Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help needed I. Garza and Neely CPAs, are preparing their service revenue (sales) budget for the coming year (2014). The practice is divided into the

Help needed

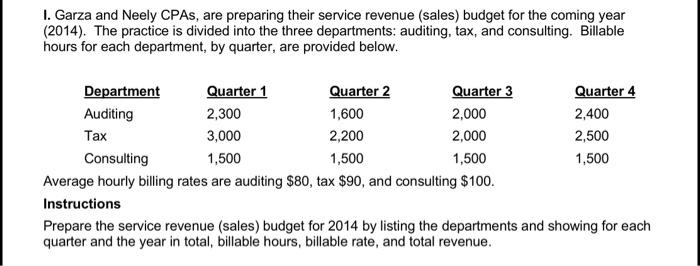

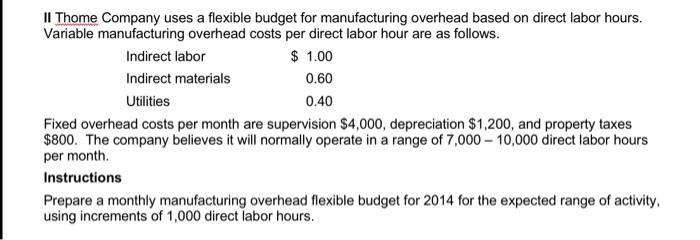

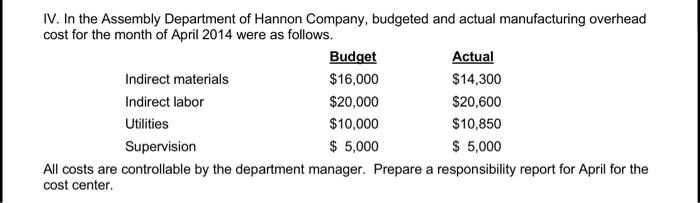

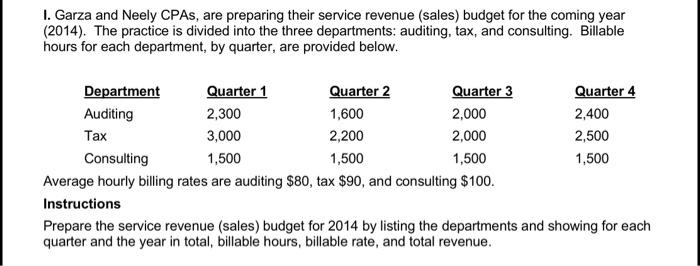

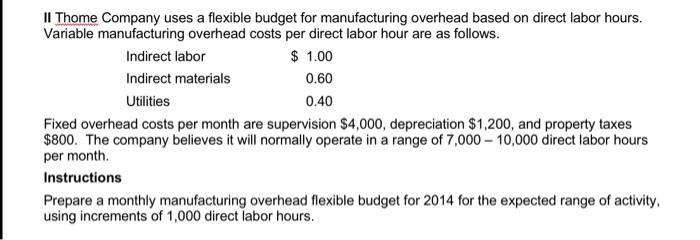

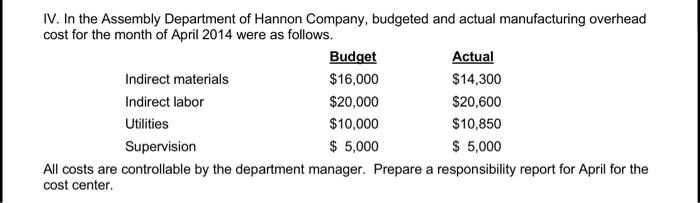

I. Garza and Neely CPAs, are preparing their service revenue (sales) budget for the coming year (2014). The practice is divided into the three departments: auditing, tax, and consulting. Billable hours for each department, by quarter, are provided below. Average hourly billing rates are auditing $80, tax $90, and consulting $100. Instructions Prepare the service revenue (sales) budget for 2014 by listing the departments and showing for each quarter and the year in total, billable hours, billable rate, and total revenue. II Thome Company uses a flexible budget for manufacturing overhead based on direct labor hours. Variable manufacturing overhead costs per direct labor hour are as follows. Fixed overhead costs per month are supervision $4,000, depreciation $1,200, and property taxes $800. The company believes it will normally operate in a range of 7,00010,000 direct labor hours per month. Instructions Prepare a monthly manufacturing overhead flexible budget for 2014 for the expected range of activity, using increments of 1,000 direct labor hours. IV. In the Assembly Department of Hannon Company, budgeted and actual manufacturing overhead cost for the month of April 2014 were as follows. All costs are controllable by the department manager. Prepare a responsibility report for April for the cost center

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started