Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help on ALL Parts please ? Please provide your work, very deatiled, to better my understanding! Beadle Consulting Services, a firm started several years ago,

Help on ALL Parts please ? Please provide your work, very deatiled, to better my understanding!

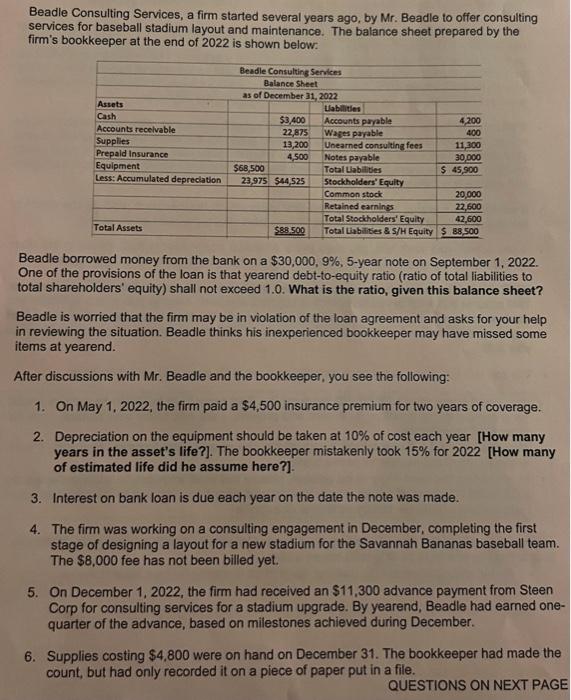

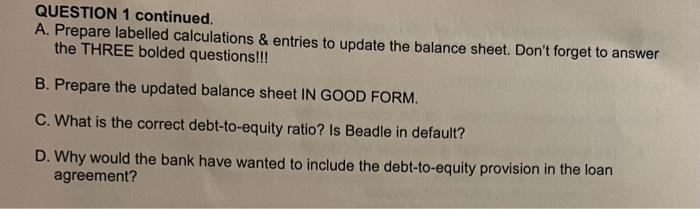

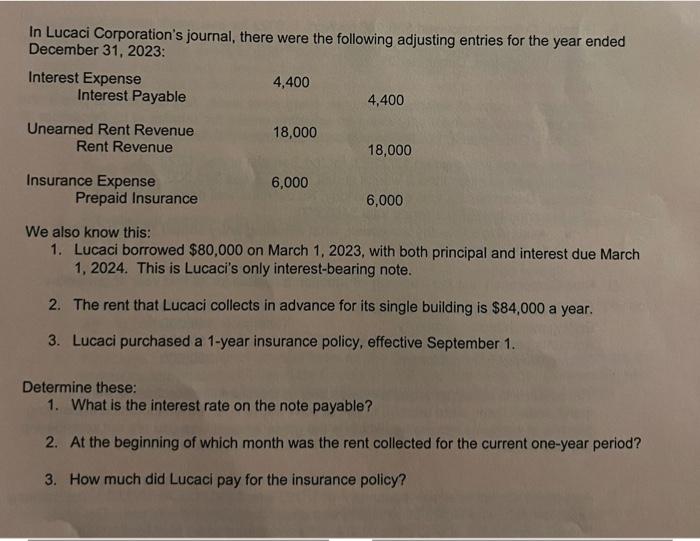

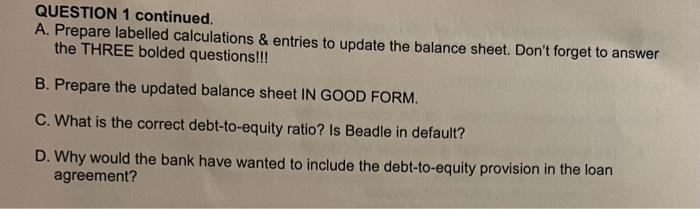

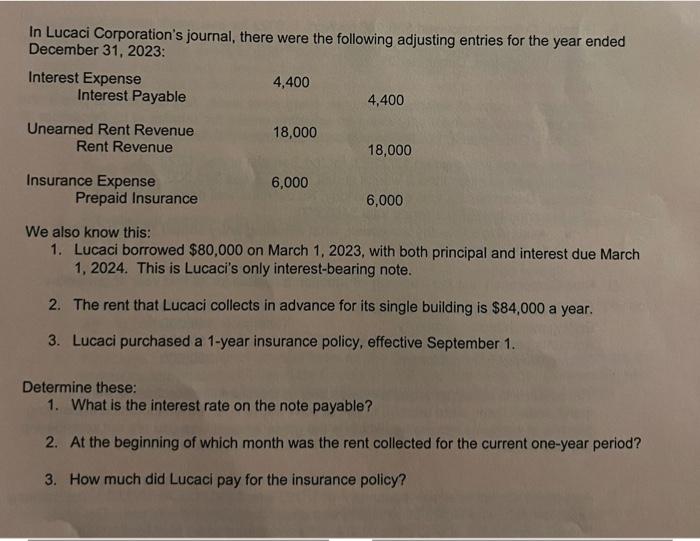

Beadle Consulting Services, a firm started several years ago, by Mr. Beadle to offer consulting services for baseball stadium layout and maintenance. The balance sheet prepared by the firm's bookkeeper at the end of 2022 is shown below: Beadle borrowed money from the bank on a $30,000,9%,5-year note on September 1, 2022. One of the provisions of the loan is that yearend debt-to-equity ratio (ratio of total liabilities to total shareholders' equity) shall not exceed 1.0. What is the ratio, given this balance sheet? Beadle is worried that the firm may be in violation of the loan agreement and asks for your help in reviewing the situation. Beadle thinks his inexperienced bookkeeper may have missed some items at yearend. After discussions with Mr. Beadle and the bookkeeper, you see the following: 1. On May 1,2022 , the firm paid a $4,500 insurance premium for two years of coverage. 2. Depreciation on the equipment should be taken at 10% of cost each year. [How many years in the asset's life?]. The bookkeeper mistakenly took 15% for 2022 [How many of estimated life did he assume here?]. 3. Interest on bank loan is due each year on the date the note was made. 4. The firm was working on a consulting engagement in December, completing the first stage of designing a layout for a new stadium for the Savannah Bananas baseball team. The $8,000 fee has not been billed yet. 5. On December 1,2022 , the firm had received an $11,300 advance payment from Steen Corp for consulting services for a stadium upgrade. By yearend, Beadle had earned onequarter of the advance, based on milestones achieved during December. 6. Supplies costing $4,800 were on hand on December 31 . The bookkeeper had made the count, but had only recorded it on a piece of paper put in a file. QUESTIONS ON NEXT PAGE QUESTION 1 continued. A. Prepare labelled calculations \& entries to update the balance sheet. Don't forget to answer the THREE bolded questions!!! B. Prepare the updated balance sheet IN GOOD FORM. C. What is the correct debt-to-equity ratio? Is Beadle in default? D. Why would the bank have wanted to include the debt-to-equity provision in the loan agreement? In Lucaci Corporation's journal, there were the following adjusting entries for the year ended December 31, 2023: We also know this: 1. Lucaci borrowed $80,000 on March 1, 2023, with both principal and interest due March 1,2024 . This is Lucaci's only interest-bearing note. 2. The rent that Lucaci collects in advance for its single building is $84,000 a year. 3. Lucaci purchased a 1-year insurance policy, effective September 1. Determine these: 1. What is the interest rate on the note payable? 2. At the beginning of which month was the rent collected for the current one-year period? 3. How much did Lucaci pay for the insurance policy

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started