Help me with this question please, I will thumbs you up! :)

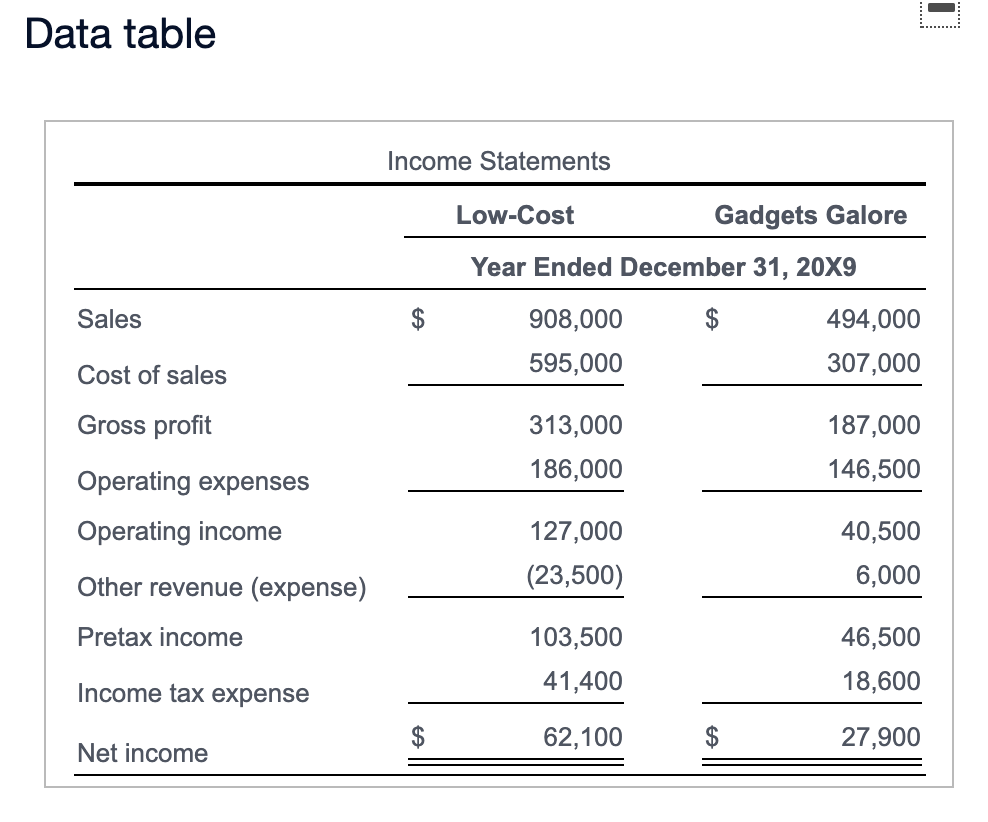

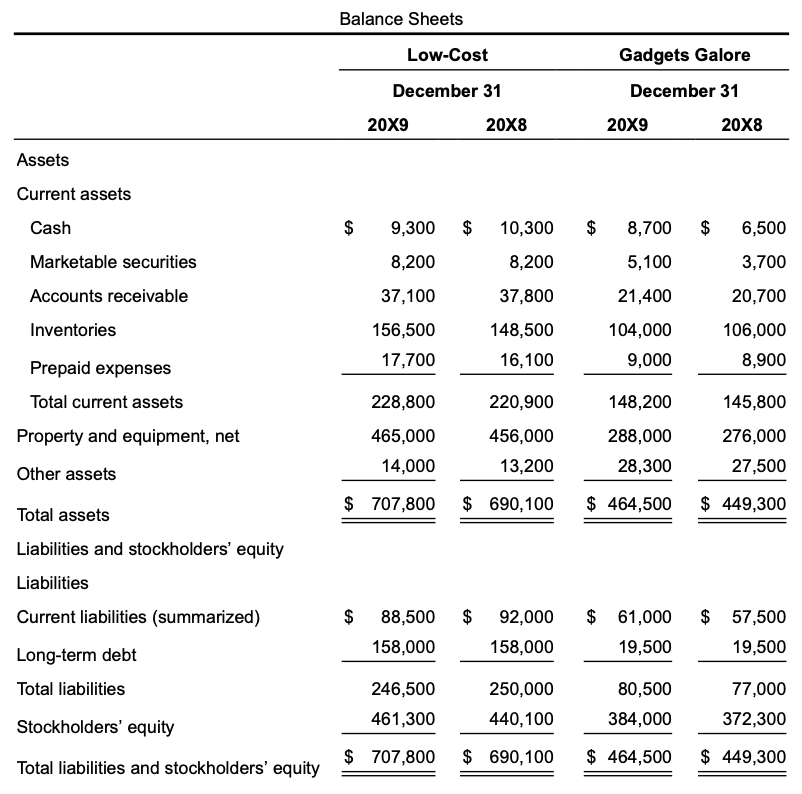

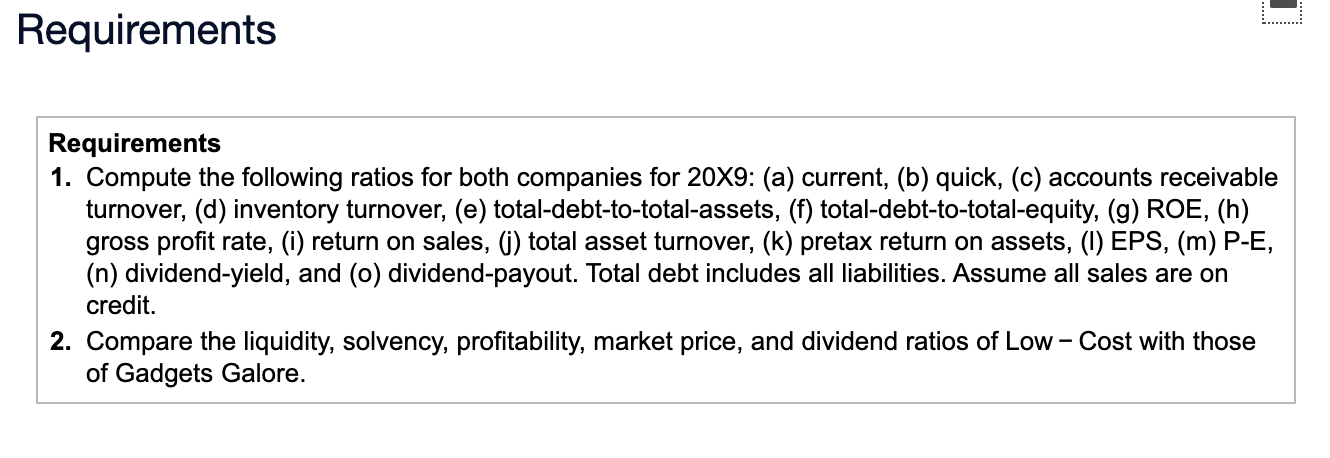

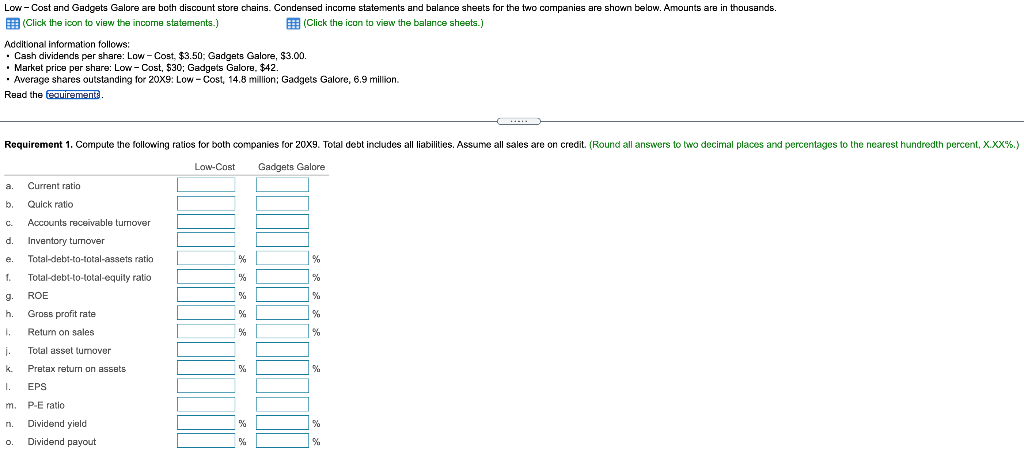

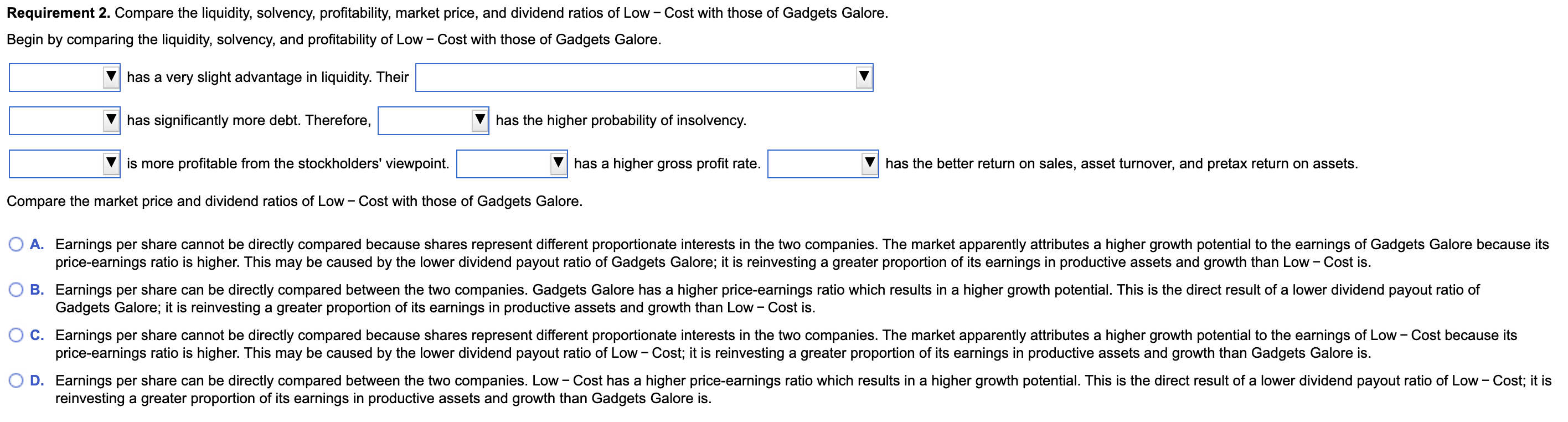

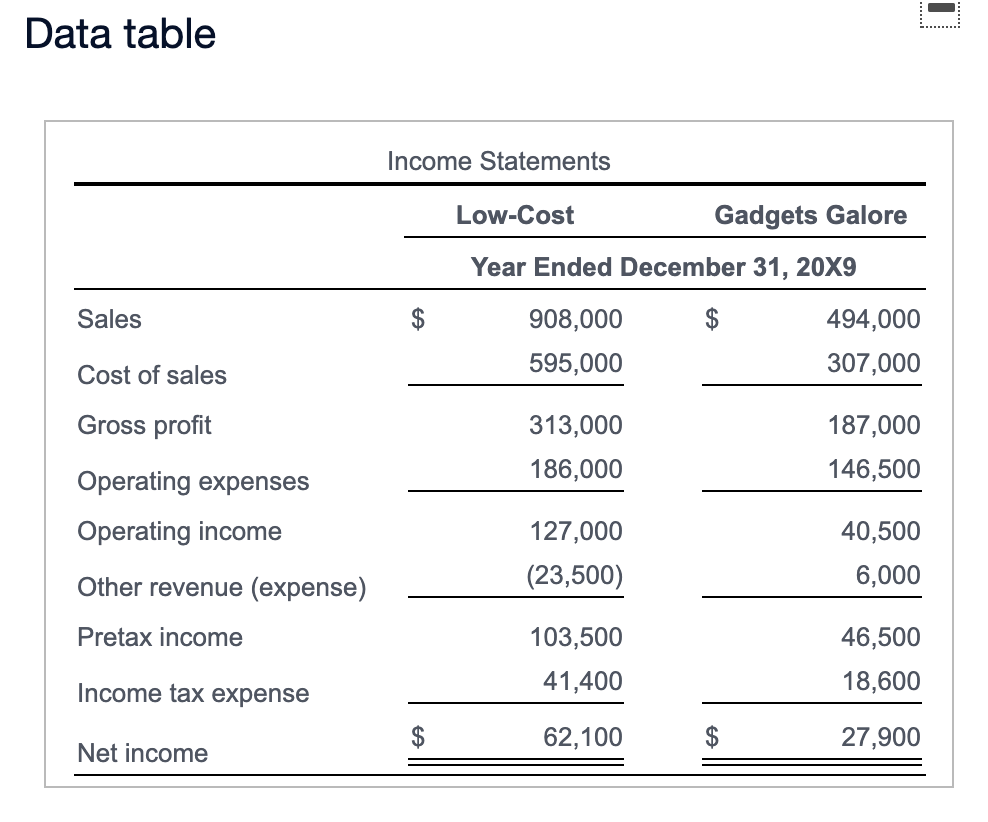

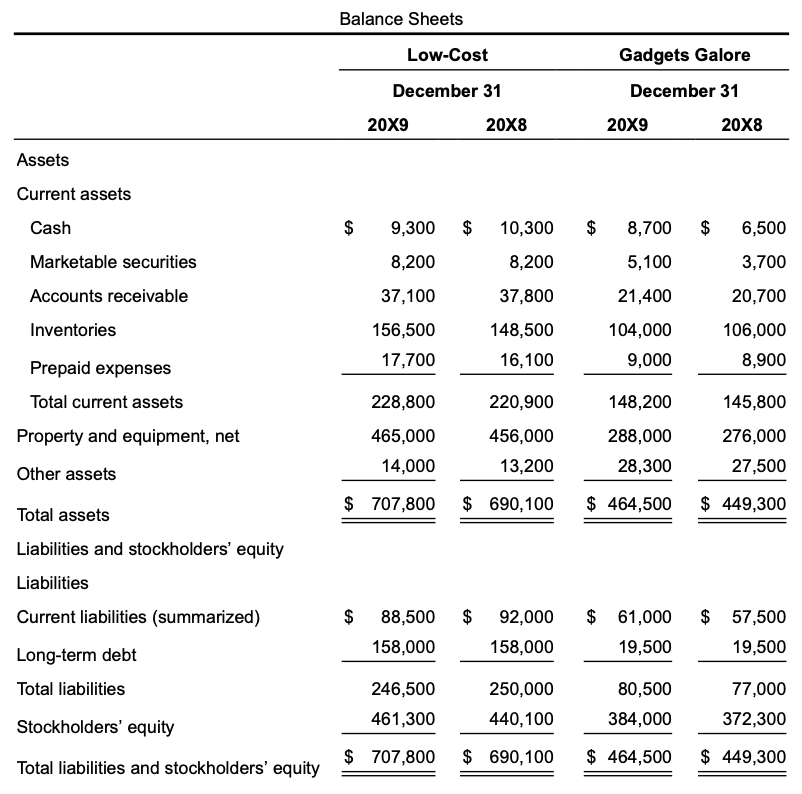

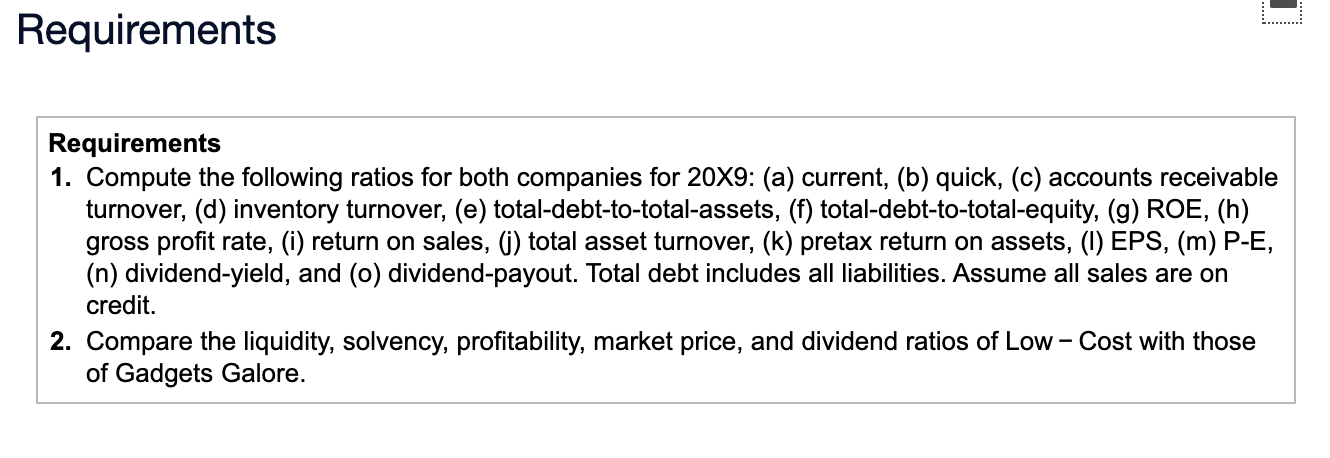

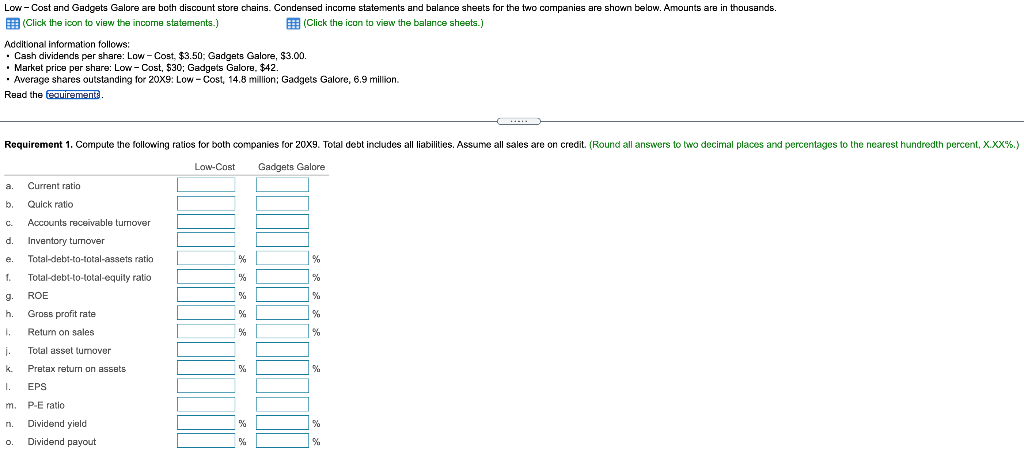

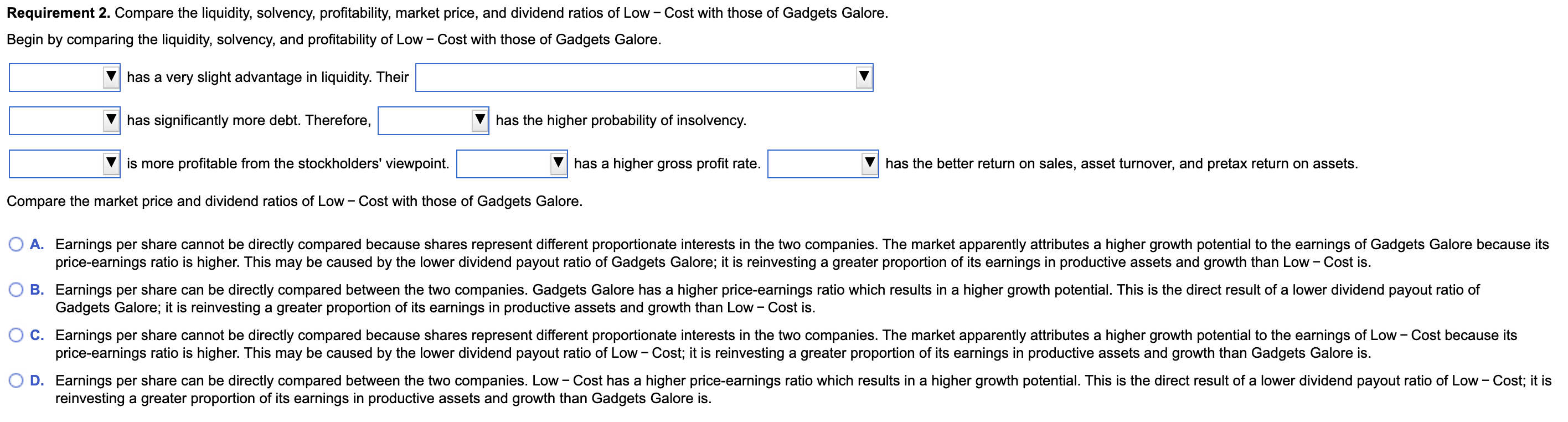

- Data table Income Statements Low-Cost Gadgets Galore Year Ended December 31, 20X9 Sales 908,000 595,000 494,000 307,000 Cost of sales Gross profit 313,000 186,000 187,000 146,500 Operating expenses Operating income 127,000 (23,500) 40,500 6,000 Other revenue (expense) Pretax income 103,500 41,400 46,500 18,600 Income tax expense 62,100 27,900 Net income Balance Sheets Gadgets Galore Low-Cost December 31 20X9 20X8 December 31 20X9 20x8 Assets Current assets Cash $ $ 10,300 $ $ 6,500 8,200 3,700 Marketable securities Accounts receivable Inventories 9,300 8,200 37,100 156,500 17,700 37,800 8,700 5,100 21,400 104,000 9,000 20,700 148,500 16,100 106,000 8,900 Prepaid expenses Total current assets Property and equipment, net 228,800 220,900 148,200 145,800 465,000 14,000 456,000 13,200 288,000 28,300 276,000 27,500 Other assets $ 707,800 $ 690,100 $ 464,500 $ 449,300 Total