Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help needed to write a simple c++ program with no compile or warning errors. Please make program as simple as possible thanks. Description: You have

Help needed to write a simple c++ program with no compile or warning errors. Please make program as simple as possible thanks.

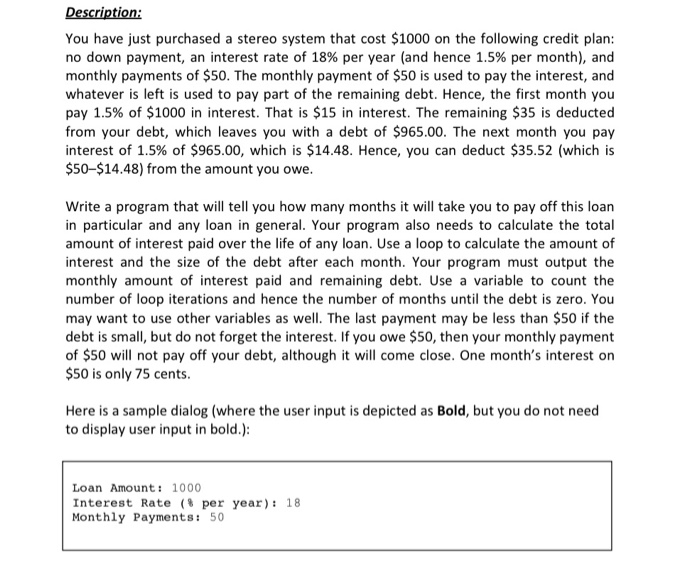

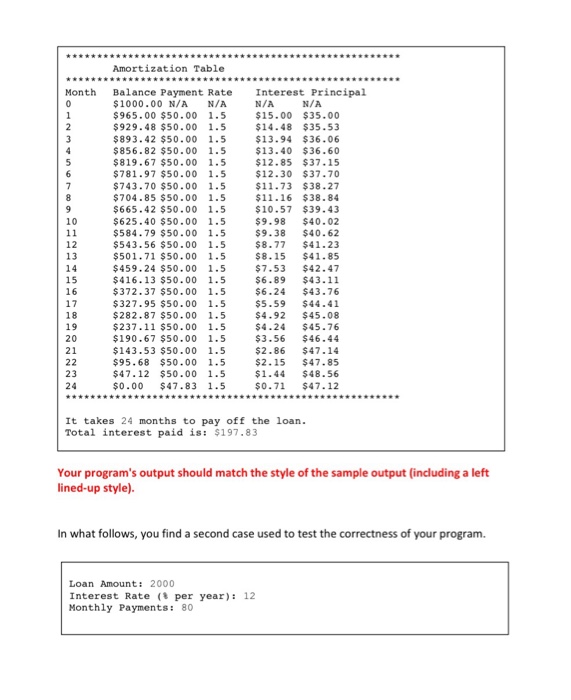

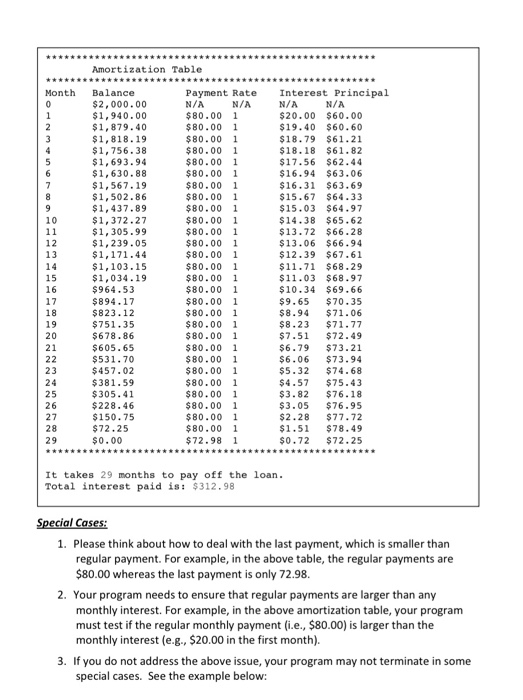

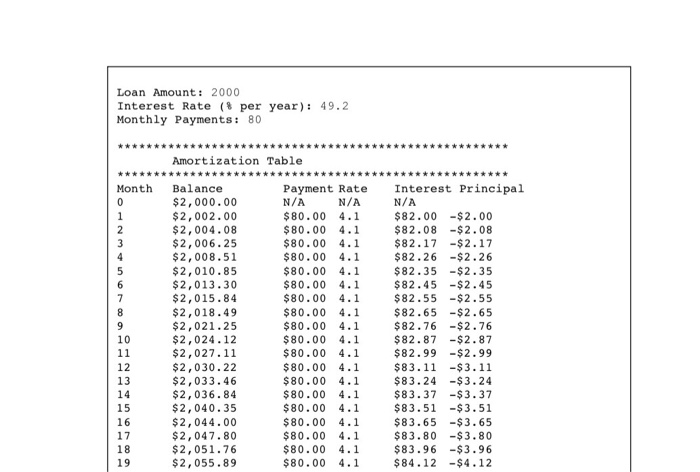

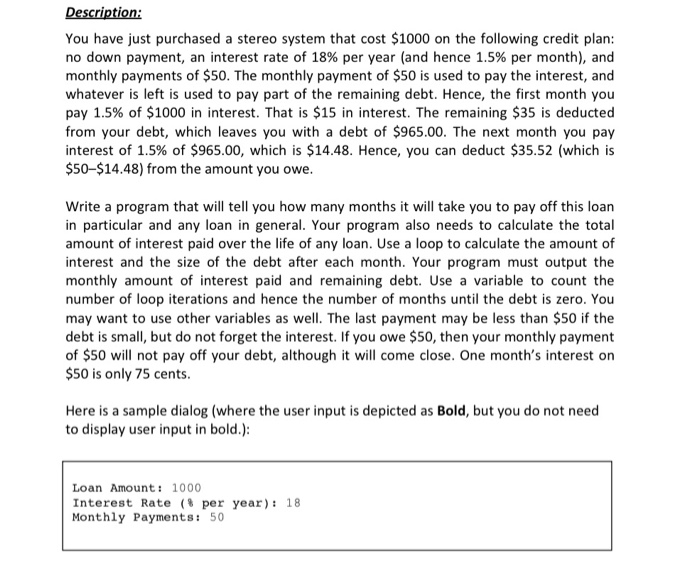

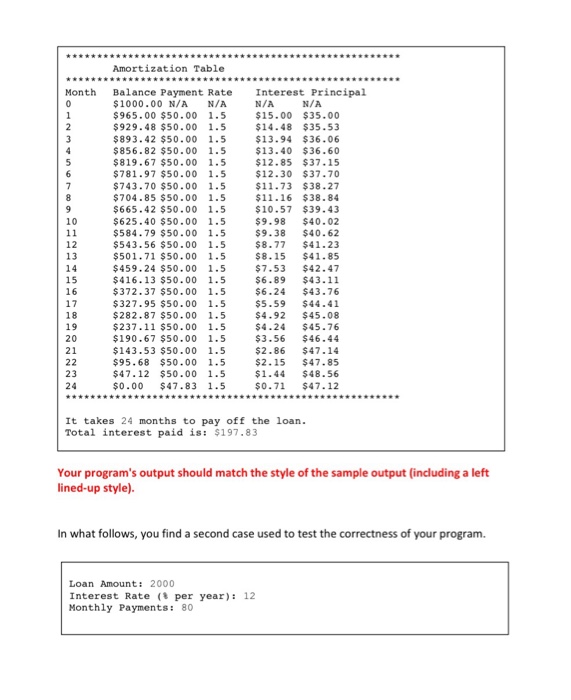

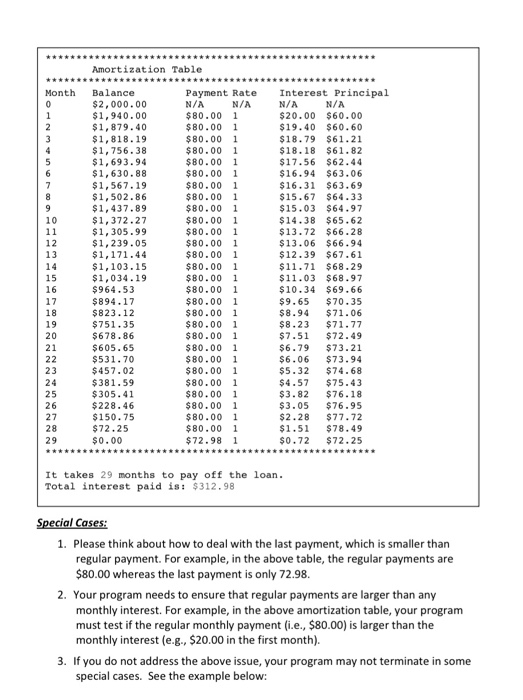

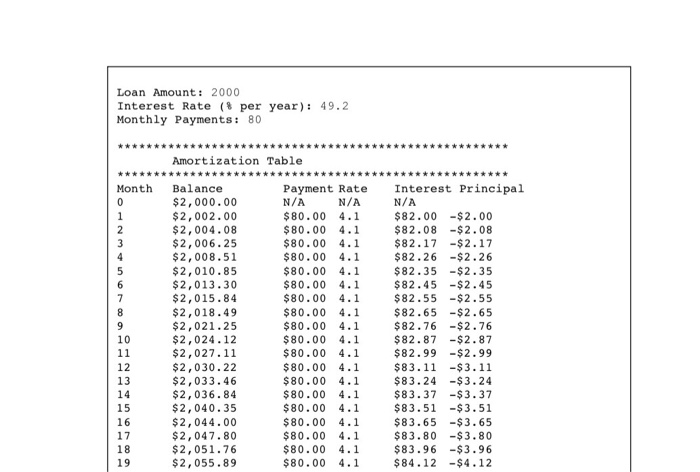

Description: You have just purchased a stereo system that cost $1000 on the following credit plan: no down payment, an interest rate of 18% per year (and hence 1.5% per month), and monthly payments of $50. The monthly payment of $50 is used to pay the interest, and whatever is left is used to pay part of the remaining debt. Hence, the first month you pay 1.5% of $1000 in interest. That is $15 in interest. The remaining $35 is deducted from your debt, which leaves you with a debt of $965.00. The next month you pay interest of 1.5% of $965.00, which is $14.48. Hence, you can deduct $35.52 (which is $50-$14.48) from the amount you owe. Write a program that will tell you how many months it will take you to pay off this loan in particular and any loan in general. Your program also needs to calculate the total amount of interest paid over the life of any loan. Use a loop to calculate the amount of interest and the size of the debt after each month. Your program must output the monthly amount of interest paid and remaining debt. Use a variable to count the number of loop iterations and hence the number of months until the debt is zero. You may want to use other variables as well. The last payment may be less than $50 if the debt is small, but do not forget the interest. If you owe $50, then your monthly payment of $50 will not pay off your debt, although it will come close. One month's interest on $50 is only 75 cents. Here is a sample dialog (where the user input is depicted as Bold, but you do not need to display user input in bold.): Loan Amount: 1000 Interest Rate (% per year): 18 Monthly Payments: 50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started