help me ?

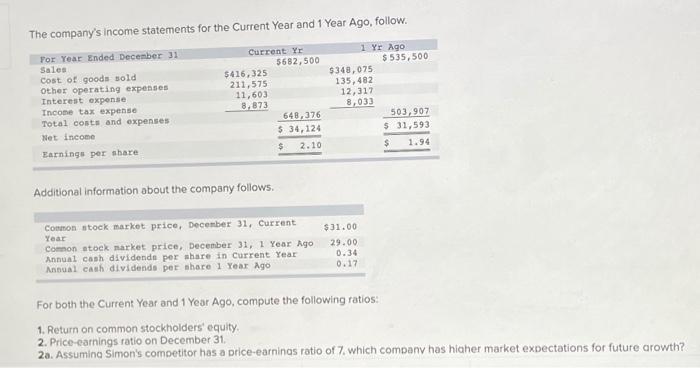

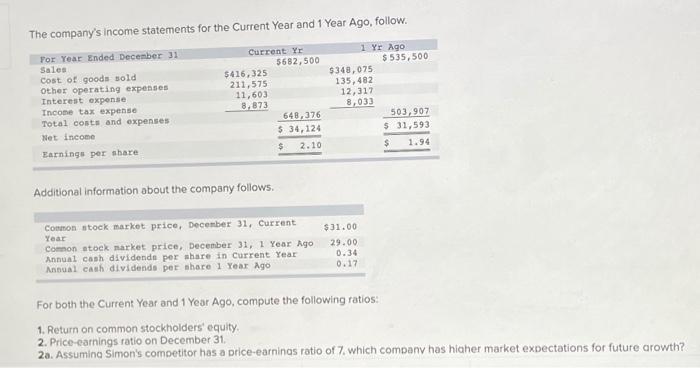

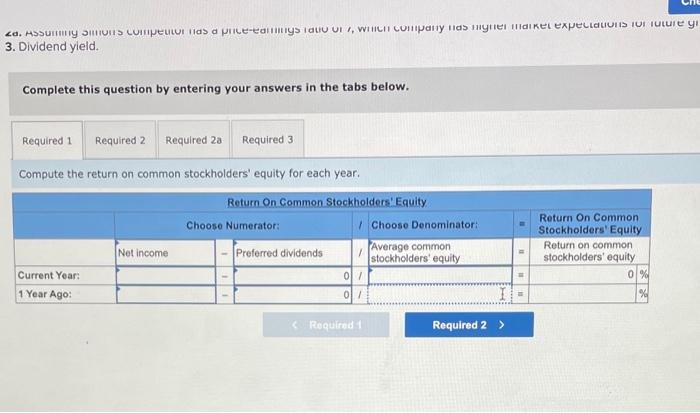

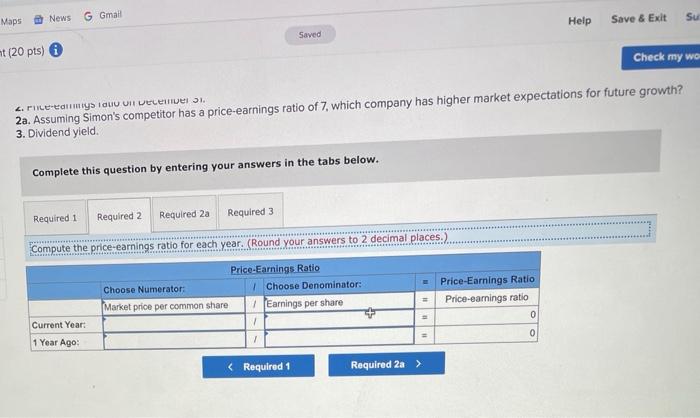

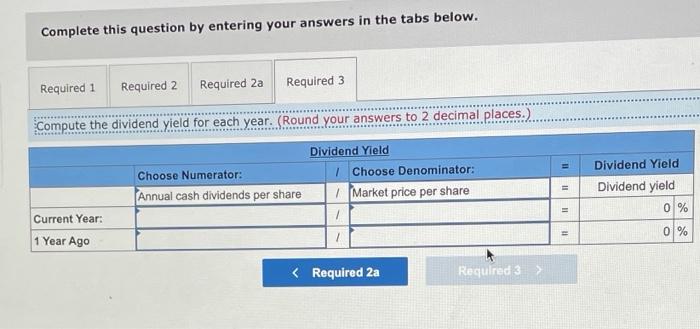

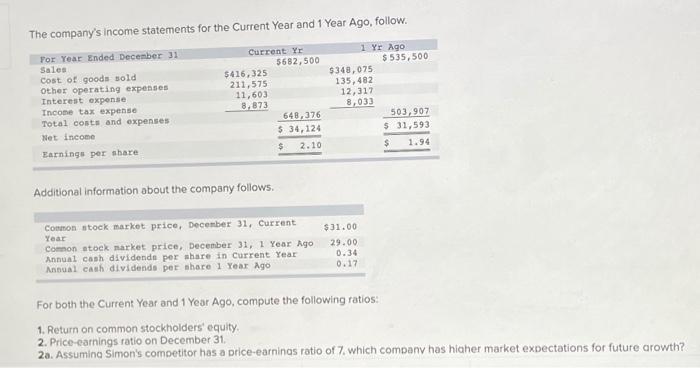

The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share Current Yr 5682,500 $416,325 211,575 11,603 8.873 648,376 $ 34,124 1 yr ago $ 535,500 $348, 075 135,482 12,317 8,033 503,907 $ 31,593 $ 1.94 $ 2.10 Additional information about the company follows. $31.00 Common stock market price, December 31, Current Year Comon stock market price, December 31, 1 Year Ago Annual cash dividende per share in Current Year Annual cash dividends per share 1 Year Ago 29.00 0.34 0.17 For both the Current Year and 1 Year Ago, compute the following ratios: 1. Return on common stockholders' equity 2. Price-earnings ratio on December 31, 20. Assuming Simon's competitor has a price-earnings ratio of 7. which company has hiaher market expectations for future growth? che 2d. ASSY SHTOI LIPULI as a Prict-eanings Idul VII WIILII Company lids Hyller dike expeLLaLIONIS TUI TULUI y 3. Dividend yield. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 23 Required 3 Compute the return on common stockholders' equity for each year. Return On Common Stockholders' Equity Choose Numerator: Choose Denominator: Preferred dividends Average common 1 stockholders' equity 07 ol/ Return On Common Stockholders' Equity Return on common stockholders' equity 0 % Net income Current Year: 1 Year Ago: (Required 1 Required 2 > G Gmail Su Maps News Saved Help Save & Exit t (20 pts) Check my wc 2. Pile- emys TOUU Un velenel i. 2a. Assuming Simon's competitor has a price-earnings ratio of 7, which company has higher market expectations for future growth? 