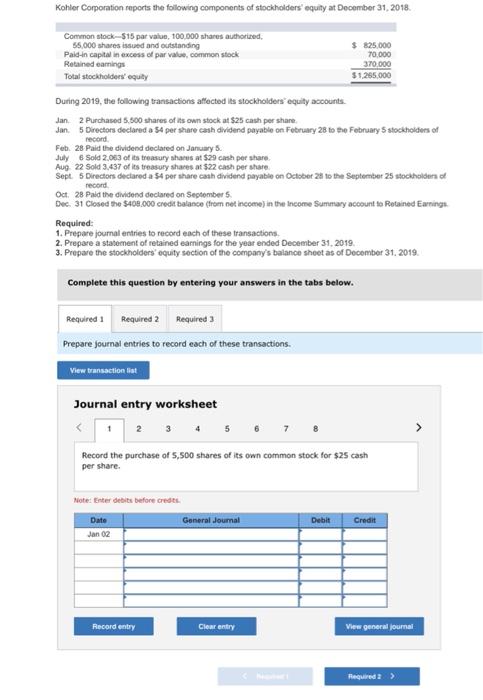

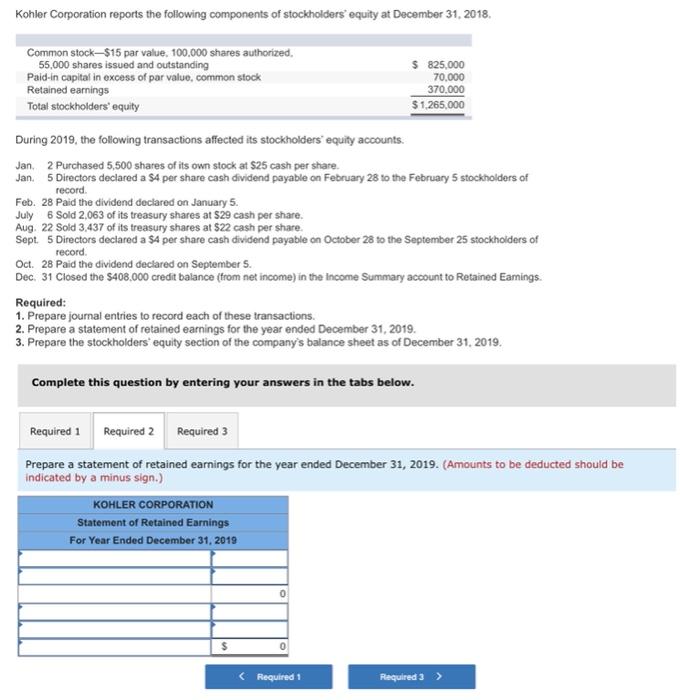

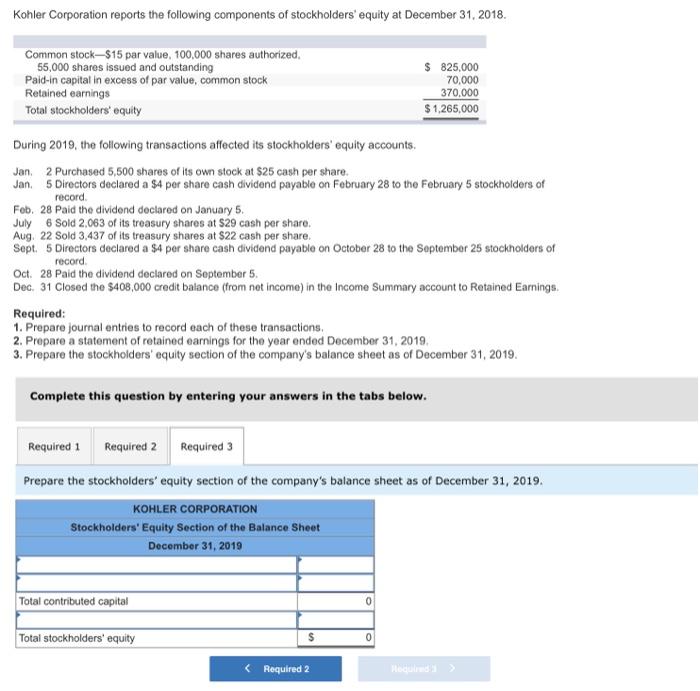

Kohler Corporation reports the following components of stockholders' equity at December 31, 2018. Common stock-$15 par vain, 100.000 shares authorized 55,000 shares issued and outstanding Paid in capital in excess of par value, common stock Retained earnings Total stockholders/equity $325.000 70.000 370 000 $1,265.000 During 2019, the following transactions affected its stockholders equity accounts Jan. 2Purchased 5.500 shares of its own stock at $25 cash per share Jan. 5 Directors declared a 54 per share cash dividend payable on February 28 to the February 5 stockholders of record Feb 28 Paid the dividend declared on January 5. July 6 Sold 2,063 of its treasury shares at $29 cash per share Aug 22 Sold 3.437 of its treasury shares a $22 cash per share Sept. Directors declared a 54 per share cash dividend payable on October 23 to the September 25 stockholders of record Oct 28 Paid the dividend declared on September Dec. 31 Closed the $408.000 credt balance (from net income) in the income Summary account to Retained Earnings. Required: 1. Prepare journal entries to record each of these transactions 2. Prepare a statement of retained earnings for the year ended December 31, 2019 3. Prepare the stockholders equity section of the company's balance sheet as of December 31, 2019. Complete this question by entering your answers in the tabs below. Required Required 2 Required 3 Prepare journal entries to record each of these transactions. View transaction lit Journal entry worksheet 8 > Record the purchase of 5,500 shares of its own common stock for $25 cash per share. Note: Enter debts before credes General Journal Debit Credit Date Jan 02 Record entry Clear entry View general journal Kohler Comoration reports the following components of stockholders' equity at December 31, 2018 Common stock-$15 par value. 100.000 shares authorized 55,000 shares issued and outstanding $ 825,000 Paid-in capital in excess of par value, common stock 70.000 Retained earnings 370.000 Total stockholders' equity $1,265,000 During 2019, the following transactions affected its stockholders' equity accounts. Jan. 2 Purchased 5,500 shares of its own stock at $25 cash per share Jan. 5 Directors declared a SA per share cash dividend payable on February 28 to the February 5 stockholders of record Feb. 28 Paid the dividend declared on January 5. July 6 