Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help me pls i dont have time 2 points Question 10 On July 10, 2012, you purchase a $10.000 par T-note that matures in five

help me pls

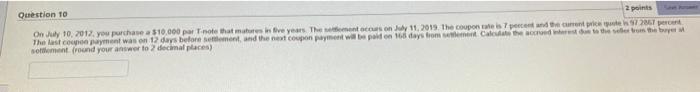

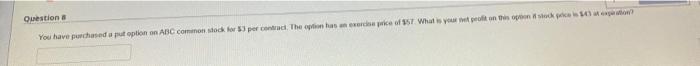

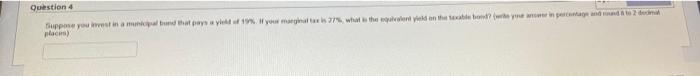

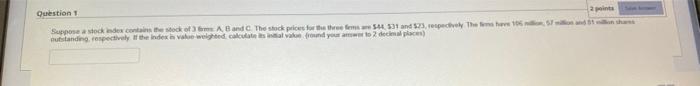

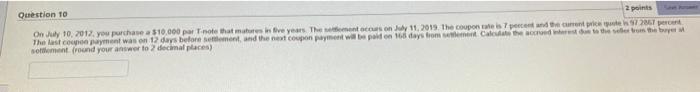

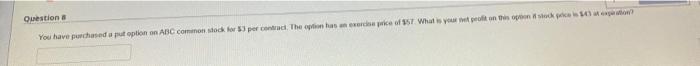

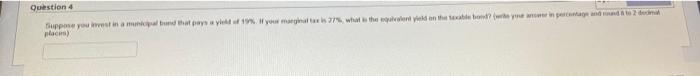

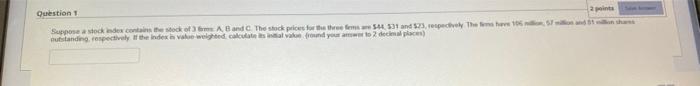

2 points Question 10 On July 10, 2012, you purchase a $10.000 par T-note that matures in five years. The seement occurs on July 11, 2019. The coupon rate is 7 percent and the current price quote is 97 2867 percent The last coupon payment was on 12 days before settlement, and the next coupon payment will be paid on 165 days from settlement Calculate the accrued interest due to the seller from the buyer at settlement (round your answer to 2 decimal places) Question a You have purchased a put option on ABC common stock for $3 per contract. The option has an exercise price of $57. What is your net profit on this option f stock price is $43 at expiation? Question 4 Suppose you invest in a municipal bund that pays a yield of 19%. If your marginal tax is 27%, what is the equivalent yield on the sexable bond? (write ye answer in percentage and and 8 to 2 decimal places); Question 1 Suppose a stock index contains the stock of 3 ms A, B and C. The stock prices for the three fems are 544, 531 and $23, respectively The Sims have 106 min outstanding, respectively If the index is value weighted calculate its inal value fround your answer to 2 decimal places) 2 points 2 points Question 10 On July 10, 2012, you purchase a $10.000 par T-note that matures in five years. The seement occurs on July 11, 2019. The coupon rate is 7 percent and the current price quote is 97 2867 percent The last coupon payment was on 12 days before settlement, and the next coupon payment will be paid on 165 days from settlement Calculate the accrued interest due to the seller from the buyer at settlement (round your answer to 2 decimal places) Question a You have purchased a put option on ABC common stock for $3 per contract. The option has an exercise price of $57. What is your net profit on this option f stock price is $43 at expiation? Question 4 Suppose you invest in a municipal bund that pays a yield of 19%. If your marginal tax is 27%, what is the equivalent yield on the sexable bond? (write ye answer in percentage and and 8 to 2 decimal places); Question 1 Suppose a stock index contains the stock of 3 ms A, B and C. The stock prices for the three fems are 544, 531 and $23, respectively The Sims have 106 min outstanding, respectively If the index is value weighted calculate its inal value fround your answer to 2 decimal places) 2 points i dont have time

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started