Answered step by step

Verified Expert Solution

Question

1 Approved Answer

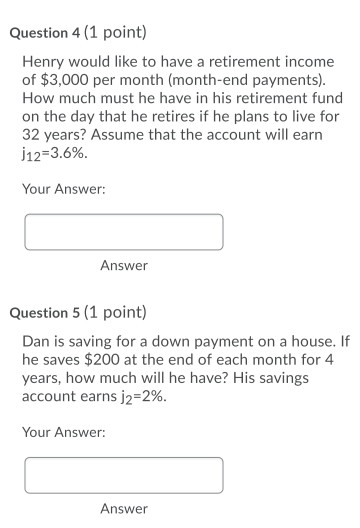

help me with 4, 5 ,6 and 7 pleass i would apprexiate that Question 4 (1 point) Henry would like to have a retirement income

help me with 4, 5 ,6 and 7 pleass i would apprexiate that

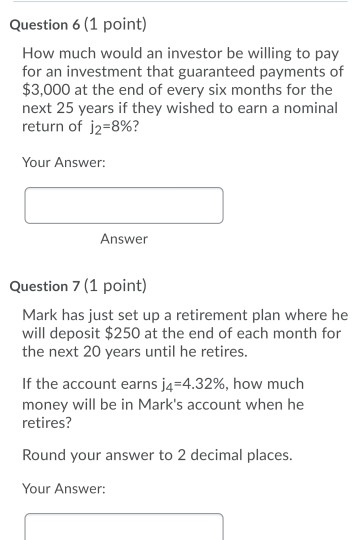

Question 4 (1 point) Henry would like to have a retirement income of $3,000 per month (month-end payments). How much must he have in his retirement fund on the day that he retires if he plans to live for 32 years? Assume that the account will earn 112=3.6% Your Answer: Answer Question 5 (1 point) Dan is saving for a down payment on a house. If he saves $200 at the end of each month for 4 years, how much will he have? His savings account earns j2=2%. Your Answer: Answer Question 6 (1 point) How much would an investor be willing to pay for an investment that guaranteed payments of $3,000 at the end of every six months for the next 25 years if they wished to earn a nominal return of j2=8%? Your Answer: Answer Question 7 (1 point) Mark has just set up a retirement plan where he will deposit $250 at the end of each month for the next 20 years until he retires. If the account earns j4=4.32%, how much money will be in Mark's account when he retires? Round your answer to 2 decimal places. YourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started