known as the London Interbank Offered Rate, or "LIBOR". The term eurodollar refers to a type of Euro-denominated cryptocurrency that has a fixed conversion rate to the U.s. dollar. Funds traded in the eurodollar market have historically been used as a source of short- term funding for banks. Funds traded in the eurodollar market cannot be used as a source of short-term funding for US banks, even though the interest rate on eurodollar borrowing is typically lower than fed funds rate. The term eurodollar refers to Euro-denominated deposits held by U.S banks, or at the Federal Reserve. The term eurodollar refers to U.S. dollar-denominated deposits at foreign banks or at the overseas branches of American banks. Partial Question 8 Which of the following are bond market instruments? (Select all that apply; 4 of the answers below are correct.) Reference: Textbook, Chapter 6 Municipal Bonds (or "munis") Repurchase Agreements (or "repos") Eurodollars Commercial Paper (or "CP") Treasury Bonds (or "T-Bonds") Negotiable CDs Convertible Bonds Debentures 0.5/1 pts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started