Suppose ABC Bank in Question 1 sells mortgage-backed securities backed by its $100 million portfolio of fixed-rate

Question:

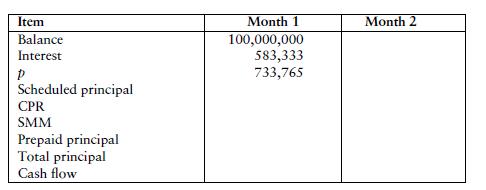

Suppose ABC Bank in Question 1 sells mortgage-backed securities backed by its $100 million portfolio of fixed-rate mortgages with the MBS having the following features:

Mortgage collateral = $100,000,000

Weighted average coupon rate (WAC) = 8%

Weighted average maturity (WAM) = 360 months Estimated prepayment speed = 150 PSA MBS pass-through rate = PT rate = 7%

ABC will service the mortgage portfolio.

a. Show in the table the first two months of cash flows going to the MBS investors.

b. What compensation would ABC receive for servicing the mortgages?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: