answer number 11 and 13

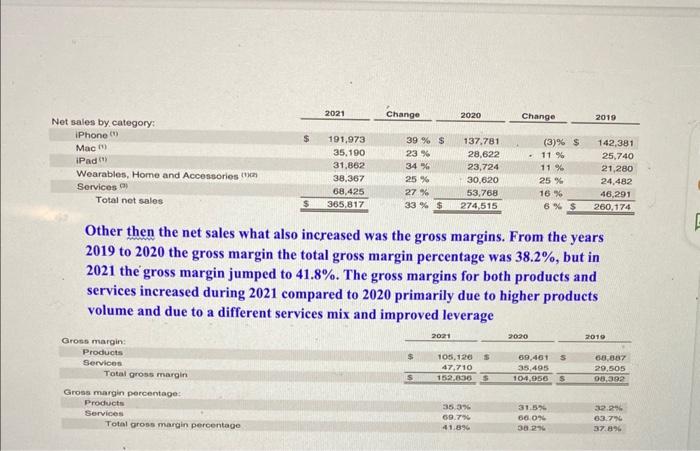

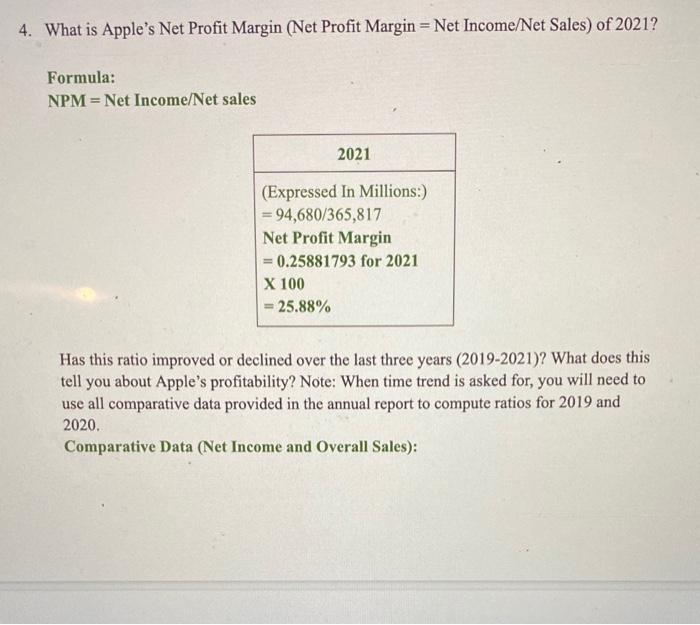

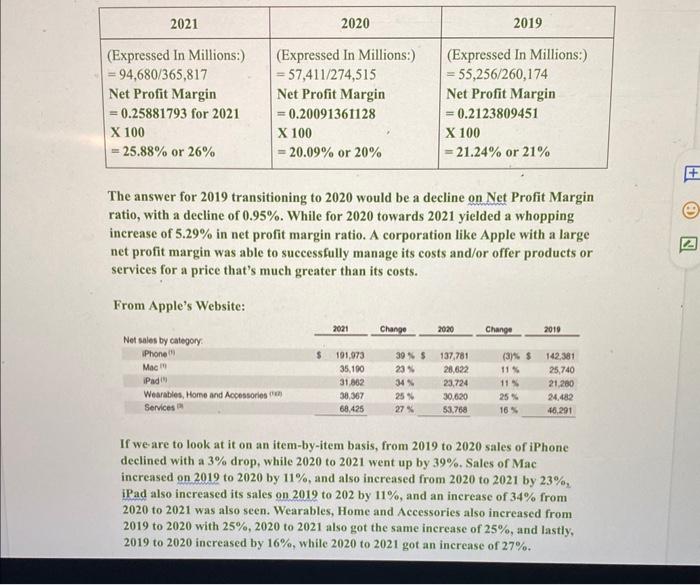

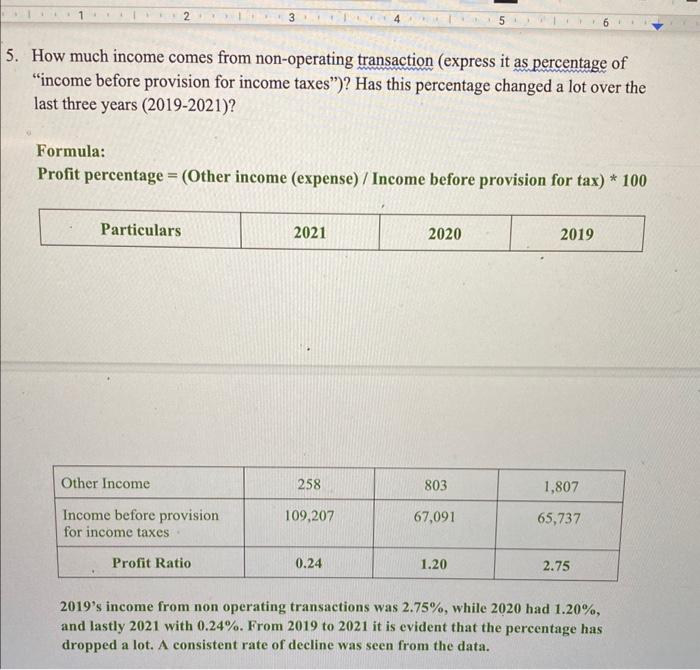

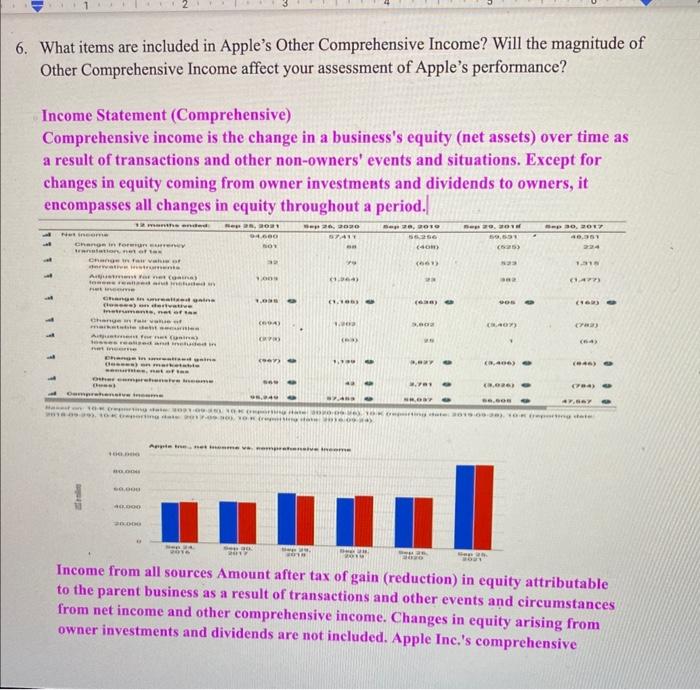

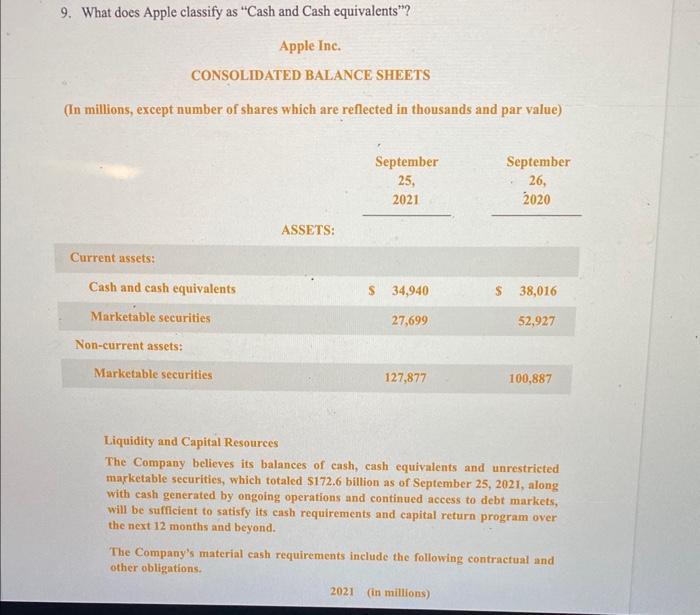

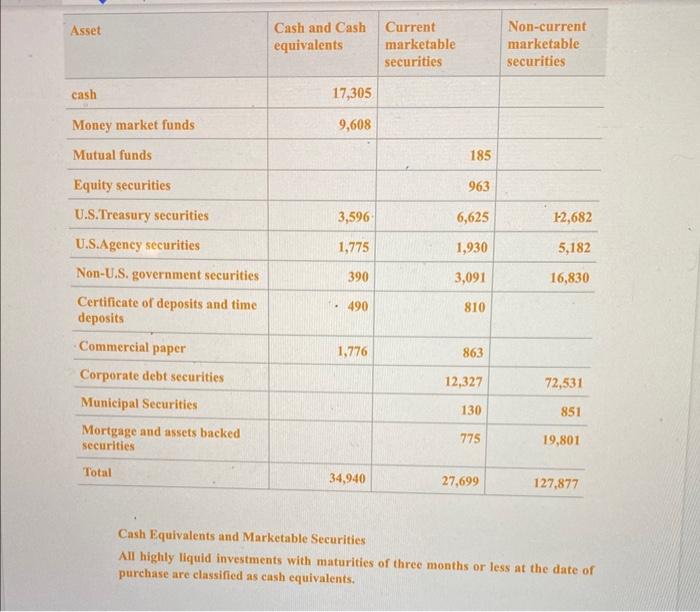

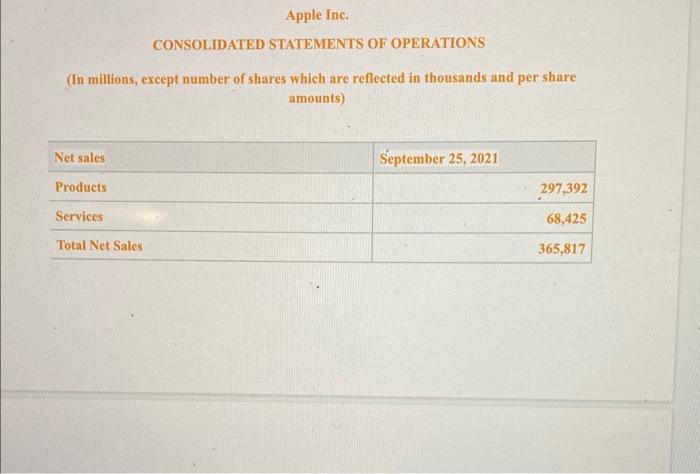

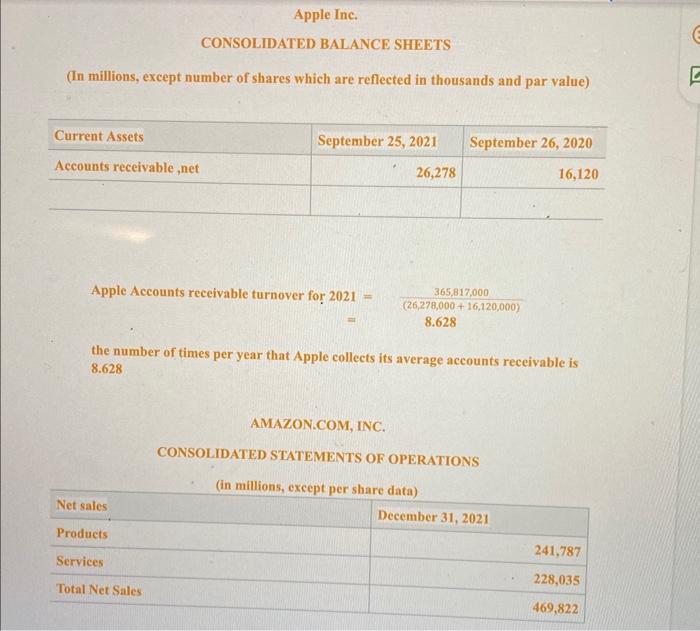

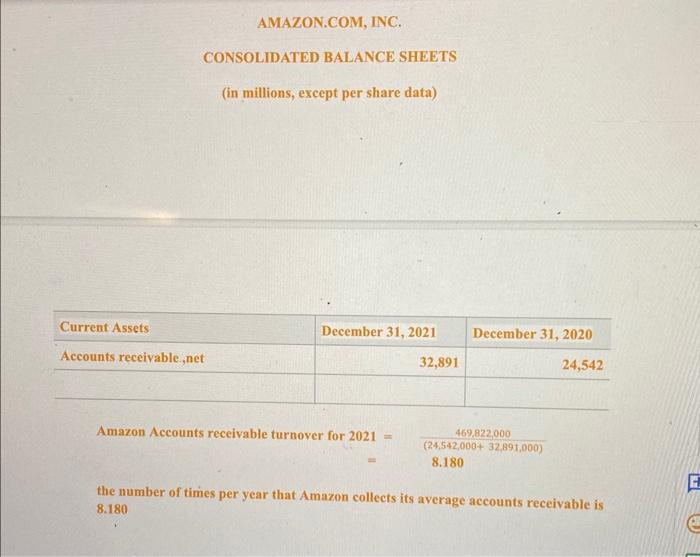

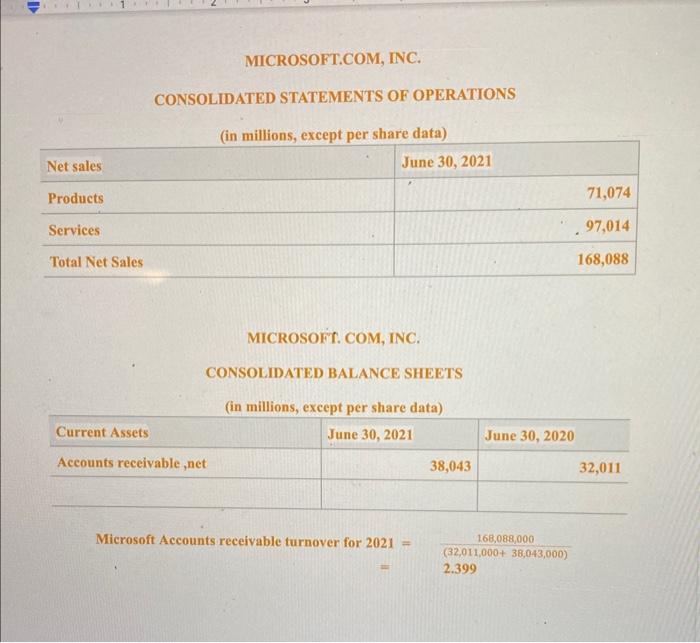

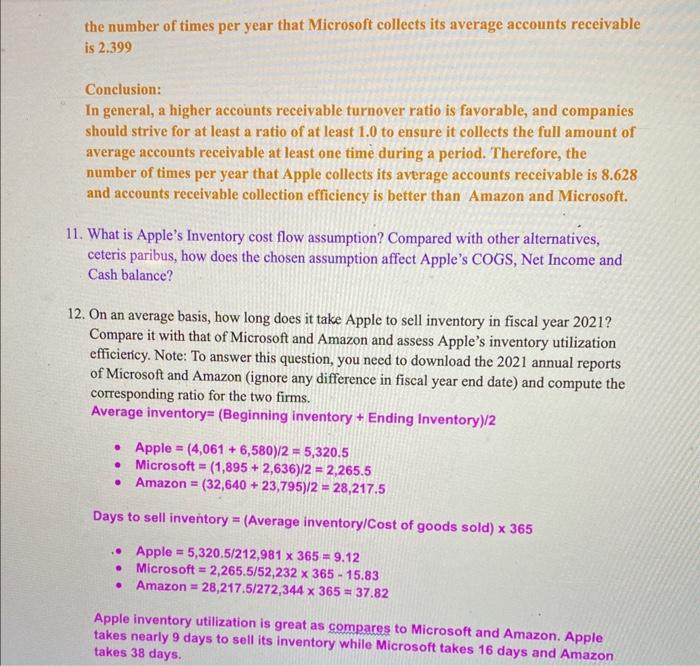

11. What is Apple's Inventory cost flow assumption? Compared with other alternatives, ceteris paribus, how does the chosen assumption affect Apple's COGS, Net Income and Cash balance? 12. On an average basis, how long does it take Apple to sell inventory in fiscal year 2021 ? Compare it with that of Microsoft and Amazon and assess Apple's inventory utilization efficiency. Note: To answer this question, you need to download the 2021 annual reports of Microsoft and Amazon (ignore any difference in fiscal year end date) and compute the corresponding ratio for the two firms. Average inventory =( Beginning inventory + Ending Inventory )/2 - Apple =(4,061+6,580)/2=5,320.5 - Microsoft =(1,895+2,636)/2=2,265.5 - Amazon =(32,640+23,795)/Z=28,217.5 Days to sell inventory =( Average inventory/Cost of goods sold )365 - Apple =5,320.5/212,981365=9.12 - Microsoft =2,265.5/52,23236515.83 - Amazon =28,217.5/272,344365=37.82 Apple inventory utilization is great as compares to Microsoft and Amazon. Apple takes nearly 9 days to sell its inventory while Microsoft takes 16 days and Amazon takes 38 days. Statement of Cash Flow 13. In 2021, overall which activity (operating, investing, or financing) is generating cash, which activity is using cash? Is the pattern same as that in 2019 and 2020 ? 14. How much is Apple's Free Cash Flow in each year from 2019 to 2021 ? What can you infer from this time trend? 1. When is the fiscal year end of Apple? In your opinion, why does Apple choose this date rather than Dec. 31 as the fiscal year end? September 25, 2021 was the fiscal year end of Apple. In my opinion Apple chooses September instead of December 31st the last day of the year as their fiscal year end potentially because of holidays. Different companies fluctuate at different times, some peaking at different seasons. During holiday times such as Thanksgiving, Black Friday, Cyber Monday, and Christmas times more people might be buying gifts for others helping them get more revenue, and this makes the next quarter look better. Companies may also have different fiscal year ends to adjust for seasonality and allow for more consistent quarter to quarter reportings. Using a different fiscal year ending than the end of the year also lets them be more flexible with aligning their revenues and expenses, which helps present a more accurate picture of the companies financial performance. 2. Who is the auditor of Apple? What is the auditor's opinion on Apple's 2021 financial statements? Luca Maestri Chief Financial Officer is Apple's auditor. The auditors opinion on the financial statement of Apple in 2021 was that in all material respects (everything listed), the financial positon of Apple, the results of its operations and its cash flows were presented fairly in conformity with the U.S. generally accepted accounting principles. The basis of these opinions were made in accordance with PCAOB standards. The audit was preformed by evaluating the risks material of misstatement of the financial statements. 