assets Liabilities and stockholders' equity Liabilities Current liabilities (summarized) $ $ $ 88,500 158,000 92,000 158,000 $ 61,000 19,500 $ 57,500 19,500 Long-term debt Total liabilities 246,500 461,300 250,000 440,100 80,500 384,000 77,000 372,300 Stockholders' equity Total liabilities and stockholders' equity $ 707,800 $ 690,100 $ 464,500 $ 449,300 Requirements Requirements 1. Compute the following ratios for both companies for 20X9: (a) current, (b) quick, (c) accounts receivable turnover, (d) inventory turnover, (e) total-debt-to-total-assets, (f) total-debt-to-total-equity, (g) ROE, (h) gross profit rate, (i) return on sales, (j) total asset turnover, (k) pretax return on assets, (1) EPS, (m) P-E, (n) dividend-yield, and (o) dividend-payout. Total debt includes all liabilities. Assume all sales are on credit. 2. Compare the liquidity, solvency, profitability, market price, and dividend ratios of Low-Cost with those of Gadgets Galore. Low-Cost and Gadgets Galore are both discount store chains. Condensed income statements and balance sheets for the two companies are shown below. Amounts are in thousands. (Click the icon to view the income statements.) (Click the icon to view the balance sheets.) Additional information follows: . Cash dividends per share: Low - Cost, $3.50: Gadgets Galore, $3.00. Market price per share: