Question

help me with the 17 journal entries thanks :) for this one question Use the above format for each journal entry ^ journal entry 1:

help me with the 17 journal entries thanks :) for this one question

Use the above format for each journal entry ^

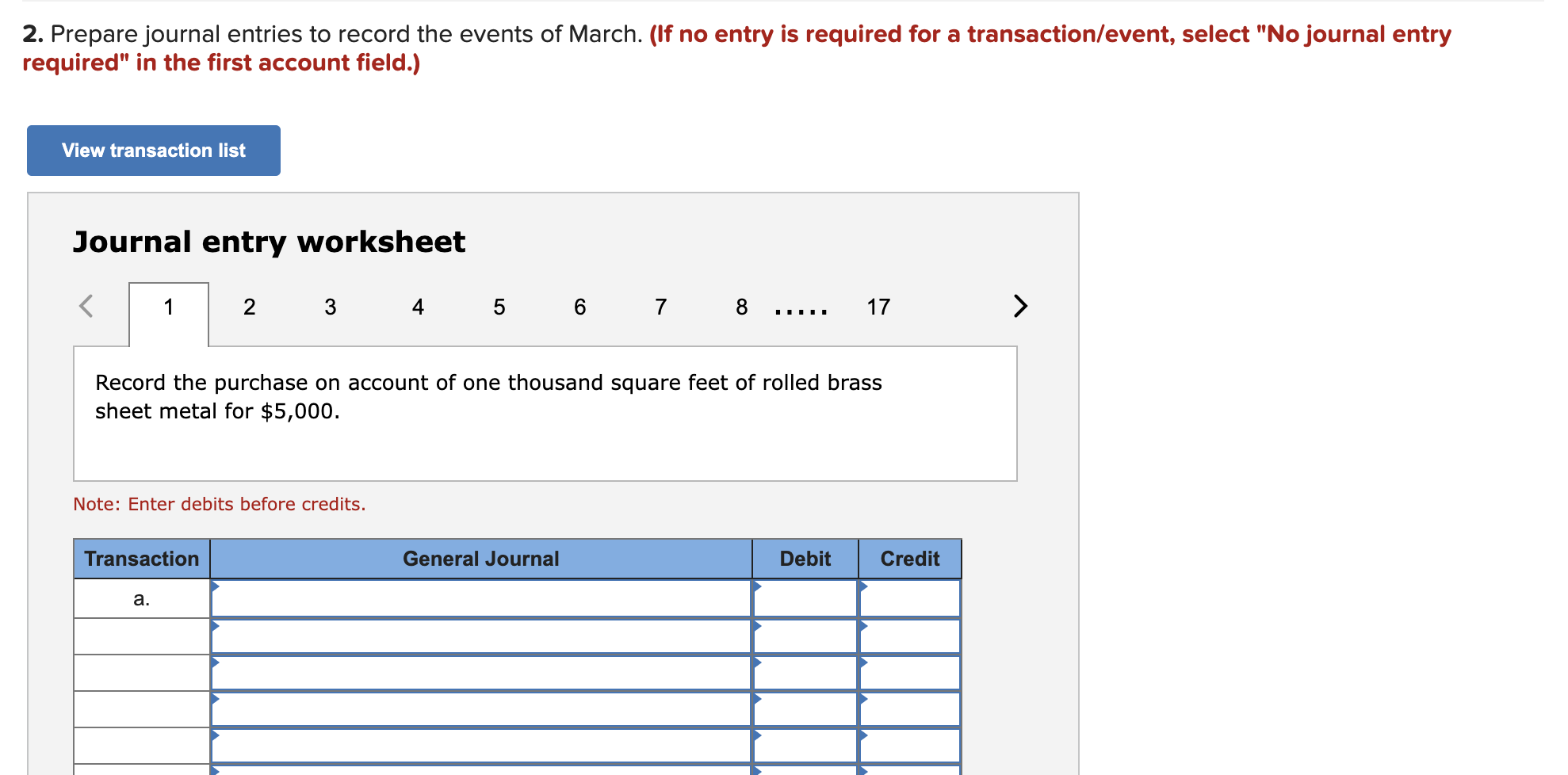

journal entry 1: Record the purchase on account of one thousand square feet of rolled brass sheet metal for $5,000.

journal entry 2: Record the purchase on account of brass tubing for $3,000.

journal entry 3: Record issue of raw materials to production

journal entry 4: Record the usage of supplies in processing.

journal entry 5: Record direct and indirect wages.

journal entry 6: Record direct and indirect wages.

journal entry 7: Record the depreciation of the factory building and equipment during March of $11,000.

journal entry 8: Record the rent paid in cash for warehouse space used during March was $1,100

journal entry 9: Record the utility costs incurred during March of $2,000. The invoices for these costs were received, but the bills were not paid in March.

journal entry 10: Record the March property taxes on the factory of $2,200, paid in cash.

journal entry 11: Record the insurance cost covering factory operations for the month of March of $3,100. The insurance policy had been prepaid.

journal entry 12: Record the costs of salaries and fringe benefits for sales and administrative personnel paid in cash during March of $7,000.

journal entry 13: Record the depreciation on administrative office equipment and space of $5,000.

journal entry 14: Record the other selling and administrative expenses paid in cash during March of $1,000.

journal entry 15: Record the completion of job number T81 on March 20

journal entry 16: Record sales on account.