3. How did Covid-19 affect Apple's business in 2021? Summarize using your own words. Quantify the impact when possible. With the affects of Covid-19 Apple's business in 2021 did exceptionally better than the previous year. Their stocks were nearly doubled from previous years and their total net sales did significantly better than the previous years. In the previous two years their total net sales were in the 200 millions but during the year 2021 their total net sales hit 300 millions and had increased by a 33\%. All products such as iPhones, iPads, Macs, and more had all increased in net sales in the year 2021. Other then the net sales what also increased was the gross margins. From the years 2019 to 2020 the gross margin the total gross margin percentage was 38.2%, but in 2021 the gross margin jumped to 41.8%. The gross margins for both products and services increased during 2021 compared to 2020 primarily due to higher products volume and due to a different services mix and improved leverage 4. What is Apple's Net Profit Margin (Net Profit Margin = Net Income/Net Sales) of 2021 ? Formula: NPM = Net Income/Net sales Has this ratio improved or declined over the last three years (2019-2021)? What does this tell you about Apple's profitability? Note: When time trend is asked for, you will need to use all comparative data provided in the annual report to compute ratios for 2019 and 2020. Comparative Data (Net Income and Overall Sales): The answer for 2019 transitioning to 2020 would be a decline on Net Profit Margin ratio, with a decline of 0.95%. While for 2020 towards 2021 yielded a whopping increase of 5.29% in net profit margin ratio. A corporation like Apple with a large net profit margin was able to successfully manage its costs and/or offer products or services for a price that's much greater than its costs. From Apple's Website: If we are to look at it on an item-by-item basis, from 2019 to 2020 sales of iPhone declined with a 3\% drop, while 2020 to 2021 went up by 39%. Sales of Mac increased on 2019 to 2020 by 11%, and also increased from 2020 to 2021 by 23% iPad also increased its sales on 2019 to 202 by 11%, and an increase of 34% from 2020 to 2021 was also seen. Wearables, Home and Accessories also increased from 2019 to 2020 with 25%,2020 to 2021 also got the same increase of 25%, and lastly, 2019 to 2020 increased by 16%, while 2020 to 2021 got an increase of 27%. How much income comes from non-operating transaction (express it as percentage of "income before provision for income taxes")? Has this percentage changed a lot over the last three years (20192021) ? Formula: Profit percentage =( Other income (expense) / Income before provision for tax ) * 100 2019's income from non operating transactions was 2.75%, while 2020 had 1.20%, and lastly 2021 with 0.24%. From 2019 to 2021 it is evident that the percentage has dropped a lot. A consistent rate of decline was seen from the data. What items are included in Apple's Other Comprehensive Income? Will the magnitude of Other Comprehensive Income affect your assessment of Apple's performance? Income Statement (Comprehensive) Comprehensive income is the change in a business's equity (net assets) over time as a result of transactions and other non-owners' events and situations. Except for changes in equity coming from owner investments and dividends to owners, it encompasses all changes in equity throughout a period. Income from all sources Amount after tax of gain (reduction) in equity attributable to the parent business as a result of transactions and other events and circumstances from net income and other comprehensive income. Changes in equity arising from owner investments and dividends are not included. Apple Inc.'s comprehensive income fell from 2019 to 2020 , but then rose from 2020 to 2021 , surpassing the previous year's level. venue Recognition 7. What are the performance obligations regularly included in Apple's sales of iPhone? When does Apple recognize revenue for each performance obligation? The revenue recognition begins when ownership of the product has been transferred to the