Answered step by step

Verified Expert Solution

Question

1 Approved Answer

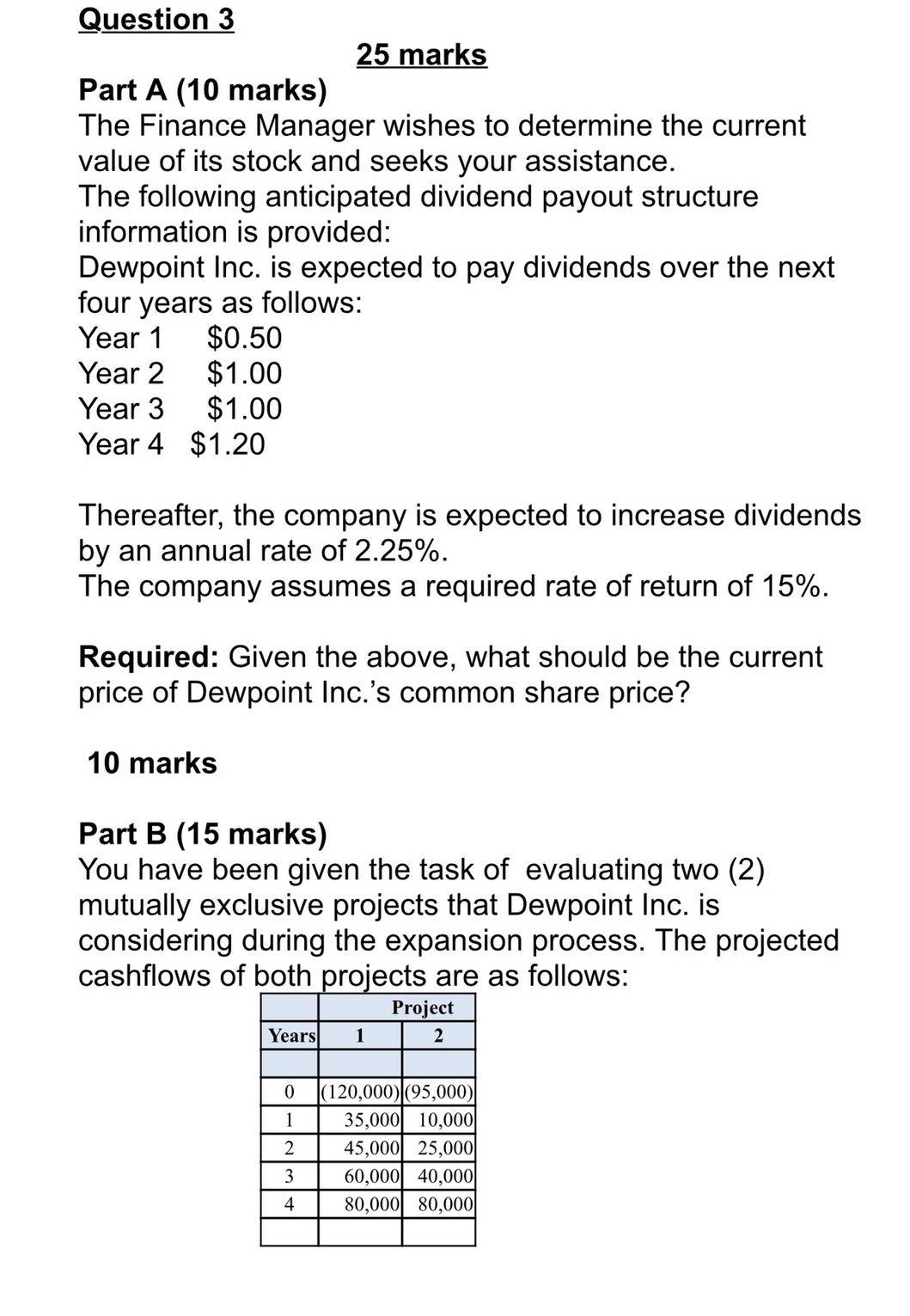

Help Needed please need it in excel format thank you Part A (10 marks) 25marks The Finance Manager wishes to determine the current value of

