Answered step by step

Verified Expert Solution

Question

1 Approved Answer

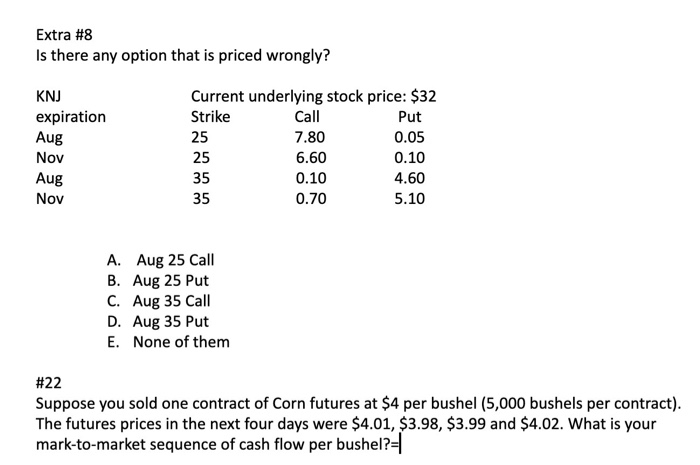

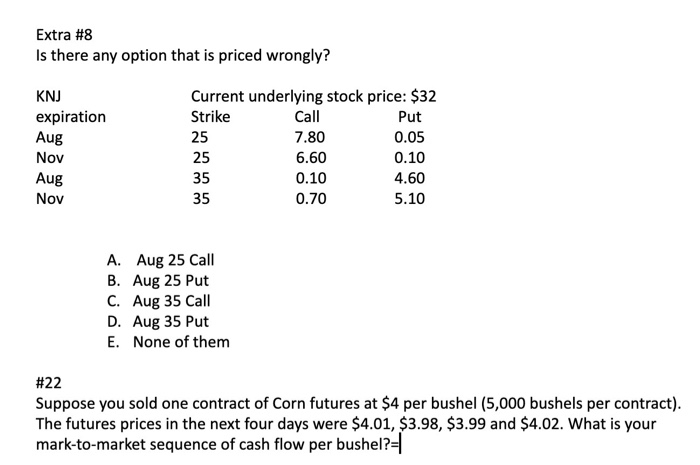

help on both questions plz Extra #8 Is there any option that is priced wrongly? KNJ expiration Aug Nov Aug Nov Current underlying stock price:

help on both questions plz

Extra #8 Is there any option that is priced wrongly? KNJ expiration Aug Nov Aug Nov Current underlying stock price: $32 Strike Call Put 7.80 0.05 6.60 0.10 4.60 0.70 5.10 25 0.10 35 35 A. Aug 25 Call B. Aug 25 Put C. Aug 35 Call D. Aug 35 Put E. None of them #22 Suppose you sold one contract of Corn futures at $4 per bushel (5,000 bushels per contract). The futures prices in the next four days were $4.01, $3.98, $3.99 and $4.02. What is your mark-to-market sequence of cash flow per bushel

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started