Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help much needed to answer this question. thanks! 6.Multifactor Use the following information to answer 25-26: Investors care about the purchasing power of their currency.

Help much needed to answer this question.

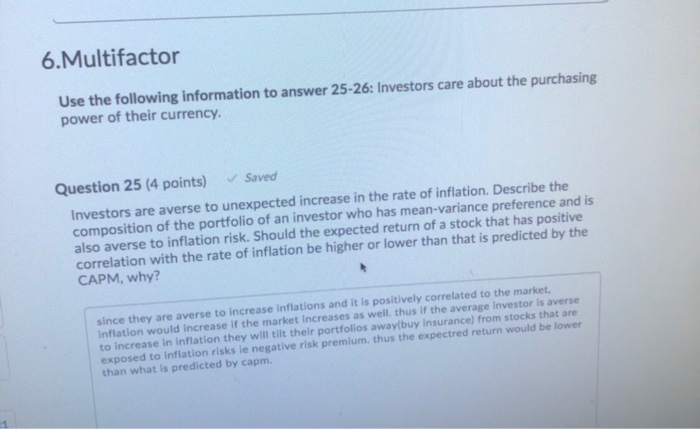

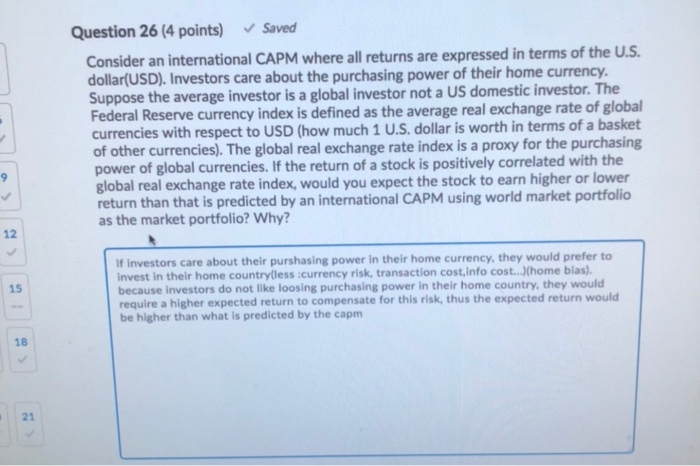

6.Multifactor Use the following information to answer 25-26: Investors care about the purchasing power of their currency. Question 25 (4 points) Saved Investors are averse to unexpected increase in the rate of inflation. Describe the composition of the portfolio of an investor who has mean-variance preference and is also averse to inflation risk. Should the expected return of a stock that has positive correlation with the rate of inflation be higher or lower than that is predicted by the CAPM, why? since they are averse to increase inflations and it is positively correlated to the market, Inflation would increase if the market increases as well, thus if the average Investor is averse to increase in inflation they will tilt their portfolios away buy insurance) from stocks that are exposed to Inflation risks ie negative risk premium. thus the expected return would be lower than what is predicted by capm. Question 26 (4 points) Saved Consider an international CAPM where all returns are expressed in terms of the U.S. dollar(USD). Investors care about the purchasing power of their home currency. Suppose the average investor is a global investor not a US domestic investor. The Federal Reserve currency index is defined as the average real exchange rate of global currencies with respect to USD (how much 1 U.S. dollar is worth in terms of a basket of other currencies). The global real exchange rate index is a proxy for the purchasing power of global currencies. If the return of a stock is positively correlated with the global real exchange rate index, would you expect the stock to earn higher or lower return than that is predicted by an international CAPM using world market portfolio as the market portfolio? Why? 12 15 If investors care about their purshasing power in their home currency, they would prefer to invest in their home countrylless .currency risk, transaction cost, info cost...) home blas). because investors do not like loosing purchasing power in their home country, they would require a higher expected return to compensate for this risk, thus the expected return would be higher than what is predicted by the capm 18 21 6.Multifactor Use the following information to answer 25-26: Investors care about the purchasing power of their currency. Question 25 (4 points) Saved Investors are averse to unexpected increase in the rate of inflation. Describe the composition of the portfolio of an investor who has mean-variance preference and is also averse to inflation risk. Should the expected return of a stock that has positive correlation with the rate of inflation be higher or lower than that is predicted by the CAPM, why? since they are averse to increase inflations and it is positively correlated to the market, Inflation would increase if the market increases as well, thus if the average Investor is averse to increase in inflation they will tilt their portfolios away buy insurance) from stocks that are exposed to Inflation risks ie negative risk premium. thus the expected return would be lower than what is predicted by capm. Question 26 (4 points) Saved Consider an international CAPM where all returns are expressed in terms of the U.S. dollar(USD). Investors care about the purchasing power of their home currency. Suppose the average investor is a global investor not a US domestic investor. The Federal Reserve currency index is defined as the average real exchange rate of global currencies with respect to USD (how much 1 U.S. dollar is worth in terms of a basket of other currencies). The global real exchange rate index is a proxy for the purchasing power of global currencies. If the return of a stock is positively correlated with the global real exchange rate index, would you expect the stock to earn higher or lower return than that is predicted by an international CAPM using world market portfolio as the market portfolio? Why? 12 15 If investors care about their purshasing power in their home currency, they would prefer to invest in their home countrylless .currency risk, transaction cost, info cost...) home blas). because investors do not like loosing purchasing power in their home country, they would require a higher expected return to compensate for this risk, thus the expected return would be higher than what is predicted by the capm 18 21 thanks!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started