Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help Needed please need it in excel format the table above is not part of question 4 and 5 it was uploaded by mistake Part

Help Needed please need it in excel format

the table above is not part of question 4 and 5 it was uploaded by mistake

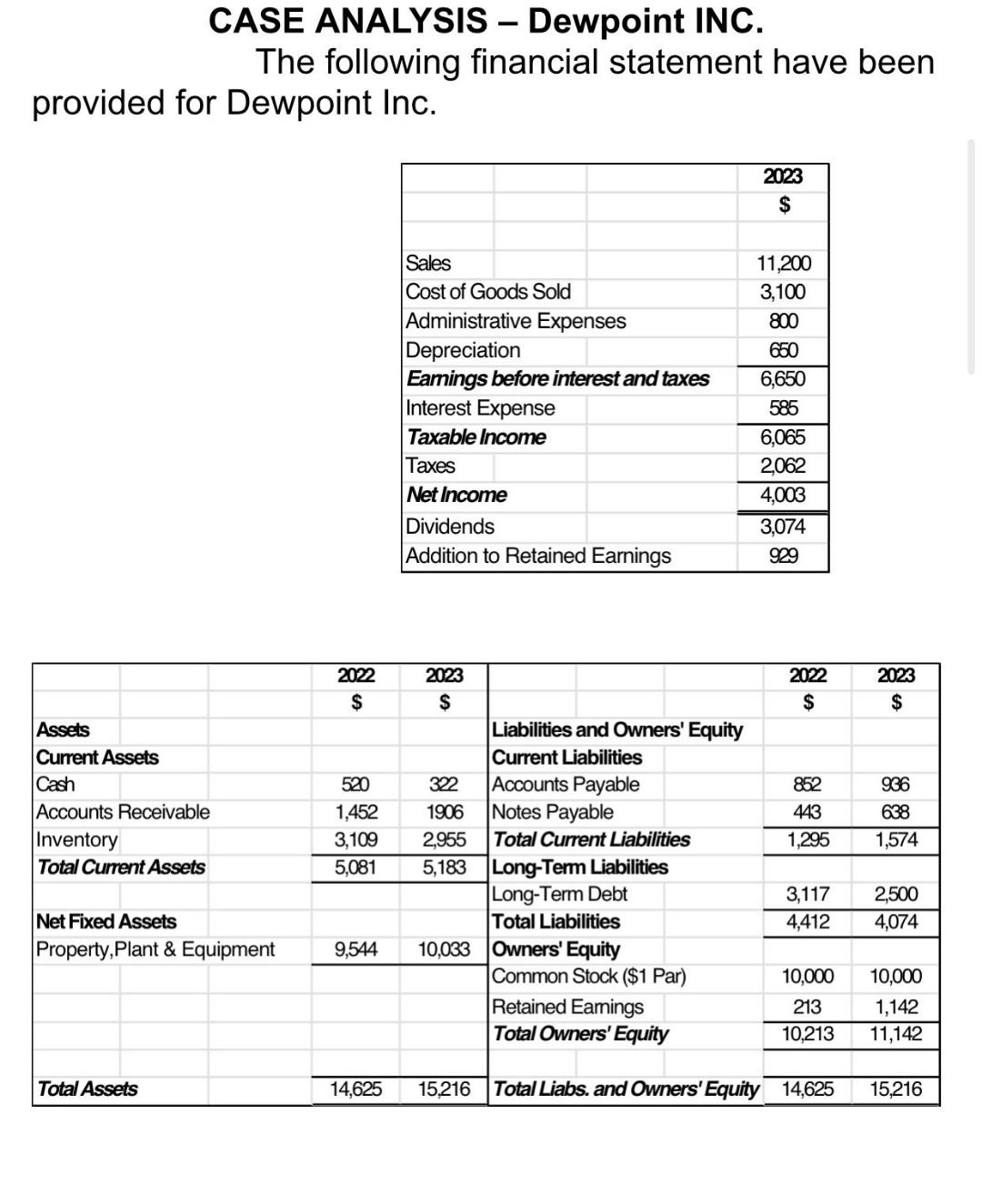

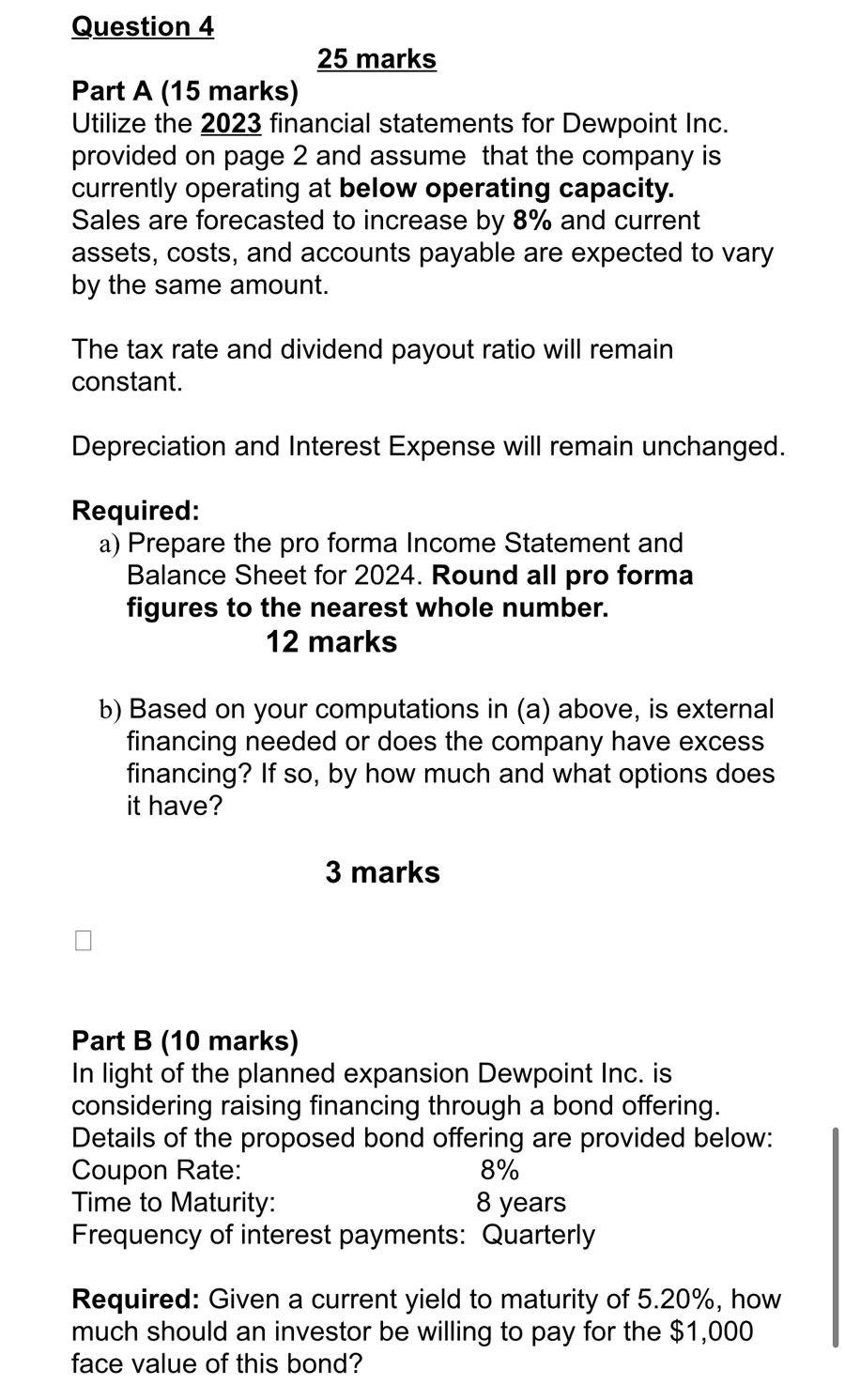

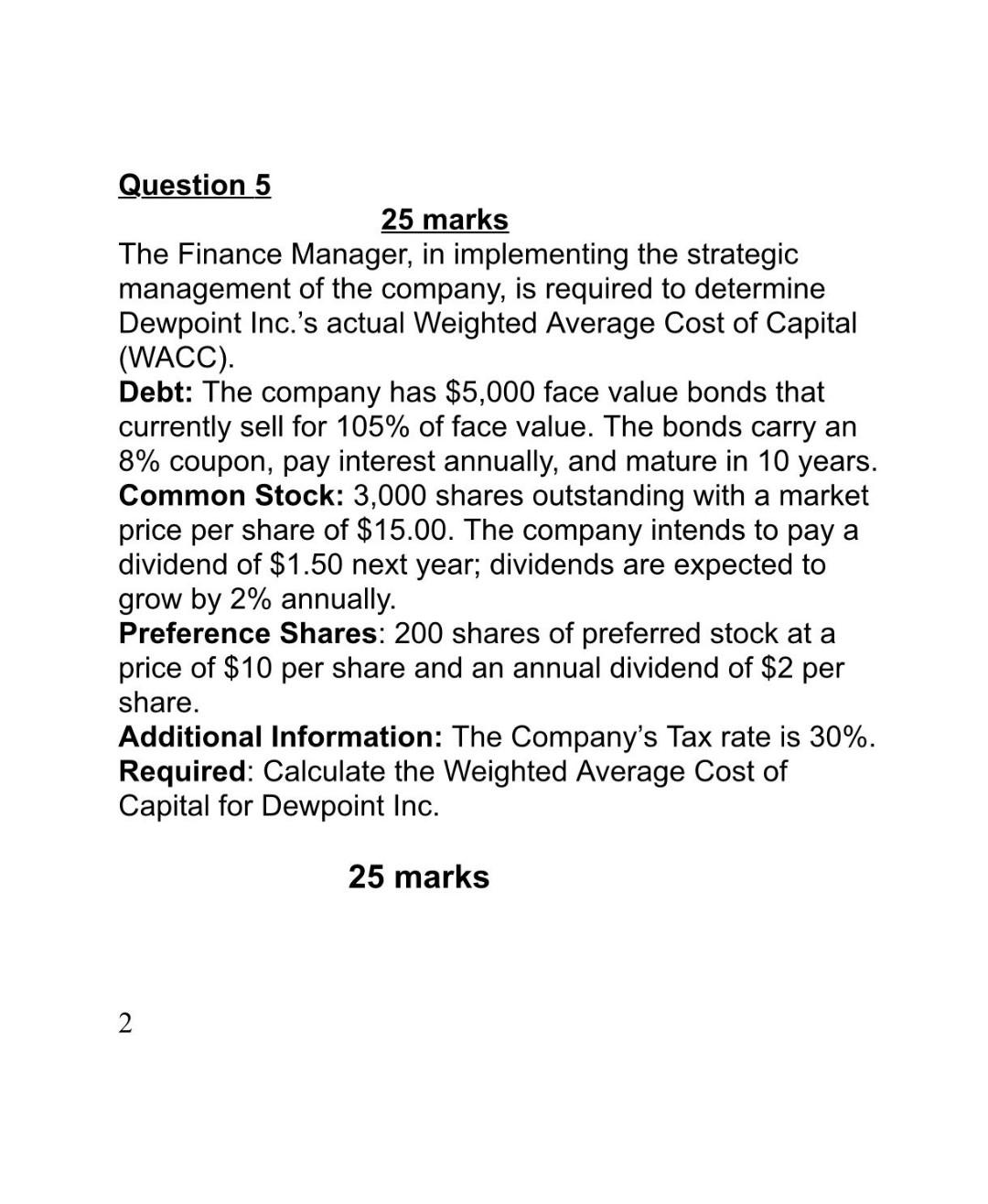

Part A (15 marks) 25 marks Utilize the 2023 financial statements for Dewpoint Inc. provided on page 2 and assume that the company is currently operating at below operating capacity. Sales are forecasted to increase by 8% and current assets, costs, and accounts payable are expected to vary by the same amount. The tax rate and dividend payout ratio will remain constant. Depreciation