customer. Appel refers that the control is transferred when the product is shipped. Furthermore, this can be linked to the time when the company has the right to be paid, which is one of the changes in control indicators. The performance obligations are allocated based on their stand alone selling price. Appel hs identified up to 3 performance obligations which include iPhone, Mac and Ipad. First performance obligation is a substantial portion and is described as the hardware together with the bundled software that is delivered at the time when the sale takes place. The revenue recognition for the first performance obligation takes place when ownership has been transferred to the customer. Can also be described by the time when the customer has taken over the control of the product. The second performance obligation means that a number of product-related services are added, such as maps and siri. The third performance obligation is described by the user being able to receive updates that come with the product. The revenue recognition related to the second and third performance obligation is allocated using a straight-line method over the period in which they are expected. 8. How does Apple recognize for third-party applications sold on the App Store? The recognition for the third party application. The company gets control of the product as an intermediary before the control is transferred to the customer the recognition is based on the gross amount the customer has been billed. several factors come into play when it comes to ownership of third-party products. In several circumstances, situations arise when the company has no control. Therefore, the company chooses to recognize the commission that the company earns from third-party products. Balance sheet 9. What does Apple classify as "Cash and Cash equivalents"? Apple Ine. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) 9. What does Apple classify as "Cash and Cash equivalents"? Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) Liquidity and Capital Resources The Company believes its balances of eash, cash equivalents and unrestricted marketable securitics, which totaled $172.6 billion as of September 25,2021 , along with cash generated by ongoing operations and continued access to debt markets, will be sufficient to satisfy its eash requirements and capital return program over the next 12 months and beyond. The Company's material eash requirements include the following contractual and other obligations. Cash Equivalents and Marketable Securities All highly liquid investments with maturities of three months or less at the date of purchase are classified as cash equivalents. The Company's investments in marketable debt securities have been classimed and accounted for as available-for-sale. The Company classifies its marketable debt securities as either short-term or long-term based on each instrument's underlying contractual maturity date. Unrealized gains and losses on marketable debt securities classified as available-for-sale are recognized in other comprehensive income/(loss) ("OCI"). The Company's investments in marketable equity securities are classified based on the nature of the securities and their availability for use in current operations. The Company's marketable equity securities are measured at fair value with gains and losses recognized in other income/(expense), net ("OI\&E"). The cost of securities sold is determined using the specific identification method. The fair values of the Company's money market funds and certain marketable equity securities are based on quoted prices in active markets for identical assets 10. Assuming all sales are credit sales, what is Apple's Accounts Receivable Turnover in 2021 ? Compare Apple's Accounts Receivable Turnover Ratio with that of Microsoft and Amazon in 2021. What conclusion can you draw about Apple's Accounts Receivable collection efficiency? Note: To answer this question, you need to download the 2021 annual reports of Microsoft and Amazon (ignore any difference in fiscal year end date), and compute the accounts receivable turnover ratio for them as well. