Answered step by step

Verified Expert Solution

Question

1 Approved Answer

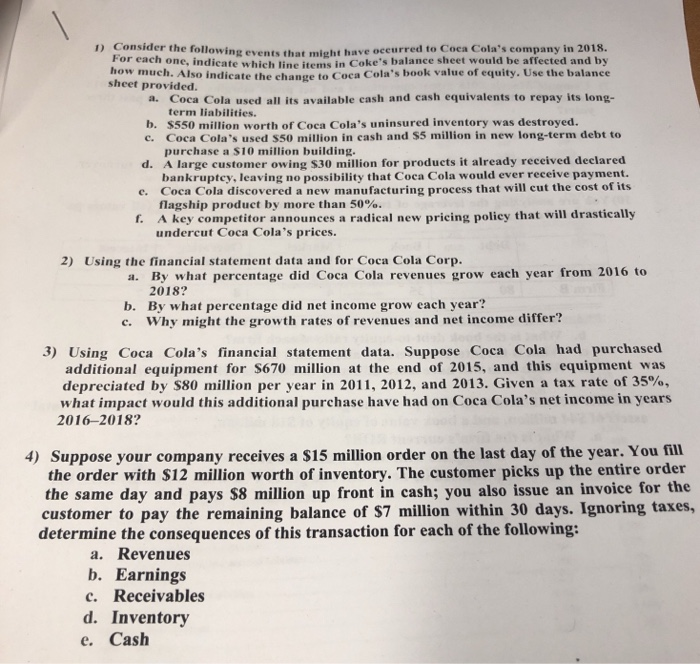

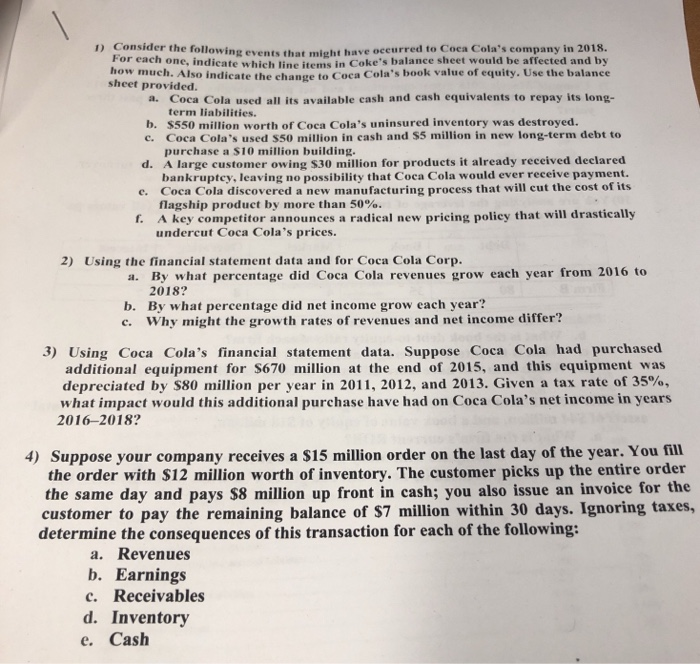

help me with questions 1-4 ) Consider the following events that might have occurred to Coca Cola's company in 2018. For each one, indicate which

help me with questions 1-4

) Consider the following events that might have occurred to Coca Cola's company in 2018. For each one, indicate which line items in Coke's balance sheet would be affected and by how much. Also indicate the change to Coca Cola's book value of equity. Use the balance sheet provided. a. Coca Cola used all its available cash and cash equivalents to repay its long- term liabilities. b. $550 million worth of Coca Cola's uninsured inventory was c. Coca Cola's used $50 million in cash and $5 million in new long-term debt to purchase a S10 million building d. A large customer owing $30 million for products it already received declared bankruptcy, leaving no possibility that Coca Cola would ever receive payment. c. Coca Cola discovered a new manufacturing process that will cut the cost of its flagship product by more than 50%. f. destroyed. A key competitor announces a radical new pricing policy that will drastically undercut Coca Cola's prices. 2) Using the financial statement data and for Coca Cola Corp. a. By what percentage did Coca Cola revenues grow each year from 2016 to 2018 b. By what percentage did net income grow each year? c. Why might the growth rates of revenues and net income differ? 3) Using Coca Cola's financial statement data. Suppose Coca Cola had purchased additional equipment for $670 million at the end of 2015, and this equipment was depreciated by $80 million per year in 2011, 2012, and 2013. Given a tax rate of 35%, what impact would this additional purchase have had on Coca Cola's net income in years 2016-2018? 4) Suppose your company receives a $15 million order on the last day of the year. You fill the order with $12 million worth of inventory. The customer picks up the entire order the same day and pays $8 million up front in cash; you also issue an invoice for the customer to pay the remaining balance of $7 million within 30 days. Ignoring taxes, determine the consequences of this transaction for each of the following: a. Revenues b. Earnings c. Receivables d. Inventory e. Cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started