Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help me with these 5 questions, the red marked choice are wrong answer!!!! Which of the following legal documents in the securitization process describes the

Help me with these 5 questions, the red marked choice are wrong answer!!!!

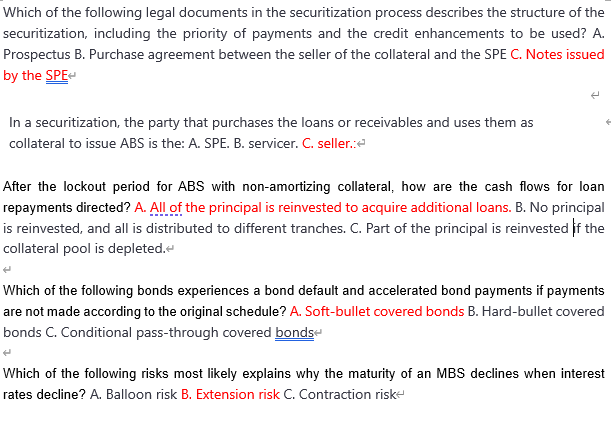

Which of the following legal documents in the securitization process describes the structure of the securitization, including the priority of payments and the credit enhancements to be used? A. Prospectus B. Purchase agreement between the seller of the collateral and the SPE C. Notes issued by the SPE In a securitization, the party that purchases the loans or receivables and uses them as collateral to issue ABS is the: A. SPE. B. servicer. C. seller: After the lockout period for ABS with non-amortizing collateral, how are the cash flows for loan repayments directed? A. All of the principal is reinvested to acquire additional loans. B. No principal is reinvested, and all is distributed to different tranches. C. Part of the principal is reinvested If the collateral pool is depleted. Which of the following bonds experiences a bond default and accelerated bond payments if payments are not made according to the original schedule? A. Soft-bullet covered bonds B. Hard-bullet covered bonds C. Conditional pass-through covered bonds Which of the following risks most likely explains why the maturity of an MBS declines when interest rates decline? A. Balloon risk B. Extension risk C. Contraction riskStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started