Answered step by step

Verified Expert Solution

Question

1 Approved Answer

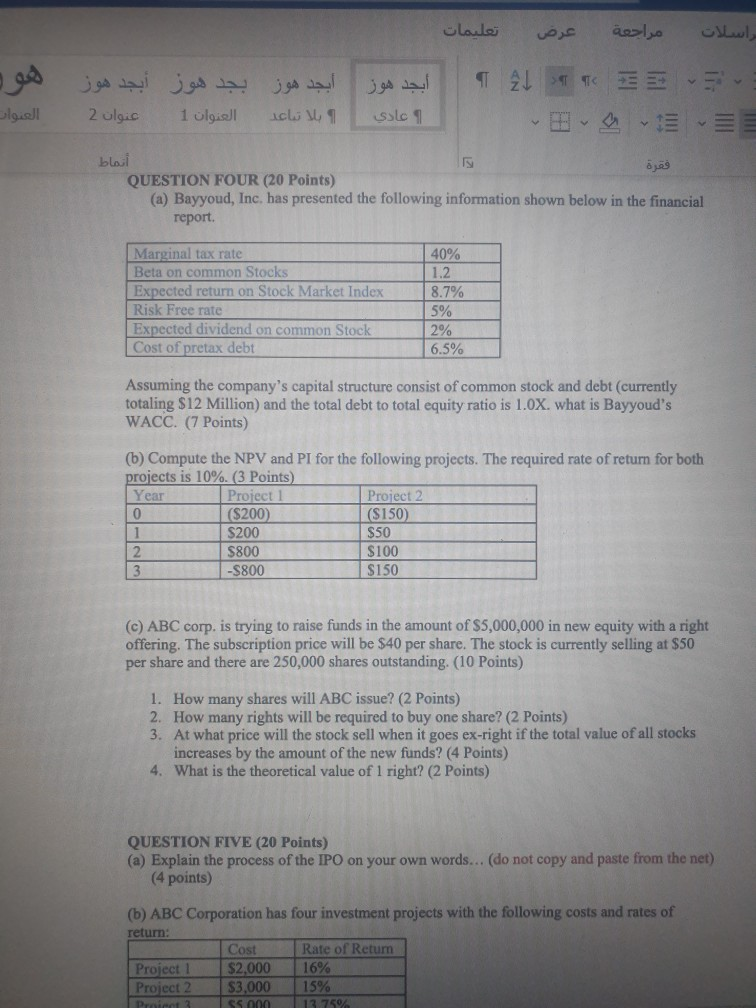

help me q4 T 1 TS 2 ulgic QUESTION FOUR (20 Points) (a) Bayyoud, Inc. has presented the following information shown below in the financial

help me q4

T 1 TS 2 ulgic QUESTION FOUR (20 Points) (a) Bayyoud, Inc. has presented the following information shown below in the financial report. Marginal tax rate Beta on common Stocks Expected return on Stock Market Index Risk Free rate Expected dividend on common Stock Cost of pretax debt 40% 1.2 8.7% 5% 2% 6.5% Assuming the company's capital structure consist of common stock and debt (currently totaling $12 Million) and the total debt to total equity ratio is 1.0X. what is Bayyoud's WACC. (7 Points) (6) Compute the NPV and PI for the following projects. The required rate of return for both projects is 10%. (3 Points) Year Project 1 Project 2 0 ($200 (S150) 1 $200 $50 2. $800 $100 3 -S800 $150 (C) ABC corp. is trying to raise funds in the amount of $5,000,000 in new equity with a right offering. The subscription price will be $40 per share. The stock is currently selling at $50 per share and there are 250,000 shares outstanding. (10 Points) 1. How many shares will ABC issue? (2 Points) 2. How many rights will be required to buy one share? (2 points) 3. At what price will the stock sell when it goes ex-right if the total value of all stocks increases by the amount of the new funds? (4 Points) 4. What is the theoretical value of 1 right? (2 Points) QUESTION FIVE (20 Points) (a) Explain the process of the IPO on your own words... (do not copy and paste from the net) (4 points) (b) ABC Corporation has four investment projects with the following costs and rates of return: Cost Rate of Return Project $2,000 16% Project 2 $3,000 15% P3 SS 000 13 75%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started