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) (In millions, except number of shares which are reflected in thousands and par value) AppleAccountsreceivableturnoverfor2021==(26,278,000+16,120,000)365,817,0008.628 the number of times per year that Apple collects its average accounts receivable is 8.628 AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF OPERATIONS AMAZON.COM, INC. CONSOLIDATED BALANCE SHEETS (in millions, except per share data) Amazon Accounts receivable turnover for 2021= =8.180 the number of times per year that Amazon collects its average accounts receivable is 8.180 MICROSOFT.COM, INC. CONSOLIDATED STATEMENTS OF OPERATIONS MICROSOFT. COM, INC. CONSOLIDATED BALANCE SHEETS (in millions, except per share data) Microsoft Accounts receivable turnover for 2021=(32,011,000+38,043,000)168,088,000 =2.399 the number of times per year that Microsoft collects its average accounts receivable is 2.399 Conclusion: In general, a higher accounts receivable furnover ratio is favorable, and companies should strive for at least a ratio of at least 1.0 to ensure it collects the full amount of average accounts receivable at least one time during a period. Therefore, the number of times per year that Apple collects its average accounts receivable is 8.628 and accounts receivable collection efficiency is better than Amazon and Microsoft. 11. What is Apple's Inventory cost flow assumption? Compared with other alternatives, ceteris paribus, how does the chosen assumption affect Apple's COGS, Net Income and Cash balance? 12. On an average basis, how long does it take Apple to sell inventory in fiscal year 2021 ? Compare it with that of Microsoft and Amazon and assess Apple's inventory utilization efficiericy. Note: To answer this question, you need to download the 2021 annual reports of Microsoft and Amazon (ignore any difference in fiscal year end date) and compute the corresponding ratio for the two firms. Average inventory =( Beginning inventory + Ending Inventory )/2 - Apple =(4,061+6,580)/2=5,320,5 - Microsoft =(1,895+2,636)/2=2,265.5 - Amazon =(32,640+23,795)/2=28,217.5 Days to sell inventory = (Average inventory/Cost of goods sold) 365 - Apple =5,320.5/212,981365=9.12 - Microsoft =2,265.5/52,23236515.83 - Amazon =28,217.5/272,344365=37.82 Apple inventory utilization is great as compares to Microsoft and Amazon. Apple takes nearly 9 days to sell its inventory while Microsoft takes 16 days and Amazon takes 38 days. tatement of Cash Flow 13. In 2021, overall which activity (operating, investing, or financing) is generating cash, which activity is using cash? Is the pattern same as that in 2019 and 2020 ? 14. How much is Apple's Free Cash Flow in each year from 2019 to 2021 ? What can you infer from this time trend? Apple annual free cash flow for 2021 was $92.953B, a 26.7% increase from 2020. Apple annual free cash flow for 2020 was $73.365B, a 24.57% increase from 2019. The growth of Apple's Free Cash Flow from 2019 to 2021 is basically steady as well as very volatile. 15. Why do "Depreciation and amortization" and "Share-based compensation expense" enter as positive amounts in the Statement of Cash Flows? "Depreciation and amortization" and "Share-based compensation expense" are non-cash expenses. These non-cash expenses must be re-added to the operating activities part of the cash flow statement. Thus, "Depreciation and amortization" and "Share-based compensation expense" are entered as positive amounts in the Statement of Cash Flows. Obtain Apple's annual report of Fiscal Year 2021 and answer the questions below. Hint: Go to the company's official website and look for the "Investor Relations" section. Download the 2021 annual report (also called Form 10-K). Do NOT use quarterly reports or reports of other years. 