help? need requirements 1 and 2 done trying to use this as an example.

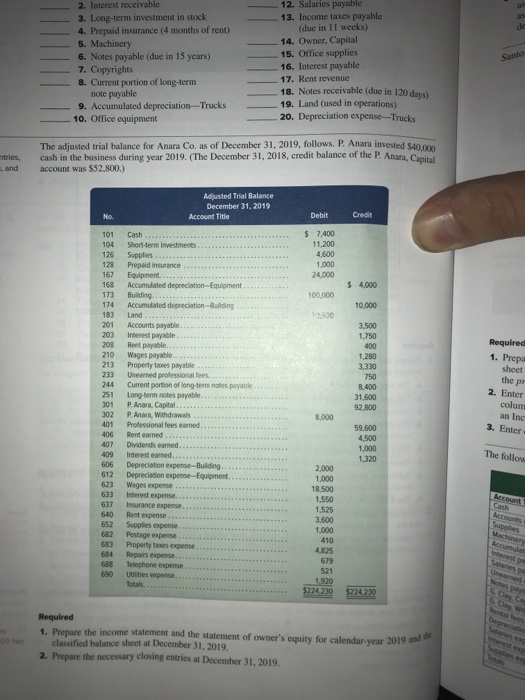

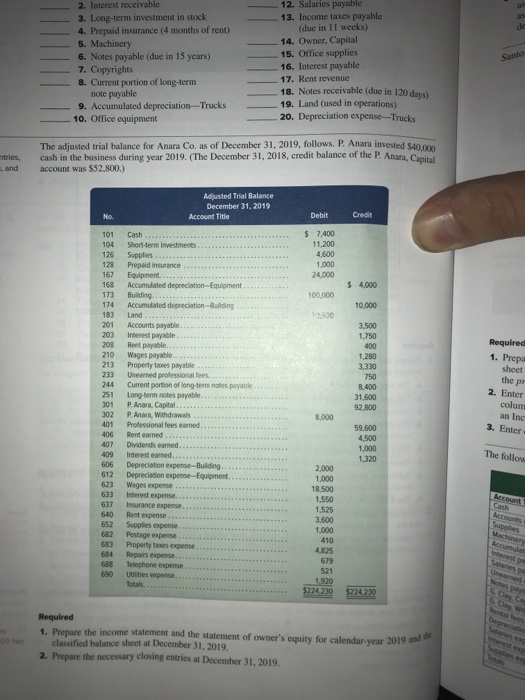

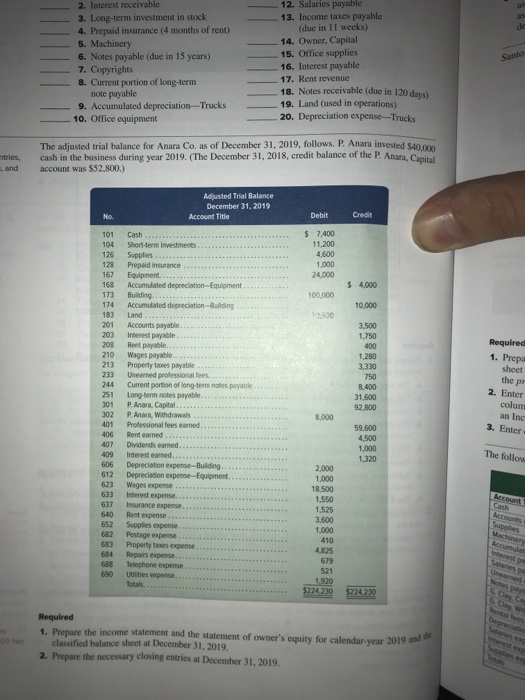

de Santo 2. Interest receivable 3. Long-term investment in stock 4. Prepaid insurance (4 months of rent) 5. Machinery 6. Notes payable (due in 15 years) 7. Copyrights 8. Current portion of long-term note payable 9. Accumulated depreciation Trucks 10. Office equipment 12. Salaries payable 13. Income taxes payable (due in 11 weeks) 14. Owner, Capital 15. Office supplies 16. Interest payable 17. Rent revenue 18. Notes receivable (due in 120 days) 19. Land (used in operations) 20. Depreciation expense --Trucks ntries, The adjusted trial balance for Anara Co, as of December 31, 2019, follows. P. Anara invested $40,000 cash in the business during year 2019. (The December 31, 2018, credit balance of the P. Anara, Capital account was $52.800.) and Adjusted Trial Balance December 31, 2019 Account Title No Debit Credit Cash $ 7,400 11,200 4600 1.000 24,000 $ 4,000 100,000 10,000 S500 3.500 1,750 400 1.280 3.330 750 8,400 31.600 92,800 Required 1. Prepa sheet 101 104 126 128 167 168 173 174 183 201 203 200 210 213 233 244 251 301 302 401 406 407 409 606 612 623 633 637 640 652 682 683 684 the pr Short-term investments Supplies ... Prepaid insurance Equipment Accumulated depreciation Equipment Building..... Accumulated depreciation-Balling Land. Accounts payable Interest payable Rent payable Wages payable Property to payable Unearned professional fees. Current portion of long-term nobes paya Long-term notes payable. P. Anara, Capital P. Anar Withdrawals Professional fees earned. Renteamed Dividends eamed. Interest earned Depreciation expense-Building Depreciation expense-Equipment. Wages expense Interest expense Insurance expense Rent expense Supplies expense Postage expense Property taxes expense Repairs expense. Telephone expense Utilities expense Totals 2. Enter colum an Inc 3. Enter 8,000 59,600 4,500 1,000 1,320 The follow 2,000 1,000 18,500 1.550 1.525 3,600 1.000 410 4.825 679 521 1.920 $224.230 Account Cash Accounts Supplies Machinery need $224 219 6. Clay.co Required 1. Prepare the income statement and the statement of owner's equity for calendar.year 2019 and or classified balance sheet at December 31, 2019, 2. Prepare the necessary closing entries at December 31, 2019