Answered step by step

Verified Expert Solution

Question

1 Approved Answer

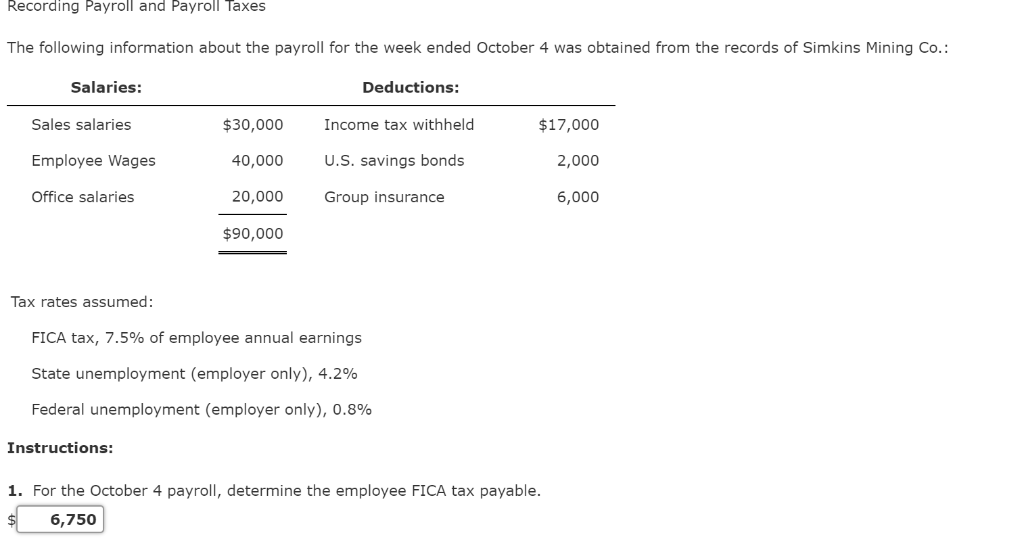

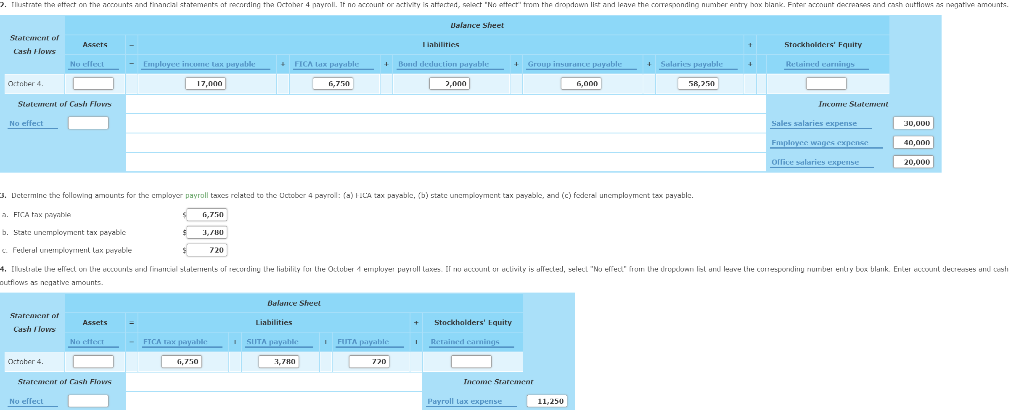

Help me with the no 2 and 4 Retained Earnings Recording Payroll and Payroll Taxes The following information about the payroll for the week ended

Help me with the no 2 and 4 Retained Earnings

Recording Payroll and Payroll Taxes The following information about the payroll for the week ended October 4 was obtained from the records of Simkins Mining Co. Deductions: Salaries: $17,000 2,000 6,000 30,000 Income tax withheld 0,000 US. savings bonds 0,000Group insurance $90,000 Sales salaries Employee Wages Office salaries Tax rates assumed: FICA tax, 7.5% of employee annual earnings State unemployment (employer only), 4.2% Federal unemployment (employer only), 0.8% Instructions: 1. For the October 4 payroll, determine the employee FICA tax payable. 6,750 Ualance Sheet Satent of Stockholders' Fquity Cash Jows No elle ble Bund deduction ble Relained e Octaber 4 7,000 6,750 ,0n0 Slotewreret of Ceash Flos Income SlatemE No effect Sales salaries expense 30,000 40,000 20,000 Office salaries Dctorminc t c f lcw n ounts or the crno oser payroll taxes rclated tc the ucto er 4 payrol: A tax payable D stetc uncmooymcnt tax payao c. and c fodera uncr ployment tax payablc. 3 l a FICA tax payahie G,T50 b. Stata unamployment tax payab c Federal urienployrment lax perreble 720 autfows as ncgate amounts Dalavice Sreel Starcanear or Cash IJoWS +Stockholders' Equity I Rerained FIITA G,750 3,7RO Srarcarear of Cash Flows acome Sraremcor No effec Payroll lax experise 11,250 Recording Payroll and Payroll Taxes The following information about the payroll for the week ended October 4 was obtained from the records of Simkins Mining Co. Deductions: Salaries: $17,000 2,000 6,000 30,000 Income tax withheld 0,000 US. savings bonds 0,000Group insurance $90,000 Sales salaries Employee Wages Office salaries Tax rates assumed: FICA tax, 7.5% of employee annual earnings State unemployment (employer only), 4.2% Federal unemployment (employer only), 0.8% Instructions: 1. For the October 4 payroll, determine the employee FICA tax payable. 6,750 Ualance Sheet Satent of Stockholders' Fquity Cash Jows No elle ble Bund deduction ble Relained e Octaber 4 7,000 6,750 ,0n0 Slotewreret of Ceash Flos Income SlatemE No effect Sales salaries expense 30,000 40,000 20,000 Office salaries Dctorminc t c f lcw n ounts or the crno oser payroll taxes rclated tc the ucto er 4 payrol: A tax payable D stetc uncmooymcnt tax payao c. and c fodera uncr ployment tax payablc. 3 l a FICA tax payahie G,T50 b. Stata unamployment tax payab c Federal urienployrment lax perreble 720 autfows as ncgate amounts Dalavice Sreel Starcanear or Cash IJoWS +Stockholders' Equity I Rerained FIITA G,750 3,7RO Srarcarear of Cash Flows acome Sraremcor No effec Payroll lax experise 11,250Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started