11. What is Apple's Inventory cost flow assumption? Compared with other alternatives, ceteris paribus, how does the chosen assumption affect Apple's COGS, Net Income and Cash balance? 12. On an average basis, how long does it take Apple to sell inventory in fiscal year 2021 ? Compare it with that of Microsoft and Amazon and assess Apple's inventory utilization efficiency. Note: To answer this question, you need to download the 2021 annual reports of Microsoft and Amazon (ignore any difference in fiscal year end date) and compute the corresponding ratio for the two firms. Average inventory =( Beginning inventory + Ending Inventory )/2 - Apple =(4,061+6,580)/2=5,320.5 - Microsoft =(1,895+2,636)/2=2,265.5 - Amazon =(32,640+23,795)/Z=28,217.5 Days to sell inventory =( Average inventory/Cost of goods sold )365 - Apple =5,320.5/212,981365=9.12 - Microsoft =2,265.5/52,23236515.83 - Amazon =28,217.5/272,344365=37.82 Apple inventory utilization is great as compares to Microsoft and Amazon. Apple takes nearly 9 days to sell its inventory while Microsoft takes 16 days and Amazon takes 38 days. Statement of Cash Flow 13. In 2021, overall which activity (operating, investing, or financing) is generating cash, which activity is using cash? Is the pattern same as that in 2019 and 2020 ? 14. How much is Apple's Free Cash Flow in each year from 2019 to 2021 ? What can you infer from this time trend? 1. When is the fiscal year end of Apple? In your opinion, why does Apple choose this date rather than Dec. 31 as the fiscal year end? September 25, 2021 was the fiscal year end of Apple. In my opinion Apple chooses September instead of December 31st the last day of the year as their fiscal year end potentially because of holidays. Different companies fluctuate at different times, some peaking at different seasons. During holiday times such as Thanksgiving, Black Friday, Cyber Monday, and Christmas times more people might be buying gifts for others helping them get more revenue, and this makes the next quarter look better. Companies may also have different fiscal year ends to adjust for seasonality and allow for more consistent quarter to quarter reportings. Using a different fiscal year ending than the end of the year also lets them be more flexible with aligning their revenues and expenses, which helps present a more accurate picture of the companies financial performance. 2. Who is the auditor of Apple? What is the auditor's opinion on Apple's 2021 financial statements? Luca Maestri Chief Financial Officer is Apple's auditor. The auditors opinion on the financial statement of Apple in 2021 was that in all material respects (everything listed), the financial positon of Apple, the results of its operations and its cash flows were presented fairly in conformity with the U.S. generally accepted accounting principles. The basis of these opinions were made in accordance with PCAOB standards. The audit was preformed by evaluating the risks material of misstatement of the financial statements. 