Answered step by step

Verified Expert Solution

Question

1 Approved Answer

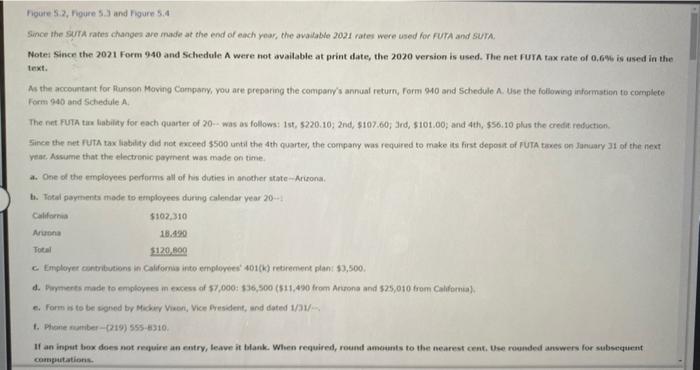

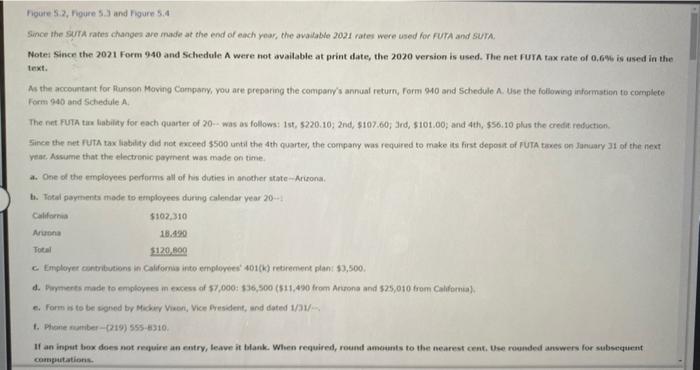

help me with part 5&3&4 houte 5.2, higure 5.3 and Figure 5.4 Since the Sumit rares changes are made at the end of each year,

