Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help me with the following Required Required 1. Required 2. Required 3. Required 4. Larry will also need to increase his fleet of delivery trucks.

Help me with the following Required

Required 1.

Required 2.

Required 3.

Required 4.

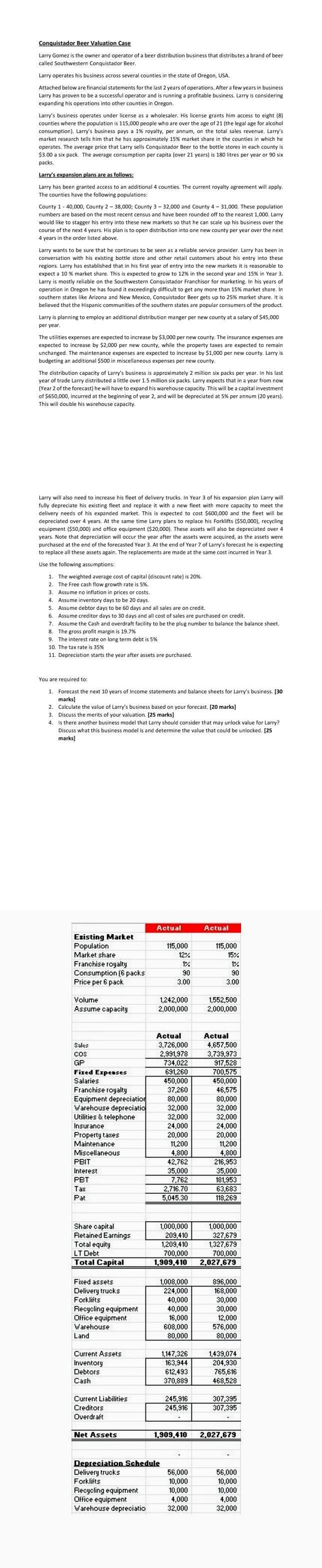

Larry will also need to increase his fleet of delivery trucks. In Year 3 of his expansion plan Larry will fully depreciate his existing fleet and replace it with a new fleet with more capacity to meet the delivery needs of his expanded market. This is expected to cost $600,000 and the fleet will be depreciated over 4 years. At the same time Larry plans to replace his Forklifts ($50,000), recycling equipment ($50,000) and office equipment ($20,000). These assets will also be depreciated over 4 years. Note that depreciation will occur the year after the assets were acquired, as the assets were purchased at the end of the forecasted Year 3 . At the end of Year 7 of Larry's forecast he is expecting to replace all these assets again. The replacements are made at the same cost incurred in Year 3. Use the following assumptions: 1. The weighted average cost of capital (discount rate) is 20%. 2. The Free cash flow growth rate is 5%. 3. Assume no inflation in prices or costs. 4. Assume inventory days to be 20 days. 5. Assume debtor days to be 60 days and all sales are on credit. 6. Assume creditor days to 30 days and all cost of sales are purchased on credit. 7. Assume the Cash and overdraft facility to be the plug number to balance the balance sheet. 8. The gross profit margin is 19.7% 9. The interest rate on long term debt is 5% 10. The tax rate is 35% 11. Depreciation starts the year after assets are purchased. You are required to: 1. Forecast the next 10 years of Income statements and balance sheets for Larry's business. [ 30 marks] 2. Calculate the value of Larry's business based on your forecast. [20 marks] 3. Discuss the merits of your valuation. [25 marks] 4. Is there another business model that Larry should consider that may unlock value for Larry? Discuss what this business model is and determine the value that could be unlocked. [ 25 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started