3. How did Covid-19 affect Apple's business in 2021? Summarize using your own words. Quantify the impact when possible. With the affects of Covid-19 Apple's business in 2021 did exceptionally better than the previous year. Their stocks were nearly doubled from previous years and their total net sales did significantly better than the previous years. In the previous two years their total net sales were in the 200 millions but during the year 2021 their total net sales hit 300 millions and had increased by a 33\%. All products such as iPhones, iPads, Macs, and more had all increased in net sales in the year 2021. Other then the net sales what also increased was the gross margins. From the years 2019 to 2020 the gross margin the total gross margin percentage was 38.2%, but in 2021 the gross margin jumped to 41.8%. The gross margins for both products and services increased during 2021 compared to 2020 primarily due to higher products volume and due to a different services mix and improved leverage 4. What is Apple's Net Profit Margin (Net Profit Margin = Net Income/Net Sales) of 2021 ? Formula: NPM = Net Income/Net sales Has this ratio improved or declined over the last three years (2019-2021)? What does this tell you about Apple's profitability? Note: When time trend is asked for, you will need to use all comparative data provided in the annual report to compute ratios for 2019 and 2020. Comparative Data (Net Income and Overall Sales): The answer for 2019 transitioning to 2020 would be a decline on Net Profit Margin ratio, with a decline of 0.95%. While for 2020 towards 2021 yielded a whopping increase of 5.29% in net profit margin ratio. A corporation like Apple with a large net profit margin was able to successfully manage its costs and/or offer products or services for a price that's much greater than its costs. From Apple's Website: If we are to look at it on an item-by-item basis, from 2019 to 2020 sales of iPhone declined with a 3\% drop, while 2020 to 2021 went up by 39%. Sales of Mac increased on 2019 to 2020 by 11%, and also increased from 2020 to 2021 by 23% iPad also increased its sales on 2019 to 202 by 11%, and an increase of 34% from 2020 to 2021 was also seen. Wearables, Home and Accessories also increased from 2019 to 2020 with 25%,2020 to 2021 also got the same increase of 25%, and lastly, 2019 to 2020 increased by 16%, while 2020 to 2021 got an increase of 27%. How much income comes from non-operating transaction (express it as percentage of "income before provision for income taxes")? Has this percentage changed a lot over the last three years (20192021) ? Formula: Profit percentage =( Other income (expense) / Income before provision for tax ) * 100 2019's income from non operating transactions was 2.75%, while 2020 had 1.20%, and lastly 2021 with 0.24%. From 2019 to 2021 it is evident that the percentage has dropped a lot. A consistent rate of decline was seen from the data. What items are included in Apple's Other Comprehensive Income? Will the magnitude of Other Comprehensive Income affect your assessment of Apple's performance? Income Statement (Comprehensive) Comprehensive income is the change in a business's equity (net assets) over time as a result of transactions and other non-owners' events and situations. Except for changes in equity coming from owner investments and dividends to owners, it encompasses all changes in equity throughout a period. Income from all sources Amount after tax of gain (reduction) in equity attributable to the parent business as a result of transactions and other events and circumstances from net income and other comprehensive income. Changes in equity arising from owner investments and dividends are not included. Apple Inc.'s comprehensive income fell from 2019 to 2020 , but then rose from 2020 to 2021 , surpassing the previous year's level. venue Recognition 7. What are the performance obligations regularly included in Apple's sales of iPhone? When does Apple recognize revenue for each performance obligation? The revenue recognition begins when ownership of the product has been transferred to the customer. Appel refers that the control is transferred when the product is shipped. Furthermore, this can be linked to the time when the company has the right to be paid, which is one of the changes in control indicators. The performance obligations are allocated