Low-Cost, $30; Gadgets Galore. $42. Average shares outstanding for 20X9: Low - Cost, 14.8 million; Gadgets Galore, 6.9 million. Read the fequirements Requirement 1. Compute the following ratios for both companies for 20x9 Total debt includes all liabilities. Assume all sales are on credit. (Round all answers to two decimal places and percentages to the nearest hundredth percent, X.XX%.) Low-Cost Gadgets Galore a b. c d. Current ratio Quick ratio Accounts receivable turnover Inventory turnover Total-debt-to-total-assets ratio - Total-debt-to-total-equity ratio - ROE e. % % 1 % % g. g. h. Gross profit rate % % 1. Return on sales % % i. k. I. Total asset lumover Pretax return on assets % EPS m. P-E ratio n. . % Dividend yield Dividend payout 0. %% % Requirement 2. Compare the liquidity, solvency, profitability, market price, and dividend ratios of Low-Cost with those of Gadgets Galore. Begin by comparing the liquidity, solvency, and profitability of Low - Cost with those of Gadgets Galore. has a very slight advantage in liquidity. Their has significantly more debt. Therefore, has the higher probability of insolvency. is more profitable from the stockholders' viewpoint. has a higher gross profit rate. has the better return on sales, asset turnover, and pretax return on assets. Compare the market price and dividend ratios of Low-Cost with those of Gadgets