Answered step by step

Verified Expert Solution

Question

1 Approved Answer

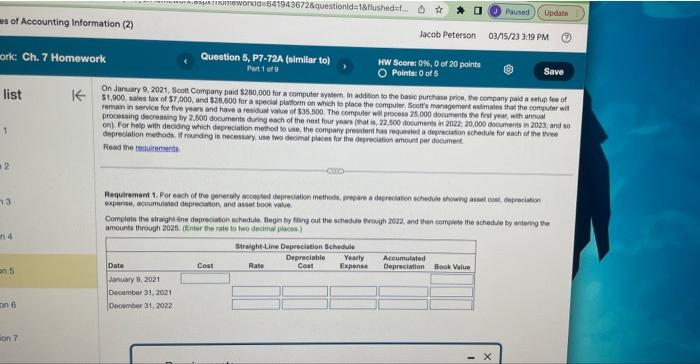

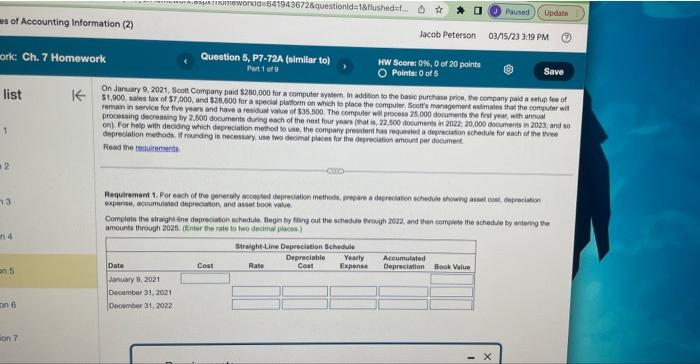

help :) On January 9, 2021. Scott Campany paid $280,000 for a computer syslem. In addion to the basic purchase price, the cempany paid a

help :)

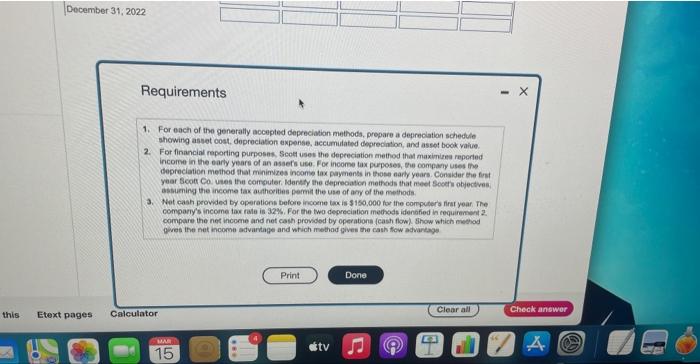

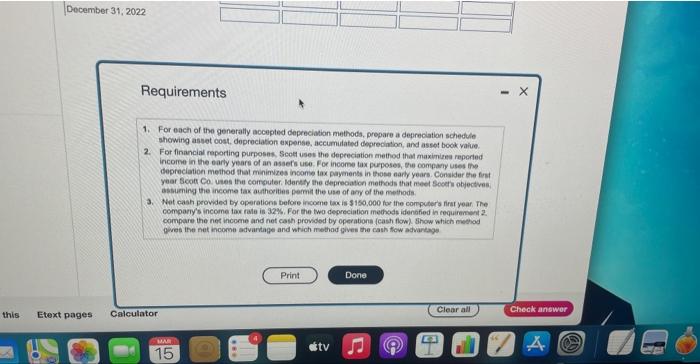

On January 9, 2021. Scott Campany paid $280,000 for a computer syslem. In addion to the basic purchase price, the cempany paid a satup tee of 51,900, saies tax of $7,000, and $28.600 for a special platorm on which to place the compuler. Soorts maragement esdmatis that the computor wat remain in service for five years and have a resibual value of $35, E00. The compuler will process 25 ond documents the fint year, ach aninual processing decreating by 2.500 documents during esch of the neat four years (hat it, 22.500 documerts in 2022: 20,000 documents in 2023 ; and a0 on). For holo with deciang which depreciation method lo use, the compaty president has requested a depreciaton schedule for each of ine thee depreciation methods, If rounding is necessary, use two decimal places for the deppeciabos amound per documene. Read the foaveremints. Requirement 1. For each of the generaly accepted depreciation methess, prepare a depreciaton sobedule ahcuing aset oest, depreciafion expense, acoummianed deprecasion, and assat book value. amounta through 2025 , Einter the rate to teo decimal plactes ) Requirements 1. For each of the generally accepted depreciadion methods, prepare a deprecation schedule showing asset cost, depreciation expense, accumutated degrecintion, and asset book value. 2. For financial reporting purposes, Scot uses the depreciation method that maximiue repered. incorne in the early youre of an assets use. For income tax puposes, the compary uses the depreciation method that minimizes income tax payenents in those early years. Consider the fret year Scot Co. uses the cornouter. Idenety the depreciaten methods that meet Sooen objectives. assuening the income tax authorities permit the use of ary of the methods. 3. Net cash peovided by operations before incoene tax is $180,000 tor the computers firat year. The comparyy's income tax rase is 32%. For the two depreciation medhods ifenofied in requirencet 2. compare the net income and net cash provided by operations (cash flow). Show which meetod pues the net income advartage and which method gives the cash thow advartags On January 9, 2021. Scott Campany paid $280,000 for a computer syslem. In addion to the basic purchase price, the cempany paid a satup tee of 51,900, saies tax of $7,000, and $28.600 for a special platorm on which to place the compuler. Soorts maragement esdmatis that the computor wat remain in service for five years and have a resibual value of $35, E00. The compuler will process 25 ond documents the fint year, ach aninual processing decreating by 2.500 documents during esch of the neat four years (hat it, 22.500 documerts in 2022: 20,000 documents in 2023 ; and a0 on). For holo with deciang which depreciation method lo use, the compaty president has requested a depreciaton schedule for each of ine thee depreciation methods, If rounding is necessary, use two decimal places for the deppeciabos amound per documene. Read the foaveremints. Requirement 1. For each of the generaly accepted depreciation methess, prepare a depreciaton sobedule ahcuing aset oest, depreciafion expense, acoummianed deprecasion, and assat book value. amounta through 2025 , Einter the rate to teo decimal plactes ) Requirements 1. For each of the generally accepted depreciadion methods, prepare a deprecation schedule showing asset cost, depreciation expense, accumutated degrecintion, and asset book value. 2. For financial reporting purposes, Scot uses the depreciation method that maximiue repered. incorne in the early youre of an assets use. For income tax puposes, the compary uses the depreciation method that minimizes income tax payenents in those early years. Consider the fret year Scot Co. uses the cornouter. Idenety the depreciaten methods that meet Sooen objectives. assuening the income tax authorities permit the use of ary of the methods. 3. Net cash peovided by operations before incoene tax is $180,000 tor the computers firat year. The comparyy's income tax rase is 32%. For the two depreciation medhods ifenofied in requirencet 2. compare the net income and net cash provided by operations (cash flow). Show which meetod pues the net income advartage and which method gives the cash thow advartags

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started