help on question 9

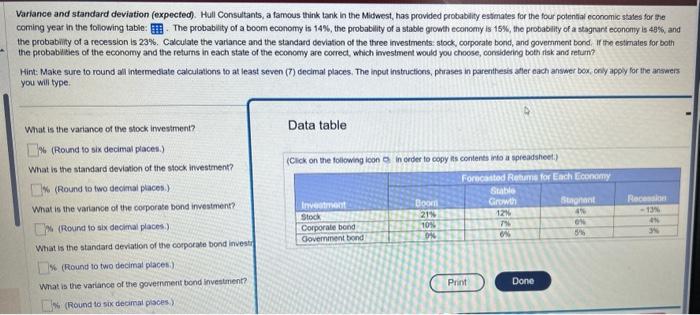

Variance and standard deviation (expected). Hull Consultants, a famous think tank in the Midsest, has provided probability estimates for the four potential cconomic stades for ane coming year in the following tabie: . The probablity of a boom economy is 14%, the probablity of a stable growth economy is 15%, the probability of a stagrans economy is 49%, and the probability of a recession is 23%. Calculate the varlance and the standard deviation of the three investments: stock, corporate bond, and goverrment bond, If the estimates for both the probabilies of the economy and the retums in each state of the economy are correct, which imvestment would you choose, consideing boen itsk and retum? Hint: Make sure to round all intermediate calculations to at least seven (7) decimal places. The input instructions, phrases in parenithesis atler each ansaer bor, cnly appy for the ansaers you will type. What is the variance of the stock imvestment? Data table (Round to six decimal places.) (Clck on the following icon o. in crder to copy as contents into a spreadsheet.) What is the standard deviation of the stock investment? What is the variance of the corporase bond investment? (Round to six decimal places.) What is the standard devation of the corporale bond invest (Round 10 two decimal placesi) What is the variance of the government bond investment? (Round 10 six decimal ploces) Variance and standard deviation (expected). Hull Consultants, a famous think tank in the Midsest, has provided probability estimates for the four potential cconomic stades for ane coming year in the following tabie: . The probablity of a boom economy is 14%, the probablity of a stable growth economy is 15%, the probability of a stagrans economy is 49%, and the probability of a recession is 23%. Calculate the varlance and the standard deviation of the three investments: stock, corporate bond, and goverrment bond, If the estimates for both the probabilies of the economy and the retums in each state of the economy are correct, which imvestment would you choose, consideing boen itsk and retum? Hint: Make sure to round all intermediate calculations to at least seven (7) decimal places. The input instructions, phrases in parenithesis atler each ansaer bor, cnly appy for the ansaers you will type. What is the variance of the stock imvestment? Data table (Round to six decimal places.) (Clck on the following icon o. in crder to copy as contents into a spreadsheet.) What is the standard deviation of the stock investment? What is the variance of the corporase bond investment? (Round to six decimal places.) What is the standard devation of the corporale bond invest (Round 10 two decimal placesi) What is the variance of the government bond investment? (Round 10 six decimal ploces)