Integrative Pro forma statements Provincial Imports, Inc., has assembled last year's financial statements (income statement and balance sheet coming year. Information related to financial

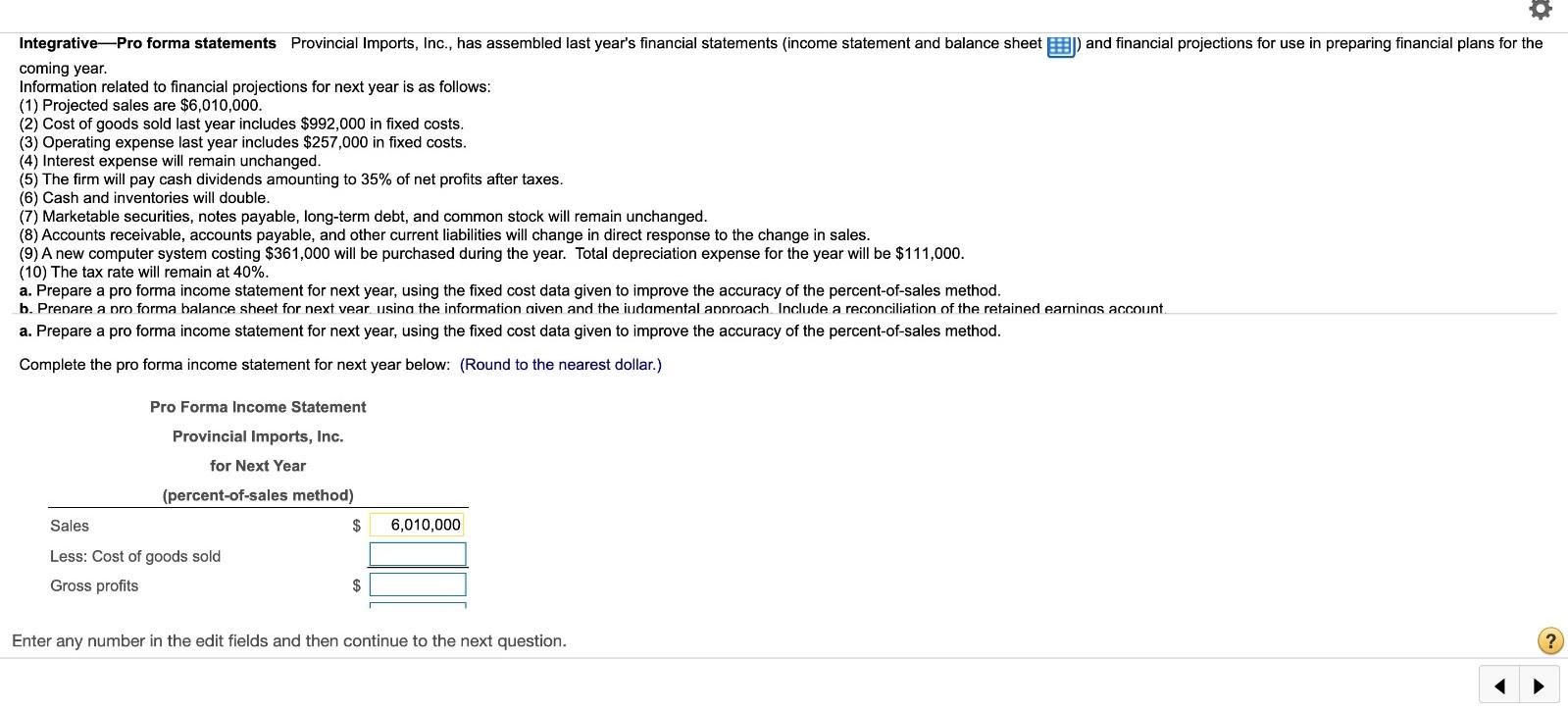

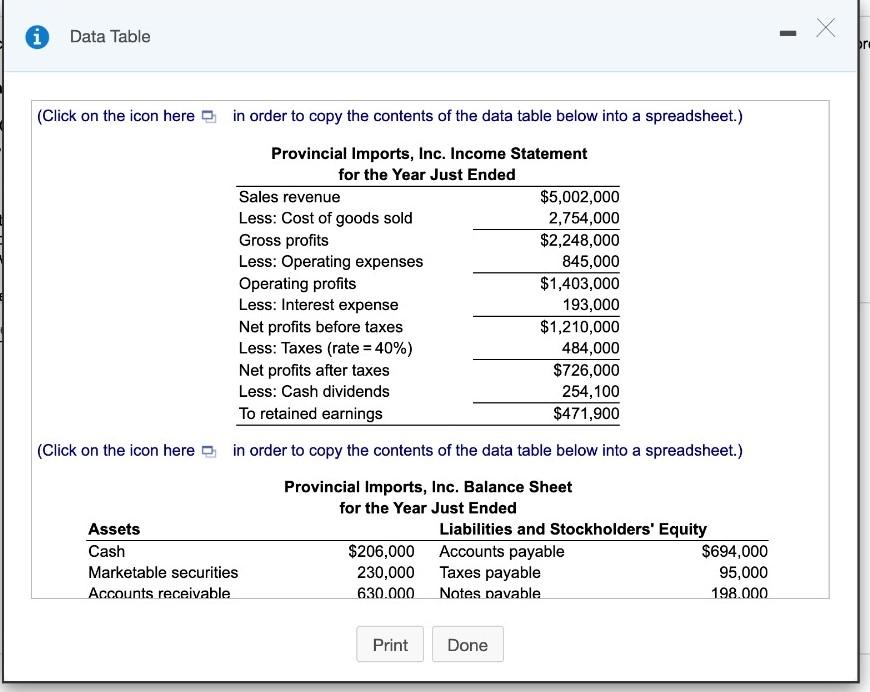

Integrative Pro forma statements Provincial Imports, Inc., has assembled last year's financial statements (income statement and balance sheet coming year. Information related to financial projections for next year is as follows: (1) Projected sales are $6,010,000. (2) Cost of goods sold last year includes $992,000 in fixed costs. (3) Operating expense last year includes $257,000 in fixed costs. (4) Interest expense will remain unchanged. (5) The firm will pay cash dividends amounting to 35% of net profits after taxes. (6) Cash and inventories will double. (7) Marketable securities, notes payable, long-term debt, and common stock will remain unchanged. (8) Accounts receivable, accounts payable, and other current liabilities will change in direct response to the change in sales. (9) A new computer system costing $361,000 will be purchased during the year. Total depreciation expense for the year will be $111,000. (10) The tax rate will remain at 40%. a. Prepare a pro forma income statement for next year, using the fixed cost data given to improve the accuracy of the percent-of-sales method. and financial projections for use in preparing financial plans for the b. Prepare a pro forma balance sheet for next year using the information given and the iudamental approach Include a reconciliation