Suppose the standard (100) prepayment profile for 10-year (120 month) conventional mortgages is one in which the

Question:

Suppose the standard (100) prepayment profile for 10-year (120 month) conventional mortgages is one in which the CPR starts at zero and increases at a constant rate of .2% per month for 20 months to equal 4% at the 20th month;

then after the 20th month the CPR stays at a constant 4%.

a. Show graphically the 100% prepayment profile.

b. In the same graph, show the prepayment profile for speeds of 200%, 150%, and 50% of the standard.

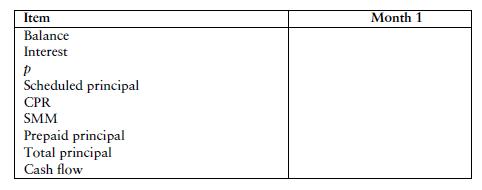

c. In the table below, show the first month’s cash flow for an MBS portfolio of 10-year mortgages with the following features:

Mortgage collateral = $50,000,000

Weighted average coupon rate (WAC) = 9%

Weighted average maturity (WAM) = 120 months

Estimated prepayment speed = 200 PSA

MBS pass-through rate = PT Rate = 8.5%

Step by Step Answer: