Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help me these question? please Question 1 0 / 1 point The PVES Index is a price weighted stock index based on the 5 largest

Help me these question? please

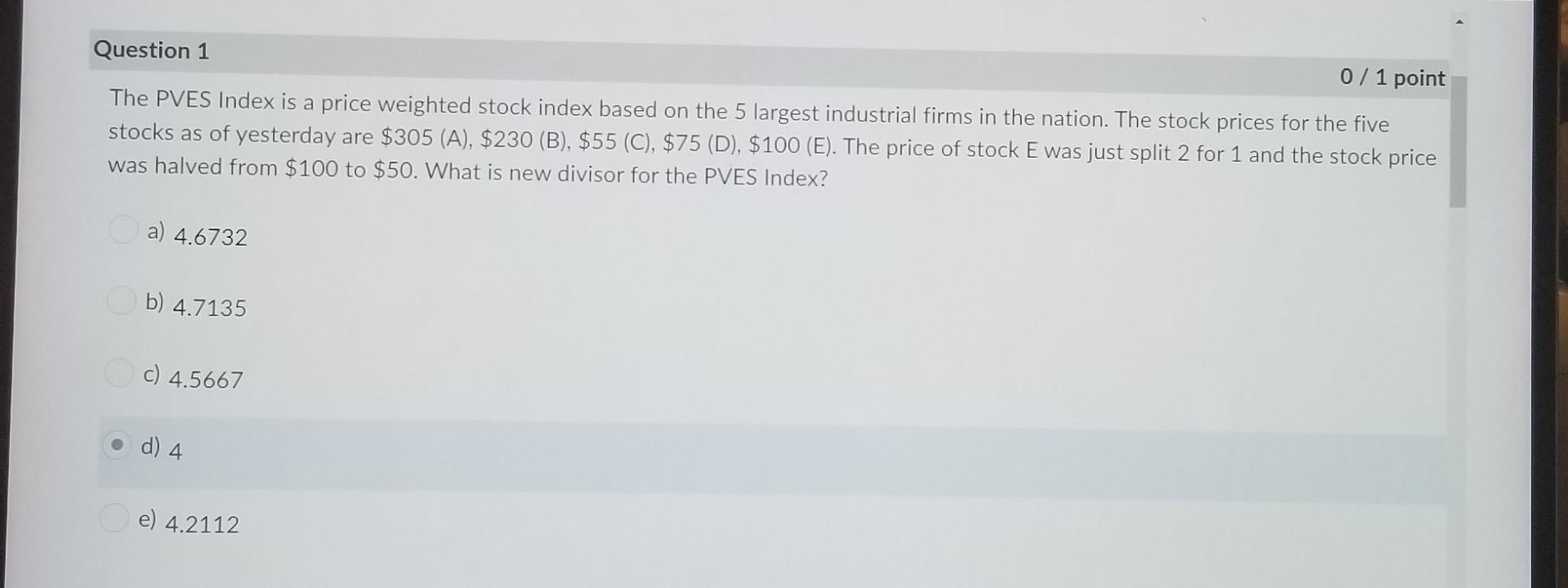

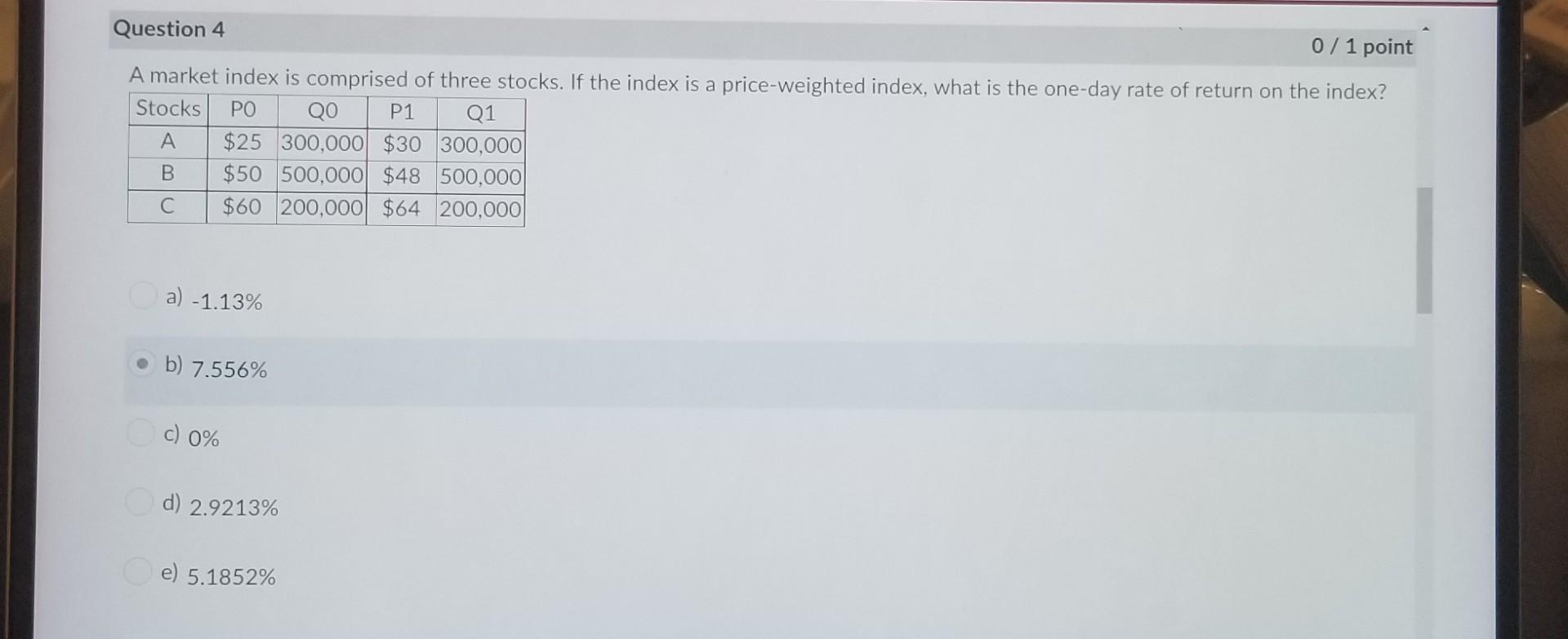

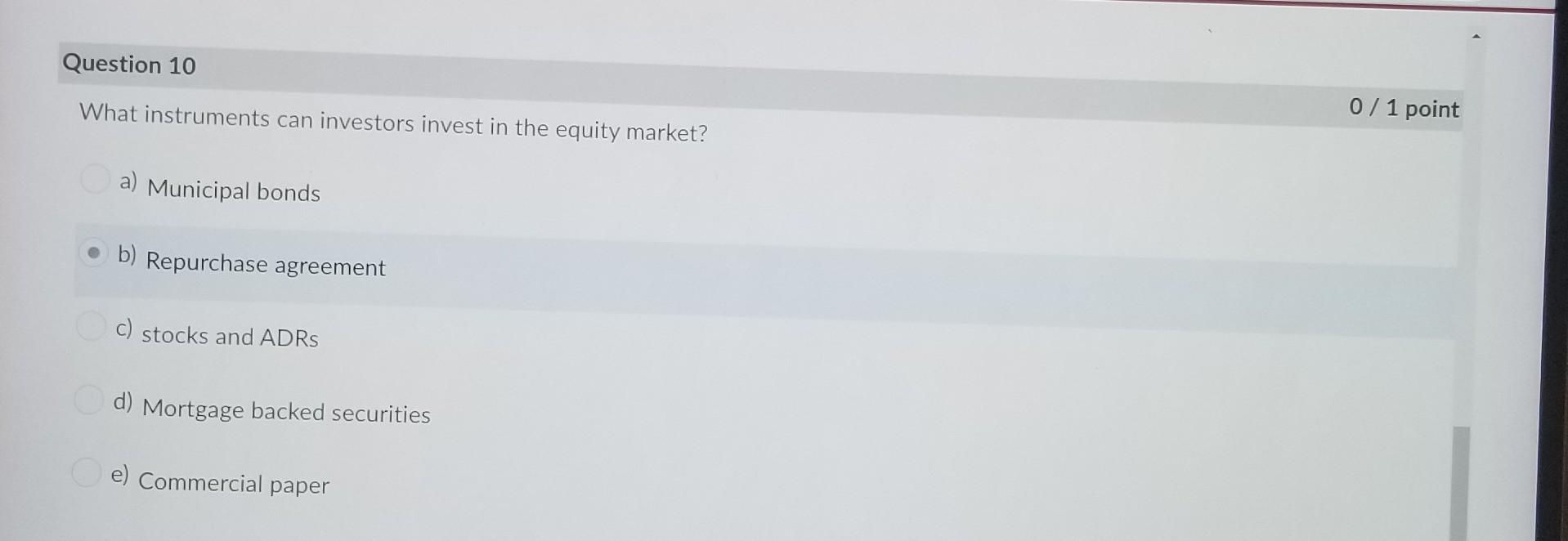

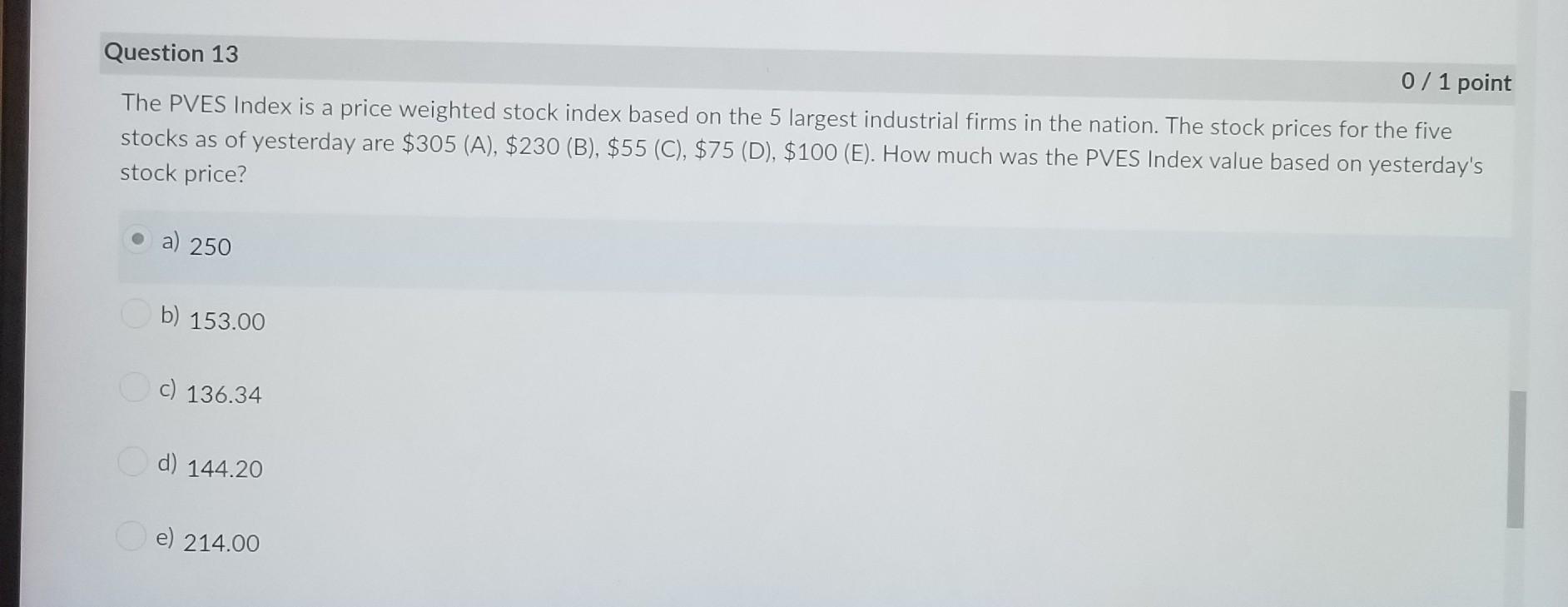

Question 1 0 / 1 point The PVES Index is a price weighted stock index based on the 5 largest industrial firms in the nation. The stock prices for the five stocks as of yesterday are $305 (A), $230 (B), $55 (C), $75 (D), $100 (E). The price of stock E was just split 2 for 1 and the stock price was halved from $100 to $50. What is new divisor for the PVES Index? a) 4.6732 b) 4.7135 c) 4.5667 d) 4 e) 4.2112 Question 4 0 / 1 point A market index is comprised of three stocks. If the index is a price-weighted index, what is the one-day rate of return on the index? Stocks PO QO P1 Q1 A $25 300,000 $30 300,000 B $50 500,000 $48 500,000 C $60 200,000 $64 200,000 a) - 1.13% . b) 7.556% c) 0% d) 2.9213% e) 5.1852% Question 10 What instruments can investors invest in the equity market? 0 / 1 point a) Municipal bonds b) Repurchase agreement c) stocks and ADRS d) Mortgage backed securities e) Commercial paper Question 13 0 / 1 point The PVES Index is a price weighted stock index based on the 5 largest industrial firms in the nation. The stock prices for the five stocks as of yesterday are $305 (A), $230 (B), $55 (C), $75 (D), $100 (E). How much was the PVES Index value based on yesterday's stock price? a) 250 b) 153.00 c) 136.34 d) 144.20 e) 214.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started