Answered step by step

Verified Expert Solution

Question

1 Approved Answer

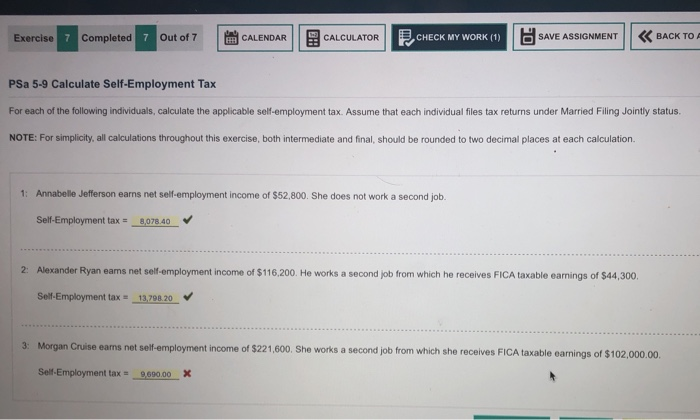

help on 3 i got 9,700 but it says its wrong and then i tried 9,690 and its wrong as well please help ! Exercise

help on 3

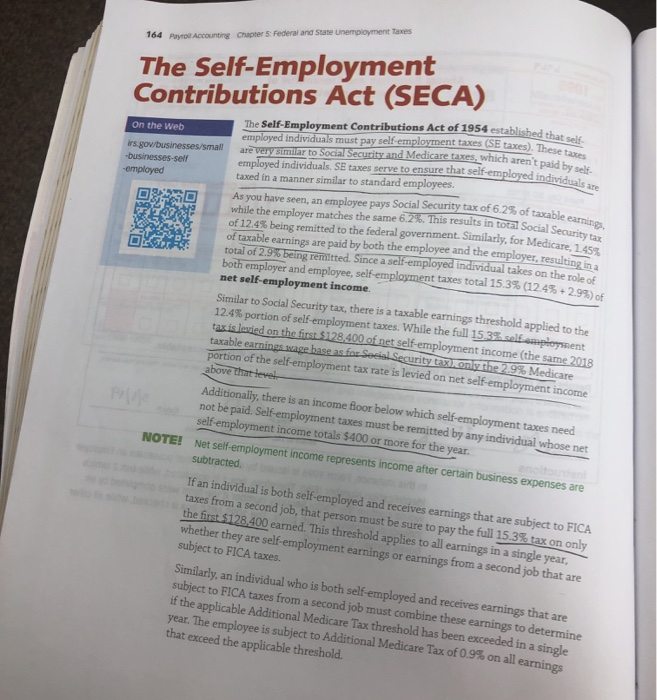

Exercise 7 Completed 7 bCALCULATOR SAVE ASSIGNMENT Out of 7 BACK TO A CALENDAR ,CHECK MY WORK (1) PSa 5-9 Calculate Self-Employment Tax For each of the following individuals, calculate the applicable self-employment tax. Assume that each individual files tax returns under Married Filing Jointly status. NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. 1: Annabelle Jefferson earns net self-employment income of $52,800. She does not work a second job. Self-Employment tax 8,078.40 2: Alexander Ryan eams net self-employment income of $116,200. He works a second job from which he receives FICA taxable earnings of $44,300. Self-Employment tax 13,798.20 3: Morgan Cruise eams net self-employment income of $221,600. She works a second job from which she receives FICA taxable earnings of $102,000.00. Self-Employment tax 9,690.00 Chapter 5: Federal and State Unempioyment Taxes The Self-Employment Contributions Act (SECA) 164 Payroll Accounting The Self-Employment Contributions Act of 1954 established that sel employed individuals must pay self-employment taxes (SE taxes). These taxes are very similar to Social Security and Medicare taxes, which aren't paid by self- employed individuals. SE taxes serve to ensure that self-employed individuals are On the Web irs gov/businesses/small -businesses-self -employed taxed in a manner similar to standard employees. employee pays Social Security tax of 6.2 % of taxable earnings As you have seen, an while the employer matches the same 6.2%. This results in total Social Security tax of 12.4% being remitted to the federal government. Similarly, for Medicare, 1.45% of taxable earnings are paid by both the employee and the employer, resulting in a total of 2.9% being remitted. Since a self-employed individual takes on the role of both employer and employee, self-employment net self-employment income. taxes total 15.3 % ( 12.4 % + 2.9%) of Similar to Social Security tax, there is a taxable earnings threshold applied to the 12.4% portion of self-employment taxes. While the full 15.3% self emplonnent tax is levied on the first $128,400 of net self-employment income (the same 2018 taxable earninas wage base as for Seeial Security tax only the 2.9% Medicare portion of the self-employment above that level tax rate is levied on net self-employment income Additionally, there is an income loor below which self-employment taxes need not be paid. Self-employment self-employment income totals $400 or more for the year. taxes must be remitted by any individual whose net anoltounn NOTE! Net self-employment income represents income after certain business expenses are subtracted. If an individual is both self-employed and receives earnings that are taxes from a second job, that person must be sure to the first $128,400 earned. This threshold applies whether they are self-employment earnings or earnings from a second job that are subject to FICA taxes. subject to FICA pay the full 15.3% tax on to all earnings in a only single year, Similarly subject to FICA taxes froma second job must combine these earnings to determine if the applicable Additional Medicare Tax threshold has been exceeded in a single year. The employee is subject to Additional Medicare Tax of 0.9% on all earnings that exceed the applicable threshold an individual who is both self-employed and receives earnings that are i got 9,700 but it says its wrong and then i tried 9,690 and its wrong as well please help !

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started