help me solve please

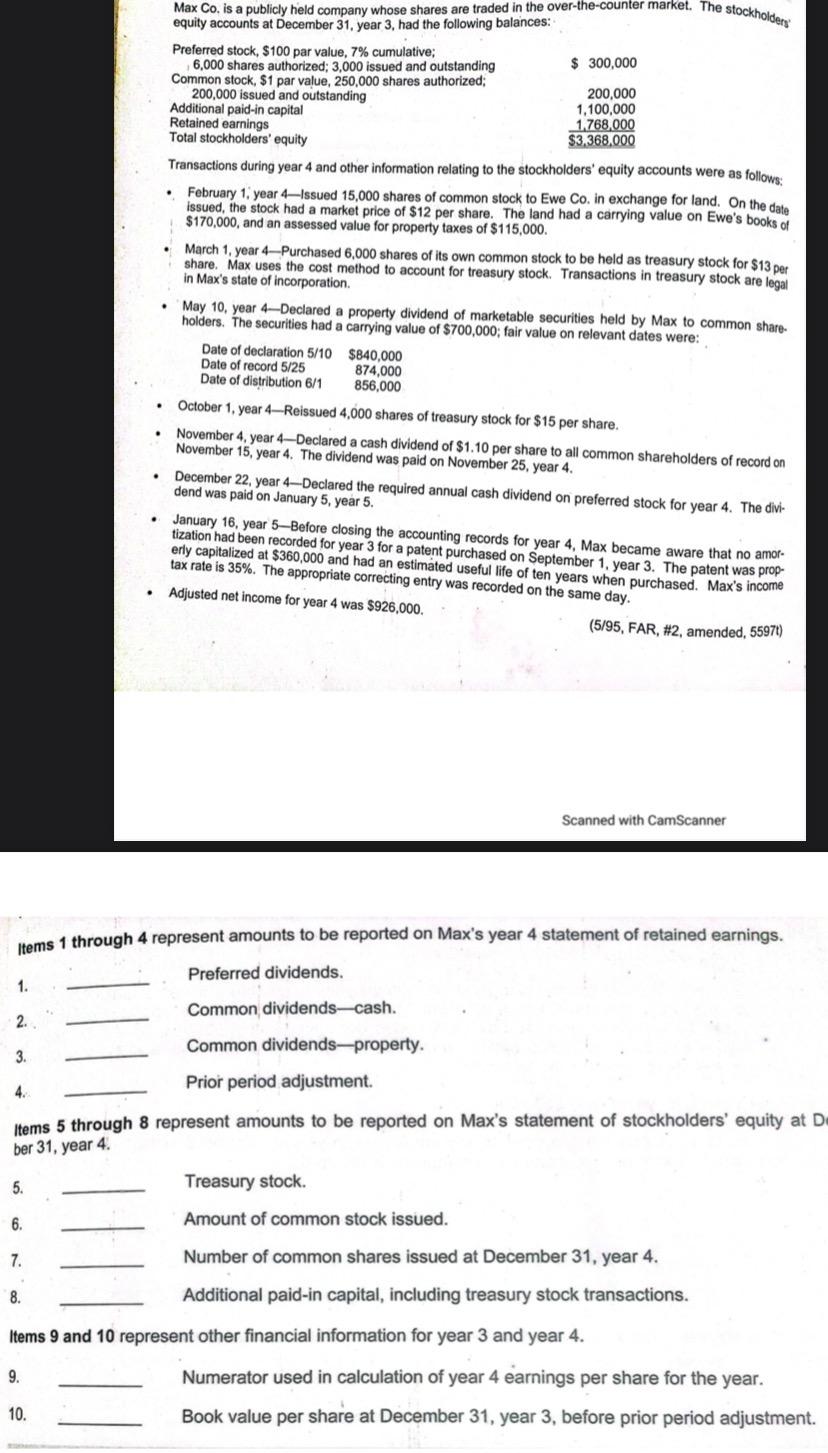

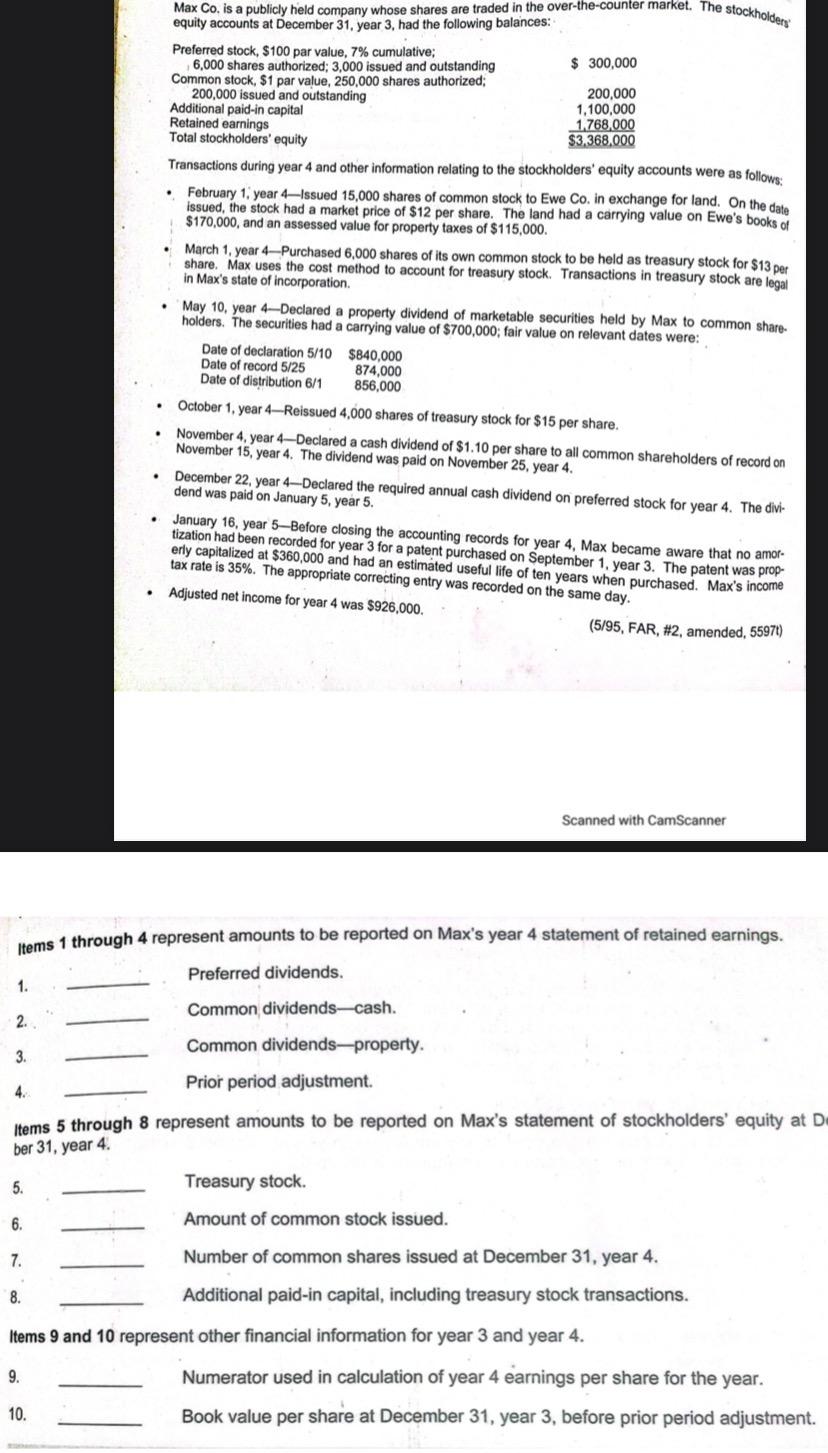

Max Co. is a publicly held company whose shares are traded in the over-the-counter market. The stockholders equity accounts at December 31, year 3, had the following balances: Preferred stock, $100 par value, 7% cumulative; 6,000 shares authorized; 3,000 issued and outstanding $ 300,000 $ Common stock, $1 par value, 250,000 shares authorized 200,000 issued and outstanding 200,000 Additional paid-in capital 1,100,000 Retained earnings 1,768,000 Total stockholders' equity $3,368,000 Transactions during year 4 and other information relating to the stockholders' equity accounts were as follows: February 1 year 4Issued 15,000 shares of common stock to Ewe Co. in exchange for land. On the date issued, the stock had a market price of $12 per share. The land had a carrying value on Ewe's books of $170,000, and an assessed value for property taxes of $115,000. . March 1 year 4-Purchased 6,000 shares of its own common stock to be held as treasury stock for $13 per share. Max uses the cost method to account for treasury stock. Transactions in treasury stock are legal in Max's state of incorporation May 10, year 4-Declared a property dividend of marketable securities held by Max to common share. holders. The securities had a carrying value of $700,000; fair value on relevant dates were: Date of declaration 5/10 $840,000 Date of record 5/25 874,000 Date of distribution 6/1 856,000 4. October 1, year 4-Reissued 4,000 shares of treasury stock