Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help me with this question QUESTION 2 FINANCIAL STATEMENTS OF A PARTNERSHIP 20) lhe information given below was extracted from the accounting records of Vampesy

help me with this question

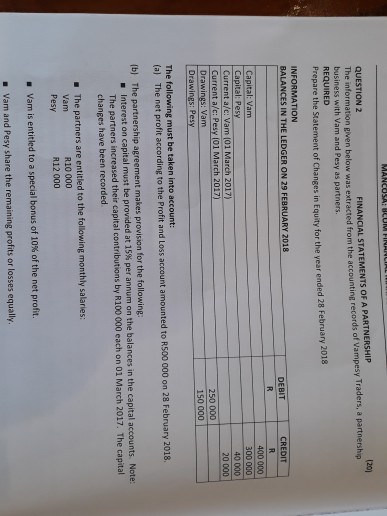

QUESTION 2 FINANCIAL STATEMENTS OF A PARTNERSHIP 20) lhe information given below was extracted from the accounting records of Vampesy Traders, a partnership business with Vam and Pesy as partners. REQUIRED Prepare the Statement of Changes in Equity for the year ended 28 February 2018 INFORMATION BALANCES IN THE LEDGER ON 29 FEBRUARY 2018 DEBIT CREDIT Capital: Vam Capital: Pesy Current a/c: Vam (01 March 2017) Current a/c: Pesy (01 March 2017) Drawings: Vam 400000 300 000 40 000 20 000 250 000 150 000 Drawings: Pesy The following must be taken into account: (a) The net profit according to the Profit and Loss account amounted to R500 000 on 28 February 2018. (b) The partnership agreement makes provision for the following Interest on capital must be provided at 15% per annum on the balances in the capital a changes have been recorded The partners are entitled to the following monthly salaries: ccounts Note: The partners increased their capital contributions by R100 000 each on 01 March 2017. The capital - R10 000 R12 000 Vam Vam is entitled to a special bonus of 10% of the net profit. . Vam and Pesy share the remaining profits or losses equallyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started