3. Dividend yield Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 2a Required 3 Compute the price-earnings ratio for each year. (Round your answers to 2 decimal places.) Price-Earnings Ratio Choose Numerator: 1 Choose Denominator: Market price per common share Earnings per share Price-Earnings Ratio Price-earnings ratio 0 Current Year: 1 Year Ago 0 1 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 2a Required 3 Compute the dividend yield for each year. (Round your answers to 2 decimal places.) 11 Choose Numerator: Annual cash dividends per share Dividend Yield 1 Choose Denominator: Market price per share Dividend Yield Dividend yield 0 % 11 11 Current Year: 1 Year Ago % G Gmail Su Maps News Saved Help Save & Exit t (20 pts) Check my wc 2. Pile- emys TOUU Un velenel i. 2a. Assuming Simon's competitor has a price-earnings ratio of 7, which company has higher market expectations for future growth? 3. Dividend yield Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 2a Required 3 Compute the price-earnings ratio for each year. (Round your answers to 2 decimal places.) Price-Earnings Ratio Choose Numerator: 1 Choose Denominator: Market price per common share Earnings per share Price-Earnings Ratio Price-earnings ratio 0 Current Year: 1 Year Ago 0 1 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 2a Required 3 Compute the dividend yield for each year. (Round your answers to 2 decimal places.) 11 Choose Numerator: Annual cash dividends per share Dividend Yield 1 Choose Denominator: Market price per share Dividend Yield Dividend yield 0 % 11 11 Current Year: 1 Year Ago %