Help me solve. Please explain.

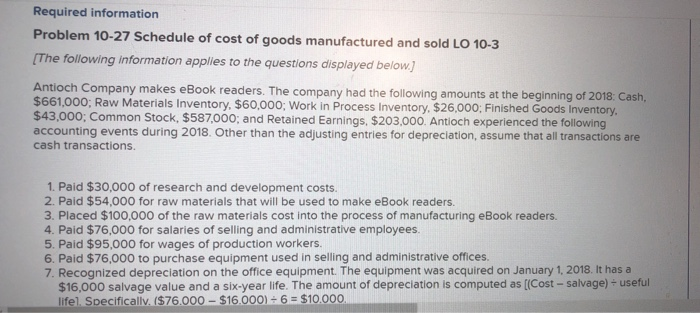

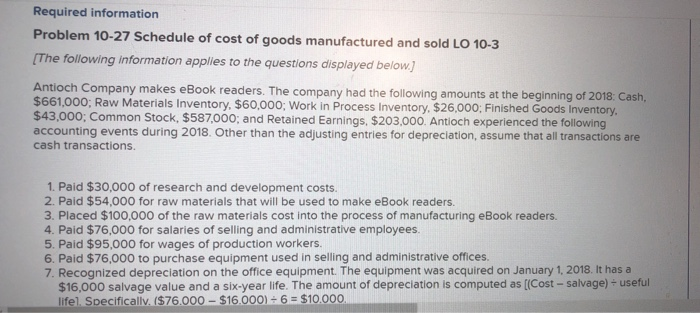

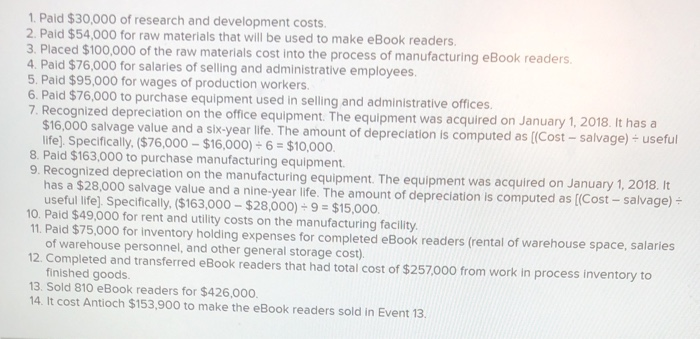

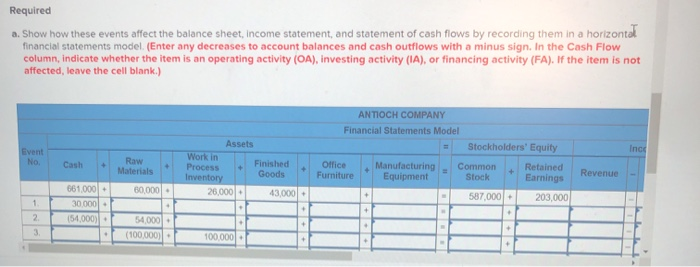

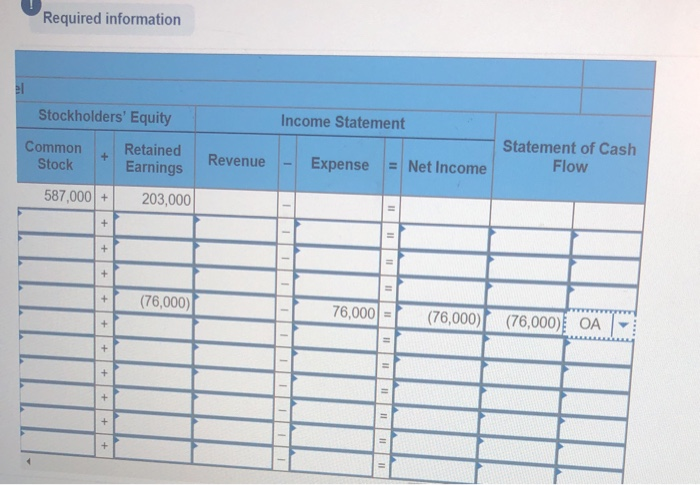

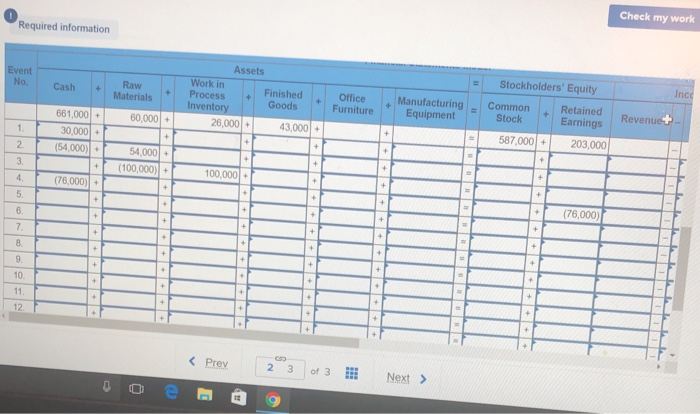

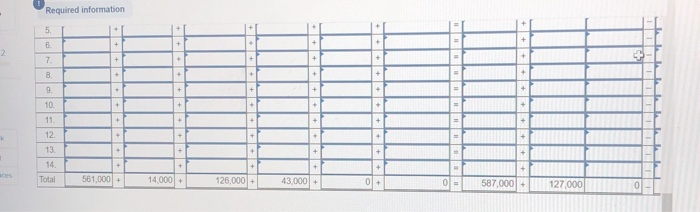

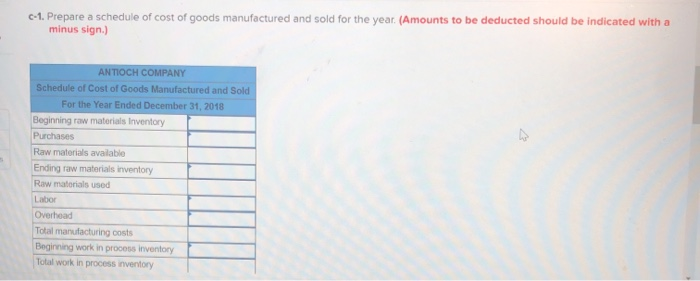

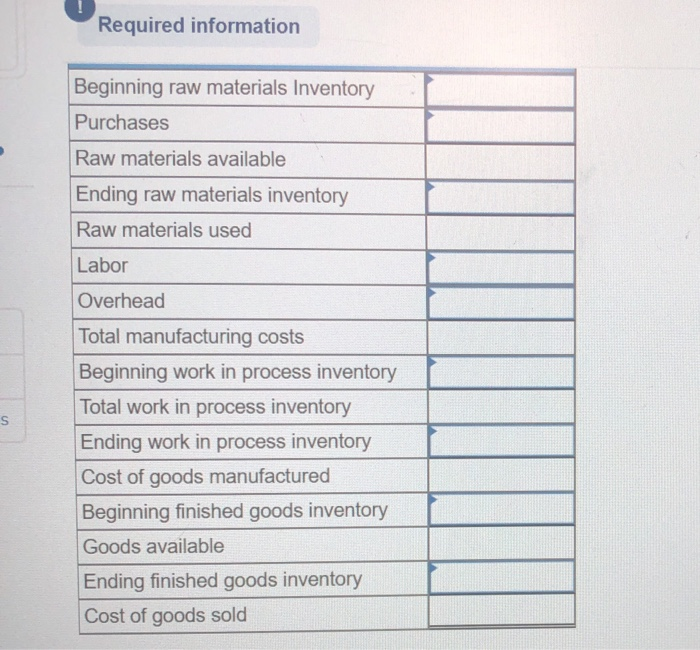

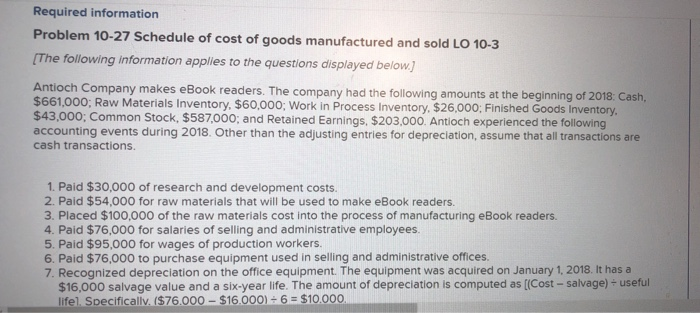

Required information Problem 10-27 Schedule of cost of goods manufactured and sold LO 10-3 [The following information applies to the questions displayed below. Antioch Company makes eBook readers. The company had the following amounts at the beginning of 2018: Cash, $661,000; Raw Materials Inventory, $60,000; Work in Process Inventory, $26,000: Finished Goods Inventory. $43,000; Common Stock, $587,000; and Retained Earnings, $203,000. Antioch experienced the following accounting events during 2018. Other than the adjusting entries for depreciation, assume that all transactions are cash transactions. 1. Paid $30,000 of research and development costs. 2. Paid $54,000 for raw materials that will be used to make eBook readers. 3. Placed $100,000 of the raw materials cost into the process of manufacturing eBook readers. 4. Paid $76,000 for salaries of selling and administrative employees. 5. Paid $95,000 for wages of production workers. 6. Paid $76,000 to purchase equipment used in selling and administrative offices. 7. Recognized depreciation on the office equipment. The equipment was acquired on January 1, 2018. It has a $16,000 salvage value and a six-year life. The amount of depreciation is computed as [(Cost-salvage) - useful lifel Specifically. ($76.000 - $16.000) - 6 = $10.000. 1. Paid $30,000 of research and development costs. 