Answered step by step

Verified Expert Solution

Question

1 Approved Answer

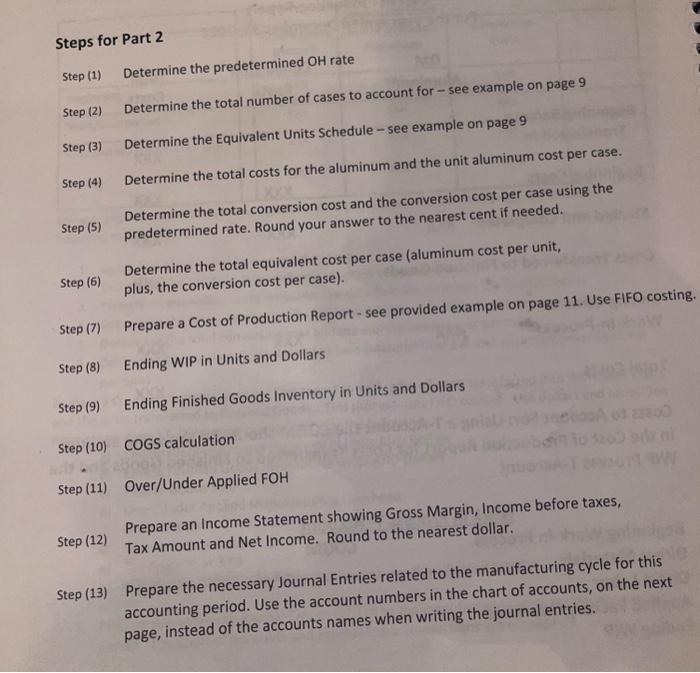

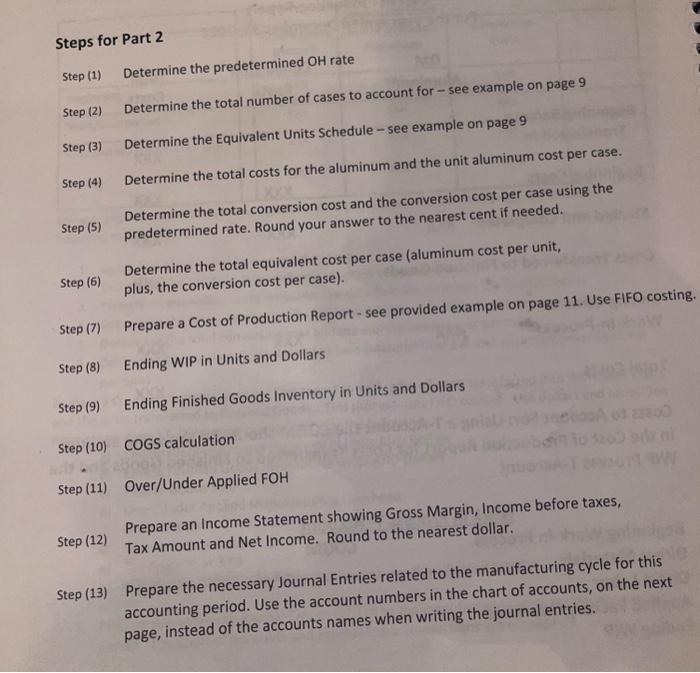

help me solve Steps for Part 2 Step (1) Determine the predetermined OH rate Step (2) Determine the total number of cases to account for

