help on all three please!

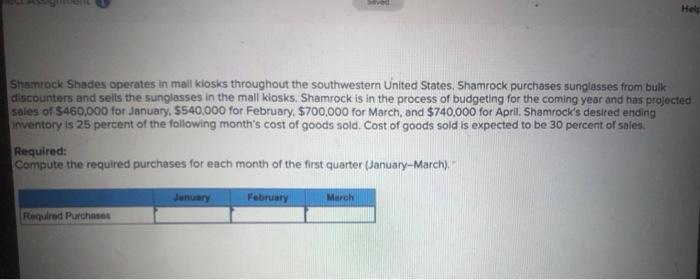

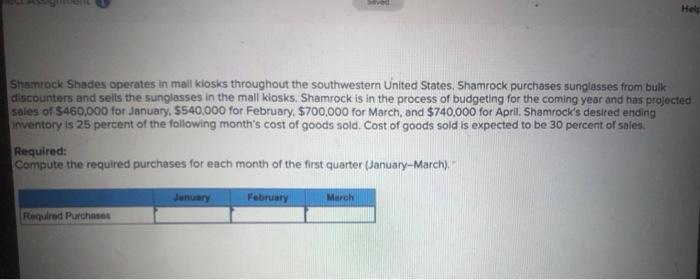

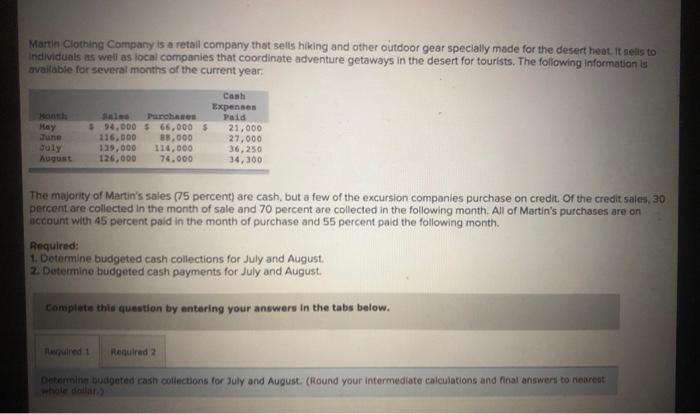

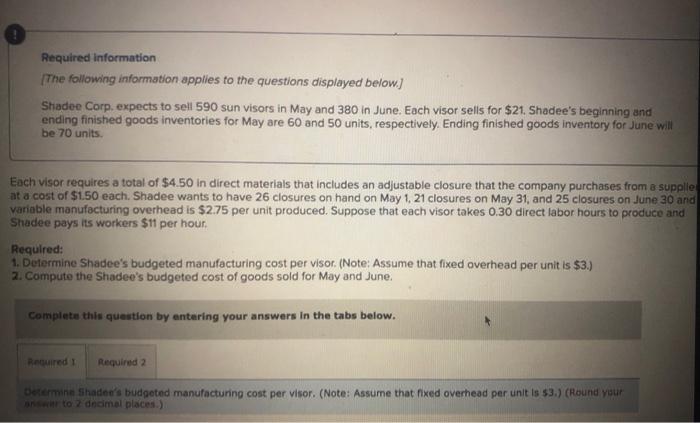

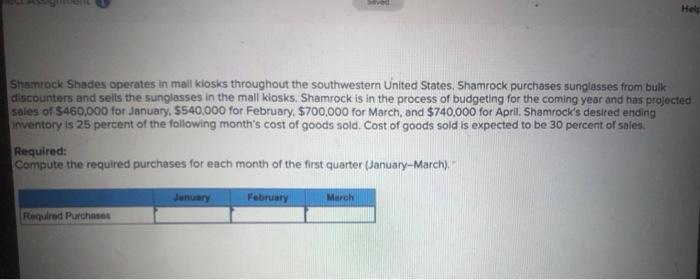

Hele Shamrock Shades operates in mall kiosks throughout the southwestern United States, Shamrock purchases sunglasses from bulk discounters and sells the sunglasses in the mall kiosks. Shamrock is in the process of budgeting for the coming year and has projected sales of $460,000 for January, S540,000 for February $700.000 for March, and $740,000 for April. Shamrock's desired ending Inventory is 25 percent of the following month's cost of goods sold. Cost of goods sold is expected to be 30 percent of sales. Required: Compute the required purchases for each month of the first quarter (January-March: January February March Required Purchases Martin Clothing Company is a retail company that sells hiking and other outdoor gear specially made for the desert heat. It sells to Individuals as well as local companies that coordinate adventure getaways in the desert for tourists. The following Information is available for several months of the current year, Hay Cash Expenses Purchase Paid $ 94,000 $ 66,000 $ 21,000 116,000 88.000 27,000 139,000 114,000 36,250 126,000 74.000 34,300 July August The majority of Martin's sales (75 percent) are cash, but a few of the excursion companies purchase on credit of the credit sales. 30 percent are collected in the month of sale and 70 percent are collected in the following month. All of Martin's purchases are on account with 45 percent paid in the month of purchase and 55 percent paid the following month. Required: 1. Determine budgeted cash collections for July and August. 2. Determine budgeted cash payments for July and August Complete this question by entering your answers in the tabs below. med 1 Required 2 Determine budgeted cash collections for July and August. (Round your intermediate calculations and final answers to nearest Required information The following information applies to the questions displayed below.) Shadee Corp. expects to sell 590 sun visors in May and 380 in June. Each visor sells for $21. Shadee's beginning and ending finished goods inventories for May are 60 and 50 units, respectively. Ending finished goods inventory for June will be 70 units Each visor requires a total of $4.50 in direct materials that includes an adjustable closure that the company purchases from a supplie at a cost of $1.50 each. Shadee wants to have 26 closures on hand on May 1, 21 closures on May 31, and 25 closures on June 30 and variable manufacturing overhead is $2.75 per unit produced. Suppose that each visor takes 0.36 direct labor hours to produce and Shadee pays its workers $11 per hour. Required: 1. Determine Shadee's budgeted manufacturing cost per visor. (Note: Assume that fixed overhead per unit is $3.) 