2. Paid $54,000 for raw materials that will be used to make eBook readers. 3. Placed $100,000 of the raw materials cost into the process of manufacturing eBook readers. 4. Paid $76,000 for salaries of selling and administrative employees 5. Paid $95,000 for wages of production workers. 6. Paid $76,000 to purchase equipment used in selling and administrative offices. 7. Recognized depreciation on the office equipment. The equipment was acquired on January 1, 2018. It has a $16,000 salvage value and a six-year life. The amount of depreciation is computed as [(Cost-salvage) = useful life). Specifically, ($76,000 - $16,000) = 6 = $10,000. 8. Paid $163,000 to purchase manufacturing equipment. 9. Recognized depreciation on the manufacturing equipment. The equipment was acquired on January 1, 2018. It has a $28,000 salvage value and a nine-year life. The amount of depreciation is computed as [(Cost - salvage) - useful life]. Specifically, ($163,000 - $28,000) - 9 = $15,000. 10. Paid $49,000 for rent and utility costs on the manufacturing facility. 11. Paid $75,000 for inventory holding expenses for completed eBook readers (rental of warehouse space, salaries of warehouse personnel, and other general storage cost). 12. Completed and transferred eBook readers that had total cost of $257,000 from work in process inventory to finished goods 13. Sold 810 eBook readers for $426,000 14. It cost Antioch $153,900 to make the eBook readers sold in Event 13. Required a. Show how these events affect the balance sheet, income statement, and statement of cash flows by recording them in a horizontal financial statements model (Enter any decreases to account balances and cash outflows with a minus sign. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If the item is not affected, leave the cell blank.) ANTIOCH COMPANY Financial Statements Model Assets Stockholders' Equity Row Cash Work in Process Inventory 26,000 Finished Goods Office Furniture Manufacturing Equipment Common Stock Retained Earnings " Revenue B000 . 561 000 10 000 587,000 + 203,000 154 00011 4000 + (100 000 100.000 Required information Stockholders' Equity Income Statement Common Stock Retained Earnings Statement of Cash Flow Revenue - Expense = Net Income 587,000 + 203,000 (76,000) 76,000 = T (76,000)| (76,000) OA Check my work Required information Event No. Raw Cash + Assets Work in Finished Process Inventory Goods 26.000 43,000 Stockholders' Equity Common Retained Stock Earnings Materials Office Furniture Manufacturing Equipment Revenue+ 50,000+ 587,000+ 203.000 661,000+ 30.000 (54.000) 54.000 (100,000) + (76,000) (76.000 Required information - 10. 11 + + + + + 12. + + + 14. Total 561,000 + 14.000 + 126,000+ 43 000 + 0 = 587,000+ 127.000 c-1. Prepare a schedule of cost of goods manufactured and sold for the year. (Amounts to be deducted should be indicated with a minus sign.) ANTIOCH COMPANY Schedule of Cost of Goods Manufactured and Sold For the Year Ended December 31, 2018 Beginning raw materials Inventory Purchases Raw materials available Ending raw materials inventory Raw materials used Labor Overhead Total manufacturing costs Beginning work in process inventory Total work in process inventory Required information Beginning raw materials Inventory Purchases Raw materials available Ending raw materials inventory Raw materials used Labor Overhead Total manufacturing costs Beginning work in process inventory Total work in process inventory Ending work in process inventory Cost of goods manufactured Beginning finished goods inventory Goods available Ending finished goods inventory Cost of goods sold