help. my teacher said i have to double it.

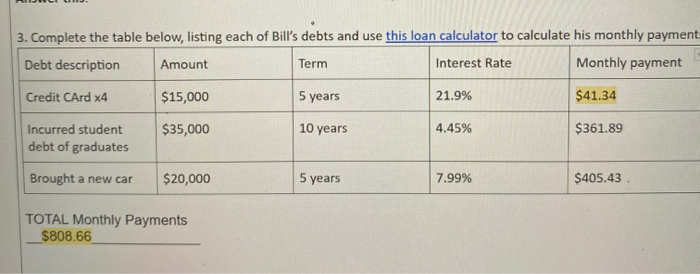

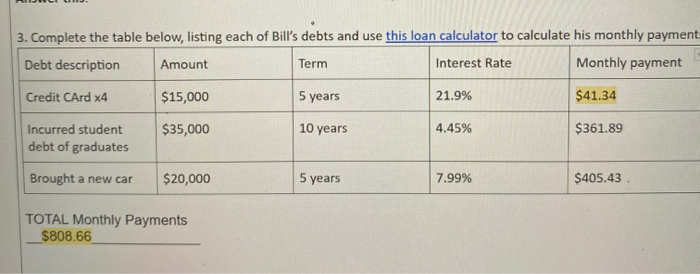

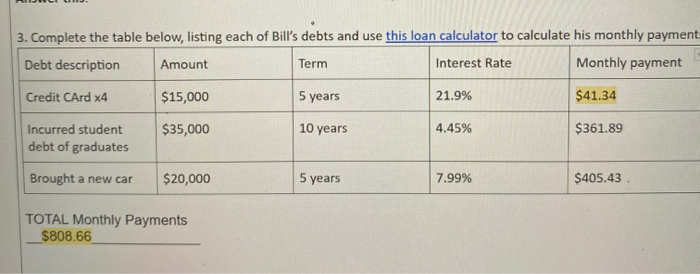

3. Complete the table below, listing each of Bill's debts and use this loan calculator to calculate his monthly payment Debt description Amount Term Interest Rate Monthly payment Credit CArd x4 $15,000 5 years 21.9% $41.34 $35,000 10 years 4.45% $361.89 Incurred student debt of graduates Brought a new car $20,000 5 years 7.99% $405.43 TOTAL Monthly Payments $808.66 VEB DEB CREDIT CARD Left college with debt on four credit cards totaling $7,000 and now has $15,000 in debt at an interest rate of 21.9%. Making minimum payment of $300/month. Bill said he was prioritizing this bill since it would have the largest impact on his credit score. He would like to pay off his credit card within 5 years so he can start saving for other things. 3234 5678 98765432 Incurred student debt of $35,000 (which is about average for recent college graduates), with a 4.45% interest rate for the 10 year term. He has missed his last three payments. Bill had heard that there was a government plan to forgive student loans after 10 years so he wasn't too concerned about missing those payments. Besides, since these were federal loans, they wouldn't affect his credit score. 53K145 Purchased a new mini-Cooper as a present to himself after graduating from college and has a $20,000 loan outstanding at 7.99% interest over a 5 year term. He hasn't made a payment in three months. Bill had resigned himself to the fact that he could always just sell the car and all would be good. 3. Complete the table below, listing each of Bill's debts and use this loan calculator to calculate his monthly payment Debt description Amount Term Interest Rate Monthly payment Credit CArd x4 $15,000 5 years 21.9% $41.34 $35,000 10 years 4.45% $361.89 Incurred student debt of graduates Brought a new car $20,000 5 years 7.99% $405.43 TOTAL Monthly Payments $808.66 VEB DEB CREDIT CARD Left college with debt on four credit cards totaling $7,000 and now has $15,000 in debt at an interest rate of 21.9%. Making minimum payment of $300/month. Bill said he was prioritizing this bill since it would have the largest impact on his credit score. He would like to pay off his credit card within 5 years so he can start saving for other things. 3234 5678 98765432 Incurred student debt of $35,000 (which is about average for recent college graduates), with a 4.45% interest rate for the 10 year term. He has missed his last three payments. Bill had heard that there was a government plan to forgive student loans after 10 years so he wasn't too concerned about missing those payments. Besides, since these were federal loans, they wouldn't affect his credit score. 53K145 Purchased a new mini-Cooper as a present to himself after graduating from college and has a $20,000 loan outstanding at 7.99% interest over a 5 year term. He hasn't made a payment in three months. Bill had resigned himself to the fact that he could always just sell the car and all would be good