based on their stand alone selling price. Appel hs identified up to 3 performance obligations which include iPhone, Mac and Ipad. First performance obligation is a substantial portion and is described as the hardware together with the bundled software that is delivered at the time when the sale takes place. The revenue recognition for the first performance obligation takes place when ownership has been transferred to the customer. Can also be described by the time when the customer has taken over the control of the product. The second performance obligation means that a number of product-related services are added, such as maps and siri. The third performance obligation is described by the user being able to receive updates that come with the product. The revenue recognition related to the second and third performance obligation is allocated using a straight-line method over the period in which they are expected. 8. How does Apple recognize for third-party applications sold on the App Store? The recognition for the third party application. The company gets control of the product as an intermediary before the control is transferred to the customer the recognition is based on the gross amount the customer has been billed. several factors come into play when it comes to ownership of third-party products. In several circumstances, situations arise when the company has no control. Therefore, the company chooses to recognize the commission that the company earns from third-party products. Balance sheet 9. What does Apple classify as "Cash and Cash equivalents"? Apple Ine. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) 9. What does Apple classify as "Cash and Cash equivalents"? Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) Liquidity and Capital Resources The Company believes its balances of eash, cash equivalents and unrestricted marketable securitics, which totaled $172.6 billion as of September 25,2021 , along with cash generated by ongoing operations and continued access to debt markets, will be sufficient to satisfy its eash requirements and capital return program over the next 12 months and beyond. The Company's material eash requirements include the following contractual and other obligations. Cash Equivalents and Marketable Securities All highly liquid investments with maturities of three months or less at the date of purchase are classified as cash equivalents. The Company's investments in marketable debt securities have been classimed and accounted for as available-for-sale. The Company classifies its marketable debt securities as either short-term or long-term based on each instrument's underlying contractual maturity date. Unrealized gains and losses on marketable debt securities classified as available-for-sale are recognized in other comprehensive income/(loss) ("OCI"). The Company's investments in marketable equity securities are classified based on the nature of the securities and their availability for use in current operations. The Company's marketable equity securities are measured at fair value with gains and losses recognized in other income/(expense), net ("OI\&E"). The cost of securities sold is determined using the specific identification method. The fair values of the Company's money market funds and certain marketable equity securities are based on quoted prices in active markets for identical assets 10. Assuming all sales are credit sales, what is Apple's Accounts Receivable Turnover in 2021 ? Compare Apple's Accounts Receivable Turnover Ratio with that of Microsoft and Amazon in 2021. What conclusion can you draw about Apple's Accounts Receivable collection efficiency? Note: To answer this question, you need to download the 2021 annual reports of Microsoft and Amazon (ignore any difference in fiscal year end date), and compute the accounts receivable turnover ratio for them as well. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) (In millions, except number of shares which are reflected in thousands and par value) AppleAccountsreceivableturnoverfor2021==(26,278,000+16,120,000)365,817,0008.628 the number of times per year that Apple collects its average accounts receivable is 8.628 AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF OPERATIONS AMAZON.COM, INC. CONSOLIDATED BALANCE SHEETS (in millions, except per share data) Amazon Accounts receivable turnover for 2021= =8.180 the number of times per year that Amazon collects its average accounts receivable is 8.180 MICROSOFT.COM, INC. CONSOLIDATED STATEMENTS OF OPERATIONS MICROSOFT. COM, INC. CONSOLIDATED BALANCE SHEETS (in millions, except per share data) Microsoft Accounts receivable turnover for 2021=(32,011,000+38,043,000)168,088,000 =2.399 the number of times per year that Microsoft collects its average accounts receivable is 2.399 Conclusion: In general, a higher accounts receivable furnover ratio is favorable, and companies should strive for at least a ratio of at least 1.0 to ensure it collects the full amount of average accounts receivable at least one time during a period. Therefore, the number of times per year that Apple collects its average accounts receivable is 8.628 and accounts receivable collection efficiency is better than Amazon and Microsoft. 11. What is Apple's Inventory cost flow assumption? Compared with other alternatives, ceteris paribus, how does the chosen assumption affect Apple's COGS, Net Income and Cash balance? 12. On an average basis, how long does it take Apple to sell inventory in fiscal year 2021 ? Compare it with that of Microsoft and Amazon and assess Apple's inventory utilization efficiericy. Note: To answer this question, you need to download the 2021 annual reports of Microsoft and Amazon (ignore any difference in fiscal year end date) and compute the corresponding ratio for the two firms. Average inventory =( Beginning inventory + Ending Inventory )/2 - Apple =(4,061+6,580)/2=5,320,5 - Microsoft =(1,895+2,636)/2=2,265.5 - Amazon =(32,640+23,795)/2=28,217.5 Days to sell inventory = (Average inventory/Cost of goods sold) 365 - Apple =5,320.5/212,981365=9.12 - Microsoft =2,265.5/52,23236515.83 - Amazon =28,217.5/272,344365=37.82 Apple inventory utilization is great as compares to Microsoft and Amazon. Apple takes nearly 9 days to sell its inventory while Microsoft takes 16 days and Amazon takes 38 days. tatement of Cash Flow 13. In 2021, overall which activity (operating, investing, or financing) is generating cash, which activity is using cash? Is the pattern same as that in 2019 and 2020 ? 14. How much is Apple's Free Cash Flow in each year from 2019 to 2021 ? What can you infer from this time trend? Apple annual free cash flow for 2021 was $92.953B, a 26.7% increase from 2020. Apple annual free cash flow for 2020 was $73.365B, a 24.57% increase from 2019. The growth of Apple's Free Cash Flow from 2019 to 2021 is basically steady as well as very volatile. 15. Why do "Depreciation and amortization" and "Share-based compensation expense" enter as positive amounts in the Statement of Cash Flows? "Depreciation and amortization" and "Share-based compensation expense" are non-cash expenses. These non-cash expenses must be re-added to the operating activities part of the cash flow statement. Thus, "Depreciation and amortization" and "Share-based compensation expense" are entered as positive amounts in the Statement of Cash Flows. Obtain Apple's annual report of Fiscal Year 2021 and answer the questions below. Hint: Go to the company's official website and look for the "Investor Relations" section. Download the 2021 annual report (also called Form 10-K). Do NOT use quarterly reports or reports of other years