Sold 2,063 of its treasury shares at $29 cash per share. Aug 22 Sold 3,437 of its treasury shares at $22 cash per share. Sept. 5 Directors declared a $4 per share cash dividend payable on October 28 to the September 25 stockholders of record. Oct. 28 Paid the dividend declared on September 5. Dec. 31 Closed the $408.000 credit balance (from net income) in the Income Summary account to Retained Eamings Required: 1. Prepare journal entries to record each of these transactions. 2. Prepare a statement of retained earnings for the year ended December 31, 2019. 3. Prepare the stockholders' equity section of the company's balance sheet as of December 31, 2019. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a statement of retained earnings for the year ended December 31, 2019. (Amounts to be deducted should be indicated by a minus sign.) KOHLER CORPORATION Statement of Retained Earnings For Year Ended December 31, 2019 0 $ 0 (Required 1 Required 3 > Kohler Corporation reports the following components of stockholders' equity at December 31, 2018. Common stock-$15 par value, 100,000 shares authorized 55,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $ 825,000 70,000 370.000 $ 1,265.000 record During 2019, the following transactions affected its stockholders' equity accounts. Jan. 2 Purchased 5,500 shares of its own stock at $25 cash per share. Jan. 5 Directors declared a 54 per share cash dividend payable on February 28 to the February 5 stockholders of Feb. 28 Paid the dividend declared on January 5. July 6 Sold 2,063 of its treasury shares at $29 cash per share. Aug 22 Sold 3,437 of its treasury shares at $22 cash per share, Sept. 5 Directors declared a 54 per share cash dividend payable on October 28 to the September 25 stockholders of record Oct. 28 Paid the dividend declared on September 5. Dec. 31 Closed the $408,000 credit balance (from net income) in the Income Summary account to Retained Earnings. Required: 1. Prepare journal entries to record each of these transactions 2. Prepare a statement of retained earnings for the year ended December 31, 2019 3. Prepare the stockholders' equity section of the company's balance sheet as of December 31, 2019. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare the stockholders' equity section of the company's balance sheet as of December 31, 2019. KOHLER CORPORATION Stockholders' Equity Section of the Balance Sheet December 31, 2019 Total contributed capital 0 Total stockholders' equity $ 0