help me solve

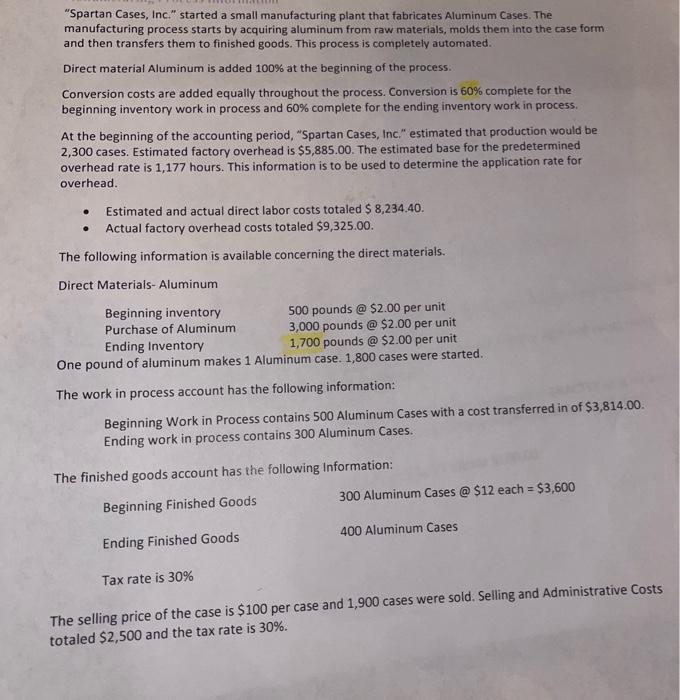

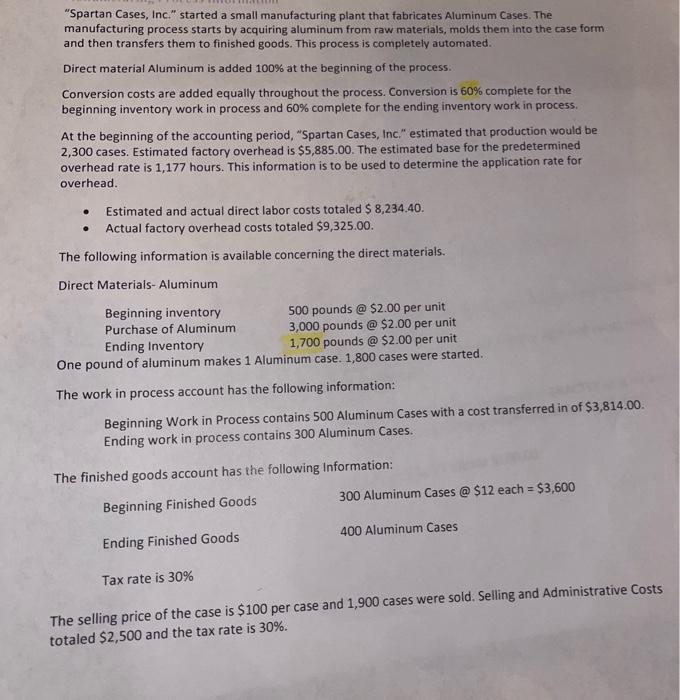

Steps for Part 2 Step (1) Determine the predetermined OH rate Step (2) Determine the total number of cases to account for - see example on page 9 Step (3) Determine the Equivalent Units Schedule - see example on page 9 Step (4) Determine the total costs for the aluminum and the unit aluminum cost per case. Step (5) Determine the total conversion cost and the conversion cost per case using the predetermined rate. Round your answer to the nearest cent if needed. Step (6) Determine the total equivalent cost per case (aluminum cost per unit, Step (8) Ending WIP in Units and Dollars Step (9) Ending Finished Goods Inventory in Units and Dollars Step (10) COGS calculation Step (11) Over/Under Applied FOH Step (12) Prepare an Income Statement showing Gross Margin, Income before taxes, page, instead of the accounts names when writi "Spartan Cases, Inc." started a small manufacturing plant that fabricates Aluminum Cases. The manufacturing process starts by acquiring aluminum from raw materials, molds them into the case form and then transfers them to finished goods. This process is completely automated. Direct material Aluminum is added 100% at the beginning of the process. Conversion costs are added equally throughout the process. Conversion is 60% complete for the beginning inventory work in process and 60% complete for the ending inventory work in process. At the beginning of the accounting period, "Spartan Cases, Inc." estimated that production would be 2,300 cases. Estimated factory overhead is $5,885.00. The estimated base for the predetermined overhead rate is 1,177 hours. This information is to be used to determine the application rate for overhead. - Estimated and actual direct labor costs totaled $8,234.40. - Actual factory overhead costs totaled $9,325.00. The following information is available concerning the direct materials. Direct Materials-Aluminum The work in process account has the following information: Beginning Work in Process contains 500 Aluminum Cases with a cost transferred in of $3,814.00. Ending work in process contains 300 Aluminum Cases. The finished goods account has the following Information: Beginning Finished Goods 300 Aluminum Cases @ $12 each =$3,600 Ending Finished Goods 400 Aluminum Cases Tax rate is 30% The selling price of the case is $100 per case and 1,900 cases were sold. Selling and Administrative Costs totaled $2,500 and the tax rate is 30%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started