of the retained earnings account. a. Prepare a pro forma income statement for next year, using the fixed cost data given to improve the accuracy of the percent-of-sales method. Complete the pro forma income statement for next year below: (Round to the nearest dollar.) Pro Forma Income Statement Provincial Imports, Inc. for Next Year (percent-of-sales method) Sales Less: Cost of goods sold Gross profits $ 6,010,000 Enter any number in the edit fields and then continue to the next question. ? i Data Table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Provincial Imports, Inc. Income Statement for the Year Just Ended Sales revenue $5,002,000 Less: Cost of goods sold 2,754,000 Gross profits $2,248,000 Less: Operating expenses 845,000 Operating profits $1,403,000 Less: Interest expense 193,000 Net profits before taxes Less: Taxes (rate = 40%) Net profits after taxes Less: Cash dividends $1,210,000 484,000 $726,000 254,100 To retained earnings $471,900 (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Assets Cash Marketable securities Accounts receivable Provincial Imports, Inc. Balance Sheet Liabilities and Stockholders' Equity Accounts payable for the Year Just Ended $206,000 230,000 Taxes payable 630.000 Notes Davable $694,000 95,000 198.000 Print Done -

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the pro forma income statement we need to follow these steps 1 Calculate the projected Cost of Goods Sold COGS Separate fixed and variable costs from the last years COGS Use the projected s... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards