help me to solve this

IFRS 11 : Joint Operation

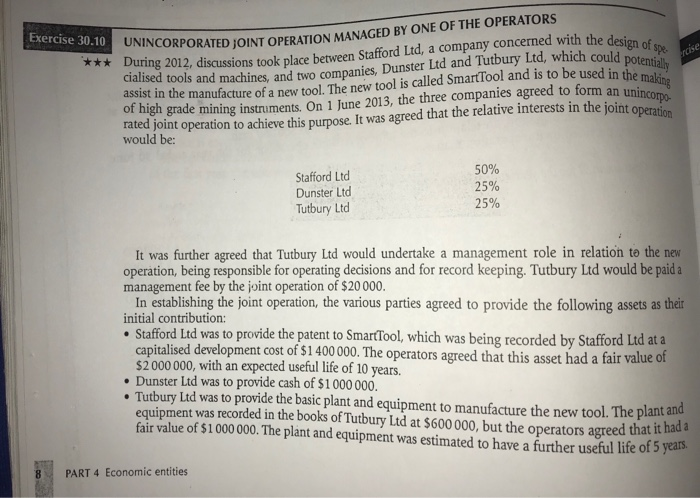

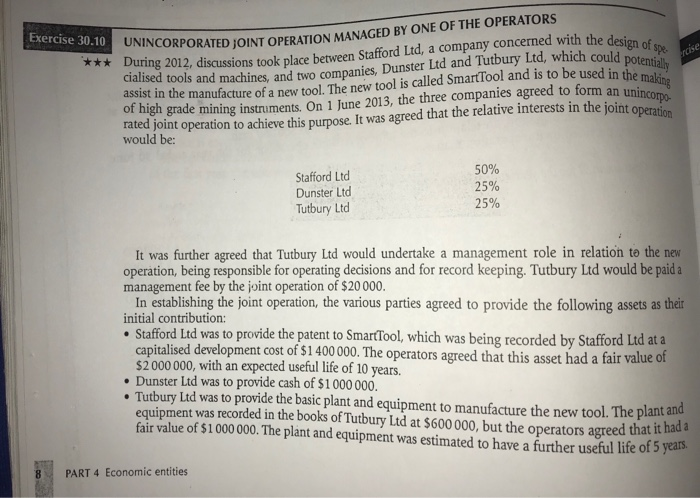

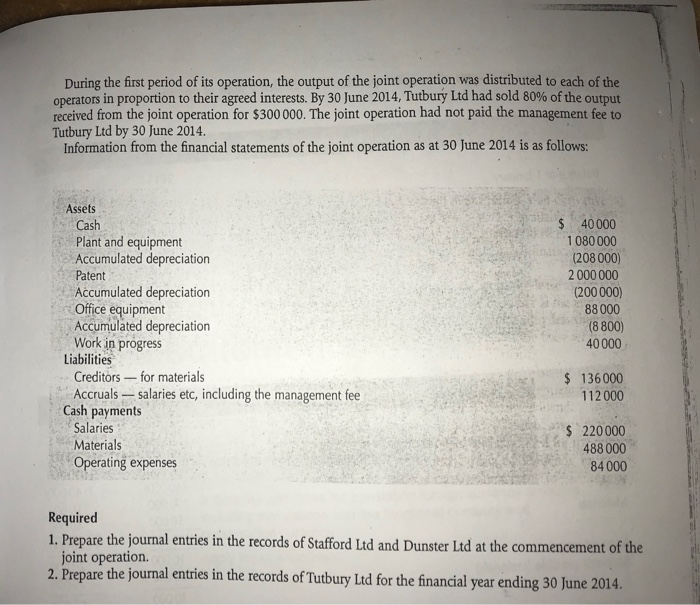

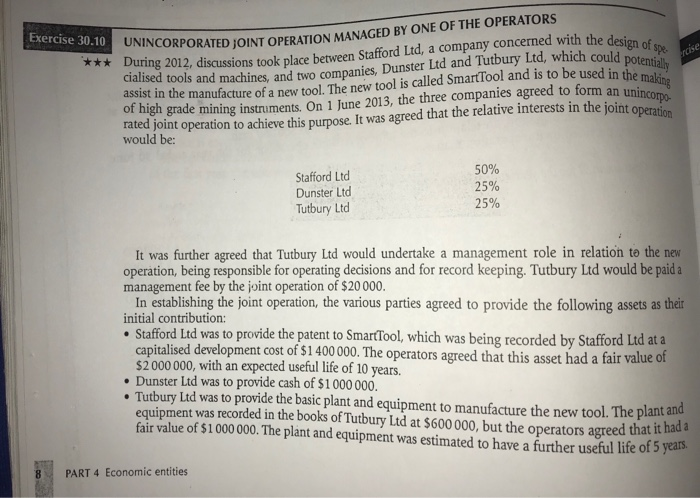

Exercise 30.10 UNINCORPORATED IOINT OPERATION MAN incise the design of spe ich could potentially sed in the making man unincorpo PORATED JOINT OPERATION MANAGED BY ONE OF THE OPERATORS ning 2012, discussions took place between Stafford Ltd, a company concerned with the design ised tools and machines, and two companies, Dunster Ltd and Tutbury Ltd, which could in the manufacture of a new tool. The new tool is called Smart Tool and is to be used in the of high grade mining instnimente On 1 June 2013, the three companies agreed to form an unin Tated joint operation to achieve this numase. It was agreed that the relative interests in the joint One cialised tools and machines erests in the joint operation would be: Stafford Ltd Dunster Ltd Tutbury Ltd 50% 25% 25% It was further agreed that Tutbury Ltd would undertake a management role in relation to the new operation, being responsible for operating decisions and for record keeping. Tutbury Ltd would be paid a management fee by the joint operation of $20 000 In establishing the joint operation, the various parties agreed to provide the following assets as their initial contribution: Stafford Ltd was to provide the patent to SmartTool, which was being recorded by Stafford Ltd at a capitalised development cost of $1 400 000. The operators agreed that this asset had a fair value of $2 000 000, with an expected useful life of 10 years. Dunster Ltd was to provide cash of $ 1 000 000. Tutbury Ltd was to provide the basic plant and equipment to manufacture the new tool. The planta equipment was recorded in the books of Tutbury Ltd at $600 000, but the operators agreed that it ha fair value of $1 000 000. The plant and equipment was estimated to have a further useful life of PART 4 Economic entities During the first period of its operation, the output of the joint operation was distributed to each of the operators in proportion to their agreed interests. By 30 June 2014, Tutbury Ltd had sold 80% of the output received from the joint operation for $300 000. The joint operation had not paid the management fee to Tutbury Ltd by 30 June 2014 Information from the financial statements of the joint operation as at 30 June 2014 is as follows: Assets Cash Plant and equipment Accumulated depreciation Patent Accumulated depreciation Office equipment Accumulated depreciation Work in progress Liabilities Creditors - for materials Accruals - salaries etc, including the management fee Cash payments Salaries Materials Operating expenses $ 40000 1 080 000 (208 000) 2 000 000 (200 000) 88000 (8 800) 40000 $ 136000 112 000 $ 220000 488000 84000 Required 1. Prepare the journal entries in the records of Stafford Ltd and Dunster Ltd at the commencement of the joint operation 2. Prepare the journal entries in the records of Tutbury Ltd for the financial year ending 30 June 2014. Exercise 30.10 UNINCORPORATED IOINT OPERATION MAN incise the design of spe ich could potentially sed in the making man unincorpo PORATED JOINT OPERATION MANAGED BY ONE OF THE OPERATORS ning 2012, discussions took place between Stafford Ltd, a company concerned with the design ised tools and machines, and two companies, Dunster Ltd and Tutbury Ltd, which could in the manufacture of a new tool. The new tool is called Smart Tool and is to be used in the of high grade mining instnimente On 1 June 2013, the three companies agreed to form an unin Tated joint operation to achieve this numase. It was agreed that the relative interests in the joint One cialised tools and machines erests in the joint operation would be: Stafford Ltd Dunster Ltd Tutbury Ltd 50% 25% 25% It was further agreed that Tutbury Ltd would undertake a management role in relation to the new operation, being responsible for operating decisions and for record keeping. Tutbury Ltd would be paid a management fee by the joint operation of $20 000 In establishing the joint operation, the various parties agreed to provide the following assets as their initial contribution: Stafford Ltd was to provide the patent to SmartTool, which was being recorded by Stafford Ltd at a capitalised development cost of $1 400 000. The operators agreed that this asset had a fair value of $2 000 000, with an expected useful life of 10 years. Dunster Ltd was to provide cash of $ 1 000 000. Tutbury Ltd was to provide the basic plant and equipment to manufacture the new tool. The planta equipment was recorded in the books of Tutbury Ltd at $600 000, but the operators agreed that it ha fair value of $1 000 000. The plant and equipment was estimated to have a further useful life of PART 4 Economic entities During the first period of its operation, the output of the joint operation was distributed to each of the operators in proportion to their agreed interests. By 30 June 2014, Tutbury Ltd had sold 80% of the output received from the joint operation for $300 000. The joint operation had not paid the management fee to Tutbury Ltd by 30 June 2014 Information from the financial statements of the joint operation as at 30 June 2014 is as follows: Assets Cash Plant and equipment Accumulated depreciation Patent Accumulated depreciation Office equipment Accumulated depreciation Work in progress Liabilities Creditors - for materials Accruals - salaries etc, including the management fee Cash payments Salaries Materials Operating expenses $ 40000 1 080 000 (208 000) 2 000 000 (200 000) 88000 (8 800) 40000 $ 136000 112 000 $ 220000 488000 84000 Required 1. Prepare the journal entries in the records of Stafford Ltd and Dunster Ltd at the commencement of the joint operation 2. Prepare the journal entries in the records of Tutbury Ltd for the financial year ending 30 June 2014