Help Needed please need it in excel format thank you

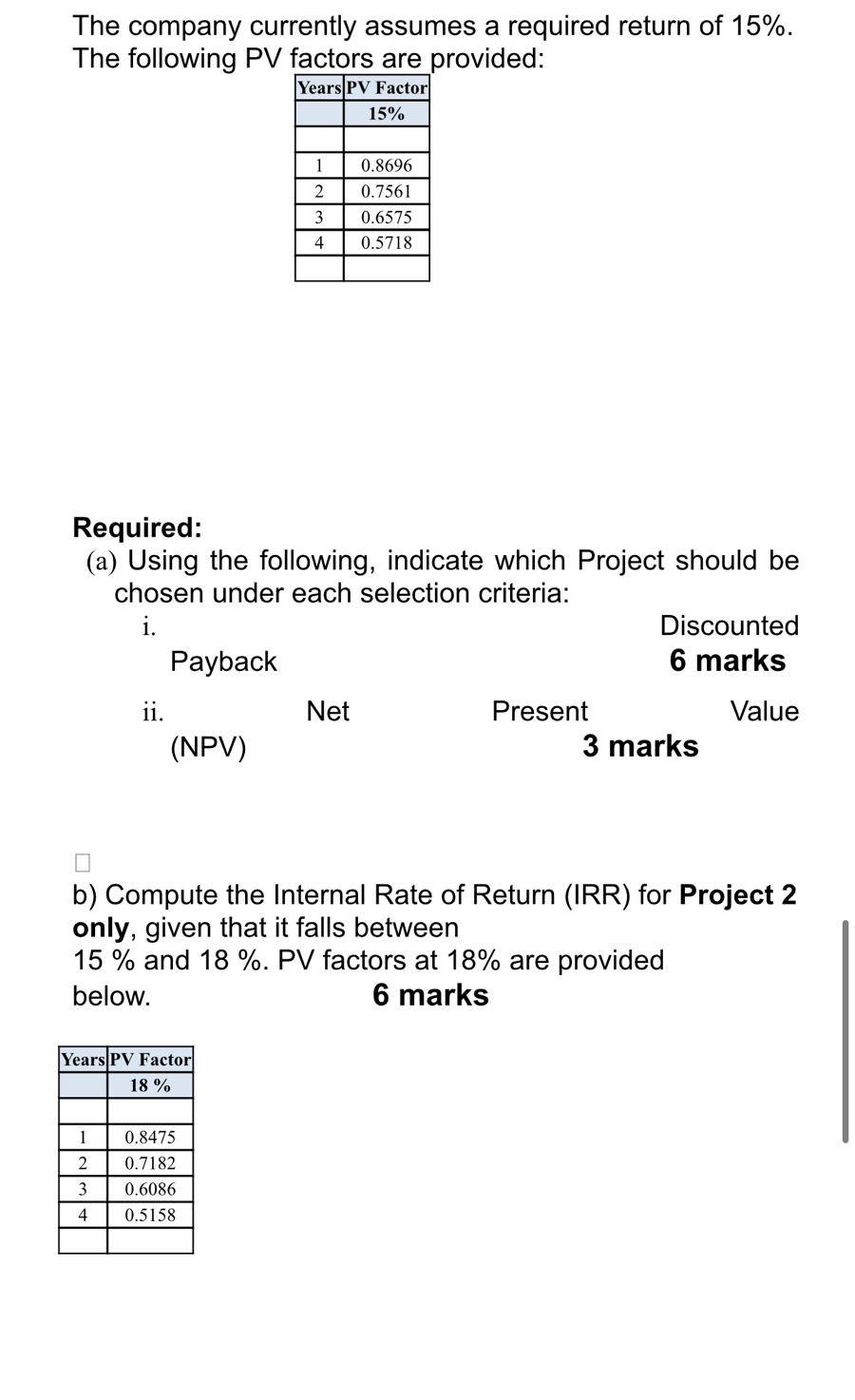

Part A (10 marks) 25marks The Finance Manager wishes to determine the current value of its stock and seeks your assistance. The following anticipated dividend payout structure information is provided: Dewpoint Inc. is expected to pay dividends over the next four years as follows: Thereafter, the company is expected to increase dividends by an annual rate of 2.25%. The company assumes a required rate of return of 15%. Required: Given the above, what should be the current price of Dewpoint Inc.'s common share price? 10 marks Part B (15 marks) You have been given the task of evaluating two (2) mutually exclusive projects that Dewpoint Inc. is considering during the expansion process. The projected cashflows of both proiects are as follows: The company currently assumes a required return of 15%. The following PV factors are provided: Required: (a) Using the following, indicate which Project should be chosen under each selection criteria: i. Payback ii. (NPV) Net Discounted 6 marks Present Value b) Compute the Internal Rate of Return (IRR) for Project 2 only, given that it falls between 15% and 18%. PV factors at 18% are provided below. 6 marksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started