for $15 per share. November 4, year 4-Declared a cash dividend of $1.10 per share to all common shareholders of record on November 15, year 4. The dividend was paid on November 25, year 4. . December 22, year 4-Declared the required annual cash dividend on preferred stock for year 4. The divi- dend was paid on January 5, year 5. January 16, year 5-Before closing the accounting records for year 4. Max became aware that no amor- tization had been recorded for year 3 for a patent purchased on September 1 year 3. The patent was prop erly capitalized at $360,000 and had an estimated useful life of ten years when purchased. Max's income tax rate is 35%. The appropriate correcting entry was recorded on the same day. Adjusted net income for year 4 was $926,000 (5/95, FAR, #2, amended, 55971) . Scanned with CamScanner Items 1 through 4 represent amounts to be reported on Max's year 4 statement of retained earnings. Preferred dividends. 1. Common dividends-cash. 2. Common dividends-property. 3. Prior period adjustment. 4. Items 5 through 8 represent amounts to be reported on Max's statement of stockholders' equity at D ber 31, year 4. 5. Treasury stock. 6. Amount of common stock issued. 7. Number of common shares issued at December 31, year 4. 8. Additional paid-in capital, including treasury stock transactions. Items 9 and 10 represent other financial information for year 3 and year 4. 9. . Numerator used in calculation of year 4 earnings per share for the year. 10. Book value per share at December 31, year 3, before prior period adjustment