Answered step by step

Verified Expert Solution

Question

1 Approved Answer

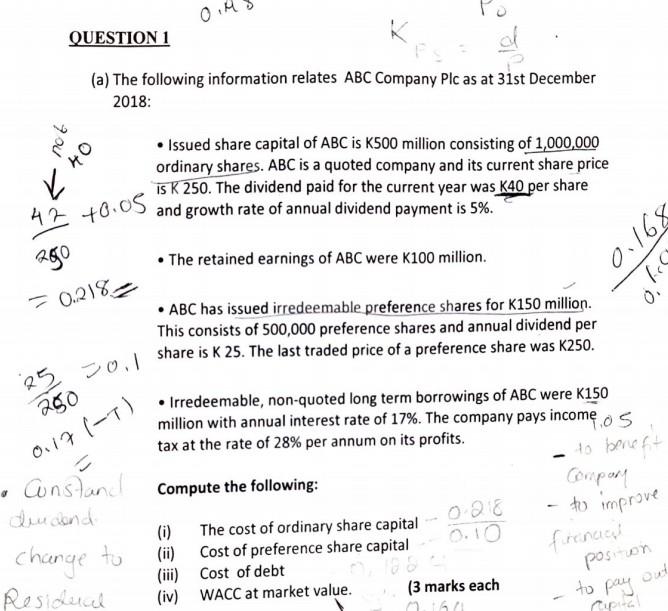

help out UESTION 1 (a) The following information relates ABC Company Plc as at 31st December 2018: - Issued share capital of ABC is K500

help out

UESTION 1 (a) The following information relates ABC Company Plc as at 31st December 2018: - Issued share capital of ABC is K500 million consisting of 1,000,000 ordinary shares. \\( A B C \\) is a quoted company and its current share price is \\( K 250 \\). The dividend paid for the current year was \\( K 40 \\) per share and growth rate of annual dividend payment is \5. - The retained earnings of \\( A B C \\) were \\( \\mathrm{K} 100 \\) million. 218 \\( +0.05 \\) \\( +0.05 \\) and growth rate of annual dividend payment is \5. - \\( A B C \\) has issued irredeemable preference shares for K150 million. This consists of 500,000 preference shares and annual dividend per share is K 25 . The last traded price of a preference share was K250. - Irredeemable, non-quoted long term borrowings of ABC were K150 million with annual interest rate of \17. The company pays income tax at the rate of \28 per annum on its profits. Compute the following: (i) The cost of ordinary share capital (ii) Cost of preference share capital (iii) Cost of debt (iv) WACC at market value. (3 marks eachStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started