2. Compute the Shadee's budgeted cost of goods sold for May and June. Complete this question by entering your answers in the tabs below. Required Required 2 Determine Shadee's budgeted manufacturing cost per visor. (Note: Assume that fixed overhead per unit is $3.) (Round your anto 2 decimal places) Hele Shamrock Shades operates in mall kiosks throughout the southwestern United States, Shamrock purchases sunglasses from bulk discounters and sells the sunglasses in the mall kiosks. Shamrock is in the process of budgeting for the coming year and has projected sales of $460,000 for January, S540,000 for February $700.000 for March, and $740,000 for April. Shamrock's desired ending Inventory is 25 percent of the following month's cost of goods sold. Cost of goods sold is expected to be 30 percent of sales. Required: Compute the required purchases for each month of the first quarter (January-March: January February March Required Purchases Martin Clothing Company is a retail company that sells hiking and other outdoor gear specially made for the desert heat. It sells to Individuals as well as local companies that coordinate adventure getaways in the desert for tourists. The following Information is available for several months of the current year, Hay Cash Expenses Purchase Paid $ 94,000 $ 66,000 $ 21,000 116,000 88.000 27,000 139,000 114,000 36,250 126,000 74.000 34,300 July August The majority of Martin's sales (75 percent) are cash, but a few of the excursion companies purchase on credit of the credit sales. 30 percent are collected in the month of sale and 70 percent are collected in the following month. All of Martin's purchases are on account with 45 percent paid in the month of purchase and 55 percent paid the following month. Required: 1. Determine budgeted cash collections for July and August. 2. Determine budgeted cash payments for July and August Complete this question by entering your answers in the tabs below. med 1 Required 2 Determine budgeted cash collections for July and August. (Round your intermediate calculations and final answers to nearest Required information The following information applies to the questions displayed below.) Shadee Corp. expects to sell 590 sun visors in May and 380 in June. Each visor sells for $21. Shadee's beginning and ending finished goods inventories for May are 60 and 50 units, respectively. Ending finished goods inventory for June will be 70 units Each visor requires a total of $4.50 in direct materials that includes an adjustable closure that the company purchases from a supplie at a cost of $1.50 each. Shadee wants to have 26 closures on hand on May 1, 21 closures on May 31, and 25 closures on June 30 and variable manufacturing overhead is $2.75 per unit produced. Suppose that each visor takes 0.36 direct labor hours to produce and Shadee pays its workers $11 per hour. Required: 1. Determine Shadee's budgeted manufacturing cost per visor. (Note: Assume that fixed overhead per unit is $3.) 2. Compute the Shadee's budgeted cost of goods sold for May and June. Complete this question by entering your answers in the tabs below. Required Required 2 Determine Shadee's budgeted manufacturing cost per visor. (Note: Assume that fixed overhead per unit is $3.) (Round your anto 2 decimal places)