Journal entry 17: Record cost of sales.

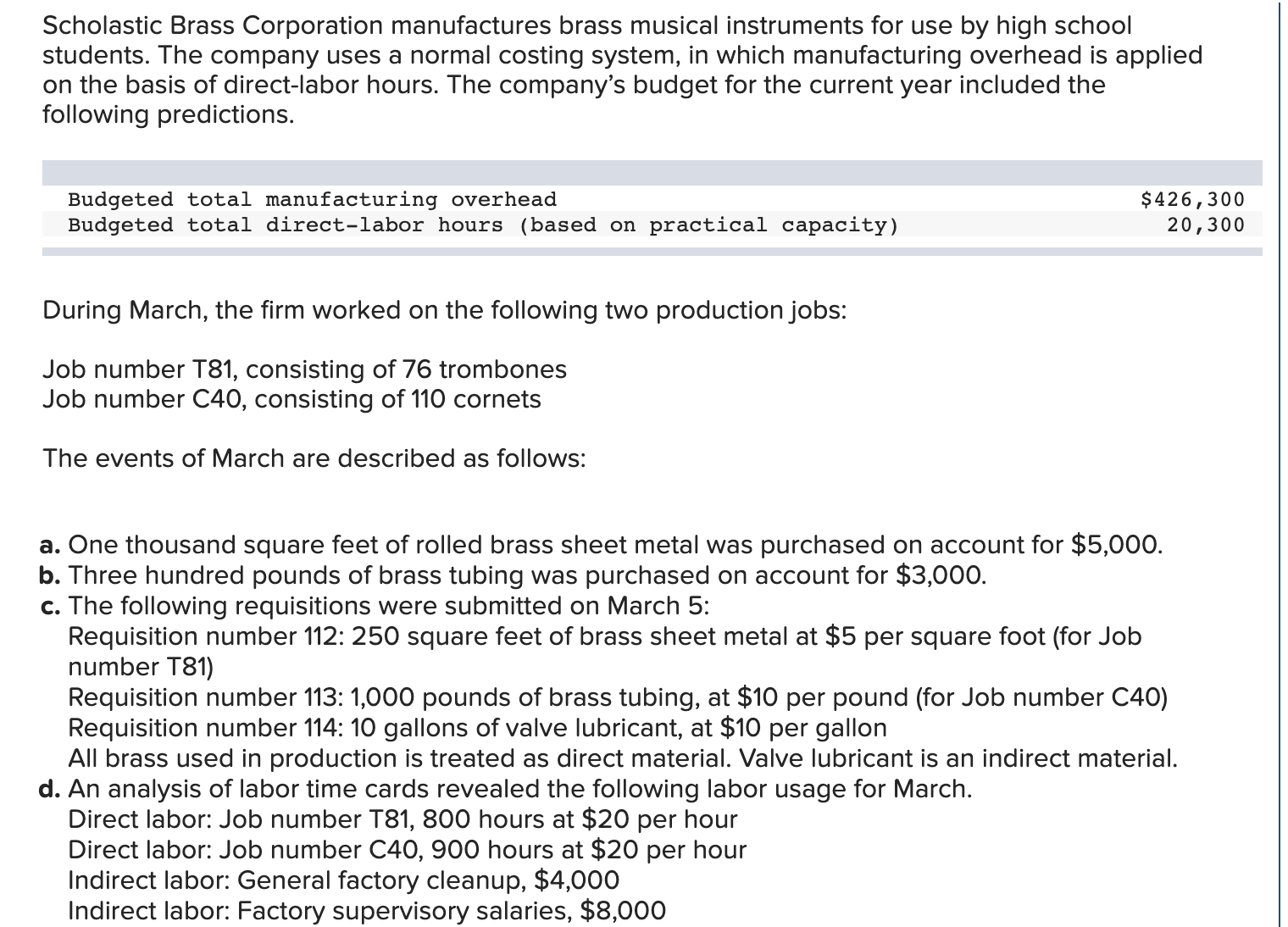

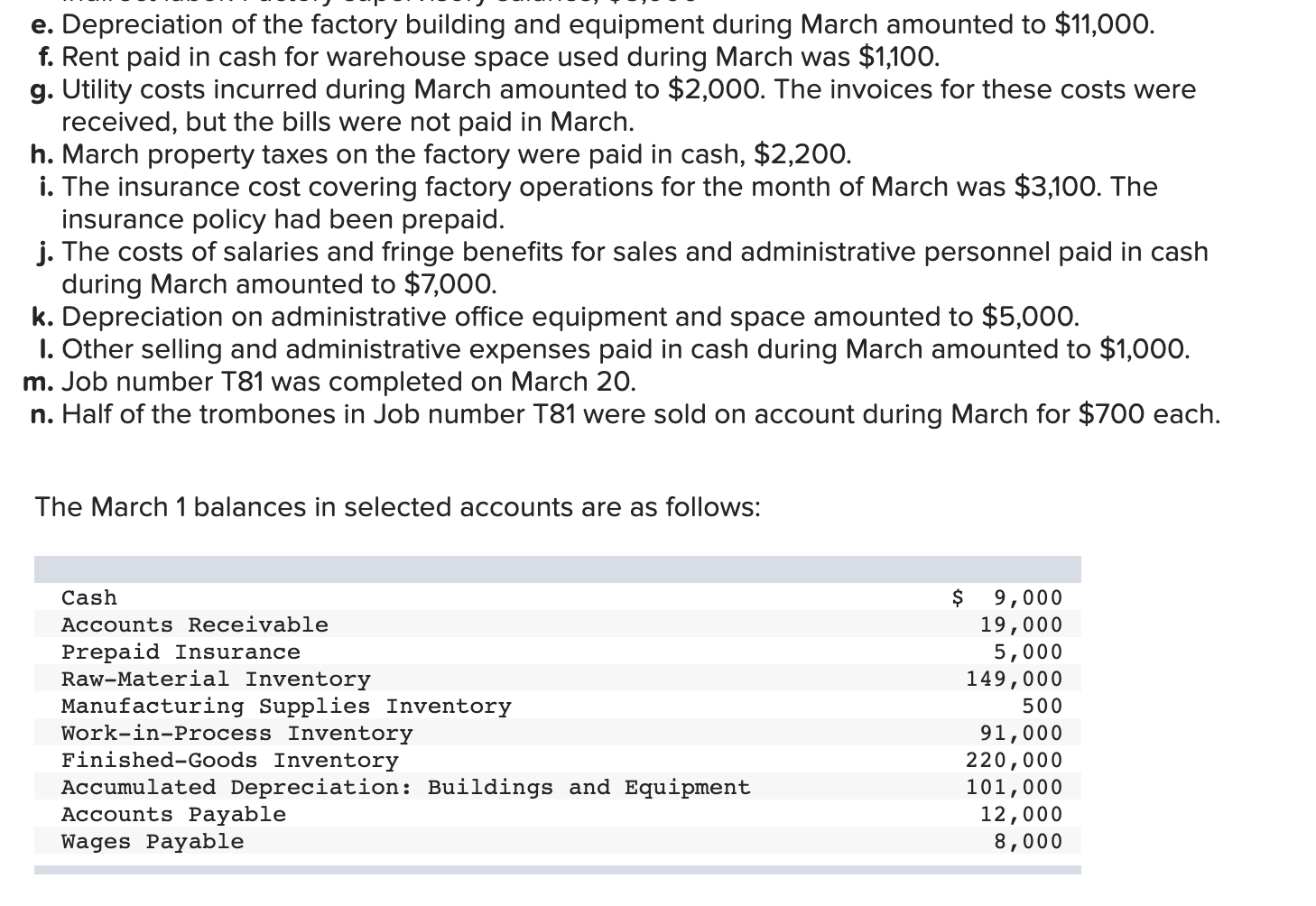

Scholastic Brass Corporation manufactures brass musical instruments for use by high school students. The company uses a normal costing system, in which manufacturing overhead is applied on the basis of direct-labor hours. The company's budget for the current year included the following predictions. During March, the firm worked on the following two production jobs: Job number T81, consisting of 76 trombones Job number C40, consisting of 110 cornets The events of March are described as follows: a. One thousand square feet of rolled brass sheet metal was purchased on account for $5,000. b. Three hundred pounds of brass tubing was purchased on account for $3,000. c. The following requisitions were submitted on March 5: Requisition number 112: 250 square feet of brass sheet metal at $5 per square foot (for Job number T81) Requisition number 113: 1,000 pounds of brass tubing, at $10 per pound (for Job number C40) Requisition number 114: 10 gallons of valve lubricant, at $10 per gallon All brass used in production is treated as direct material. Valve lubricant is an indirect material. d. An analysis of labor time cards revealed the following labor usage for March. Direct labor: Job number T81, 800 hours at $20 per hour Direct labor: Job number C40,900 hours at $20 per hour Indirect labor: General factory cleanup, $4,000 Indirect labor: Factory supervisory salaries, $8,000 e. Depreciation of the factory building and equipment during March amounted to $11,000. f. Rent paid in cash for warehouse space used during March was \$1,100. g. Utility costs incurred during March amounted to $2,000. The invoices for these costs were received, but the bills were not paid in March. h. March property taxes on the factory were paid in cash, $2,200. i. The insurance cost covering factory operations for the month of March was $3,100. The insurance policy had been prepaid. j. The costs of salaries and fringe benefits for sales and administrative personnel paid in cash during March amounted to $7,000. k. Depreciation on administrative office equipment and space amounted to $5,000. I. Other selling and administrative expenses paid in cash during March amounted to $1,000. m. Job number T81 was completed on March 20. n. Half of the trombones in Job number T81 were sold on account during March for $700 each. The March 1 balances in selected accounts are as follows: 2. Prepare journal entries to record the events of March. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the purchase on account of one thousand square feet of rolled brass sheet metal for $5,000. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started