Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help me these few accounting questions based on adjusting and journal entries. Jean Ratelle opened his investment advisory business as a proprietary company (JR Advisors

Help me these few accounting questions based on adjusting and journal entries.

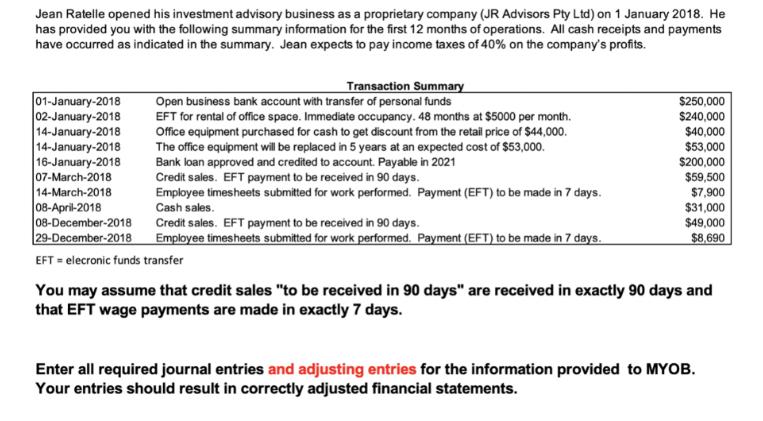

Help me these few accounting questions based on adjusting and journal entries. Jean Ratelle opened his investment advisory business as a proprietary company (JR Advisors Pty Ltd) on 1 January 2018. He has provided you with the following summary information for the first 12 months of operations. All cash receipts and payments have occurred as indicated in the summary. Jean expects to pay income taxes of 40% on the company's profits. Transaction Summary Open business bank account with transfer of personal funds EFT for rental of office space. Immediate occupancy. 48 months at $5000 per month. Office equipment purchased for cash to get discount from the retail price of $44,000. The office equipment will be replaced in 5 years at an expected cost of $53,000. Bank loan approved and credited to account. Payable in 2021 Credit sales. EFT payment to be received in 90 days. Employee timesheets submitted for work performed. Payment (EFT) to be made in 7 days. Cash sales. Credit sales. EFT payment to be received in 90 days. Employee timesheets submitted for work performed. Payment (EFT) to be made in 7 days. 01-January-2018 02-January-2018 14-January-2018 14-January-2018 16-January-2018 07-March-2018 14-March-2018 08-April-2018 08-December-2018 29-December-2018 EFT = elecronic funds transfer $250,000 $240,000 $40,000 $53,000 $200,000 $59,500 $7,900 $31,000 $49,000 $8,690 You may assume that credit sales "to be received in 90 days" are received in exactly 90 days and that EFT wage payments are made in exactly 7 days. Enter all required journal entries and adjusting entries for the information provided to MYOB. Your entries should result in correctly adjusted financial statements.

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Certainly I can help you with the journal entries and adjusting entries based on the provided inform...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started