and Interest Expense will remain unchanged. Required: a) Prepare the pro forma Income Statement and Balance Sheet for 2024. Round all pro forma figures to the nearest whole number. 12 marks b) Based on your computations in (a) above, is external financing needed or does the company have excess financing? If so, by how much and what options does it have? 3 marks Part B (10 marks) In light of the planned expansion Dewpoint Inc. is considering raising financing through a bond offering. Details of the proposed bond offering are provided below: Coupon Rate: 8% Time to Maturity: 8 years Frequency of interest payments: Quarterly Required: Given a current yield to maturity of 5.20%, how much should an investor be willing to pay for the $1,000 face value of this bond? 25 marks The Finance Manager, in implementing the strategic management of the company, is required to determine Dewpoint Inc.'s actual Weighted Average Cost of Capital (WACC). Debt: The company has $5,000 face value bonds that currently sell for 105% of face value. The bonds carry an 8% coupon, pay interest annually, and mature in 10 years. Common Stock: 3,000 shares outstanding with a market price per share of $15.00. The company intends to pay a dividend of $1.50 next year; dividends are expected to grow by 2% annually. Preference Shares: 200 shares of preferred stock at a price of $10 per share and an annual dividend of $2 per share. Additional Information: The Company's Tax rate is 30\%. Required: Calculate the Weighted Average Cost of Capital for Dewpoint IncStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started