Galore. O A. Earnings per share cannot be directly compared because shares represent different proportionate interests in the two companies. The market apparently attributes a higher growth potential to the earnings of Gadgets Galore because its price-earnings ratio is higher. This may be caused by the lower dividend payout ratio of Gadgets Galore; it is reinvesting a greater proportion of its earnings in productive assets and growth than Low-Cost is. O B. Earnings per share can be directly compared between the two companies. Gadgets Galore has a higher price-earnings ratio which results in a higher growth potential. This is the direct result of a lower dividend payout ratio of Gadgets Galore; it is reinvesting a greater proportion of its earnings in productive assets and growth than Low - Cost is. C. Earnings per share cannot be directly compared because shares represent different proportionate interests in the two companies. The market apparently attributes a higher growth potential to the earnings of Low-Cost because its price-earnings ratio is higher. This may be caused by the lower dividend payout ratio of Low - Cost; it is reinvesting a greater proportion of its earnings in productive assets and growth than Gadgets Galore is. D. Earnings per share can be directly compared between the two companies. Low - Cost has a higher price-earnings ratio which results in a higher growth potential. This is the direct result of a lower dividend payout ratio of Low - Cost; it is reinvesting a greater proportion of its earnings in productive assets and growth than Gadgets Galore is. - Data table Income Statements Low-Cost Gadgets Galore Year Ended December 31, 20X9 Sales 908,000 595,000 494,000 307,000 Cost of sales Gross profit 313,000 186,000 187,000 146,500 Operating expenses Operating income 127,000 (23,500) 40,500 6,000 Other revenue (expense) Pretax income 103,500 41,400 46,500 18,600 Income tax expense 62,100 27,900 Net income Balance Sheets Gadgets Galore Low-Cost December 31 20X9 20X8 December 31 20X9 20x8 Assets Current assets Cash $ $ 10,300 $ $ 6,500 8,200 3,700 Marketable securities Accounts receivable Inventories 9,300 8,200 37,100 156,500 17,700 37,800 8,700 5,100 21,400 104,000 9,000 20,700 148,500 16,100 106,000 8,900 Prepaid expenses Total current assets Property and equipment, net 228,800 220,900 148,200 145,800 465,000 14,000 456,000 13,200 288,000 28,300 276,000 27,500 Other assets $ 707,800 $ 690,100 $ 464,500 $ 449,300 Total assets Liabilities and stockholders' equity Liabilities Current liabilities (summarized) $ $ $ 88,500 158,000 92,000 158,000 $ 61,000 19,500 $ 57,500 19,500 Long-term debt Total liabilities 246,500 461,300 250,000 440,100 80,500 384,000 