help me with part 5&3&4

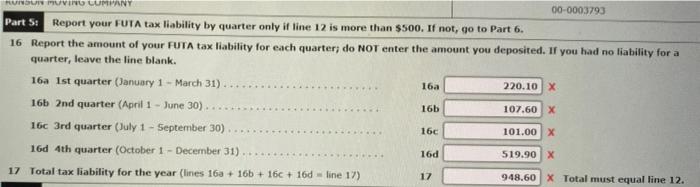

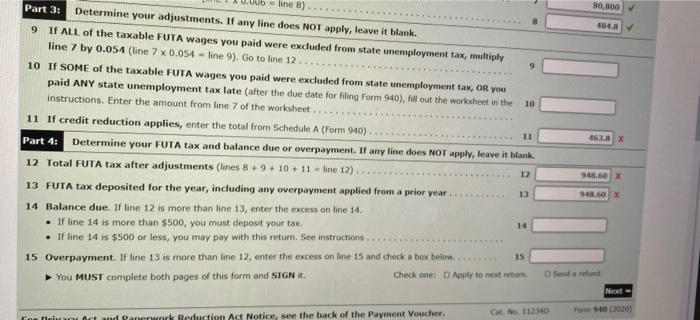

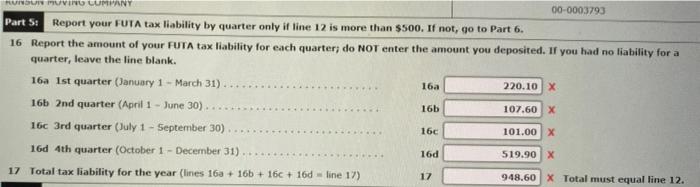

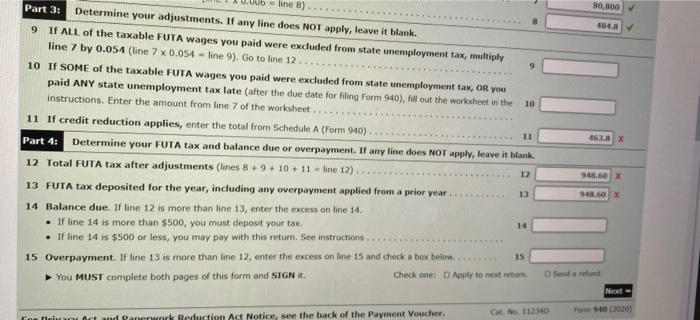

houte 5.2, higure 5.3 and Figure 5.4 Since the Sumit rares changes are made at the end of each year, the available 2021 rates were used for fura and 5 UTA. Note Since the 2021 Form 940 and Sichedule A were not available at print date, the 2020 version is used. The net. FuTA tax rate of 0,696 is ased in the text. As the accountant for flunson Moving Compary, you are preparing the company's annual return, Form Mo and Schedule A. Use the foliowing informstion to compilete Form 940 and Schedule A. The net FUTA tim liability for each quarter of 205 was as follows: 1st, 5220.10,2 nd, $107.60; 3 idd, $101.00; and 4 th, 556.10 plus the credit reduction. Since the net FUTA tax liability did not exceed 3500 until the 4th quartec, the company was required to make its first deposit of FUTA tives on January 31 of the next veac, Assume that the electronic payenent was made on time. a. One of the emplovees pertorms all of his duties in another sate-Arisona. b. Total paymenta mode to etmployees durthe caleedar year 20 -1 c. Eirployer ountritutions in Californas inte ernplowies' 401(k) retarement plani 13,500 . e. Form in to be woned by Mackivy Visen, Vice Presdent, and dated 1/ay/as. 1. Phane mumber (219) 5S5-6310. If an inpet box does not require an entry, feave it blask. When required, roumat ameunts to the nearest cent, Use roumded anwwers for sabsequent conerputations. 16 Report the amount of your FuTA tax liability for each quarter; do NOT enter the amount you deposited. If you had no liability for a quarter, leave the line blank. 16a Ist quarter (January 1 March 31) 166 2nd quarter (April 1 - June 30) 16c 3rd quarter (July 1 - September 30) 16d 4th quarter (October 1 - December 31) 17 Total tax liability for the year (lines 16a+16b+16c+16d= line 17 ) 17 Part 3: Determine your adjustments. If any line does NOT apply, leave it blank. 9. If ALL of the taxable FUTA wages you paid were excluded from state unemployment tax, muttiply line 7 by 0.054 (line 70.054 - line 9). Go to line 12 ... Taxable FUTA wages you paid were excluded from state unemployment tax, on you 10 If SOME of the taxable unemployment tax late (ofter the due date for filing Form 940), fill out the worksheet in the 10 instructions. Enter the amount from line 7 of the worksheet. 11 If credit reduction applies, enter the total from Schedule A (form 940). Part 4: Determine your FUTA tax and balance due or overpayment, If any line does Not apply, leave it blank. 12 Total FUTA tax after adjustments (lines 8+9+10+11= line 12 ) 13 FUTA Lax deposited for the year, including any overpayment applied from a prior year. 14 Balance due. If line 12 is more than line 13 , enter the excess on line 14. - If line 14 is more than $500, you must deposit your tax. - If line 14 is $500 or less, you muy pay with thes return. See instrucbons. 15 Overpayment. If line 13 is more than line 12 , enter the excess on line 15 and check a box bebow. ...2.2. 15 You MUST complete both pages of this form and SiGN it. Check ones D. Apply to nest evturn. Mext = houte 5.2, higure 5.3 and Figure 5.4 Since the Sumit rares changes are made at the end of each year, the available 2021 rates were used for fura and 5 UTA. Note Since the 2021 Form 940 and Sichedule A were not available at print date, the 2020 version is used. The net. FuTA tax rate of 0,696 is ased in the text. As the accountant for flunson Moving Compary, you are preparing the company's annual return, Form Mo and Schedule A. Use the foliowing informstion to compilete Form 940 and Schedule A. The net FUTA tim liability for each quarter of 205 was as follows: 1st, 5220.10,2 nd, $107.60; 3 idd, $101.00; and 4 th, 556.10 plus the credit reduction. Since the net FUTA tax liability did not exceed 3500 until the 4th quartec, the company was required to make its first deposit of FUTA tives on January 31 of the next veac, Assume that the electronic payenent was made on time. a. One of the emplovees pertorms all of his duties in another sate-Arisona. b. Total paymenta mode to etmployees durthe caleedar year 20 -1 c. Eirployer ountritutions in Californas inte ernplowies' 401(k) retarement plani 13,500 . e. Form in to be woned by Mackivy Visen, Vice Presdent, and dated 1/ay/as. 1. Phane mumber (219) 5S5-6310. If an inpet box does not require an entry, feave it blask. When required, roumat ameunts to the nearest cent, Use roumded anwwers for sabsequent conerputations. 16 Report the amount of your FuTA tax liability for each quarter; do NOT enter the amount you deposited. If you had no liability for a quarter, leave the line blank. 16a Ist quarter (January 1 March 31) 166 2nd quarter (April 1 - June 30) 16c 3rd quarter (July 1 - September 30) 16d 4th quarter (October 1 - December 31) 17 Total tax liability for the year (lines 16a+16b+16c+16d= line 17 ) 17 Part 3: Determine your adjustments. If any line does NOT apply, leave it blank. 9. If ALL of the taxable FUTA wages you paid were excluded from state unemployment tax, muttiply line 7 by 0.054 (line 70.054 - line 9). Go to line 12 ... Taxable FUTA wages you paid were excluded from state unemployment tax, on you 10 If SOME of the taxable unemployment tax late (ofter the due date for filing Form 940), fill out the worksheet in the 10 instructions. Enter the amount from line 7 of the worksheet. 11 If credit reduction applies, enter the total from Schedule A (form 940). Part 4: Determine your FUTA tax and balance due or overpayment, If any line does Not apply, leave it blank. 12 Total FUTA tax after adjustments (lines 8+9+10+11= line 12 ) 13 FUTA Lax deposited for the year, including any overpayment applied from a prior year. 14 Balance due. If line 12 is more than line 13 , enter the excess on line 14. - If line 14 is more than $500, you must deposit your tax. - If line 14 is $500 or less, you muy pay with thes return. See instrucbons. 15 Overpayment. If line 13 is more than line 12 , enter the excess on line 15 and check a box bebow. ...2.2. 15 You MUST complete both pages of this form and SiGN it. Check ones D. Apply to nest evturn. Mext =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started