77,000 372,300 Stockholders' equity Total liabilities and stockholders' equity $ 707,800 $ 690,100 $ 464,500 $ 449,300 Requirements Requirements 1. Compute the following ratios for both companies for 20X9: (a) current, (b) quick, (c) accounts receivable turnover, (d) inventory turnover, (e) total-debt-to-total-assets, (f) total-debt-to-total-equity, (g) ROE, (h) gross profit rate, (i) return on sales, (j) total asset turnover, (k) pretax return on assets, (1) EPS, (m) P-E, (n) dividend-yield, and (o) dividend-payout. Total debt includes all liabilities. Assume all sales are on credit. 2. Compare the liquidity, solvency, profitability, market price, and dividend ratios of Low-Cost with those of Gadgets Galore. Low-Cost and Gadgets Galore are both discount store chains. Condensed income statements and balance sheets for the two companies are shown below. Amounts are in thousands. (Click the icon to view the income statements.) (Click the icon to view the balance sheets.) Additional information follows: . Cash dividends per share: Low - Cost, $3.50: Gadgets Galore, $3.00. Market price per share: Low-Cost, $30; Gadgets Galore. $42. Average shares outstanding for 20X9: Low - Cost, 14.8 million; Gadgets Galore, 6.9 million. Read the fequirements Requirement 1. Compute the following ratios for both companies for 20x9 Total debt includes all liabilities. Assume all sales are on credit. (Round all answers to two decimal places and percentages to the nearest hundredth percent, X.XX%.) Low-Cost Gadgets Galore a b. c d. Current ratio Quick ratio Accounts receivable turnover Inventory turnover Total-debt-to-total-assets ratio - Total-debt-to-total-equity ratio - ROE e. % % 1 % % g. g. h. Gross profit rate % % 1. Return on sales % % i. k. I. Total asset lumover Pretax return on assets % EPS m. P-E ratio n. . % Dividend yield Dividend payout 0. %% % Requirement 2. Compare the liquidity, solvency, profitability, market price, and dividend ratios of Low-Cost with those of Gadgets Galore. Begin by comparing the liquidity, solvency, and profitability of Low - Cost with those of Gadgets Galore. has a very slight advantage in liquidity. Their has significantly more debt. Therefore, has the higher probability of insolvency. is more profitable from the stockholders' viewpoint. has a higher gross profit rate. has the better return on sales, asset turnover, and pretax return on assets. Compare the market price and dividend ratios of Low-Cost with those of Gadgets Galore. O A. Earnings per share cannot be directly compared because shares represent different proportionate interests in the two companies. The market apparently attributes a higher growth potential to the earnings of Gadgets Galore because its price-earnings ratio is higher. This may be caused by the lower dividend payout ratio of Gadgets Galore; it is reinvesting a greater proportion of its earnings in productive assets and growth than Low-Cost is. O B. Earnings per share can be directly compared between the two companies. Gadgets Galore has a higher price-earnings ratio which results in a higher growth potential. This is the direct result of a lower dividend payout ratio of Gadgets Galore; it is reinvesting a greater proportion of its earnings in productive assets and growth than Low - Cost is. C. Earnings per share cannot be directly compared because shares represent different proportionate interests in the two companies. The market apparently attributes a higher growth potential to the earnings of Low-Cost because its price-earnings ratio is higher. This may be caused by the lower dividend payout ratio of Low - Cost; it is reinvesting a greater proportion of its earnings in productive assets and growth than Gadgets Galore is. D. Earnings per share can be directly compared between the two companies. Low - Cost has a higher price-earnings ratio which results in a higher growth potential. This is the direct result of a lower dividend payout ratio of Low - Cost; it is reinvesting a greater proportion of its earnings in productive assets and growth than Gadgets Galore is